On this page

- Theme introduction

- Indicator: Forest sector gross domestic product

- Indicator: Production of forest products

- Indicator: Exports of forest products

- Sources and information

Theme introductionFootnote 1

The forest sector is an important contributor to Canada’s economy, serving as a source of prosperity for communities and workers across Canada. In 2023, the forest sector contributed $27 billion to Canada’s nominal gross domestic product (GDP) and directly employed 199,345 people. A total of $36.2 billion of forest products were exported.

Forest sector contributions across Canada

Forest sector operations serve as an important source of jobs and income across Canada. Of the 199,345 people directly employed in the forest sector, approximately 11,000 are Indigenous (2021). The forest sector generates about $2.3 billion in revenue for provincial and territorial governments (2020) through stumpage charges, taxes and various other fees. The largest employment contributions are in Québec (33% of the national forest sector jobs), British Columbia (25%), and Ontario (20%) followed by Alberta, Atlantic Canada, Manitoba, Saskatchewan and the territories. The forest sector is a key economic contributor in many remote, rural and Indigenous communities. According to the 2021 census, over two fifths of Canada’s forest sector workers live in rural and remote communities.

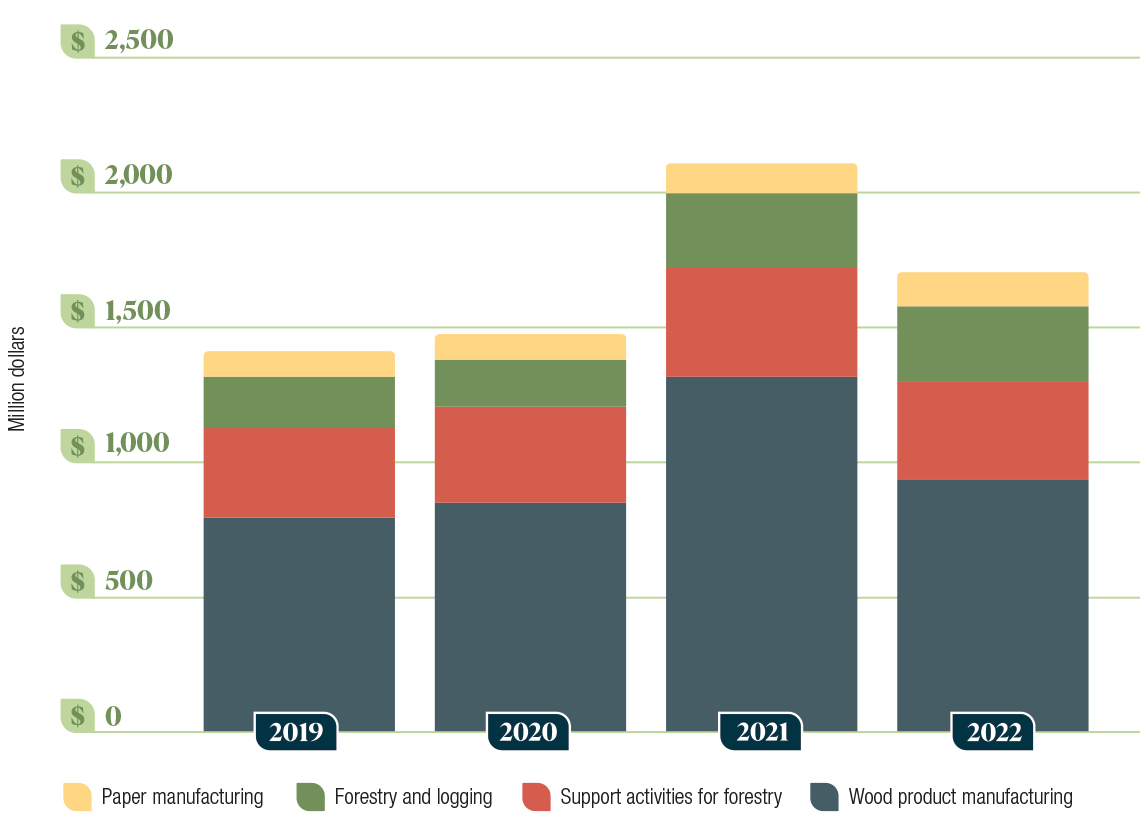

Comparison of the gross domestic product from various forestry subsectors that contribute to environmental and clean technology for 2019-2022

Graph summary

Comparison of the gross domestic product from various forestry subsectors for 2019, 2020, 2021 and 2022.

