Foreword

The science of climate change is clear: the primary driver is greenhouse gas emissions from the production and combustion of fossil fuels.

Canada—and countries around the world—need to move aggressively to largely eliminate the unabated combustion of fossil fuels over the period between now and 2050. Simultaneously, we must focus on the elimination of emissions relating to oil and gas production, to ensure that those volumes of oil and gas that continue to be used post 2050 in non-combustion or abated combustion applications, are compatible with a net-zero future.

During the coming 30-year period of transition and beyond 2050, countries that focus on producing hydrocarbons with ultra-low production emissions will enhance their competitiveness. Aggressive action to reduce emissions from the production of oil and gas is thus critical for the competitiveness of any producing country that wishes its resources to be relevant in a net-zero future.

This federal government’s focus on decarbonizing Canada’s oil and gas sector is both a plan to protect the planet for future generations and to enhance the short and long-term competitiveness of the industry.

It is a plan that recognizes the direction in which the global economy is heading. A plan that utilizes an array of effective incentives, regulations, investments and programs. A plan that collaborates and engages with provinces and territories, industry, Indigenous Peoples, international partners, and others. A plan that centres on and prioritizes workers from coast to coast to coast.

It’s up to us as a country to make smart choices. And we do have a choice.

We can choose to lead by recognizing where the world is heading and aggressively decarbonize and diversify in pursuit of major areas of economic opportunity. Or we can bury our head in the sand, pretend that the world is not moving rapidly toward a cleaner, greener future—and thereby erode our competitiveness and our long-term prosperity.

We simply must choose to lead.

Minister of Environment and Climate Change

Minister of Energy and Natural Resources

Introduction

Addressing climate change is the most pressing global challenge of our generation—one that, at the same time, offers enormous economic opportunity for countries that choose to seize it. As the world races to reduce greenhouse gas (GHG) emissions and avoid the destructive impacts of climate change, thoughtful countries are moving rapidly to seize the opportunities that decarbonization and a net-zero global economy present.

For Canada’s oil and gas sector, climate change is not just an environmental issue, it is a competitiveness issue. As the world moves to reduce emissions generated by the production and combustion of fossil fuels, oil and gas extracted with the lowest production emissions are expected to be in the highest demand. This is true not only for combustion-related uses of oil and gas that will exist in smaller volumes as global demand declines over the coming decades, but also for non combustion applications of fossil fuels—such as petrochemicals, solvents, waxes, asphalt, carbon graphite and others—that will continue to be required in a net-zero world.

Aggressively reducing production-related emissions early and boldly can confer a significant competitive advantage to the sector and its workers. In recent years, Canada’s oil and gas sector has made progress in reducing the emissions intensity of its production and in developing new emission reduction technologies. Many leading firms in the sector have committed themselves to achieving net-zero by 2050, as have the major oil and gas producing provinces of Alberta, British Columbia, and Newfoundland and Labrador.

However, ensuring long-term competitiveness for Canada’s oil and gas sector requires that it achieve significant and sustained reductions in absolute emissions on a path to net-zero production emissions by 2050.

The Government of Canada has committed to achieving net-zero emissions by 2050 and has set an ambitious and achievable target for 2030 to ensure we get there. Achieving these goals will require collective action on the part of the Government of Canada, provinces and territories, Indigenous Peoples, industry, unions and civil society. The Government of Canada is committed to working collaboratively to spur innovation and action that will ensure the long-term competitiveness of Canada’s economy—including the long-term competitiveness of Canada’s oil and gas sector—while simultaneously aggressively reducing greenhouse gas emissions.

This roadmap seeks to provide a framework for efforts to decarbonize, diversify and enhance the competitiveness of the oil and gas sector.

The roadmap outlines the diversity of the sector, its role in Canada’s economy and global trends in oil and gas. The roadmap also outlines the various measures that the Government of Canada is undertaking to reduce oil and gas sector emissions, accelerate investment, and enhance long-term competitiveness.

Canada’s Oil and Gas Sector – Composition and Emissions

The oil and gas industry in Canada can be divided into three primary sub-sectors—upstream, midstream and downstream—each of which represent different stages of oil and gas production and distribution processes:

- Upstream activities: involve exploration and production of crude oil and natural gas. Canada has significant upstream operations in British Columbia, Alberta, and Saskatchewan, and in the offshore in Newfoundland and Labrador. Oil sands, conventional oil and offshore oil and gas production methods differ greatly in terms of where the production takes place, cost, time horizon and emissions. Most natural gas in Canada today comes from tight gas in British Columbia and Alberta, which is from reservoirs that need to be hydraulically fractured to flow at economic rates.

