The Persian Gulf War drove oil prices up in 1990-91, dampening demand and leading to a economic downturn. Since 1992 demand for petroleum products has been growing steadily at a rate of about 1 percent per year. However, product demand is a moving target and the demand for each product does not always grow at the same pace.

Gasoline demand has increased slightly in most of the last 10 years. The distillate demand (diesel oil, furnace oil and kerosene), driven primarily by on-road diesel requirements, dipped during the economic recession in 1991-92 but has been the fastest growing component since 1993. Because of the significant proportion of distillate demand that comes from the trucking industry, this component is the most closely linked with economic activity.

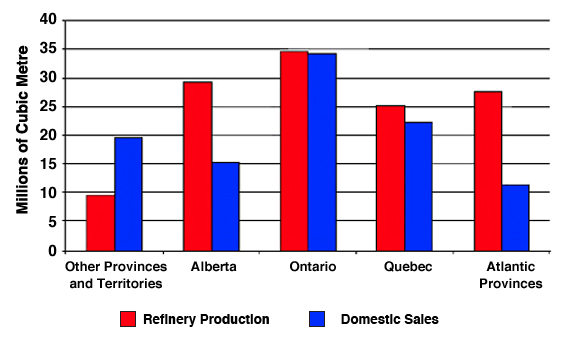

Some of the distribution challenges arise from the fact that petroleum products are refined in only a few geographic regions but they are consumed all across Canada. Of the western provinces, only Alberta and Saskatchewan produce more products and they consume. Manitoba and parts of British Columbia and most of the territories are supplied primarily from the three refineries in Edmonton.

Refined Petroleum Product Production vs. Sales

Source: Statistics Canada 45-004, 2004

Quebec and Ontario together are close to being in balance with significant volumes moving from Quebec to Ontario since the closure of the Oakville refinery. Atlantic Canada is a major exporter of petroleum products. However, even the provinces that are self-sufficient must still move petroleum products over long distances to supply all of their customers.

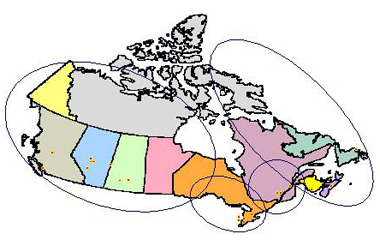

The figure below illustrates how far product is moved in Canada. Western refineries supply all product demand from Vancouver to Thunder Bay, including the northern territories. Refiners in southern Ontario move product to Sault Ste-Marie, northern Ontario and as far east as Ottawa. Montreal and Quebec City facilities supply the St Lawrence River corridor from Toronto to the Gaspé Peninsula, as well as the more remote areas of northern Quebec and occasionally parts of the Arctic. Petroleum products from the three Atlantic refineries find their way to the Arctic and Hudson Bay regions as well as the U.S. eastern seaboard.