Measuring progress and realizing potential

May 2024

Disclaimer

The Hydrogen Strategy for Canada Progress Report (the “Progress Report”) provides the perspectives of numerous stakeholders from across governments, non-governmental organizations and academia. While the Government of Canada led the development of the report and consulted broadly, the Progress Report represents a summarized viewpoint, and some parts may not be unanimously endorsed by all the participating organizations and individuals. The Progress Report is based on the best available information at the time it was compiled, and it is important to acknowledge that the low-carbon hydrogen economy continues to evolve at a rapid dace domestically and internationally.

Industry projects highlighted in the Progress Report are done in this manner to provide transparency and awareness to readers. Their mentions do not preclude any governmental or regulatory approval processes nor should be interpreted as indicating governmental support or approval in any such processes.

Table of contents

- Foreword to the Progress Report

- 1. Hydrogen Strategy for Canada: Progress and evolving context

- 2. Sector progress and recommendations status

- 3. What’s next: Priorities and actions

- Appendices

- Glossary of terms

Foreword to the Progress Report

In 2020, Canada issued a call to action to seize the hydrogen opportunity for the benefit of Canada and Canadians. The Hydrogen Strategy for Canada laid out a framework that focuses low-carbon hydrogen as a tool to achieve our goal of net-zero emissions by 2050, while creating jobs, growing our economy, expanding exports and protecting our environment.

Across Canada, interest in low-carbon hydrogen is booming. Approximately 80 low-carbon hydrogen production projects have been announced, representing an expression of interest of over $100 billion in potential investment dedicated to building out this clean energy opportunity.

Pilot projects are underway, showcasing Canadian ingenuity and demonstrating how hydrogen can help fuel our trucks, buses, and trains, help decarbonize our industries, or help heat our homes and businesses.

Hydrogen hubs are forming, such as in Edmonton, Vancouver and Southern Ontario, to match low-carbon hydrogen supply with demand.

We are advancing commitments to provide competitive and reliable low-carbon hydrogen to advance the energy security imperative with our friends and allies and compete as a major exporter of hydrogen, its derivatives, and hydrogen technologies, in the growing global market. Potential buyers in Europe and Asia have shown strong interest in establishing partnerships with Canadian export producers, bringing opportunities for sustainable clean job creation in Atlantic and Western Canada and global emissions reductions.

And provinces are showing tremendous leadership, complementing Canada’s Hydrogen Strategy with their own provincial strategies, and leading the development of provincial funding programs, policies and supportive measures.

Since 2020, the developments show that low-carbon hydrogen can play a key supporting role alongside electrification to decarbonize our economy, and an essential role in meeting global energy needs in the context of energy security, the energy transition and the broader climate imperative.

This Progress Report provides an update of Canada’s Hydrogen Strategy. It is the product of 3 years of engagement and analysis involving over 1,000 of Canada’s leading experts and stakeholders, all working in collaboration to achieve the hydrogen opportunity. It highlights major developments across the hydrogen value chain and reports on progress in implementing the recommendations made in the Hydrogen Strategy. It also features projections of hydrogen’s potential role in meeting Canada’s climate objectives and provides a roadmap of Canada’s next steps and priorities in the coming years.

Make no mistake, many challenges remain. This Progress Report shows that great progress can be made when we all work together towards a common vision. It is now time to continue the journey and realize the enormous potential of nature’s smallest molecule to help build a thriving, sustainable, made-in-Canada clean economy—for ourselves, our children, and our grandchildren.

The Honourable Jonathan Wilkinson

Minister of Energy and Natural Resources of Canada

1. Hydrogen Strategy for Canada: Progress and evolving context

The Hydrogen Strategy for Canada was developed through extensive engagement and represents a collective view of a Canada-wide hydrogen roadmap, which assessed domestic market and export opportunities for hydrogen and fuel cell technologies. This strategy proposed a vision for the future role of hydrogen in Canada and the steps required to achieve that vision. It also provided an overview of hydrogen fundamentals, including production pathways, end uses and potential benefits.