- Midstream activities: focus on the transportation and storage of oil and natural gas, from production sites to refineries or processing facilities particularly in central Canada, the United States and to global markets. This sector includes pipelines, tanker trucks, rail transport, and storage facilities. Soon it will also include liquified natural gas (LNG) export terminals which will ship LNG from the coast of British Columbia to global markets.

- Downstream activities: focus on refining oil into various petroleum products and distributing them to end users. Refineries in Canada process crude oil into products such as gasoline, diesel, jet fuel, and petrochemicals. The downstream sector also includes retailing, where oil and gas products are sold to consumers at gas stations and through other retail channels.

The oil and gas sector consists of a wide range of companies that vary in size, ownership structure and operational focus. Large multinational corporations are particularly active in the Alberta oil sands, and in the Canada-Newfoundland and Labrador offshore. Many of these companies have extensive global operations. There are also several large Canadian companies that are integrated across the entire oil and gas value chain. Some of these operators are public companies. In addition, medium-and-small scale independent operators contribute to the production of Canada’s conventional oil and gas resources in rural and remote regions across Canada, primarily in northern British Columbia and southern Alberta and Saskatchewan.

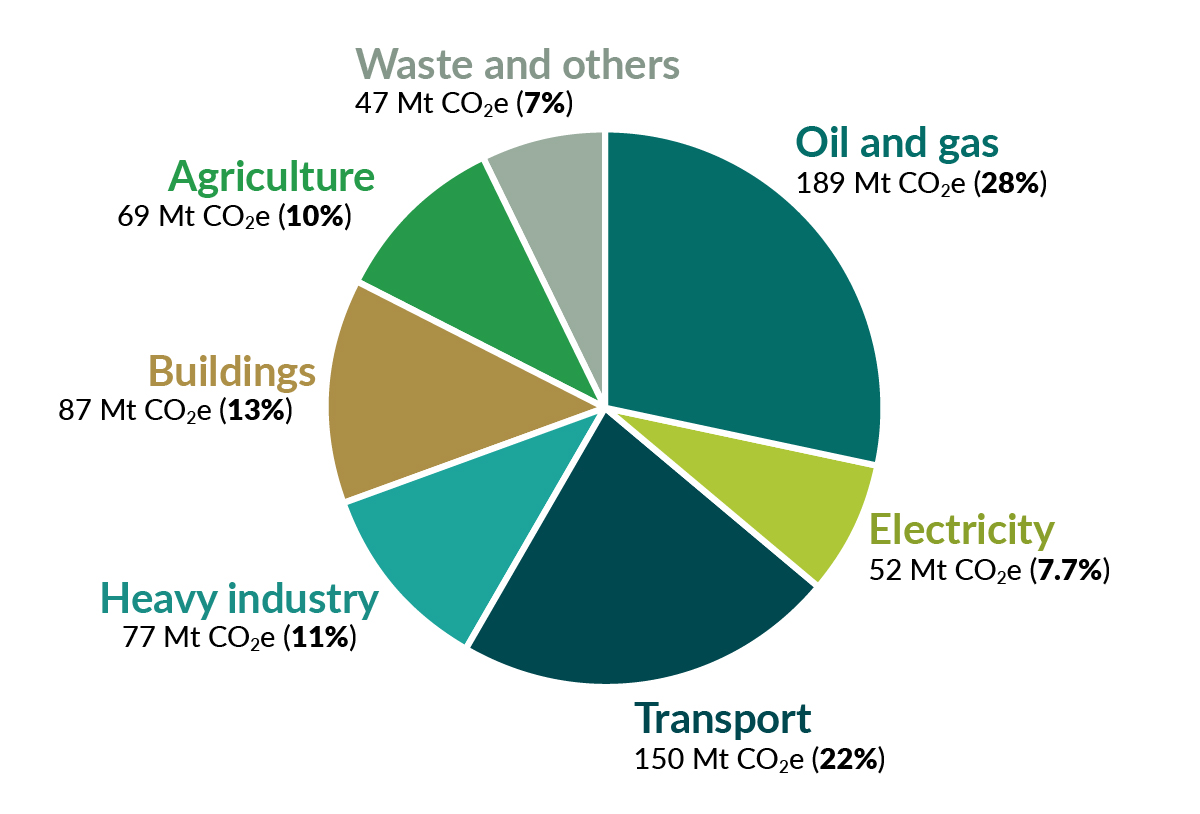

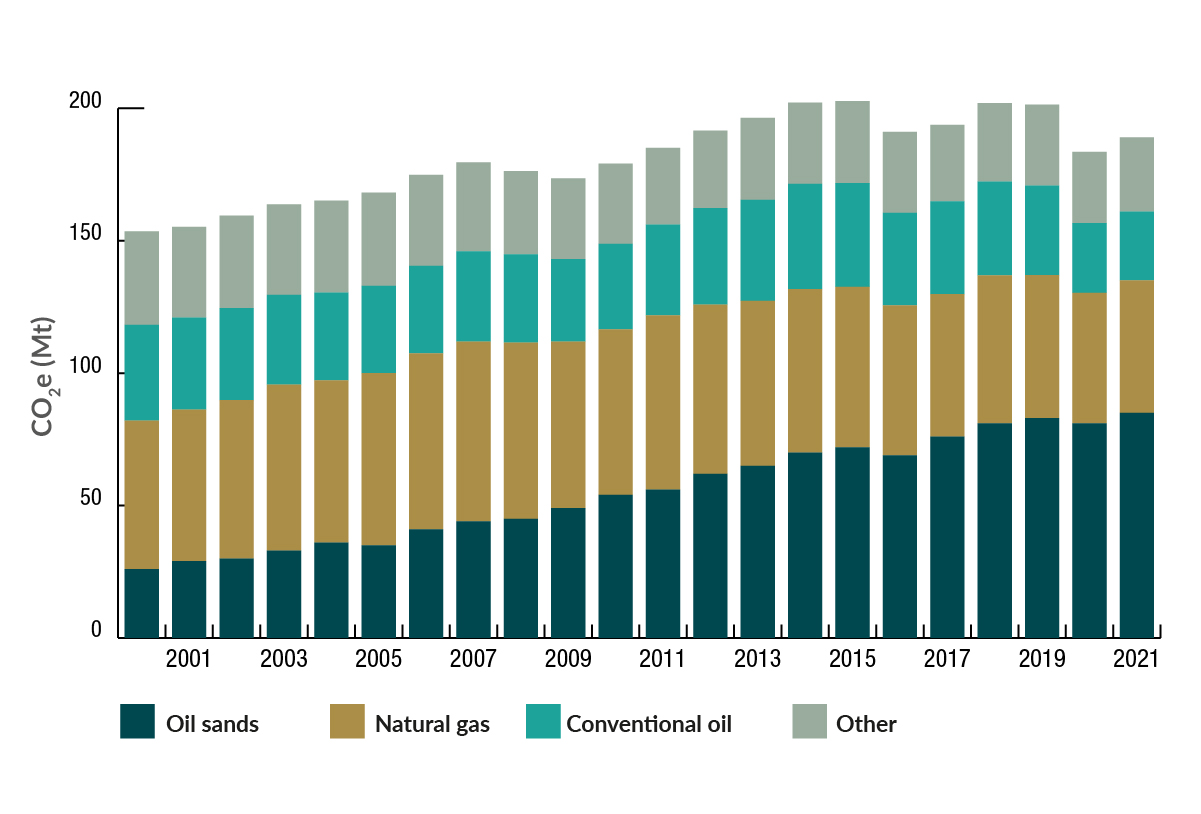

The oil and gas sector is the largest single source of emissions for Canada—accounting for 28% of Canada’s emissions in 2021Footnote 1. With production increasing considerably over the past few decades, primarily in the emissions-intensive oil sands, emissions have followed, rising from 168 MT carbon dioxide equivalent (CO2e) in 2005 to 201 MT C02e in 2019, the latest year in which we have data that is not skewed by the COVID-19 pandemic.Footnote 2.

