British Columbia

A product of the Energy and Mines Ministers’ Conference

British Columbia’s Oil and Gas Resources

- 524,6 TRILLION CUBIC FEET

Technically Recoverable Natural Gas

- 29 MILLION BARRELS

Technically Recoverable Crude Oil

- 3.7 BILLION CUBIC FEET/DAY

Total Natural Gas Production (2013)- 2.7 BILLION CUBIC FEET/DAY

Shale/Tight Gas Production (2013)

- 2.7 BILLION CUBIC FEET/DAY

- 0.04 MILLION BARRELS/DAY

Total Crude Oil Production (2013)- 0.003 MILLION BARRELS/DAY

Tight Oil Production (2013)

- 0.003 MILLION BARRELS/DAY

Source:

- Resource estimates: Government of British Columbia

- Production estimates: National Energy Board (may not align with provincial data due to differences in methodology)

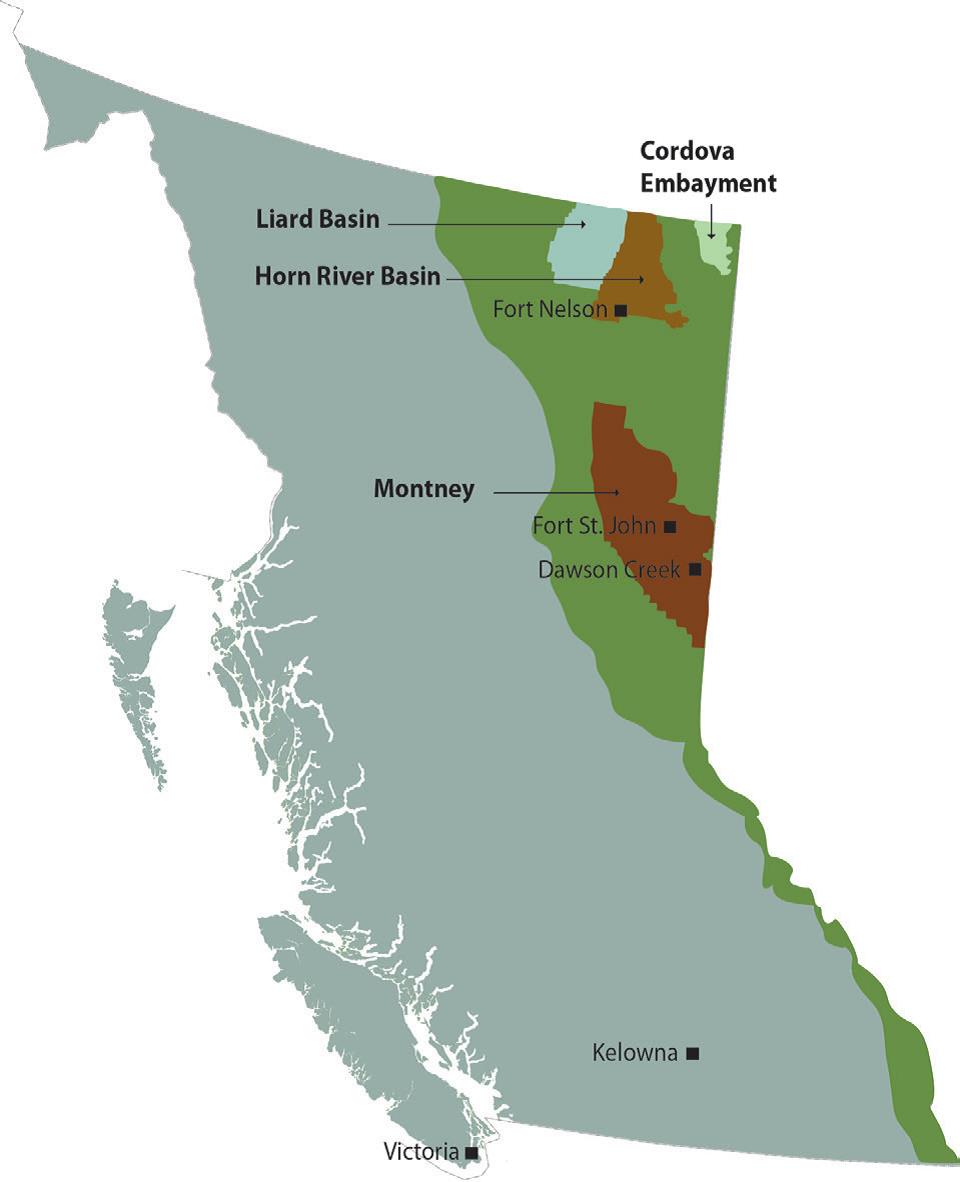

Geography

Oil and gas exploration in British Columbia (BC) takes place in the northeast corner of the province (Figure 1). The largest and most productive play, the Montney, stretches from the BC/Alberta border near Dawson Creek 200 kilometres northwest to the BC Rocky Mountain foothills. The second largest, and second most productive play, is the Horn River Basin, which stretches from south of Fort Nelson north to the BC/Yukon border. The Liard Basin and Cordova Embayment, which are still in early development, are situated to the west and east, respectively, of the Horn River Basin and also reach the edge of the BC/Yukon border.

Figure 1: Unconventional Gas Play Trends in northeast British Columbia

Source: BC Oil and Gas Commission

Text version

Figure 1: Map of Alberta's Shale Formations

Map of unconventional gas plays in northeastern British Columbia. North: Liard Basin, Horn River Basin and Cordova Embayment. South: Montney.

Geology

BC’s portion of the Western Canadian Sedimentary Basin is a predominantly gas-charged system, in which black oil is a relatively minor component of overall production. While conventional exploration and production has been ongoing since the 1950s, unconventional resources in BC have become an increasingly important component of recognized natural gas resource potential. The first efforts at targeted unconventional resource development in the province began in the mid-1990s with the use of horizontal drilling in the Devonian carbonates of