Canada committed to publishing a Progress Report of the Hydrogen Strategy for Canada to take stock of low-carbon hydrogen developments across Canadian provinces and territories, including producers and users of hydrogen.

For the past 3 years, the Government of Canada, under the leadership of Natural Resources Canada (NRCan), has been working with provinces and territories, Indigenous organizations, industry, academia, and non-governmental organizations to implement the recommendations of the Hydrogen Strategy for Canada and inform the development of this Progress Report. This report leverages input from over 1,000 participating companies, organizations and individuals sourced through a variety of different forums, bilateral discussions and complementary studies. It also responds to the recommendations of the Commissioner of the Environment and Sustainable Development’s 2022 Audit of the Hydrogen Strategy.

Like the Hydrogen Strategy for Canada, the Progress Report is a strategic directional document based on the best available information at this time. Adjustments will be made as technology, research, codes and standards, pilot projects, the international hydrogen landscape and policy evolve.

1.1 Status of the Canadian hydrogen industry

The Canadian hydrogen and fuel cell sector is recognized as a global leader for pioneering new technologies and expertise. Increasing demand for clean energy products and solutions domestically and worldwide is generating opportunities and investments in a broad range of applications, including industrial processes, feedstock production, transport, electricity storage and building heat. In the few years since the strategy was released, there has been a surge in hydrogen research, project announcements, policies and international agreements.

Canadian low-carbon hydrogen industry developments and status at-a-glance

Production

Deployed low-carbon H2 production capacity

3,450 tonnes-H2 per year

80 projects

announced, under consideration or under developmentFootnote 1

Announced or under development low-carbon H2 production capacityFootnote 2

5+ Mt H2 per year

Total announced project investment

>$100B

Route to market

12 international agreements

6 provincial strategies

23 announced export projects

8 hubs formed or forming

End-use applications

Transportation

7 truck and bus

4 train trials underway

Codes and standards

22 developed

Hydrogen refuelling stations

8 operating

21 announced

Currently serviced by H2 - Natural gas blends

3,600 Ontario households

2,100 Alberta customers

Cross-cutting areas

Clean Hydrogen ITC to provide

$17.7B for clean H2 productionFootnote 3

Indigenous involvement

13 project partnerships

Number of jobs (2021)Footnote 4

4,291 (full-time equivalent)