Graph data

| Year | Gross domestic product (millions of dollars) | |||

|---|---|---|---|---|

| Forestry and logging | Support activities for forestry and logging |

Wood product manufacturing |

Paper manufacturing | |

| 2019 | 196 | 331 | 792 | 88 |

| 2020 | 179 | 355 | 846 | 95 |

| 2021 | 271 | 404 | 1,318 | 112 |

| 2022 | 281 | 364 | 934 | 122 |

Forest sector contributions to environmental and clean technology products in Canada

The forest sector, as a part of the bioeconomy, is an increasingly significant contributor to the environmental and clean technology products sector in Canada. For example, wood residues and forest biomass are converted into renewable energy sources such as pellets, liquid biofuels and biogas. Other bioproducts involving forest sector products include bioplastics and textiles. The value of environmental and clean technology products attributable to the forest sector increased from $1.4 billion (2.0%) in 2019 to $2.1 billion (2.9%) in 2021, though it decreased to $1.7 billion in 2022 (2.1%). Wood product manufacturing was the driver of this decline from 2021–2022, decreasing from a contribution of 63% of the total value to 55%. This was likely due to a return to normal levels of demand for environmental and clean technology-qualifying wood products following the elevated demand in 2021 owing to the COVID-19 pandemic. The environmental and clean technology sector accounted for 3.1% of Canada’s GDP in 2022.

Innovation in Canada’s forest sector

New and innovative forest products like cross-laminated timber, biofuels and forest product-based biodegradable packaging materials are an increasingly important part of Canada’s economy. These bioeconomy innovations help support government objectives, including reaching net-zero emissions by 2050 and building efficient, affordable housing using more sustainable materials. The Government of Canada supports this net-zero transition and innovation through programs such as the Investments in Forest Industry Transformation Program, which provides support to projects developing and commercializing new and more efficient building materials, and the Green Construction through Wood Program, which supports innovative wood-oriented construction technologies like mass timber buildings.

Canadian forest bioproducts in the global market

Canada is a leading global forest product manufacturer. The forest sector is highly export-oriented and Canadian-made forest bioproducts are valued worldwide in a variety of industries. Canada is the global leader in the export of softwood lumber, oriented strandboard, northern bleached softwood kraft pulp and newsprint. Most exports go to the United States (76% by value), China (10%) and Japan (3%). Beyond these countries, Canada continues to take advantage of new opportunities in other global markets in Asia and Europe to diversify our export partners.

Indicator: Forest sector gross domestic productFootnote 2

Annual reporting of the Canadian forest sector’s GDP. Contributions to nominal GDP is one of the primary indicators used to evaluate the size and health of Canada’s forest sector.

Indicator details

In 2023, the forest sector contributed $27.0 billion (0.9%) to Canada’s nominal GDP, representing a 22% reduction compared to 2022. Real GDP for the forest sector also contracted 8% year-over-year.

For comparison, nominal GDP for Canada’s total economy shrank by 0.5% in 2023, yet real GDP rose by 1.3%.

- Prices for some key forest products were significantly lower in 2023, such as softwood lumber and oriented strand board. The lower prices contributed to the outsized drop in the forest sector’s nominal GDP compared to the real GDP.

- In the wood product manufacturing subsector, real GDP shrank 7%, in part due to lumber production curtailments and sawmill closures, most notably in British Columbia.

- Real GDP in the pulp and paper manufacturing subsector decreased 10% from the previous year. Several pulp facilities curtailed production or closed operations during the year as the structural decline in demand for some paper products continued, with increasing global digitalization.

- Real GDP in the forestry and logging subsector fell 7%, driven by ongoing wood supply constraints in British Columbia and the record-setting wildland fire season in 2023.

GDP is the total value of all final goods and services produced annually in a country. It can be thought of as the size of a country’s economy.

The World Bank ranked Canada as the ninth-largest economy in the world in 2022.

Why is this indicator important?

- Contribution to nominal GDP is one of the primary indicators used to gauge the size and health of Canada’s forest sector compared to other sectors each year.

- Real GDP measures the year-over-year change in the size of the forest sector’s economy, after accounting for inflation.

What is the outlook?

- Growth in the wood products subsector is highly linked to housing starts and construction projects. Spending in these segments has been negatively affected by higher mortgage and interest rates. In the long term, the prospects for this subsector are positive and will be supported by strong underlying demand in both the Canadian and United States housing markets.

- Demand for traditional paper products, such as newsprint and printing and writing paper, is expected to continue to decline. Demand for packaging products is expected to grow to keep pace with the demand for online shopping and e-commerce deliveries.

How government initiatives support sustainable forest management

- The federal government’s commitment to address housing affordability and increase the construction of new housing, as part of the Canada’s National Housing Strategy, is expected to support growth for the wood products sector.

Canadian forest sector's gross domestic product, 2013–2023

Graph summary

Graph 1: Comparison of the forest sector nominal gross domestic product by subsector for each year between 2013 and 2023.

Graph 2: Comparison of the proportion of real gross domestic product growth for all sectors and for the forest sector between 2013 and 2023.