Figure 1: Breakdown of Canada’s GHG emissions by economic sector (2021)

Text version

Figure 1 is a pie chart displaying the breakdown of Canada’s GHG emissions in 2021 by the following seven economic sectors: oil and gas, electricity, transport, heavy industry, buildings, agriculture, and waste and others. The total GHG emissions are 670 Mt CO2e. The figure shows that 28% of GHG emissions come from the oil and gas industry, 22% from the transport industry, and 13% from the buildings industry. Heavy industry, agriculture, electricity, and waste and others contribute to the smaller shares.

While Canada’s overall GHG emissions have decreased between 2005 and 2021, this is largely attributed to emission reductions from the electricity and heavy industry sectors. The transportation and waste/other sectors have also reduced emissions, but the buildings, agriculture, and oil and gas sector emissions increased during this period.

Within the oil and gas sector, the emissions intensity (emissions per unit of production) of oil production has declined across most subsectors since 2005 through a combination of energy efficiency, fuel switching and the deployment of additional clean technologies.

Figure 2: Canada’s oil and gas sector GHG emissions by production from 2000 to 2021Footnote 3

Text version

Figure 2 presents the breakdown of the oil and gas sector’s GHG emissions by production source (oil sands, natural gas, conventional oil, and other) between 2000 and 2021. It shows that oil sands production has consistently emitted the most GHG emissions, followed by natural gas, conventional oil, and other. The figure also shows that during this period, oil sand production emissions increased while emissions from conventional oil and natural gas production decreased.