Revenues of Canadian H2 sector companies (2021)Footnote 5

$527M

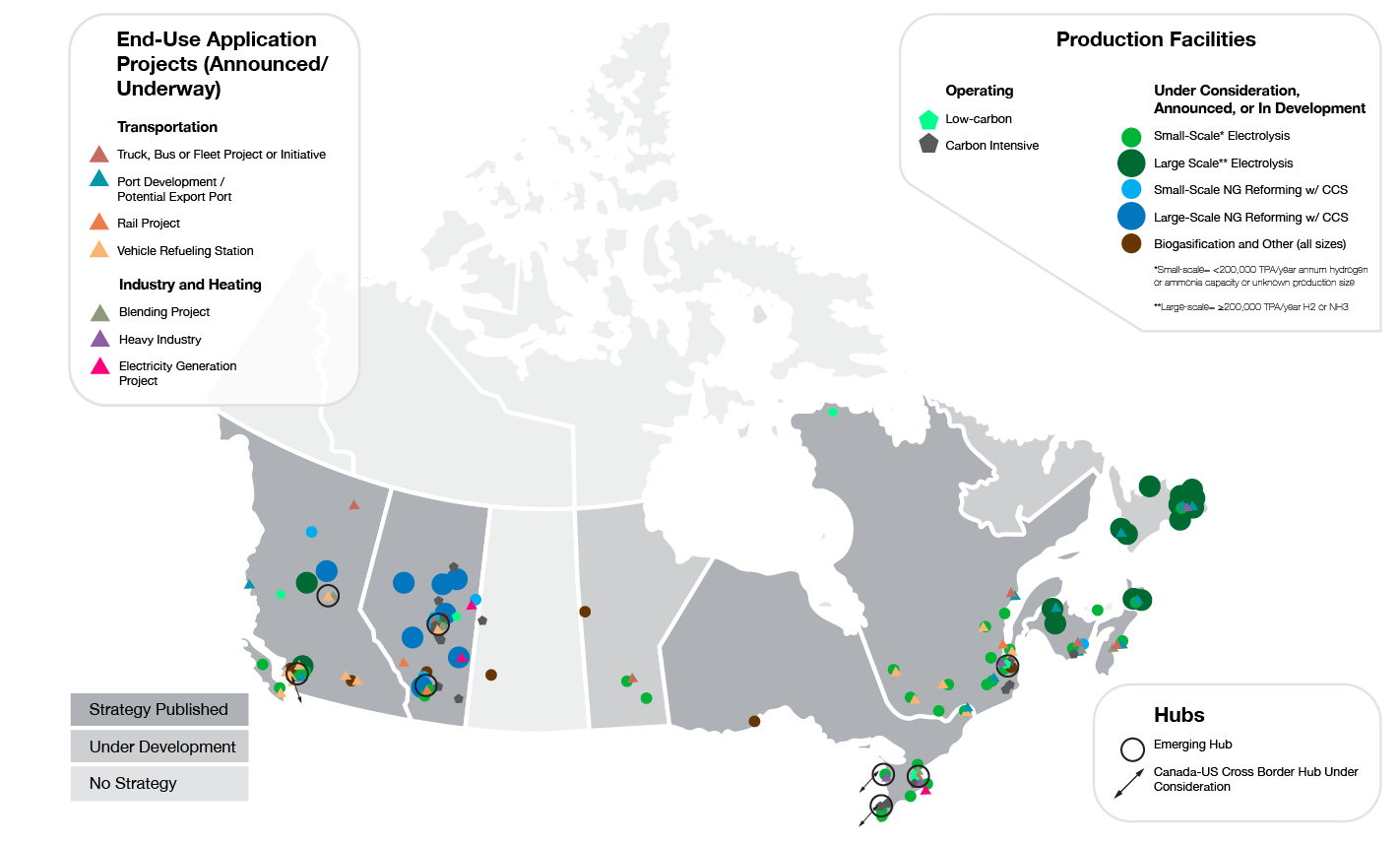

Summary map: Hydrogen developments in Canada since 2020 – Production, end-use, hubs and strategies

Text version

Map of Canada showing hydrogen developments since 2020, across the hydrogen value chain. Provinces are shaded based on status of Provincial strategy development: BC, AB, ON, QC, NB, and NS have published strategies; MB, and NL have strategies under development; SK, PEI, and the territories have no strategies. The map has icons showing where hydrogen production and end-use projects are located. Production projects are divided by size and by production type (electrolysis compared to natural gas reforming with carbon capture), and end-use icons include showing projects in truck/bus/fleets, ports, rail, vehicle refueling, blending, heavy industry, or electricity generation. Clusters of activity across the value chains can be found in BC (Vancouver area, Prince George area); AB (Edmonton, Calgary, and Alberta industrial heartland); Ontario (Toronto, Sarnia, and Bruce County); QC (Montreal to Quebec City); and along some of the coasts of NB, NS, and NL.

Figure 1: Map of hydrogen developments in Canada since 2020, across the hydrogen value chain.

1.2 Major policy and regulatory updates

Low-carbon hydrogen continues to be Canada’s goal. Canada has brought forward a number of measures since 2020 to promote the production and use of low-carbon hydrogen. While some measures directly apply to low-carbon hydrogen projects, others have a broader reach but can be accessed by participants across the low-carbon hydrogen value chain.

Government of Canada initiatives

Dedicated support

In the 2022 Fall Economic Statement, the federal government announced the Clean Hydrogen Investment Tax Credit (CHITC), a refundable investment tax credit for investments made in clean hydrogen production based on the life cycle carbon intensity of hydrogen. This critical investment in a growing source of energy will help create good middle-class careers, ensure that Canadian companies can remain globally competitive and encourage the use of clean energy to reduce pollution.

The credit will apply to both electrolysis projects and natural gas reforming projects if emissions are abated with carbon capture utilization and storage (CCUS). Going forward, Canada will continue to review eligibility for other production pathways.

