Canada is recognized as a leading mining nation. Our minerals sector, which includes exploration, mining and related support activities, primary processing, and downstream product manufacturing, is a mainstay of the economy that supports jobs and economic activity in every province and territory.

Find out what Canada is doing to advance the economy through minerals

Critical minerals

Critical minerals

Canada is a leading global producer of critical mineralsFootnote 1, offering a reliable and responsibly produced supply of the materials essential for national security, advanced technologies, and the global energy transition. Critical minerals already make a substantial contribution to Canada’s economic prosperity by adding (directly and indirectly) $40 billion to the GDP and supporting more than 109,000 jobs in 2023.

Rising global demand presents a significant opportunity to expand this impact even further. Backed by strong environmental stewardship, world-class expertise, and a commitment to stable, secure supply chains, Canada is well positioned to strengthen its leadership in this strategic and rapidly evolving sector.

Learn more about critical minerals in Canada and consult the interactive map of critical minerals sites in Canada

Greenhouse gas emissions and advanced green technologies

Greenhouse gas emissions and advanced green technologies

Developing Canada's minerals sector in clean and sustainable ways ensures that it can continue to contribute to the Canadian economy for years to come.

Greenhouse gas emissions

Canadian mines have relatively low intensities of greenhouse gas emissions across a range of commodities. Canada’s carbon competitiveness stems from a host of advantages, including access to clean energy sources and significant investments in research, development, and adoption of green technologies.

Canadian mines and processing facilities continue to invest to lower their emissions through electrification of equipment and vehicle fleets and through the development of new technologies. This includes mines in remote off-grid locations that have few alternative energy sources. Some of these remote sites have installed wind turbines and other renewable solutions to help reduce their reliance on diesel fuel.

Advanced green technologies

The Green Mining Initiative, led by Natural Resources Canada (NRCan), aims to improve the minerals sector's environmental performance and create green technology opportunities. NRCan works in close partnership with provincial and territorial governments, industry, academia, non-governmental organizations, and other interested stakeholders, such as the Canada Mining Innovation Council.

Learn more about the green mining innovation and other mining research and innovation at CanmetMINING.

Mineral production

Mineral production

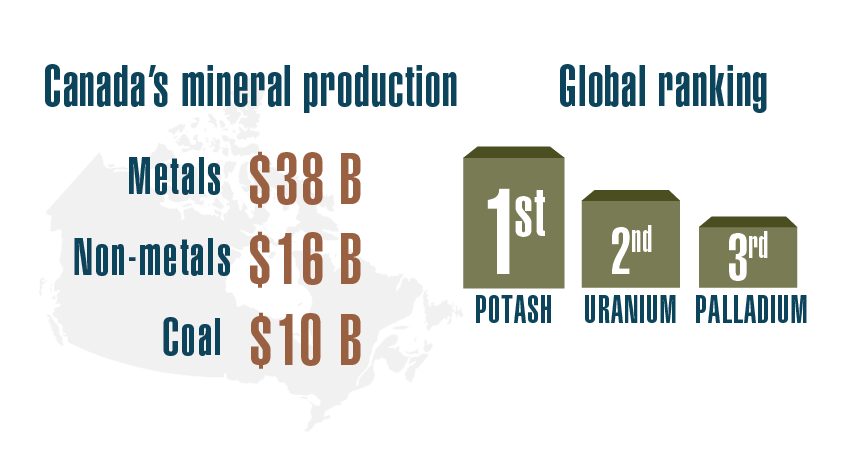

Canada is the global leader in potash production and ranks among the top five global producers of cobalt, diamonds, gold, indium, nickel, niobium, palladium, platinum, titanium concentrate, and uranium.

Canada is also the world’s fourth-largest producer of primary aluminum.

Key facts

- Canada produced 60 minerals and metals at almost 200 mines and 6,500 sand, gravel and stone quarries.

- The value of Canada’s mineral production reached $64.3 billion in 2024.

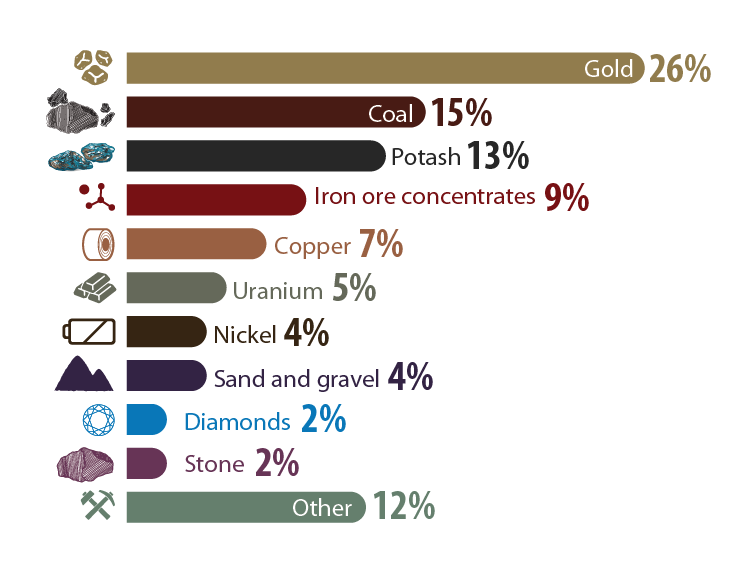

- Gold was the top-ranked commodity by value of production in Canada in 2024 with a value of $16.9 billion.

Learn more about 10 Key Facts on Canada’s Minerals Sector (PDF - 2505 KB).

Mineral production by commodity group

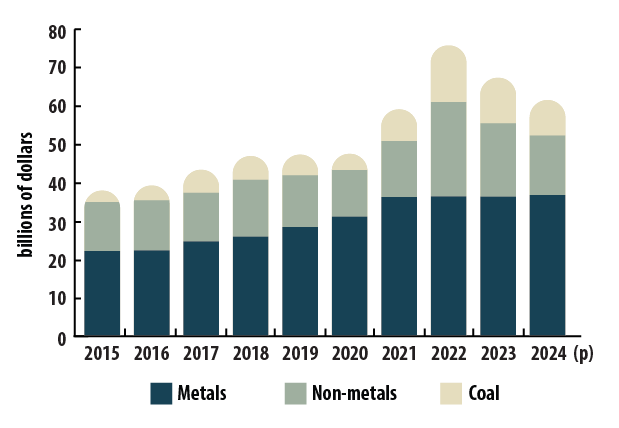

The value of Canadian mineral production in 2024 was $64.3 billion, down 9% from $70.4 billion in 2023. The value of metals production rose by 1%, while non-metals and coal declined by 19% and 22%, respectively, largely because of lower coal and potash prices.