the Jean Marie formation. Ten years later, a significant unconventional tight gas resource was successfully identified and developed in the Deep Basin area within Cretaceous sandstones of the Cadomin Formation. This early unconventional activity was followed by Devonian shale gas development in the Horn River Basin and the Triassic-aged siltstones of the Montney formation. Exploration is also ongoing in the emerging unconventional play areas of the Cordova Embayment and the Liard Basin (Figure 1).

Today there are two major areas with unconventional shale and tight gas development and production and a significant third area undergoing early exploratory drilling and assessment.

The Horn River Basin is an unconventional shale play targeting dry gas from mid-Devonian aged, over-pressured shales of the Muskwa, Otter Park and Evie Formations. Situated in the northeast corner of the province (Figure 1), the Horn River Basin is confined to the west by the Bovie Lake Fault Zone and to the east and south by the time equivalent Devonian Carbonate Barrier Complex. The Horn River Basin has two major producing horizons, the Muskwa-Otter Park and the Evie, which can result in stacked horizontal well development

| Table 1: Horn River Basin | |

|---|---|

| Total area | 1,145,989 ha |

| Formation type | Shale gas |

| Target formations | Muskwa / Otter Park / Evie |

| Gross thickness | 140–280m |

| Formation porosity | 3–6 % |

| Formation pressure | 20–53 Mpa |

| Formation temperature | 80–160 oC |

| Drilling method | Horizontal |

| Of interest since | 2005 |

| Average depth | 1,900–3,100m |

| Resource potential | 448 Tcf, 78 Tcf marketable Footnote 1 |

Source: BC Oil and Gas Commission

Located in the more populated region of northeast BC, the Montney Basin is a hybrid tight gas and natural gas liquids play within mid-Triassic, over-pressured siltstones. Within BC, the Montney can reach 300 metres in thickness and may contain up to three or four vertically stacked, horizontally targeted sub-horizons within stratigraphically defined upper, middle and lower Montney zones. The Montney also has a significant natural gas liquid (NGL) content and a marketable, technically recoverable NGL resource potential estimated at 12.6 billion barrels.