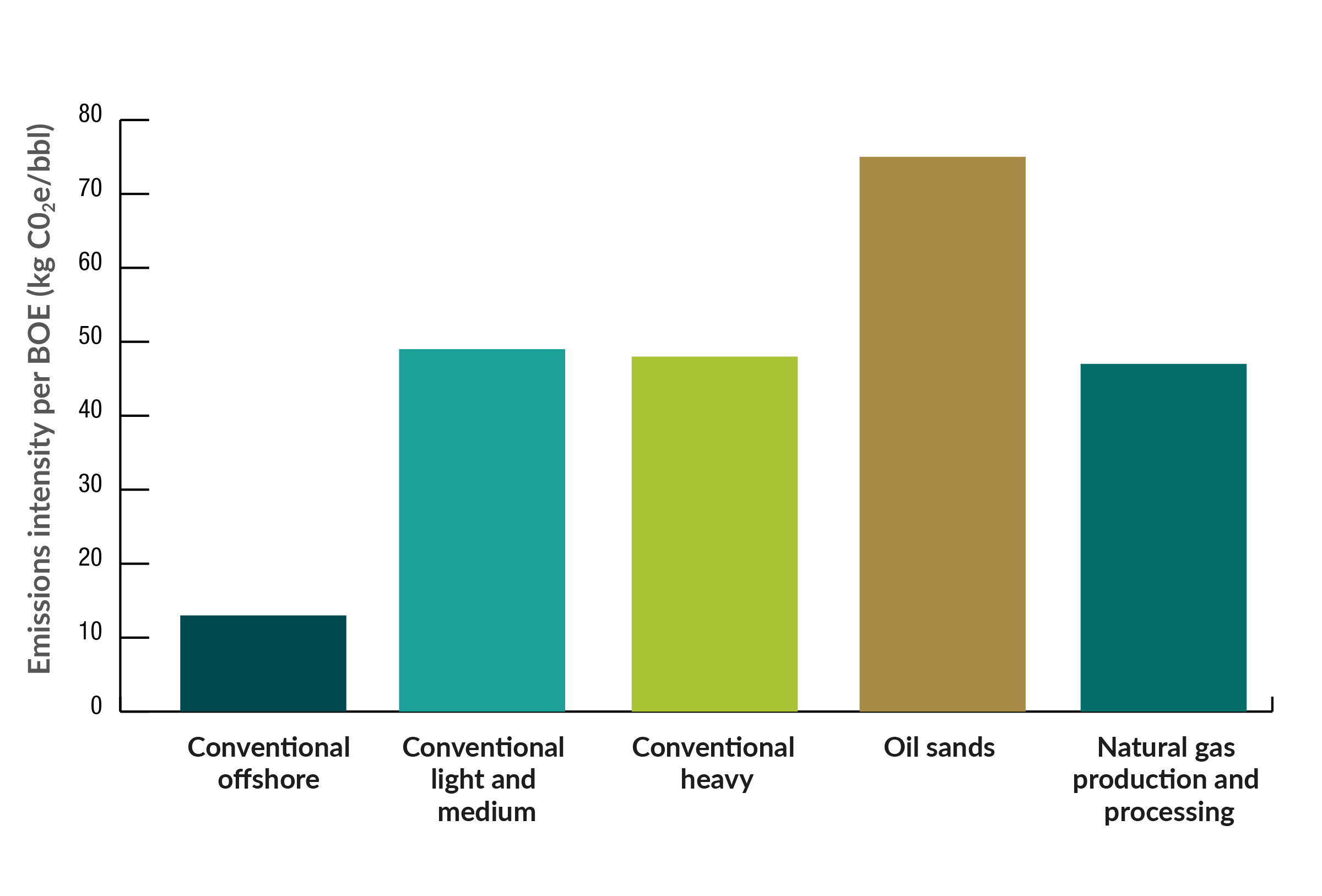

Importantly, emissions intensity of oil and gas production can vary significantly depending on how, where, and what type of oil and gas is produced. For example, in 2020, Canada’s offshore oil production of lighter crude had an average emissions intensity that was approximately 25% of the average for heavy oil from Canada’s oil sands—20 kg CO2e/barrel compared to 80 kg CO2e/barrel.Footnote 4

The average emissions intensity of natural gas production is about 46 kg CO2e/barrel. Canada’s strengthened oil and gas methane regulations are expected to further drive down the Canadian oil and gas sector’s emissions intensity, which has already been on the decline for several years.