Mineral production by commodity group, 2015–2024 (p)

Text version

This bar graph shows the value of mineral production by commodity group for each year from 2015 to 2024 (p). The table, Mineral production by commodity group, 2015–2024 (p) indicates the specific values for each region.

| Commodity group | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2023 (p) |

|---|---|---|---|---|---|---|---|---|---|---|

| Metals | 23,129 | 23,302 | 25,738 | 27,059 | 29,695 | 32,511 | 37,880 | 38,049 | 37,979 | 38,408 |

| Non-metals | 13,393 | 13,724 | 13,304 | 15,531 | 14,144 | 12,769 | 15,309 | 25,723 | 20,034 | 16,256 |

| Coal | 3,126 | 4,009 | 6,281 | 6,459 | 5,625 | 4,392 | 8,610 | 15,469 | 12,408 | 9,663 |

| Total | 41,153 | 39,420 | 45,323 | 49,049 | 49,464 | 49,672 | 61,799 | 79,241 | 70,421 | 64,327 |

Canada’s top five mineral products by value for 2024 were gold, coal, potash, iron ore concentrates, and copper. Their combined value was $45.3 billion, accounting for over two thirds of the total value of mineral production.

Service suppliers

Canadian cities provide regional bases for supporting exploration, mining, and allied industries through specialized equipment and service suppliers. Large urban areas, such as Toronto and Vancouver, are also recognized as global hubs for mining and mineral exploration, financing, and legal services.

Thousands of firms in Canada are available to provide technical, legal, financial, accounting, environmental, and other expertise to the exploration and mining industry.

Transportation plays a key enabling role for the minerals sector, not only in delivering mineral products to markets, but also in bringing equipment and supplies to mining operations. The transportation industries – such as rail – benefit from a vibrant mining sector because mining accounts for over half of Canada's rail-freight tonnage annually.

Consult Canada’s Minerals and Mining Map for locations and information on Canada’s major metallic, non-metallic and industrial mineral mines.

Mineral exploration

Mineral exploration

Mineral exploration is the search for materials in the Earth's crust where concentration and quantity allow for extraction and processing at a profit.

Key facts

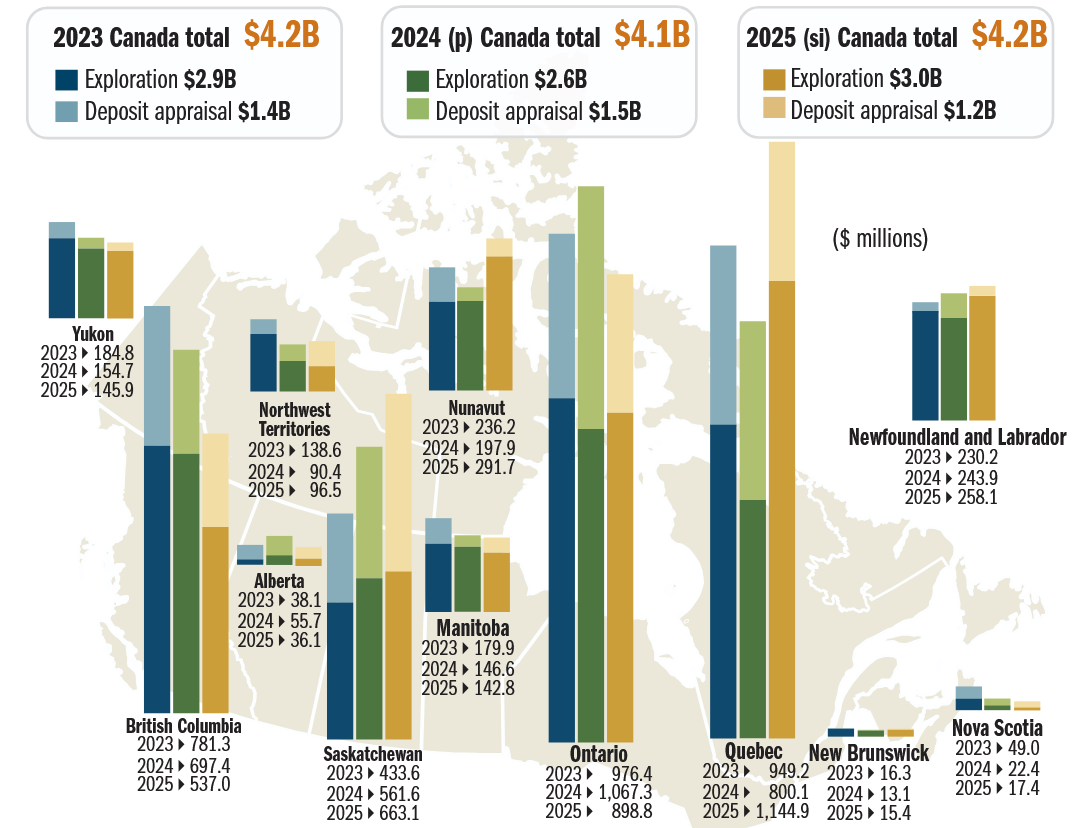

- Preliminary figures for 2024 indicate that mining and mineral exploration companies spent $4.1 billion on exploration and deposit appraisal projects in Canada, compared with $4.2 billion in 2023.

- 2025 expenditures are expected to rise to $4.2 billion—an increase of about 5%—based on reported spending intentions (si).

- Exploration and mining companies that have their headquarters in Canada accounted for the largest portion of worldwide non-ferrous exploration budgets, reaching 38% in 2024.

- Canada was among the world’s top destinations for non-ferrous mineral exploration in 2024, attracting 20% of global exploration budgets.

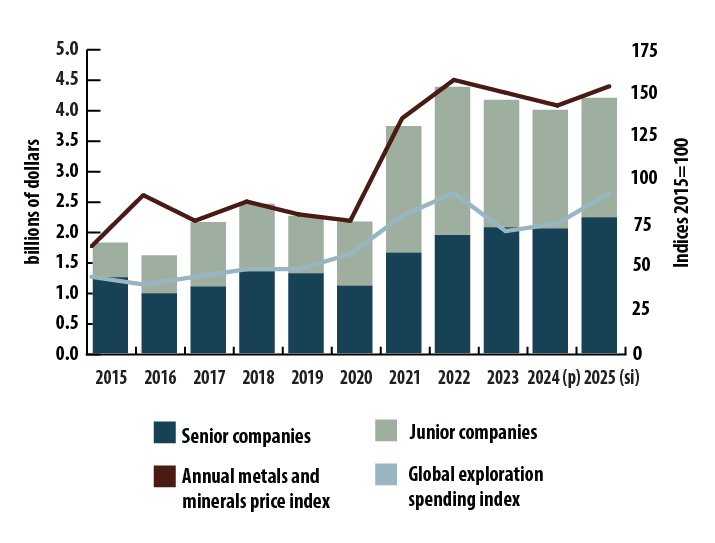

The amount spent on mineral exploration and on deposit appraisal activity depends largely on market conditions and commodity prices. Over the last decade, mineral and metal prices fluctuated significantly, with a notable decline from 2014 to 2016 as global supply outpaced demand, driven by slowing economic growth in key emerging markets such as China. This decline led to reduced spending on exploration and appraisal activities during this period.

Prices began to recover in the latter part of 2016, a trend that continued into the second half of 2019, but shifted for most metals in early 2020 because of the economic lockdowns implemented in response to the COVID-19 pandemic. Metal prices recovered late in 2020 as supply diminished and demand recovered. In 2021 and in the first half of 2022, the pace at which prices rose intensified because of growing inflationary pressures and the Russia-Ukraine conflict.