| Table 2: Montney Trend | |

|---|---|

| Total area | 2,600,000 ha |

| Formation type | Tight gas / Shale gas |

| Target formations | Montney / Doig Phosphate |

| Gross thickness | 30–300m |

| Formation porosity | 2–9 % |

| Formation pressure | 15–50 Mpa |

| Formation temperature | 80–100 oC |

| Drilling method | Horizontal |

| Of interest since | 2005 |

| Average depth | 1,400–3,800m |

| Resource potential | 1,965 Tcf OGIP, 271 Tcf marketableFootnote 2 |

Source: BC Oil and Gas Commission

Located to the west of the Horn River Basin and straddling both the Yukon and Northwest Territories borders, the Liard Basin is a shale play similar in nature to the Horn River Basin but deeper and with higher reservoir pressure. Although provincially significant annual volumes of natural gas production have yet to occur, a joint assessment of unconventional shale resource potential has recently been undertaken for the Liard Basin by the National Energy Board, the BC Oil and Gas Commission, the BC Ministry of Natural Gas Development, the Northwest Territories Geological Survey and the Yukon Geological Survey. Based on results of a small number of publically available exploration wells and using the Horn River Basin as an analog, the extremely thick Exshaw, Patry and Horn River shales of the Liard Basin are expected to contain 1213 Tcf OGIP. Technically recoverable volumes of natural gas were also estimated for the the Exshaw and Patry shales only. Across all three jurisdictions marketable gas was estimated at 219 Tcf, with British Columbia’s share of that marketable resource estimated at 167 Tcf.

Exploration and Production

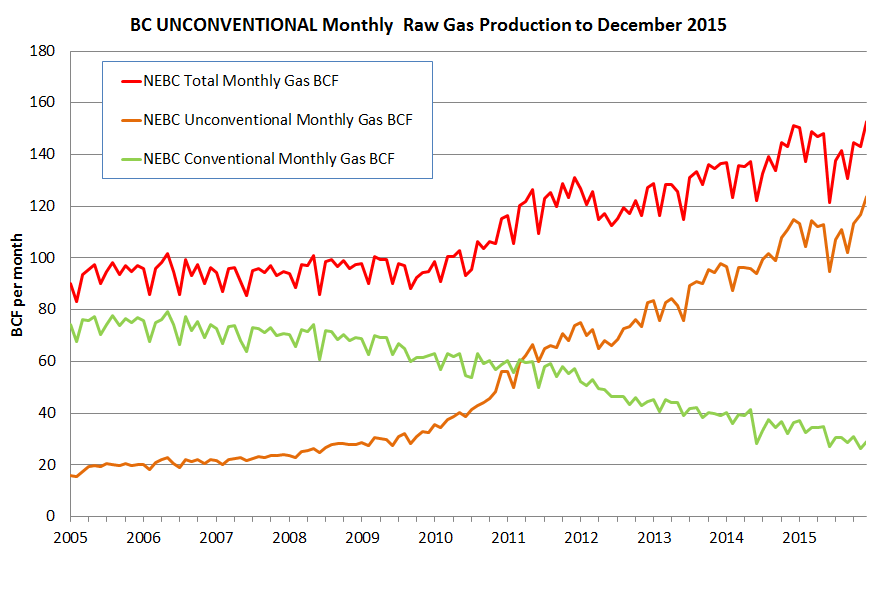

Since 2005, the unconventional share of BC’s natural gas production has continued to increase. By 2011, the contribution of unconventionally sourced gas surpassed gas production from conventional reservoirs. By year-end 2015, BC’s unconventional gas production accounted for about 80 percent of total gas production (Figure 2).