The levels of support will vary from 15% to 40% of eligible project costs, depending on the life cycle emissions of the hydrogen produced. Certain labour conditions would have to be met for proponents to access their credit in full. The CHITC also extends to equipment for converting clean hydrogen to ammonia, at a credit rate of 15%. The credit applies as of March 28, 2023, and will be phased out by 2035. Canada is targeting to introduce CHITC legislation in Parliament in early 2024. The CHITC is expected to provide $17.7 billion in tax incentive support to the sector by 2035 (based on expected use of the credit and does not represent a funding envelope or target).

In addition to the CHITC, several related tax credits were announced in Budget 2023 that could also support reductions in the initial capital cost of low-carbon hydrogen projects:

The Clean Electricity Investment Tax Credit or the Clean Technology Investment Tax Credit

- Offers a credit of up to 30% on electricity generation systems, such as wind or solar

- With large amounts of electricity required for electrolysis-based hydrogen production, these tax credits could provide significant support

- Available as of March 28, 2023

The Clean Technology Manufacturing Investment Tax Credit

- Available as of January 1, 2024

- Offers a credit of up to 30% for new machinery to manufacture technologies, including manufacturing of electrolysers, which can lower the costs of hydrogen project equipment manufactured in Canada

The Investment Tax Credit for Carbon Capture, Utilization and Storage

- Originally announced in August 2022 and is available as of January 1, 2022

- Offers a 37.5% to 60% credit on the equipment necessary to capture, transport and store carbon emissions, benefitting facilities producing hydrogen from natural gas

Broader support accessible to the low-carbon hydrogen value chain

Several programs are underway to support the development of low-carbon fuels and associated infrastructure required, which provide support to hydrogen projects.

In Budget 2021, the Government of Canada committed to invest $1.5 billion in a Clean Fuels Fund (CFF), with the objective to increase domestic production of clean fuels, including hydrogen and synthetic fuels

- As of October 2023, the government had selected about 10 hydrogen production projects that will receive support totalling over $300 million

- In addition, some of the CFF-supported projects may use hydrogen as an intermediary to produce other clean fuels, such as the conversion of Newfoundland and Labrador’s Come By Chance refinery

The Strategic Response Fund – Net Zero-Accelerator (SRF-NZA) announced funding for 2 hydrogen projects, the Air Products Net Zero Hydrogen Energy complex in Edmonton, Alberta ($300 million in support) and the AVL Fuel Cell Canada’s global hydrogen fuel cell R&D facility in Burnaby, British Columbia ($15 million)

- Additional projects are undergoing final negotiations and funding support is expected to be announced in the coming months

SIF-NZA Strategic Innovation Fund – Net-Zero Accelerator

The Canada Growth Fund (CGF), announced in the Fall 2022 Economic Statement, is a $15 billion fund designed to offset some of the risks that may deter private capital from flowing into clean energy and technology

- One of the strategic objectives of the fund is to accelerate the deployment of low-carbon hydrogen

- The CGF’s mandate is to invest in the scale-up of projects that are beyond the pilot and demonstration phase and have a reasonable expectation of return on capital

The Canada Infrastructure Bank (CIB) provides financing for decarbonization projects

- The CIB launched a $500 million Charging and Hydrogen Refuelling Infrastructure Initiative to help remove barriers to the adoption of zero-emission vehicles

- In March 2023, the CIB confirmed that it would provide $277 million in financing to the Varennes biorefinery and hydrogen electrolysis project

- The CIB also provides loan funding for front-end engineering and design (FEED) expenditures for hydrogen production projects through its Project Acceleration program

The Zero Emission Vehicle Infrastructure Program (ZEVIP) provides $680 million in funding to owners/operators of ZEV infrastructure, delivery organizations, and Indigenous organizations to deploy electric vehicle chargers and hydrogen refuelling stations in Canada

- ZEVIP targets the deployment of 30 hydrogen stations by 2029

The Government of Canada introduced a suite of programs to accelerate zero-emission transportation, providing funding opportunities for the deployment of hydrogen solutions.