In 2023, prices for many metals declined, with battery metals such as lithium, nickel, and cobalt particularly affected by oversupply and weaker demand. Despite this, 2024 and 2025 saw renewed upward pressure on many metals, driven by expectations of lower interest rates, ongoing investment in clean energy technologies, and continued demand from industrial and energy transition sectors. Gold, in particular, has performed exceptionally well, reaching record highs throughout 2024 and 2025 as investors sought safe-haven assets amid economic uncertainty.

Exploration and deposit appraisal expenditures and metals and minerals price index, 2015-2025 (si)

Text version

This line graph displays exploration and deposit appraisal expenditures on the left vertical axis and the Bank of Canada’s metals and minerals price index on the right vertical axis, from 2015 to 2025.

Mineral exploration by commodity

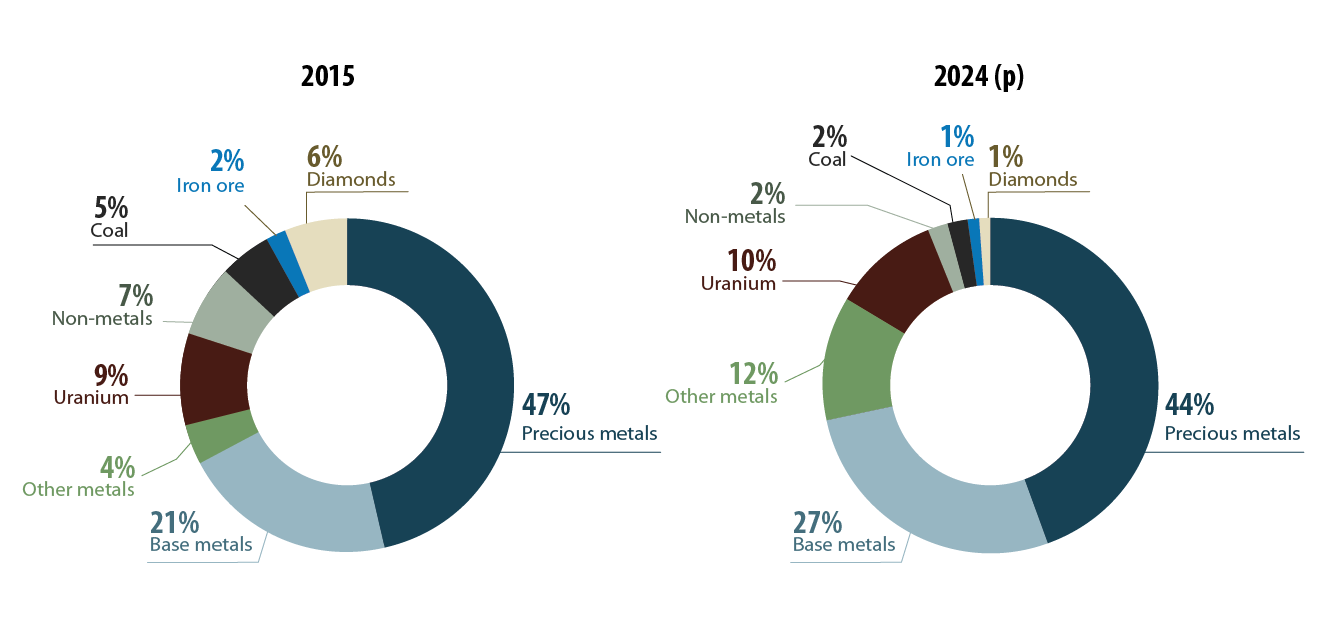

Canada benefits from a diversified mineral endowment that includes traditional commodities, such as gold, base metals and diamonds, as well as critical minerals essential for clean energy applications and advanced technologies, such as rare earth elements, graphite and lithium.

In 2024, exploration spending was highest for precious metals, reaching $1.8 billion—a 13% decrease from 2023—and accounting for 44% of total expenditures. Base metals followed, representing 27% of total spending at $1.1 billion.

Exploration and deposit appraisal percentage of expenditures by mineral commodity group, 2015 and 2025 (si)

Text version

This set of two circular charts shows exploration and deposit appraisal expenditures by mineral commodity group for 2015 and 2024. In 2015, precious metals accounted for 47% of spending, while base metals accounted for 21% and uranium for 9%. In 2024, precious metals accounted for 44% of the spending, while base metals accounted for 27% and uranium for 10%. Review the table, Exploration and deposit appraisal expenditure, by mineral commodity group, 2015–2025 (si) for specific values by commodity group for individual years.

| Commodity group | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (p) | 2025 (si) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Precious metals | 857.5 | 952.6 | 1,430.5 | 1,522.8 | 1,297.9 | 1,480.2 | 2,475.0 | 2,589.6 | 2,056.4 | 1,785.1 | 1,925.8 |

| Base metals | 382.0 | 236.7 | 322.2 | 376.6 | 425.4 | 385.4 | 800.4 | 1,163.1 | 1,050.2 | 1,105.5 | 998.2 |

| Iron ore | 28.1 | 22.5 | 9.1 | 18.4 | 17.1 | 30.6 | 97.6 | 20.2 | 27.8 | 59.7 | 231.9 |

| Uranium | 170.2 | 163.9 | 137.4 | 169.7 | 162.3 | 66.8 | 122.2 | 237.7 | 315.9 | 414.7 | 520.3 |

| Diamonds | 119.3 | 77.7 | 83.2 | 108.8 | 127.0 | 64.0 | 51.8 | 40.0 | 35.0 | 22.3 | 10.8 |

| Other metals | 68.7 | 48.0 | 89.0 | 140.7 | 105.9 | 33.1 | 112.6 | 262.4 | 616.3 | 501.6 | 406.3 |

| Non-metals | 124.8 | 81.2 | 58.4 | 78.6 | 58.7 | 35.1 | 65.3 | 71.8 | 63.4 | 86.4 | 99.0 |

| Coal | 91.8 | 46.2 | 55.7 | 69.5 | 92.2 | 96.2 | 56.1 | 46.5 | 48.8 | 75.9 | 55.4 |

| Total | 1,842.4 | 1,628.8 | 2,185.5 | 2,485.2 | 2,286.5 | 2,191.4 | 3,781.0 | 4,431.3 | 4,213.8 | 4,051.1 | 4,247.7 |

Mineral exploration by province and territory

In 2024, Ontario was the leading jurisdiction in terms of mineral exploration spending, followed by Quebec and British Columbia. These three jurisdictions accounted for 63% of total exploration and deposit appraisal expenditures.

Exploration and deposit appraisal expenditures by province and territory, 2023–2025 (si)

Text version

The bar graphs superimposed on this map of Canada show the amount of exploration and deposit appraisal expenditures for each province and territory for the years 2023, 2024, and 2025. Each bar is divided into two segments: one for exploration and one for deposit appraisal. The top-spending jurisdictions in 2024 were Ontario ($1.1 billion), Quebec ($800.1 million) and British Columbia ($697.5 million).