Graph data

Graph 1: Comparison of the forest sector nominal gross domestic product by subsector for each year between 2013 and 2023

| Year | Nominal gross domestic product (billion dollars) | ||

|---|---|---|---|

| Forestry and logging | Wood product manufacturing | Pulp and paper manufacturing | |

| 2013 | 3.39 | 8.79 | 7.42 |

| 2014 | 3.73 | 8.72 | 7.93 |

| 2015 | 3.99 | 8.96 | 8.58 |

| 2016 | 4.09 | 9.99 | 8.61 |

| 2017 | 4.52 | 11.12 | 8.84 |

| 2018 | 4.82 | 11.86 | 10.47 |

| 2019 | 4.28 | 9.34 | 9.22 |

| 2020 | 4.04 | 11.88 | 8.11 |

| 2021 | 5.41 | 18.42 | 8.69 |

| 2022 | 6.22 | 18.62 | 9.67 |

| 2023 | 4.88 | 13.33 | 8.81 |

Graph 2: Comparison of the proportion of real gross domestic product growth for all sectors and for the forest sector between 2013 and 2023

| Year | Real gross domestic product growth (% annual) | |

|---|---|---|

| Total all sectors | Total forest sector | |

| 2013 | 2.6 % | 1.8 % |

| 2014 | 2.8 % | 4.1 % |

| 2015 | 0.9 % | 3.1 % |

| 2016 | 1.0 % | 0.6 % |

| 2017 | 3.1 % | -2.2 % |

| 2018 | 2.8 % | -0.7 % |

| 2019 | 2.0 % | -5.3 % |

| 2020 | -4.7 % | -6.9 % |

| 2021 | 5.4 % | 7.1 % |

| 2022 | 3.9 % | 0.0 % |

| 2023 | 1.3 % | -8.1 % |

Indicator: Production of forest productsFootnote 3

Total yearly production of Canadian forest products. This indicator is important because Canada is one of the top global manufacturers of forest products, and production is one of the first indicators influenced by economic and market challenges.

Indicator details

Between 2022 and 2023, Canadian production of nearly all forest products decreased. Softwood lumber production decreased by 5.9% and production of structural panels decreased by 5%. Printing and writing paper production decreased by 22.9%. Wood pulp and newsprint decreased by 7.5% and 4% respectively.

- Demand for lumber and structural wood panels continued to decrease in 2023 due to increases in interest rates, which reduced construction activity and housing affordability. This was also the case in the United States, Canada’s largest market for softwood lumber.

- Fibre shortages from wildland fire impacts, mountain pine beetle infestations and other factors creating downtime at production facilities contributed to declines in wood product and pulp production.

- Newsprint as well as printing and writing paper production continued its long-term downward trend, reflecting the increasing digitization of media and workflows.

Canada is one of the world’s leading producers of newsprint, northern bleached softwood kraft pulp and softwood lumber.

Why is this indicator important?

- Canada is one of the world’s top manufacturers and exporters of forest products.

- Production is one of the first forest sector indicators to be affected by economic and market challenges.

What is the outlook?

- A limited supply of Canadian logs due to rising log costs and a declining supply of fibre is expected to continue in 2024, dampening the production of wood products and pulp. Downtime in production has a trickle-down effect on pulp and paper production due to reducing the quantity of wood chips, which are a key input.

- Over the medium term, a focus on expanding the housing supply in Canada and the United States should encourage the construction activity, in turn supporting long-term demand for wood products.

How government initiatives support sustainable forest management

- The federal government’s Forest Innovation Program enables the growth of Canada’s bioeconomy by delivering R&D and technology transfer funding to the forest sector. The aim of this program is to improve the sustainability and economic productivity of Canada’s forest sector.

Production of Canadian forest products, 2013–2023

Graph summary

Comparison between the production of five wood products for each year between 2013 and 2023 (split between two graphs).