Figure 2: BC Unconventional Monthly Raw Gas Production to December 2015

Source: BC Oil and Gas Commission

Text version

Figure 2: BC Unconventional Monthly Raw Gas Production to December 2014

Line graph showing conventional, unconventional and total monthly raw gas production in British Columbia from 2005 to December 2015.

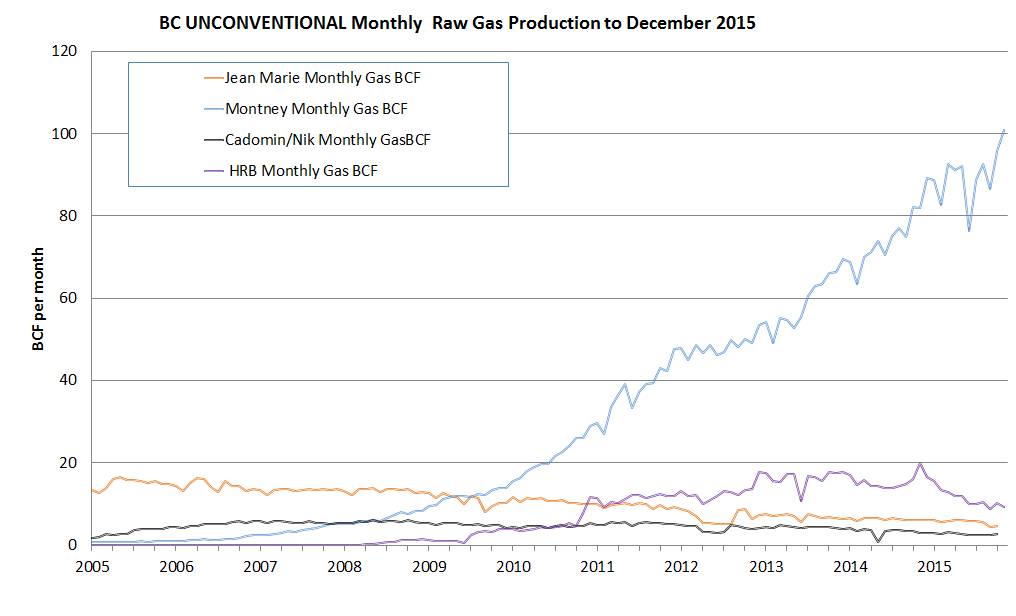

The following graph (Figure 3) illustrates, over the same time period, the relative rise of Montney unconventional gas production compared to the other major unconventional plays in northeast BC.

Figure 3: BC Unconventional Monthly Raw Gas Production to December 2015

Source: BC Oil and Gas Commission

Text version

Figure 3: BC Unconventional Monthl Raw Gas Production to December 2014

Line graph showing unconventional monthly raw gas production of various plays in British Columbia from 2005 to December 2015. Production in the Montney grew substantially beginning in 2009 while production in other plays remained constant.

As of December 2015, cumulative raw production from the unconventional Montney play surpassed 4.3 trillion cubic feet (Tcf), up from just 25 billion cubic feet (Bcf) at the start of 2005. The play currently has over 3,1 00 active gas wells, essentially all of which are post-2005 horizontals. Daily production levels are presently at 3.4 billion cubic feet per day (Bcf/d). The growth in targeted Montney drilling over the past few years combined with the decline in conventional gas drilling has resulted in the Montney becoming the single most important unconventional gas producing horizon in Canada. The unconventional Montney play now contributes about 67 percent of BC’s total current monthly raw gas volumes.

Montney play trend can have very substantial natural gas liquids (ethane, propane, butane) and condensate (pentanes plus) content. Focussed development within the wet gas trend has resulted in significant NGL and condensate produced volumes. As of November 2015, Montney sales volumes reached; 34,000 barrels per day (b/d) condensate, 7100b/d propane and 8000b/d butane.