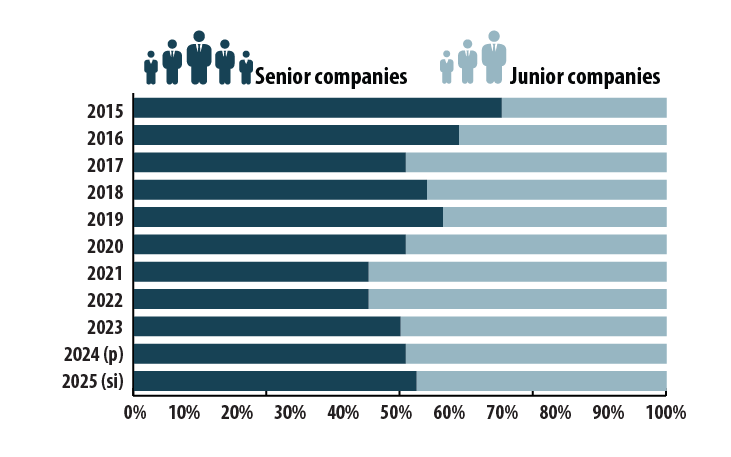

Mineral exploration by company type

Two types of companies work in mineral exploration:

- Senior companies normally derive recurring operating revenues from mining or other business segments. These are not necessarily mining companies.

- Junior companies have no internally generated revenue (i.e. they do not have an operating mine) and rely mostly on equity markets to raise the capital necessary to conduct their exploration programs.

Junior mining companies tend to specialize in early-stage exploration activities, while senior companies are more likely to bring mines into production.

Junior companies play a critical role in the discovery and advancement of mineral projects in Canada, projects that represent the next generation of Canadian mines. In 2024, junior mining companies spent $2.0 billion on exploration and deposit appraisal activities, down 6.6% from 2023. Senior company expenditures decreased by 1% over 2023 to reach $2.1 billion.

Exploration and deposit appraisal share of expenditures by junior and senior companies, 2015–2025 (si)

Text version

This bar graph shows the percentage distribution of exploration and deposit appraisal spending for junior and senior companies from 2015 to 2025 (si). Junior businesses accounted for 31% of spending in 2015, which increased to 49% in 2024. Review the table, Exploration and deposit appraisal expenditures by junior and senior companies, 2015–2025 (si) for specific values by junior and senior companies for individual years.

| Company Type | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (p) | 2025 (si) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Senior companies | 1,265 | 996 | 1,109 | 1,364 | 1,329 | 1,122 | 1,673 | 1,965 | 2,097 | 2,075 | 2,264 |

| Junior companies | 578 | 632 | 1,076 | 1,121 | 957 | 1,070 | 2,108 | 2,466 | 2,117 | 1,976 | 1,984 |

| Total | 1,842 | 1,629 | 2,186 | 2,485 | 2,286 | 2,191 | 3,781 | 4,431 | 4,214 | 4,051 | 4,248 |

Learn more about Canadian mineral exploration.

Canadian mining assets

Canadian mining assets

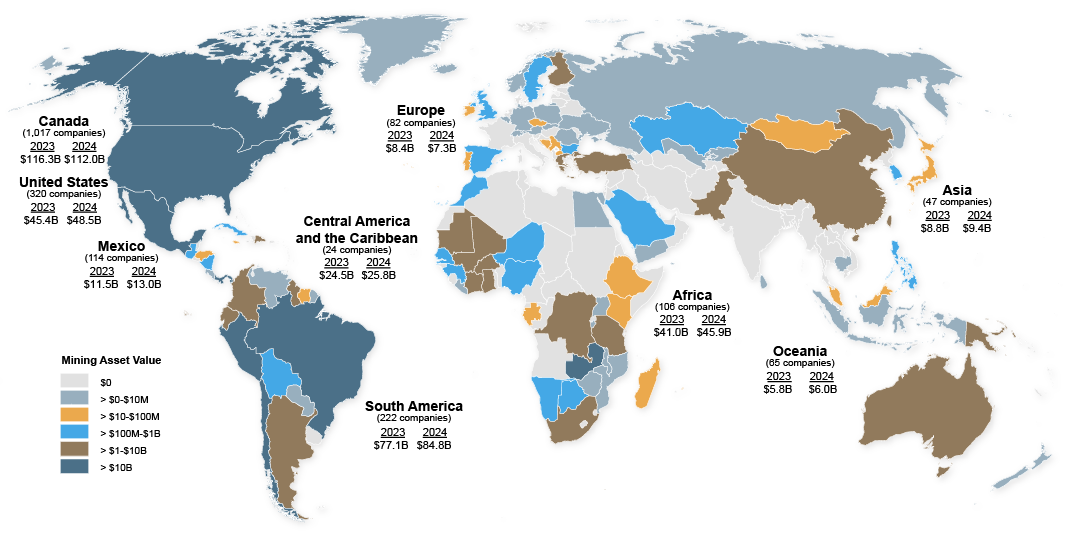

Canadian exploration and mining companies are active across the globe. The extent of their presence can be determined by examining the value and location of Canadian mining assets.

In 2024, the total value of Canadian mining assets increased by 4.1% from the previous year, with the portion located in Canada decreasing by 3.7%. Outside of Canada, the value of Canadian mining assets increased by 8.1%.

Key facts

- Canadian mining assets totalled $352.6 billion in 2024.

- Canadian mining assets abroad totalled $240.6 billion in 2024.

- In 2024, assets located abroad accounted for 68% of total assets.

Canada's presence abroad

In 2024, 71.5% of the value of Canadian mining assets abroad were in the Americas, where the value of assets increased by 8.6% from the previous year. Assets worth a total of $220.4 billion were located in 95 foreign countries in 2024. The top 10 countries are presented in the following table.

| Ranking | Country | Percentage |

|---|---|---|

| 1 | United States | 20.2% |

| 2 | Chile | 18.1% |

| 3 | Panama | 6.8% |

| 4 | Brazil | 6.7% |

| 5 | Zambia | 5.4% |

| 6 | Mexico | 5.4% |

| 7 | Peru | 4.7% |

| 8 | Democratic Republic of the Congo | 3.8% |

| 9 | Argentina | 3.4% |

| 10 | Dominican Republic | 3.1% |

Canadian mining assets, 2023–2024 (p)

Text version

The countries on this world map are colour-coded to represent a range of values for Canadian mining assets. For example, countries in light blue have Canadian mining assets in the range of $100 million to $1 billion. The asset values are listed for each continent and individually for Canada, the United States, and Mexico. Review the table, Canadian mining assets by global region, 2023–2024 (p) for specific values by region.

| Region | 2023 | 2024 (p) | Change ($ billions) | Change (%) |

|---|---|---|---|---|

| Africa | 41.0 | 45.9 | 4.9 | 12.1 |

| Americas (except Canada) | 158.5 | 172.1 | 13.6 | 8.6 |

| Asia | 8.8 | 9.4 | 0.6 | 6.4 |

| Europe | 8.4 | 7.3 | -1.1 | -13.6 |

| Oceania | 5.8 | 6.0 | 0.2 | 2.7 |

| Canadian mining assets abroad | 222.4 | 240.6 | 18.1 | 8.1 |

| Canada | 116.3 | 112.0 | -4.3 | -3.7 |

| Total Canadian mining assets | 338.8 | 352.6 | 13.8 | 4.1 |

Learn more about the global presence of Canadian mining companies.