Figure 3: Emissions intensity by sub-sector in Canada’s oil and gas sectorFootnote 5

Text version

This bar graph shows the oil and gas emissions intensity per barrel of oil by subsector in 2021. It shows that oil sands have the highest emissions intensity (approximately 75 kg CO2e/barrel), followed by conventional light and medium (approximately 49 kg CO2e/barrel), conventional heavy (approximately 48 kg CO2e/barrel), natural gas production and processing (approximately 47 kg CO2e/barrel) and conventional offshore (approximately 13 kg CO2e/barrel).

Beyond the progress that has been made in driving down emissions intensity, absolute emissions have also begun to stabilize in the sector. This success has been driven by federal and provincial government policies developed and implemented over the past eight years and by investments made by the sector to improve emissions performance.

Many companies in the sector are committed to net-zero by 2050 and have ambitious interim targets. This includes the Pathways Alliance, a collective of Canada’s oil sands companies, as well as numerous global oil and gas companies. The Pathways Alliance has outlined a decade-by-decade path to net-zero that includes cutting emissions by 22 MT CO2e by 2030. Canadian Natural Resources Limited, one of Canada’s largest producers of oil and gas, has committed to reducing absolute emissions by 40% from a 2020 baseline by 2035Footnote 6. Cenovus recently committed to cutting methane emissions by 80% from a 2019 baseline by 2028Footnote 7.

Governments have a role to play in ensuring that the sector can and will reduce emissions at the pace and scale necessary to reach net-zero by 2050. Meeting these important objectives will require significant innovation and will on the part of industry and federal and provincial governments.

The Role of the Oil and Gas Sector in Canada’s Economy

Canada is presently the world’s fourth largest oil producer and fifth largest gas producerFootnote 3, providing fuel to move people and goods, sources of heat and electricity for residential, commercial, and industrial purposes. Oil and gas are feedstocks to produce critical material and value-added products including petrochemicals, fertilizers, solvents, personal protective equipment, construction materials such as asphalt, and pharmaceuticalsFootnote 4.

The oil and gas sector is a major contributor to the national economy and a significant source of jobs. In 2022, the sector accounted directly for 7.2% of Canada’s nominal GDP and contributed $217 billion in exports, representing 30% of the total value of Canadian exportsFootnote 3. It also generates significant revenue—both income tax and resource royalties—for all orders of government. From 2017 to 2021, federal, provincial, and territorial governments received an average of $12 billion annually in revenues from the sectorFootnote 3. In 2021, the total revenue for the Canadian oil and gas extraction industry was $174 billionFootnote 8.

The sector supports employment across the country and has increased local incomes significantly for Canadians in rural and remote regions in British Columbia, Alberta, Saskatchewan and Newfoundland and Labrador. In 2022, the sector directly and indirectly employed 412,600 CanadiansFootnote 3. The sector is also the largest private sector employer for Indigenous Peoples in Canada, with approximately 10,800 Indigenous people working in the sector in 2022Footnote 3.

In addition to the jobs concentrated in oil and gas producing provinces, there are thousands of jobs in manufacturing, environmental, and financial services tied to the oil and gas industry in provinces across the country. Canada has benefitted as a nation from generations of hard-working Canadians who have provided the energy needed by our growing economy and that of partners around the world.

Global and Domestic Demand Scenarios for Oil and Gas

Every year, the world’s foremost authority on global energy markets, the International Energy Agency (IEA), releases three forecasts of global oil and gas demand between now and 2050 that consider various levels of international climate ambition, including the achievement of net-zero global emissions. It is within this context that Minister Jonathan Wilkinson tasked the Canada Energy Regulator (CER) to model Canada-specific forecasts, based on the IEA’s modelling. Consequently, the CER released its June 2023 Energy Future Report, which explored how various levels of Canadian and global climate ambition would affect Canadian oil and gas production.

Two of these scenarios, the Global Net-Zero and Canada Net-Zero scenarios, explore pathways to net-zero and both assume Canada achieves net-zero emissions by 2050. The Global Net-Zero scenario models the conditions that would need to be met for the world to achieve net-zero by 2050 and to keep global warming below 1.5 degrees Celsius above pre-industrial levels. It assumes that larger global emitters like China and India accelerate their net-zero commitments by 10 and 20 years respectively although neither state has demonstrated an intention to do.

The Canada Net-Zero scenario assumes all parties to the Paris Agreement achieve their current climate commitments. This means that virtually all high-income countries achieve net-zero by 2050 while China and India reach net-zero by 2060 and 2070 respectively, as they have previously committed to do.