- The Zero Emission Transit Fund (ZETF) provides $2.75 billion in funding to public transit and school bus operators in Canada to accelerate the adoption of zero-emission buses

- The $550 million Incentives for Medium and Heavy-Duty Zero-Emission Vehicles (iMHZEV) provides up to $200,000 per vehicle for businesses and communities across the country that make the switch to medium and heavy-duty zero-emission vehicles

- The Zero-Emission Trucking Program (ZETP) will use $75 million in funding to accelerate the safe deployment of medium and heavy-duty zero-emission vehicles

- The Canadian Federation of Municipalities’ $1 billion Green Municipal Fund can fund grants of up to $500,000 to municipalities for zero-emission vehicles and alternative fuel fleet conversion pilot projects

Funding is also available from Canada’s Regional Development Agencies, including PacifiCan, PrairiesCan, FedDev Ontario and the Atlantic Canada Opportunities Agency. Canada’s regional development agencies have provided over $30 million to date for various hydrogen opportunities, including hub development plans and electrolyser manufacturing facilities.

Regulatory updates that can drive demand and lower emissions

Canada’s Clean Fuel Regulations (CFR), released in mid 2022, requires fossil-based transportation fuels to reduce carbon intensity by 15% (compared to 2016) by 2030. The regulations establish a credit market for regulated parties (producers and importers). Credits are proportional to the carbon intensity of the hydrogen that is used.

The following uses of hydrogen can create CFR credits:

- Hydrogen used as a fuel or feedstock in the production of liquid fossil fuels

- Hydrogen used as a fuel or feedstock at a low-carbon-intensity fuel production facility

- Hydrogen used as a fuel in stationary applications (for example, hydrogen injected in natural gas pipelines)

- This use of hydrogen creates gaseous credits, which can only be used by regulated parties to satisfy up to 10% of their annual obligation

- Hydrogen supplied for use in transportation (for example, refuelling hydrogen fuel-cell vehicles)

Canada’s approach to Carbon Pollution Pricing creates an incentive for projects that use low carbon hydrogen, especially in industry or transport. For example, hydrogen could support the decarbonization of industry through high-temperature heat applications (for example, steel and iron production) and as a direct input in heavy oil upgrading and the chemical sector (for example, ammonia for fertilizers).

Both the CFR and Canada’s approach to carbon pollution pricing incentivize Canada’s existing producers and users of carbon-intensive hydrogen, such as in the oil refining, petrochemical, or fertilizer sectors, to reduce the carbon intensity of their hydrogen or transition to low-carbon hydrogen.

Canada’s proposed Methane Regulations will also contribute to a lower lifecycle carbon intensity for hydrogen derived from natural gas. The regulations will reduce upstream oil and gas methane emissions through the introduction of emission standards and work practices to inspect sites and make repairs.

Provincial and territorial measures

Opportunities for hydrogen exist in every region of our country, leveraging unique opportunities and strengths in various jurisdictions, including renewable electricity potential, natural gas reserves, natural geological formations that can be used for carbon capture and storage, critical minerals (some of which play a key role in hydrogen and fuel cell technologies), biomass and clean fuels. Regional hydrogen priorities vary, reflecting provinces’ diverse resources, energy mixes and economic drivers.

Since 2020, 6 provinces have published hydrogen strategies, identifying hydrogen as a provincial clean energy priority and describing provincial actions and objectives to realize their regional low-carbon hydrogen objectives. British Columbia and Alberta released strategies in 2021, with Ontario and Québec publishing their strategies in 2022. Nova Scotia published its Green Hydrogen Action Plan in 2023, and New Brunswick published its Hydrogen Roadmap in early 2024. Newfoundland and Labrador is developing a Hydrogen Development Action Plan, and Manitoba is also currently working on a provincial strategy.

Provinces are advancing hydrogen priorities through various initiatives and investments, such as British Columbia’s Hydrogen Office within its Clean Energy and Major Projects Office, Alberta’s Hydrogen Centre of Excellence or Atlantic wind energy leases.

Appendix II provides a provincial perspective on recent developments in the hydrogen space and further details on provincial and territorial measures.