Indigenous partnerships and participation

Indigenous partnerships and participation

NRCan’s lands and minerals sector is committed to promoting Indigenous partnerships and participation in mineral exploration and mining activities by sharing information to support informed decision-making and encouraging community capacity building.

Indigenous representation in the minerals sector has increased in the last decade, especially in the mining industry.

Key facts

- More than 17,300 Indigenous Peoples are employed in the minerals and metals sector.

- Indigenous Peoples account for 11% of the upstream mining industry’s labour force.

Learn more about our tools and information products on Indigenous participation in exploration and mining.

Indigenous employment

Based on the 2021 census, over 17,300 Indigenous Peoples were employed in Canada’s mining and mineral processing industries. About half of the Indigenous employment was in the upstream mining subsector, where Indigenous Peoples accounted for 11% of the industry’s labour force, more than double the all-industry average representation of 4%.

Agreements between companies and Indigenous Peoples

Agreements between mineral exploration and mining companies and Indigenous communities or governments have enabled secure benefits for many Indigenous communities and businesses and improved certainty for exploration and mining companies. Fostering the relationship between industry and Indigenous businesses builds the capacity for Indigenous businesses to capitalize on economic opportunities available in or near their communities. It also allows industry to create reliable, local supply chains and the social licence to operate in a community.

Learn more about Indigenous Peoples and Natural Resources.

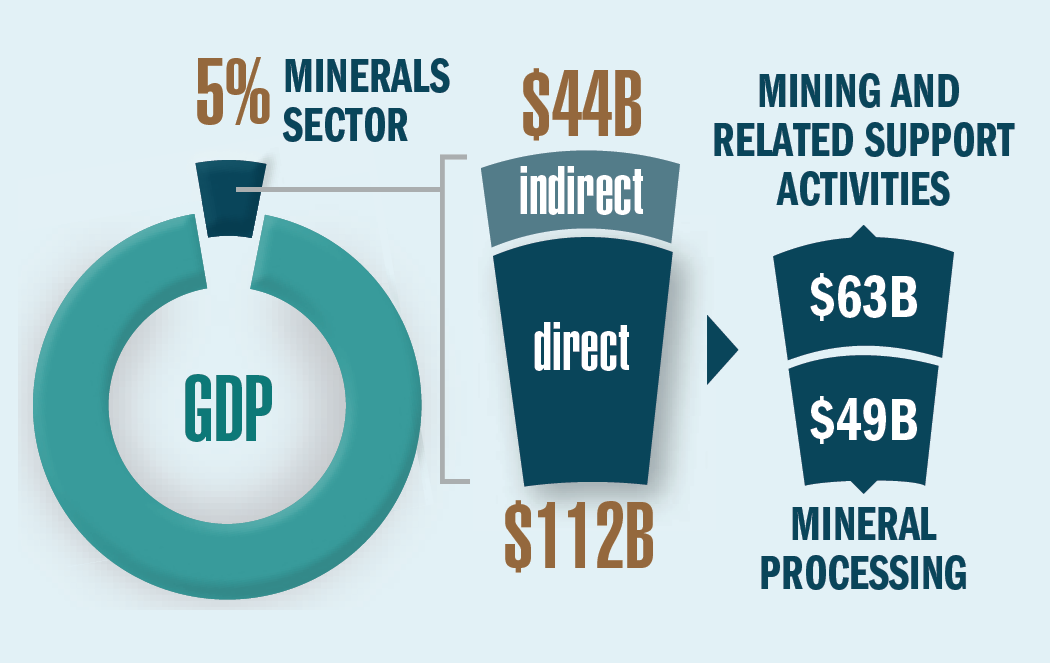

Nominal GDP in the minerals sector

Nominal GDP in the minerals sector

In 2024, the direct contribution of Canada’s minerals and metals sector to Canada’s gross domestic product (GDP) was $112 billion. The indirect contribution from the minerals and metals sector added a further $44 billion to the GDP, for a total of $156 billion, which represented 5% of Canada’s total GDP.

Minerals sector contribution to Canada’s gross domestic product, 2024

Text version

This chart shows that the direct and indirect contribution of the minerals and metals sector accounted for 5% of Canada’s total gross domestic product (GDP) in 2024. Indirect GDP for the minerals sector was $44 billion, while direct GDP was $112 billion. The direct contribution is further divided into mining and related support activities ($63 billion) and minerals processing ($49 billion).

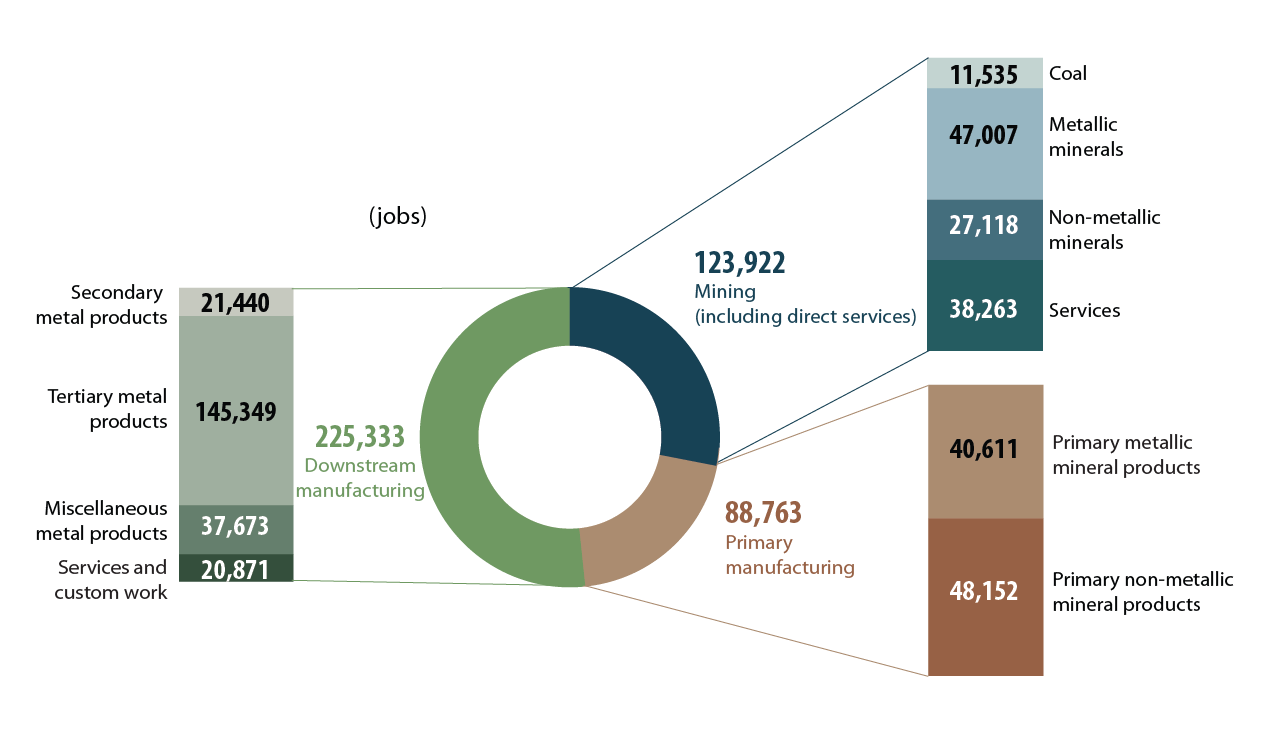

Employment in Canada's minerals sector

Employment in Canada's minerals sector

The minerals sector offers well-paid, high-quality jobs for Canadians across the country, including many in northern and remote locations.