This is an ambitious scenario that assumes all parties to the Paris Agreement achieve what they have committed thus far. This scenario is estimated to keep warming to 1.7 degrees Celsius above pre-industrial levels. It projects that Canadian oil and gas production will peak by 2030, and then decline to 2050—in line with global demand.

In the two Net-Zero scenarios, global demand for oil and gas will decline to between 35 and 75% of current production levels by 2050. Nevertheless, even in a net-zero future, demand for oil and gas will remain, specifically for non-combustion products, abated combustion applications and in some smaller residual uses that may not be easily fully decarbonized.

The third CER scenario—a Business as Usual scenario—assumes no significant further climate action is taken by the international community. This scenario would see more significant increases in the rise of global average temperatures than what is projected if countries complied with their stated commitments under the Paris Agreement. It is essentially a scenario that assumes the world will not act to keep the rise in global average temperature to less than 2 degrees Celsius. In Canada, oil production would peak in the mid-2030s and then decline more gradually while natural gas production increases out to 2050 in this scenario.

According to the IEA’s most recent World Energy Outlook report, global demand for oil and gas will peak before 2030, even in the most conservative scenario modelled wherein no new action is taken to reduce emissionsFootnote 9. In the IEA Net-Zero scenarios, global demand for oil and gas will decline to between 25 and 50% of current production levels by 2050. Nevertheless, even in a net-zero future, demand for oil and gas will remain, as noted above.

Modelling done by large global oil and gas companies including Shell,Footnote 10 BP,Footnote 11 and EquinorFootnote 12 show that global demand for oil and gas is expected to decline in scenarios where the international community fulfills its emissions reduction pledges under the Paris Agreement.

The Decarbonization Imperative for Canada’s Oil and Gas Sector

While production in Canada’s oil and gas sector has continued to increase since 2014, employment peaked that year, at the same time capital investment in the sector also reached its zenith. Globally, the oil and gas sector was particularly hard hit during the pandemic, although demand is now higher than it was before the pandemic, while employment levels have partially recovered. Employers have seen challenges in hiring new staff due to the cyclical nature of the industry and because the skills of oil and gas workers are in strong demand in other parts of the energy sector.

Challenges are likely to persist as the world shifts toward a net-zero future and demand for oil and gas will begin to decline—as, for example, more zero-emission vehicles (ZEVs) are deployed on our roads. As noted previously, the IEA now projects such a decline will begin to happen later this decade. Specifically, in a world where demand declines, and supply remains largely constant, these markets will become more competitive and producers will increasingly need to drive down their emissions intensity, along with costs, to be able to compete.

Countries shifting to net-zero may increasingly value lower carbon intensity oil and gas. For example, the European Union’s carbon border adjustment mechanism may be expanded to cover oil and gas. Other countries are also exploring carbon border adjustments, including the United States, to whom Canada exports approximately 97% of its oilFootnote 3 .

Global financial markets, financial institutions, and institutional investors are also increasingly focused on assets that will perform well in a low-carbon world—and away from those that will not. During COP26, for example, the Glasgow Financial Alliance for Net-Zero (GFANZ) was formed, bringing together over 500 financial institutions that committed to accelerate the shift to net-zeroFootnote 13. Additionally, BlackRock, the world’s largest institutional investor with over USD 8 trillion in assets, has called on companies in which it invests to show that they have credible plans to achieve net-zero by 2050Footnote 14.

Consequently, to ensure Canada’s oil and gas sector will continue to be an important economic driver that provides good paying jobs for Canadians, it must aggressively reduce emissions to ensure its products will be highly competitive in a low-carbon future.

By focusing on decarbonization, Canada’s oil and gas sector can enhance its global competitiveness and continue to support well paying, sustainable jobs for workers across the country.

Positioning Canada’s Oil and Gas Industry for Success in a Low Carbon World

Methane emissions abatement provides a clear example of how decarbonization can drive innovation and jobs and create economic opportunities. Methane regulations implemented by federal and provincial governments have spurred an ecosystem of innovation in Alberta and other producing provinces. There are now over 170 companies providing methane management solutions.Footnote 15 These companies are helping Canada’s oil and gas sector reduce methane emissions while exporting solutions to oil and gas companies in other parts of the world.

Similarly, the development and deployment of carbon management technologies are poised to create thousands of well-paying jobs that will enable the sector to decarbonize. Today, Canada is home to 8 of the 41 global commercial carbon capture facilities, including five commercial-scale carbon management projects and three carbon transport and storage hubs. Many of the global leaders in carbon management are also based in Canada. For instance, Burnaby-based Svante Inc. is developing a novel low-cost point-source carbon capture technology for use at industrial sites and is constructing a Carbon Capture, Utilization and Storage (CCUS) Centre of Excellence with millions in support from the Government of Canada. Through companies like Svante, Canada is contributing to efforts to decarbonize oil and gas at home and abroad.