The Montney has one significant black oil pool. Oil development there currently has 67 active horizontal wells that averaged about 3, 800 b/d in 2015.

The Horn River Basin currently has about 180 active gas wells. Cumulative production to December 2015 is 900 Bcf. Daily production averaged about 365million cubic feet per day (MMcf/d) in 2015. As a result of current economic conditions there has not been any significant new development drilling programs initiated in the past few years.

Regulation

Regulatory oversight for shale and tight resources development is achieved through legislation, regulation and permit conditions. The primary legislation for oil and gas activity in BC is the Oil and Gas Activities Act and the Petroleum and Natural Gas Act.

The BC Oil and Gas Commission (Commission) is the provincial, single-window regulatory agency with responsibilities for overseeing oil and gas operations in BC, including exploration, development, pipeline transportation and reclamation. The Commission regulates all oil and gas activities under the Oil and Gas Activities Act, including shale and tight resources development activities.

The Oil and Gas Activities Act is up-to-date legislation enacted in 2010 that focuses on effective oversight of oil and gas development while protecting public safety and the environment. Associated regulations within the Act include the Drilling and Production Regulation, Pipeline Regulation, Environmental Protection and Management Regulation and Geophysical Exploration Regulation. These regulations also apply to conventional and unconventional development A key regulatory tool is the FracFocus Chemical Disclosure Registry, a public resource for information on hydraulic fracturing and a database containing fracturing ingredients used by companies in the province. BC was the first province in Canada to sign onto FracFocus, making disclosure mandatory in 2012.

Regulation of Exploration

Subsurface petroleum and natural gas (PNG) rights are issued, administered and managed by the Ministry of Natural Gas Development (Ministry) under the Petroleum and Natural Gas Act. Companies must obtain the rights through a monthly competitive sealed bid process prior to being able to apply for exploration or development activities. The Ministry can dispose of rights by issuing Drilling Licences or Leases. Drilling Licences provide the exclusive right to explore for petroleum and natural gas by drilling wells and have primary terms of three, four or five years depending on location. Leases provide the exclusive right to produce petroleum and natural gas and they have primary terms of five or ten years depending on location.

Once a company has acquired the PNG subsurface rights it has the ability to apply for exploration, development or production activities through the Commission. The Geophysical Exploration Regulation applies to companies undertaking geophysical activities. Other regulations that apply prior to activity permits being issued include the Fee, Levy and Security Regulation and Consultation and Notification Regulation. The Commission also uses the Area-Based Analysis approach to determining the impacts of oil and gas activities on the land base. Using this analysis, Commission decision-makers assess the impact of oil and gas activities on ecological, cultural and social values in the context of all other development activities.

Regulation of Production

The production of unconventional gas resources is regulated by the Oil and Gas Activities Act and associated regulations. Technical regulations surrounding drilling, hydraulic fracturing and production are in the Drilling and Production Regulation; environmental protection regulations are in the Environmental Protection and Management Regulation; and emergency requirements are in the Emergency Management Regulation. For a full list of regulations, visit the Legislation page on the Commission’s website.

Regulations and permitting processes were designed to encompass the technologies employed in shale gas development, including hydraulic fracturing and the use of water, and outline how the industry must protect water resources during drilling and production operations. The Commission manages water approvals and use with specific focus on environmental values and suspends water use when necessary to protect these values. Another requirement is the submission of ingredients used in hydraulic fracturing fluids to the FracFocus website.

The Commission has an extensive compliance and enforcement program that applies to all aspects of oil and gas activities – from exploration through development, operations and ultimate abandonment and reclamation. The Commission conducts more than 4,000 inspections each year in addition to a number of audits, investigations and other assessments. Enforcement actions include orders and monetary penalties and are published quarterly in the Reports section of the Commission website. Other resources for regulating unconventional gas activity include the Major Projects Centre and water information website.

Public Research

Energy and Mines Ministers’ Conference

British Columbia