In 2024, the minerals and metals sector directly employed 438,000 individuals and indirectly employed an additional 286,000, for a total of 724,000 individuals.

At $146,213, the average annual total compensation per job in the mining industry is almost twice the all-industry average of $78,098.

Minerals sector direct employment, by subsector and product group, 2024

Text version

This chart shows the number of direct jobs in the minerals subsectors. Stacked bars show a further breakdown by product group for 2024. Review the table, Minerals sector employment by subsector and product group, 2015–2024 for the specific values for each subsector and product group.

- Employment by subsector, by product group, and by year

- Employment by industry and by year

- Compensation per job by industry and by year

Employment by subsector, by product group and by year

| Subsector/commodity group | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Non-metallic minerals | 22 | 22 | 23 | 25 | 25 | 24 | 26 | 27 | 28 | 27 |

| Coal | 6 | 7 | 7 | 9 | 9 | 8 | 8 | 11 | 12 | 12 |

| Total extraction | 59 | 65 | 66 | 73 | 75 | 73 | 77 | 85 | 85 | 86 |

| Services | 29 | 29 | 29 | 33 | 33 | 30 | 37 | 37 | 37 | 38 |

| Primary metallic minerals products | 43 | 43 | 47 | 44 | 43 | 40 | 42 | 40 | 41 | 41 |

| Primary non-metallic minerals products | 47 | 45 | 46 | 49 | 49 | 43 | 47 | 48 | 48 | 48 |

| Total primary manufacturing | 90 | 88 | 93 | 93 | 93 | 83 | 89 | 87 | 88 | 89 |

| Secondary metal products | 25 | 23 | 24 | 25 | 26 | 22 | 22 | 23 | 22 | 21 |

| Tertiary metal products | 124 | 121 | 123 | 132 | 138 | 121 | 131 | 138 | 144 | 145 |

| Miscellaneous metal products | 38 | 36 | 32 | 30 | 31 | 29 | 35 | 35 | 37 | 38 |

| Services and custom work | 22 | 21 | 21 | 22 | 21 | 19 | 19 | 20 | 21 | 21 |

| Total downstream manufacturing | 209 | 201 | 201 | 209 | 216 | 191 | 208 | 216 | 224 | 225 |

| Total minerals sector | 388 | 382 | 389 | 408 | 416 | 378 | 410 | 426 | 435 | 438 |

Employment by industry and by year

| Industry | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Mining and quarrying (except oil and gas) | 64 | 70 | 73 | 75 | 78 | 76 | 80 | 88 | 88 | 90 |

| Mining-related support activities | 22 | 21 | 22 | 26 | 25 | 23 | 30 | 29 | 29 | 32 |

| Non-metallic mineral product manufacturing | 54 | 52 | 53 | 55 | 55 | 48 | 52 | 53 | 53 | 53 |

| Primary metal manufacturing | 64 | 62 | 64 | 63 | 63 | 57 | 60 | 60 | 59 | 59 |

| Fabricated metal product manufacturing | 164 | 162 | 161 | 166 | 172 | 151 | 160 | 168 | 174 | 172 |

| Total minerals sector | 368 | 367 | 373 | 385 | 392 | 355 | 381 | 398 | 404 | 405 |

Compensation per job, by industry and by year

| Industry | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (p) |

|---|---|---|---|---|---|---|---|---|---|---|

| Mining and quarrying (except oil and gas) | 120,354 | 118,592 | 117,703 | 121,508 | 123,392 | 128,897 | 130,160 | 133,972 | 142,471 | 146,213 |

| Mining-related support activities | 107,847 | 103,263 | 105,341 | 108,396 | 110,062 | 118,241 | 117,158 | 124,336 | 133,326 | 137,710 |

| Non-metallic mineral product manufacturing | 73,759 | 74,059 | 75,593 | 78,769 | 79,076 | 85,835 | 88,603 | 94,466 | 101,785 | 105,240 |

| Primary metal manufacturing | 103,561 | 103,786 | 106,373 | 110,761 | 111,868 | 119,084 | 120,043 | 124,368 | 133,842 | 138,050 |

| Fabricated metal product manufacturing | 72,463 | 70,836 | 70,648 | 72,818 | 74,144 | 79,866 | 80,684 | 86,059 | 91,421 | 94,760 |

| Canadian all-industry average | 58,878 | 58,334 | 59,417 | 61,356 | 62,599 | 68,150 | 69,119 | 71,920 | 75,260 | 78,098 |

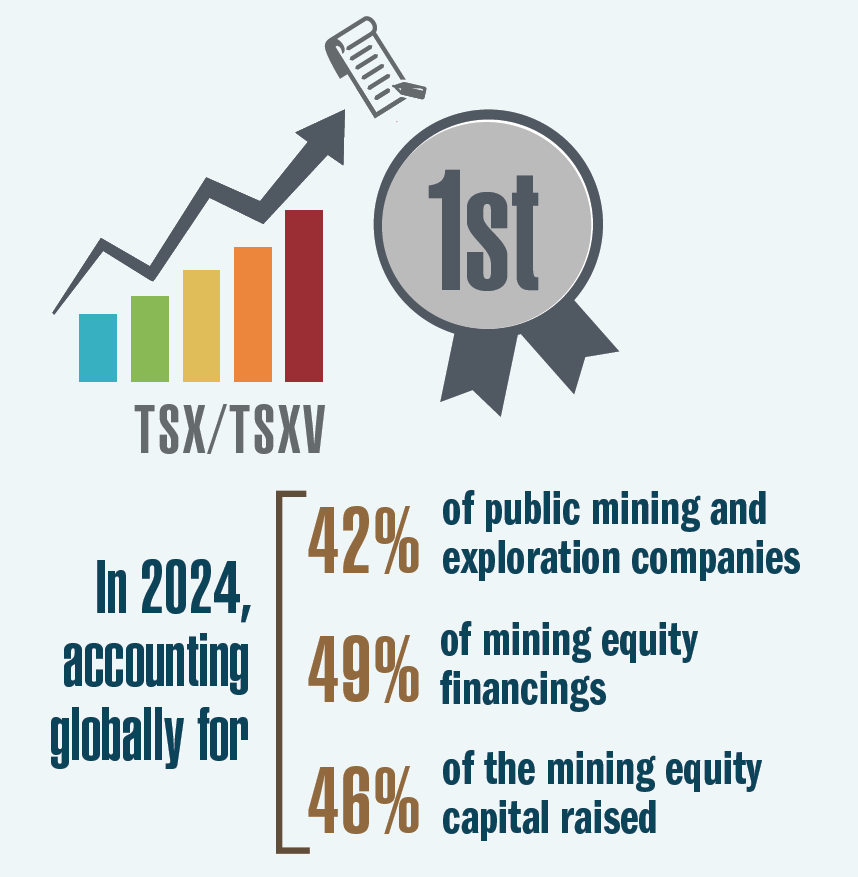

Financing

Financing

The Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) are the world’s primary listing venues for mining and mineral exploration companies. They included more than 1,097 issuers in 2024, accounting for about 40% of global listings.