Indigenous partnerships and participation

Indigenous Partnerships in or Indigenous-Led Projects

- World Energy GH2 and Qalipu FN

- EverWind Fuels and Membertou, Paqtnkek, Potlokek FNs

- FFI and Home Guard Cree FN

- FFI and Lheidli-’T’enneh FN

- ABO and Miawpukek FN

- Hydrogen Naturally and Fort Nelson FN

- Tse’khene Energy Transition Hub

- Wáwátéwák Corridor

- Edmonton Region Hydrogen Hub and Enoch Cree, Alexander FNs

- Grey Bruce Hub and Saugeen FN

- Belledune and Pabineau, Eel River Bar FNs

- Kanata and Frog Lake FN

The Hydrogen Strategy for Canada identified that the emerging hydrogen economy could offer new opportunities to Indigenous groups and communities through employment and new business creation. Today, evidence of these opportunities is underway, with examples of Indigenous participation in major production projects and hubs initiatives stemming from early relationships that have begun to be built by Canada’s low-carbon hydrogen sector.

Currently, there are approximately 13 partnership agreements or memoranda of understanding between hydrogen project proponents and Indigenous groups, communities or organizations that NRCan is aware of, in addition to Indigenous participation and co-chairing of the Edmonton Region Hydrogen Hub and participation in the proposed Grey Bruce Hydrogen Hub.

International context, exports, and competitiveness

Since 2020, major geopolitical events have been affecting the global energy market. Russia’s unjustifiable war of aggression against Ukraine that began in February 2022 has dramatically shifted the energy landscape in Europe. It led to soaring commodity prices for consumers, and highlighted dependence on fossil fuels and the risks of an undiversified energy supply. These factors have reinforced the importance of energy security, with countries seeking to invest in energy infrastructure, diversify energy suppliers, produce more energy locally through renewables and redirect imports to reliable, politically stable partners.

In response, countries are developing policies and making investments to accelerate the energy transition. The US Inflation Reduction Act, the European Commission’s REPowerEU Plan, Australia’s Hydrogen Headstart Program and the GX Green Transformation in Japan are examples of this. These and other measures increase opportunities for low-carbon hydrogen, as importing countries look to strengthen energy security and diversified energy supplies, and countries rich in hydrogen feedstocks compete for offtake agreements.

Canada is likewise aiming to be a key player in the nascent global clean hydrogen and ammonia market. Leveraging our abundant feedstocks, stable geopolitical environment, and commitment to a clean economy, Canada is well positioned to provide competitively priced low-carbon ammonia, as the near-term vector for hydrogen, to global markets. Canada’s 23 clean hydrogen export projects constitute the majority of potential investment in new production projects.

In the East, Atlantic Canada’s abundant and untapped wind resources and immediate proximity to Atlantic shipping routes will allow wind-to-hydrogen electrolysis projects to become reliable suppliers of clean hydrogen to Germany and other European markets. Germany has announced its intention to import up to 50-70 percent of its hydrogen demand by 2030 (approximately 3-4 million tonnes of hydrogen annually) as it looks to decarbonize hard-to-abate industrial sectors that cannot be electrified and to cut dependence on imported fossil fuels from Russia. In the West, export projects deriving ammonia from natural gas are looking to export to Japan, South Korea, and Asian markets, largely as a means to reduce emissions from coal power.

To advance the clean hydrogen export opportunity, Canada is actively engaging with its allies and signing commitments to support energy security through the production and export of hydrogen and its derivatives, including:

- the 2021 Memorandum of Understanding between Canada and the Netherlands on cooperation in the field of hydrogen energy, which seeks to advance the development of export-import corridors and enhance cooperation on topics such as standards, certification, investment, trade and technologies. Canada and Netherlands have since engaged on ports collaboration and a supply chain study

- the 2021 Memorandum of Understanding between Natural Resources Canada and the United States Department of Energy on energy cooperation, which aims to jointly identify green corridors and cross-border hydrogen hubs and accelerate efforts to develop and standardize common global methodology for carbon intensity. This collaboration has advanced through engagement under the North American Leaders Summit Declaration