Graph data

Production of Canadian forest products, 2013–2023

Graph 1

| Year | Production (million tonnes) | ||

|---|---|---|---|

| Newsprint | Printing and writing paper | Wood pulp | |

| 2013 | 3.97 | 3.47 | 17.25 |

| 2014 | 4.01 | 3.26 | 16.96 |

| 2015 | 3.51 | 3.04 | 16.55 |

| 2016 | 3.34 | 3.00 | 16.51 |

| 2017 | 3.05 | 2.98 | 16.30 |

| 2018 | 3.00 | 3.05 | 16.18 |

| 2019 | 2.68 | 2.61 | 15.42 |

| 2020 | 1.96 | 2.27 | 14.30 |

| 2021 | 1.89 | 2.43 | 14.26 |

| 2022 | 1.84 | 2.60 | 13.58 |

| 2023 | 1.76 | 2.00 | 12.56 |

Graph 2

| Year | Production (million cubic metres) | |

|---|---|---|

| Softwood lumber | Structural wood panels | |

| 2013 | 57.51 | 7.13 |

| 2014 | 57.78 | 7.69 |

| 2015 | 62.72 | 7.97 |

| 2016 | 65.03 | 8.73 |

| 2017 | 65.13 | 8.92 |

| 2018 | 64.38 | 9.17 |

| 2019 | 56.66 | 8.45 |

| 2020 | 54.72 | 8.30 |

| 2021 | 55.84 | 8.94 |

| 2022 | 50.52 | 8.87 |

| 2023 | 47.54 | 8.42 |

Indicator: Exports of forest productsFootnote 4

Total value of annual exports of Canadian forest products. This indicator provides information related to how the Canadian forest sector meets the needs of global consumers, including helping them achieve their climate mitigation goals, while making a substantial contribution to Canada’s economy and balance of trade.

Indicator details

In 2023, the value of Canada’s total forest products exports decreased 21% year-over-year to $36.2 billion because of weak forest product prices and subsequent reduced production.

- By value, softwood lumber exports demonstrated the greatest contraction (down $5.2 billion or 38% compared to 2022), resulting from significantly lower average lumber prices and resulting production curtailments in British Columbia and Québec. The value of structural wood panel exports also dropped 33% from the previous year.

- High interest and mortgages rates slowed new housing construction in the United States, lowering demand for Canadian lumber and panels. Furthermore, the continued application of United States import duties on Canadian softwood lumber products made exports of softwood lumber less competitive in the United States market compared to those from other jurisdictions.

- In 2023, wood pulp exports decreased by 16%, printing and writing paper exports fell 13%, and newsprint exports declined 7% (by value). Weak global economic growth from high levels of inflation and elevated interest rates, led to lower demand and weaker prices.

In 2023, Canada was the world’s leading exporter of softwood lumber, northern bleached softwood kraft pulp, oriented strand board and newsprint.

Why is this indicator important?

- As one of the world’s largest forest product exporters, Canada is a key supplier to countries around the world.

- Canada has an abundant and renewable supply of wood sourced from sustainably managed forests. By exporting forest products, the Canadian forest sector meets the needs of global consumers, which could include helping them toward their climate change mitigation goals, while making a substantial contribution to Canada’s economy and balance of trade.

What is the outlook?

- Demand for softwood lumber and structural wood panels used in home construction has been negatively impacted by rising interest rates. The pace of recovery for Canada’s forest product exports will depend on the pace of the housing sector expansion in the United States and Canada.

- Over the medium term, a focus on expanding housing supply in Canada and the United States should help the recovery of the consumption of related wood construction products. Going forward, strong underlying demand in the United States residential construction, which is the main export destination for Canadian panels and softwood lumber, should help to support export growth in these products.

- The consumption, and thus exports, of paper products (e.g. newsprint) are expected to continue to trend downward over the long term, while others are expected to remain flat, such as tissue paper.

How government initiatives support sustainable forest management

- To counter the weaker long-term growth prospects, Canada is seeking to diversify its forest product offerings by adding value through more secondary wood manufacturing and investing in innovative, low-carbon projects.

Exports of Canadian forest products, 2013–2023

Graph summary

Comparison of the export value among various Canadian forest products, for each year between 2013 and 2023.

Graph data

| Year | Exports (billion dollars) | |||||

|---|---|---|---|---|---|---|

| Softwood lumber | Newsprint | Printing and writing paper | Structural wood panels | Wood pulp | Other forest products | |

| 2013 | 7.4 | 2.4 | 2.5 | 1.5 | 7.0 | 7.7 |

| 2014 | 8.3 | 2.6 | 2.5 | 1.4 | 7.5 | 8.6 |

| 2015 | 8.5 | 2.3 | 2.6 | 1.6 | 8.0 | 9.8 |

| 2016 | 10.0 | 2.2 | 2.2 | 2.2 | 7.6 | 10.3 |

| 2017 | 10.4 | 2.0 | 2.1 | 2.5 | 8.3 | 10.7 |

| 2018 | 10.2 | 2.3 | 2.4 | 2.7 | 9.7 | 11.1 |

| 2019 | 8.0 | 1.9 | 2.4 | 2.0 | 8.0 | 10.9 |

| 2020 | 10.0 | 1.3 | 2.0 | 2.9 | 6.7 | 10.4 |

| 2021 | 16.4 | 1.4 | 2.0 | 5.5 | 7.7 | 12.1 |

| 2022 | 13.7 | 1.8 | 2.6 | 4.7 | 8.9 | 13.8 |

| 2023 | 8.5 | 1.7 | 2.3 | 3.2 | 7.5 | 13.1 |