In 2024, about 46% ($10.4 billion) of the world’s total equity capital for these activities was raised by companies listed on the TSX or TSXV. This amount also accounted for 49% of the number of mining equity financings for mineral exploration and mining globally. Canada is ranked first in the world in equity financing raised for mining and mineral exploration.

Text version

This graphic shows the Toronto Stock Exchange (TSX) and the TSX Venture Exchange (TSXV) as the world’s primary listing venues for mining and mineral exploration companies. It also shows that these exchanges account globally for 42% of public exploration and mining companies and 49% of the financings, which raised 46% of the capital in 2024.

Government revenues

Government revenues

In 2023, the mining and related support activities (mining and quarrying and support activities for mining) paid $6.8 billion in corporate income taxes and royalties. Mining taxes and royalties account for 58% of that amount, while the remainder is paid in the form of corporate income taxes to the federal, provincial, and territorial governments.

Read more on taxes relevant to the minerals and metals industries.

Trade

Trade

In 2024, Canada’s mineral imports and exports, which include ores, concentrates, and semi- and final-fabricated mineral products, recorded a balance of trade of over $34.2 billion.

| Trade partner | Domestic exports (excluding re-exports) |

Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| United States | 79.3 | 84.1 | 57.6 | 26.5 |

| United Kingdom | 22.7 | 23.4 | 0.7 | 22.7 |

| China | 9.5 | 9.5 | 14.9 | -5.4 |

| Switzerland | 5.5 | 5.5 | 1.0 | 4.5 |

| Japan | 5.3 | 5.4 | 2.6 | 2.8 |

| South Korea | 4.6 | 4.6 | 2.3 | 2.4 |

| Netherlands | 3.1 | 3.6 | 0.3 | 3.2 |

| Belgium | 2.2 | 2.2 | 0.4 | 1.9 |

| Germany | 2.1 | 2.4 | 2.7 | -0.2 |

| Hong Kong | 2.1 | 2.1 | 0.1 | 2.0 |

| Other countries | 16.5 | 17.1 | 43.3 | -26.2 |

| Total for Canada | 153.0 | 160.0 | 125.8 | 34.2 |

Exports

Valued at $153.0 billion in 2024, domestic mineral exports accounted for 21% of Canada’s total merchandise exports.

Text version

This graphic shows that domestic mineral exports account for 21% of total exports.

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Gold | 17.6 | 18.4 | 18.6 | 17.3 | 22.3 | 23.6 | 21.4 | 22.3 | 30.2 | 40.2 |

| Iron and steel | 13.6 | 12.9 | 14.9 | 16.4 | 14.5 | 13.1 | 20.0 | 22.9 | 21.8 | 20.6 |

| Aluminum | 10.5 | 10.7 | 12.7 | 13.0 | 11.0 | 11.1 | 15.2 | 18.2 | 16.9 | 17.4 |

| Iron ore | 6.9 | 6.2 | 7.2 | 7.6 | 7.0 | 7.4 | 9.9 | 9.4 | 9.3 | 10.7 |

| Copper | 3.8 | 4.7 | 7.1 | 7.9 | 7.5 | 4.9 | 8.0 | 14.5 | 12.7 | 10.2 |

| Coal | 3.6 | 3.8 | 4.6 | 5.3 | 6.6 | 7.6 | 10.1 | 8.8 | 8.9 | 8.8 |

| Potash and potassium compounds | 6.9 | 4.7 | 5.1 | 6.4 | 6.6 | 6.1 | 7.1 | 16.4 | 11.6 | 8.0 |

| Nickel | 5.4 | 4.2 | 3.8 | 4.2 | 4.1 | 3.9 | 4.7 | 7.0 | 5.9 | 4.6 |

| Platinum group metals | 1.7 | 1.8 | 2.1 | 2.6 | 2.3 | 2.0 | 2.3 | 2.4 | 2.1 | 2.0 |

| Zinc | 1.2 | 1.2 | 0.8 | 1.2 | 1.6 | 2.7 | 3.7 | 3.0 | 2.6 | 1.4 |

| All other minerals | 20.8 | 20.1 | 20.5 | 22.4 | 22.5 | 20.3 | 24.5 | 28.1 | 28.5 | 29.3 |

| Grand total | 91.9 | 88.6 | 97.3 | 104.3 | 106.0 | 102.6 | 127.0 | 153.2 | 150.4 | 153.0 |

Learn more about Canada's mineral imports and exports.

Minerals sector investment

Minerals sector investment

In 2024, the minerals sector invested $22.2 billion in new capital construction and in machinery and equipment, accounting for 6% of the Canadian total.

| Industry | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (p) | 2025 (si) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mining and quarrying (except oil and gas) | 10.2 | 9.6 | 9.0 | 10.0 | 10.9 | 9.5 | 11.5 | 14.5 | 17.1 | 16.3 | 16.5 |

| Mining-related support activities | 0.4 | 0.4 | 0.2 | 0.2 | 0.3 | 0.3 | 0.2 | 0.4 | 0.4 | 0.6 | 0.5 |

| Non-metallic mineral product manufacturing | 1.1 | 1.2 | 0.9 | 0.6 | 0.7 | 0.6 | 0.8 | 0.8 | 1.0 | 0.9 | 0.9 |

| Primary metal manufacturing | 3.2 | 2.3 | 1.5 | 1.8 | 2.3 | 1.8 | 1.7 | 2.9 | 2.9 | 3.4 | 3.7 |

| Fabricated metal product manufacturing | 0.7 | 0.7 | 0.9 | 0.9 | 1.1 | 0.9 | 1.1 | 1.2 | 0.0 | 1.1 | 1.1 |

| Total | 15.7 | 14.3 | 12.5 | 13.5 | 15.2 | 13.1 | 15.2 | 19.7 | 21.4 | 22.2 | 22.7 |

Learn more about capital investment by Canada's minerals sector.

Major natural resource projects

In 2024, current and potential investment in major mining-related projects (e.g. mine construction, redevelopment, expansion and processing facilities) over the next 10 years was estimated at $117.1 billion in capital expenditures, spread over 138 projects, compared with $93.6 billion and 129 projects in 2023.

Learn more about major natural resource projects that are planned and under construction over the next 10 years.

Notes and sources

(p) preliminary

(si) spending intentions

(r) revised

Totals may be different because of rounding.