- the August 2022 Joint Declaration of Intent to establish a Canada-Germany Hydrogen Alliance, which seeks to create a transatlantic supply chain for hydrogen before 2030. Achievements since the partnership was formed include a working group, supply chain analysis, and ongoing consideration of co-financing mechanisms, including the memorandum of understanding signed March 2024

- the May 2023 Memorandum of Understanding with South Korea on cooperation in critical mineral supply chains, the clean energy transition and energy security, which features hydrogen, its derivatives, and enabling technologies as one of the key areas of cooperation

- the Canada-Japan Energy Policy Dialogue, active since 2019, which signed an updated Action Plan for 2023 to 2025 where ammonia was added to the hydrogen pillar. Under this forum, Canada and Japan aim to explore market opportunities and ways to bolster cooperation, including on the export of low-carbon ammonia from Canada to Japan to help decarbonize Japan’s power sector

- inclusion of hydrogen in the Canada-EU High-Level Energy Dialogue, active since 2007, where Canada and the EU collaborate on mutual goals of energy security and the clean energy transition. A hydrogen Action Plan was signed in March 2023 to cooperate on supply chain analyses and trade and investment missions to EU members

Advancing Market Access to Germany

Building on the Joint Declaration of Intent, in March 2024 Canada and Germany signed a Memorandum of Understanding to establish a first-of-its-kind program for a dedicated Bilateral Window through Germany’s H2Global Foundation. The program will support commercial transactions between Canada’s hydrogen producers and Germany’s industrial manufacturing and energy distribution sectors by committing Canada and Germany to launch aligned supply and demand auctions in the coming months through which Hydrogen Purchase Agreements will be secured. Accelerating commercial-scale hydrogen trade between Canada and Germany by securing early access for clean Canadian hydrogen producers in the German market will strengthen both countries’ efforts to fight climate change and enhance energy security.

These agreements build on the policy framework enacted by Canada in support of low-carbon hydrogen across the value chain, from production supports through our clean economy investment tax credits to creating an environment that incentivizes decarbonization efforts through carbon pricing and clean fuel regulations. Third party analysis by consultancy, Wood Mackenzie, verifies that Canada has already established itself as a leading market for low-carbon hydrogen exports, backed by one of the most advanced states of hydrogen policy readiness.

Figure 2: Canada and Germany sign memorandum of understanding to advance market access in Hamburg, 2024. Source: Hamburg Chamber of Commerce

2. Sector progress and recommendations status

2.1 Sector progress

Hydrogen production

There are 13 low-carbon hydrogen production facilities in operation in Canada, comprising 6 electrolytic facilities and 7 projects that have adopted carbon capture to lower the emissions of traditionally carbon intensive hydrogen production. The Air Liquide 20 MW electrolyser in Bécancour, Québec began operating in 2021, and was the largest electrolyser plant in the world at that time.