Overall, it is estimated that investments in decarbonization in the sector could generate thousands of jobs in oil- and gas-producing provinces.

Beyond the opportunities that exist for the oil and gas sector to enhance its competitiveness via the production of low-carbon oil and gas, there are enormous adjacent opportunities for the sector that many organizations are already pursuing. These would include:

- Hydrogen derived from natural gas with carbon capture, a promising low-emissions pathway to producing hydrogen which is critical to decarbonize hard-to-abate sectors like steel and long-distance shipping. Oil and gas companies are already partners in one third of projects to produce hydrogen from natural gas with carbon capture globally, and that has the potential to grow as global demand for low-emissions hydrogen grows to between 250 and 415 megatonnes per year globally by 2050Footnote 16.

- Low-carbon biofuel production, which utilizes many of the same skills and expertise as oil and gas extraction, making the switch far easier for workers in the industry. Recognizing this potential, many oil and gas firms have invested in biofuels production. This includes Imperial Oil’s $720 million renewable diesel facility in the Edmonton area that was announced earlier this yearFootnote 17.

- Renewable energy, including renewable electricity generation, is a lucrative investment opportunity for oil and gas companies given that it is a rapidly growing sector, especially in the oil- and gas-producing province of Alberta. Alberta accounted for 75% of Canada’s increase in solar and wind generation in 2022, largely owing to its abundance of solar and wind resourcesFootnote 18.

- Critical mineral extraction, which is vital for manufacturing numerous clean technologies, is an area that oil and gas companies are exploring as a source of long-term sustainable wealth. Canada’s Leduc oil fields have been identified as a potential location for lithium brine extractionFootnote 19.

- Electric vehicle charging infrastructure, in which some oil and gas companies are investing in electric vehicle chargers, is a growing need as drivers rapidly shift toward electric vehicles and away from internal combustion engines vehicles. For example, Petro-Canada opened a coast-to-coast network of electric vehicle fast chargers in 2019Footnote 20.

Overall, a recent IEA report indicated that approximately 30% of energy consumed in a net-zero system is projected from low-emissions fuels and technologies that would benefit from the skills and resources of the oil and gas industry. There is a USD 350–500 billion annual investment opportunity in clean energy technologies in 2030 that are suited to the skills and expertise of the oil and gas industryFootnote 16.

It is evident that decarbonization and diversification are a necessity in Canada’s oil and gas sector and more needs to be done. The sector has financial resources due to record profits it has generated in recent years, and the Government of Canada is a willing partner with tools such as the suite of Investment Tax Credits that were announced in Budget 2023. Major opportunities exist to sustain and to create jobs and economic opportunity in the sector. It is up to all of us to work together to seize these opportunities.

Canada’s Actions to Reduce Oil and Gas Sector Emissions

Since 2015, the Government of Canada has been developing and implementing several important measures focused on decarbonizing and thereby strengthening the oil and gas sector. These measures can be grouped into three broad categories: (1) incentives, (2) carbon pricing and regulations, and (3) global and domestic leadership.

- Incentives

- Committing billions of dollars via major funding tools to support innovation and emission-reducing activities, such as through Canada’s Energy Innovation Program, Emissions Reduction Fund (onshore and offshore), and Strategic Innovation Fund.

- Introducing an Investment Tax Credit for Carbon Capture, Utilization and Storage (CCUS), with enabling legislation being introduced before the end of 2023.

- Introducing an Investment Tax Credit for Clean Hydrogen, which includes hydrogen derived from natural gas with carbon capture, with a larger tax credit being granted as the emissions intensity of production is reduced.

- Supporting low-emission biofuel projects through contributions disbursed under the Clean Fuels Fund.

- Driving the manufacturing of clean energy projects through the Smart Renewable and Electrification Pathways Program which was recapitalized with $3 billion in new funds in Budget 2023.

- Supporting the uptake of Zero-Emission Vehicles through the installation of 84,500 public electric vehicle chargers by 2029 via the Zero-Emission Vehicle Infrastructure Program and the Canada Infrastructure Bank.

- Committing up to $7 billion through the Canada Growth Fund to issue contracts for difference which can be used to support CCUS projects.

- Supporting Indigenous communities in sharing in the benefits of major projects in their territories, including through an Indigenous Loan Guarantee Program.

- Phasing-out inefficient fossil fuel subsidies in 2023 and publishing rigorous analytical guidelines and a framework to support transparent action.

- Ending new public support for the international unabated fossil fuel energy sector, as committed under the Glasgow Statement.