Critical minerals

- Direct nominal GDP and employment

- Statistics Canada. Table 36-10-0707-01: Economic contribution of critical mineral production based on the Natural Resources Satellite Account, by commodity, Canada

- Indirect nominal GDP and employment

- Statistics Canada. Custom data table

Mineral production

- Canada’s mineral production, global ranking

- Natural Resources Canada; Statistics Canada; U.S. Geological Survey;

World Nuclear Association; Kimberley Process Rough Diamond Statistics

- Natural Resources Canada; Statistics Canada; U.S. Geological Survey;

- Mineral production by commodity group, 2015–2024 (p)

- Natural Resources Canada; Statistics Canada

- Leading minerals by value of production, 2024 (p)

- Natural Resource Canada; Statistics Canada

Mineral exploration

- Exploration and deposit appraisal expenditures and metals and minerals price index, 2015–2025 (si)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

- Annual Bank of Canada commodity price index, Metals and Minerals

- Exploration and deposit appraisal percentage of expenditures by mineral commodity group, 2015 and 2024 (p)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

- “Precious metals” include gold, silver and platinum group metals (iridium, osmium, palladium, platinum, rhodium and ruthenium). “Base metals” refers to non-ferrous metals such as copper, lead, nickel and zinc. “Other metals” refers to all other metals that do not fall under the categories of precious metals, base metals, uranium and iron ore.

- Exploration and deposit appraisal expenditures by mineral commodity group, 2015 to 2025 (si)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

- “Precious metals” include gold, silver and platinum group metals (iridium, osmium, palladium, platinum, rhodium and ruthenium). “Base metals” refers to non-ferrous metals such as copper, lead, nickel and zinc. “Other metals” refers to all other metals that do not fall under the categories of precious metals, base metals, uranium and iron ore.

- Exploration and deposit appraisal expenditures by province and territory, 2023–2025 (si)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

- Exploration and deposit appraisal activities include all activities carried out to search for, discover, characterize, and define in detail a mineral deposit for the pre-feasibility and final feasibility studies that will support a production decision, as well as the investment required. Expenditures include on-mine-site and off-mine-site activities, fieldwork, overhead costs, engineering, economic and pre-production or production feasibility studies, and environment and land access costs.

- Exploration and deposit appraisal share of expenditures by junior and senior companies, 2015–2025 (si)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

- Exploration and deposit appraisal expenditures by junior and senior companies, 2015–2025 (si)

- Natural Resources Canada, based on the annual Survey of Exploration, Deposit Appraisal and Mine Complex Development Expenditures

Canadian mining assets

- Share of Canadian mining assets abroad by country, 2024 (p)

- Natural Resources Canada

- Canadian mining assets, 2023–2024 (p)

- Natural Resources Canada

- Canadian mining assets by global region, 2023–2024 (p)

- Natural Resources Canada

- Canadian mining asset values are those reported in company financial reports, nearest to December 31, 2024, for public companies headquartered in Canada that are not under foreign control. Mining assets, in this context, reflect non-current assets. Such assets include mineral properties, deferred mineral exploration expenses, royalties, investments in non-Canadian mining companies, and other non-current assets related to mining that can be reconciled to a specific geographic location. Canadian mining assets include values for all countries including Canada, while Canadian mining assets abroad include values for all countries except Canada.

Indigenous partnerships and participation

- The Indigenous representation and employment numbers presented in this section are from Statistics Canada’s 2021 Census.

Nominal GDP in the minerals sector

- Minerals sector contribution to Canada’s gross domestic product, 2024

- Minerals sector nominal gross domestic product by subsector and product group, 2024

- Statistics Canada, Natural Resources Satellite Account, Table 38-10-0285-01

Employment in Canada's minerals sector

- Minerals sector direct employment by subsector and product group, 2024

- Statistics Canada, Natural Resources Satellite Account, annual average, Table 38-10-0285-01

- Minerals sector employment by subsector and product group, 2015–2024

- Statistics Canada, Natural Resources Satellite Account, annual average, Table 38-10-0285-01

- Minerals sector employment, by industry, 2015–2024

- Statistics Canada, System of National Accounts, Table 36-10-0489-01

- Minerals sector average annual total compensation per job, by industry, 2015–2024

- Statistics Canada, System of National Accounts, Table 36-10-0489-01

- Indirect jobs

- Estimated by Statistics Canada

Financing

- Key facts

- TMX group

Government revenues

- Key facts

- Statistics Canada; Natural Resources Canada, based on provincial/territorial public accounts

Trade

- Canadian mineral trade by trading partner, 2024

- Natural Resources Canada; Statistics Canada

- Exports key facts

- Natural Resources Canada; Statistics Canada

- Canadian domestic mineral exports, by commodity, 2015–2024

- Natural Resources Canada; Statistics Canada

- Mineral trade includes ores, concentrates, and semi- and final-fabricated mineral products.

Minerals sector investment

- Key facts

- Natural Resources Canada calculations based on Statistics Canada data

- Minerals sector capital expenditures, by industry, 2015–2025 (si)

- Natural Resources Canada; Statistics Canada, Table 34-10-0035-01

Minerals and metals sector

The minerals and metals sector (or minerals sector) refers to the following North American Industry Classification System (NAICS) industries:

- Mining:

- NAICS 212 – mining and quarrying (except oil and gas)

- Mining-related support activities:

- NAICS 213117 – contract drilling (except oil and gas)

- NAICS 213119 – other support activities for mining, including mineral exploration

- Mineral processing:

- NAICS 327 – non-metallic mineral product manufacturing

- NAICS 331 – primary metal manufacturing

- NAICS 332 – fabricated metal product manufacturing

The mining-related support activities subsector includes exploration and drilling companies and service companies operating on a fee or contract basis. It does not include all mining industry suppliers because some entities service multiple sectors (e.g., transportation, construction, finance and legal).

The GDP and employment values are based on the Statistics Canada Natural Resources Satellite Account (NRSA), which estimates the contribution of resource-related activities to the Canadian economy. The NRSA defines natural resource activities as products and services originating from naturally occurring assets, such as minerals, used in economic activity. In this way, the NRSA goes beyond an industry perspective of natural resources and seeks to identify natural resource activities and products within the Canadian economy. For NRSA-based indicators, the minerals and metals sector includes activities involved in:

- Extracting and initial processing of mineral products (also referred to as primary production):

- Extraction of coal, metallic minerals (e.g., copper, gold, lead, nickel, silver and zinc), and non-metallic minerals (e.g., diamonds, potash, salt and stone)

- Services for mining and quarrying and for exploration

- Primary metallic mineral products (e.g., aluminum and aluminum-alloy ingots and billets, iron and steel basic shapes, ferro-alloy products, and refined precious and base metals)

- Primary non-metallic mineral products (e.g., clay products, glass and glass products, and cement)

- Downstream processing and manufacturing of metal products, which use a large portion of metal products as inputs:

- Secondary metal products (e.g., iron and steel pipes and foundry products)

- Tertiary metal products (e.g., cutlery and forged and stamped products)

- Miscellaneous metal products (e.g., communication and energy wire and cable and motor vehicle metal stamping)

- Services and custom work (e.g., coating, engraving and heat treating)

For more information on the NRSA, consult Statistics Canada, The Natural Resources Satellite Account: Feasibility Study.

Find out more