- Carbon pricing and regulations

- Putting a price on carbon pollution and increasing carbon price predictability.

- Strengthening methane regulations to reduce methane emissions by 75% from 2012 levels by 2030.

- Complementary to the Enhanced Methane Regulations, the Government of Canada is investing $30 million over 5 years to establish a Methane Centre of Excellence that will improve our understanding and reporting of methane emissions, with a focus on collaborative initiatives on data and measurement.

- Accelerating the use of clean technologies and fuels through the Clean Fuel Regulations.

- Putting in place a system to cap and cut oil and gas sector emissions at a pace and scale required to contribute to Canada’s 2030 climate goals, to achieve net-zero GHG emissions by 2050, and in a way that allows the sector to compete in the emerging net-zero global economy.

- Global and domestic leadership

- Showcasing Canada’s approach to oil and gas sector methane actions globally via the Global Methane Pledge and collaborating with domestic and international partners to increase measurement, reporting, verification, and mitigation of methane emissions.

- Demonstrating leadership in sustainable finance by developing, in consultation with regulators, the financial sector, industry and independent experts, a taxonomy that is aligned with reaching net-zero by 2050.

- Releasing a Carbon Management Strategy to promote a competitive and robust carbon management sector in Canada.

- Establishing the Net-Zero Producers Forum, a platform for oil- and gas-producing countries to share best practices on decarbonization and support the implementation of the Paris Agreement, including through the methane toolbox unveiled at COP28.

- Participating in the Measurement, Monitoring, Reporting and Verification Framework working group in order to harmonize and coordinate global voluntary measurement, monitoring, verification, and reporting certification schemes to drive down emissions throughout the natural gas supply chain.

Taken together, these federal measures are aimed at supporting the sector and producing provinces to achieve our common objectives of net-zero by 2050 while ensuring economic competitiveness, prosperity, good jobs, and energy security moving forward.

The Government of Canada is also:

- growing our clean electricity system so that the electricity sector can deliver power and heat across the country and play a significant role in producing low-carbon products such as steel, wood, fertilizers, cement, and mineralsFootnote 21;

- decarbonizing the transportation sector, investing in electrified public transportation and improving uptake in ZEVs by increasing financial support for purchasing ZEVs, investing in charging infrastructure, and building a Canadian battery supply chain that includes critical minerals and manufacturing;

- shifting the country’s building stock to net-zero through the development of Canada’s Green Building Strategy and various funding and financing programs for residential, community and public building retrofits and net-zero new builds to help Canadians save on energy bills and reduce emissions.

Beyond the policies and regulations implemented by the Government of Canada, provinces and territories have also undertaken several important actions to decarbonize the oil and gas industry in Canada, including:

- administering carbon pricing systems, in accordance with the federal backstop under the Greenhouse Gas Pollution Pricing Act, which provides a price signal for oil and gas producers to lower the emissions intensity of their operations;

- using the proceeds of industrial carbon pricing to invest in emissions reduction projects in the oil and gas sector. For instance, the Alberta government’s Technology Innovation and Emissions Reduction (TIER) Fund uses funds acquired through its TIER industrial carbon pricing system to support methane emission abatement;

- implementing methane emissions reduction equivalency agreements with the Government of Canada to reduce methane emissions in the oil and gas sector by 45% below 2012 levels by 2025. Alberta, Saskatchewan, and British Columbia, all signed methane emission reduction equivalency agreements with the Government of Canada;

- Increasing investment in carbon capture, utilization and storage facilities including Alberta’s recently announced Carbon Capture Incentive Program, which will grant up to 12% of eligible capital costs to companies adding CCUS to their projects. Some funds from Alberta’s TIER program will be used to support these investments.

The Path Forward

A thoughtful and ambitious plan aimed at reducing GHG emissions in the oil and gas sector on a path to net-zero by 2050 will help secure the long-term competitiveness of the industry while creating well-paying jobs for Canadians across the country. Thousands of skilled workers will be needed to build and operate decarbonization technologies and infrastructure projects.

The Government of Canada is committed to working with provinces and territories, Indigenous Peoples, industry, workers and others to implement this plan. Through continued collaboration we can accelerate innovation and develop technology that reduce emissions, drive innovation and create sustainable jobs.

Canada’s oil and gas sector has long been an innovator. Increasingly, firms across the industry are committing to achieving net-zero emissions by 2050. Through active partnership with the Government of Canada along with provincial and territorial governments, Indigenous Peoples and civil society, Canada’s oil and gas sector can achieve both environmental and economic success.

Bold and ambitious choices today can reduce emissions, improve the carbon competitiveness of Canada’s oil and gas sector, and benefit Canadian workers through the creation of well-paying jobs for generations to come.