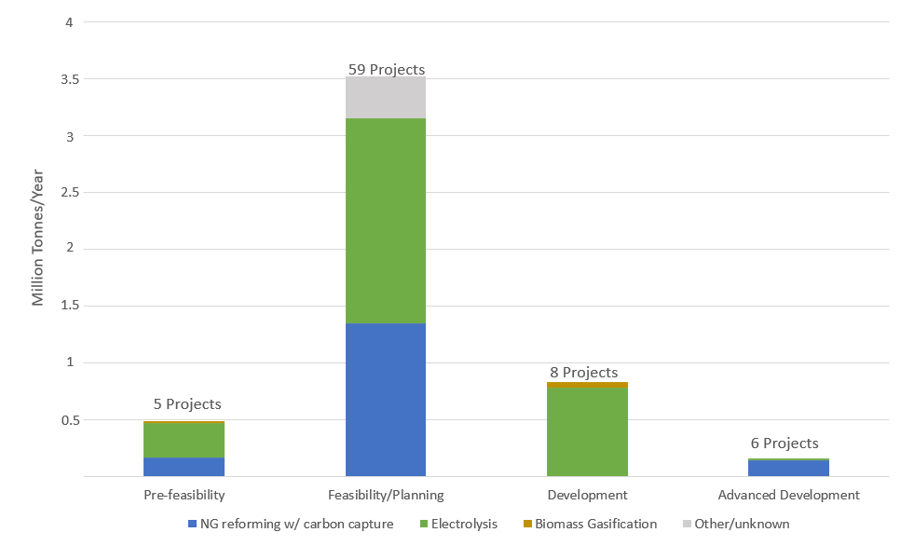

Approximately 80 production projects have been announced since the Hydrogen Strategy was released in 2020 and are at various stages of development. Combined, these 80 projects have the potential to bring 5 million tonnes of annual low carbon hydrogen production capacity online if all were to become fully operational, and represent over $100 billion in potential investment.

Most of these projects will produce low-carbon hydrogen through electrolysis or natural gas reforming (via steam methane reforming or autothermal reforming) with carbon capture and storage (CCS). A few early-stage projects are developing the use of pyrolysis technology, and some are planning on the use of biomass gasification with CCS. The projects are targeting a broad array of end uses, including oil and gas refining, industry feedstock, natural gas blending, transport and several projects focused on ammonia production for export.

Highlights of key production projects across Canada are featured in Appendix I.

Text version

Bar graph showing the number of announced hydrogen production projects per project stage, with production pathway type, and the total amount of planned hydrogen production per project stage. 5 projects are listed as pre-feasibility, totaling approximately 0.5 million tonnes per year (MTpa) of hydrogen production. 59 projects are in the feasibility/planning stage totalling close to 3.5 MTpa, 8 projects are in development totalling approximately 0.8 MT, and 6 projects are in advanced development, totalling almost 0.2 MT.

Figure 3: Status and estimated hydrogen capacity of production projects, by production method.

Source: Compiled by NRCan, based on information disclosed publicly and derived from various sources, as well as information disclosed in confidence. Data is provided in aggregate to maintain confidentiality. Production is not representative of all projects due to data gaps and limitations. Estimates may include full potential build-out of proposed plants, components of which may be in earlier stages of development. Projects of unknown status are excluded. Project status assigned to the best of NRCan knowledge.

Definitions:

- Advanced development – Under construction

- Development – Some permitting, regulatory approvals or processes and other preparatory work underway, but construction has not yet commenced

- Planning/feasibility – Active planning underway, which may include feasibility studies, pre-FEED and FEED work and other project activities

- Pre-feasibility – Announced plans or agreement but limited or unknown planning and feasibility activity commenced

Hydrogen end-use and hubs

On the demand side, projects are underway across each of the potential end uses of low-carbon hydrogen that were identified in Canada’s Hydrogen Strategy, showing the potential of hydrogen as a decarbonization opportunity in the areas of transport, industry, buildings or heating (natural gas blending), and electricity generation and storage. Hydrogen hubs are forming in many of the areas where production and end-use projects have been announced.

Hydrogen end-use projects and hubs developments, as well as updated findings since 2020 related to each end use, are described below.

Transportation

Vehicle refuelling

Hydrogen refuelling networks are developing in British Columbia, Québec, Ontario and Alberta, which will enable more widespread fuel cell electric vehicle (FCEV) adoption, including in commercial applications.

- HTEC has built a network of 5 operational light-duty vehicle hydrogen fuelling stations across British Columbia, with more planned for construction

- Hydrolux’s “Trans-Québec 1” project includes the development of 7 hydrogen refuelling stations equipped with 5 MW electrolysers

- Air Products is planning to build Alberta’s first commercial refuelling station near its Net Zero hydrogen production complex for both heavy-duty trucks and light-duty cars

- Greater Toronto Airports Authority is working with Carlsun Energy to develop Ontario’s first public hydrogen refuelling station at Toronto Pearson, with $1 million in funding from NRCan’s ZEVIP program

Trucking and freight

Hydrogen powertrains, whether based on fuel cells or combustion, provide the best path forward for heavier truck classes needing the significant range, higher energy density and faster refilling times of hydrogen. New hydrogen-platform business and truck models are being developed and early demonstration projects have been announced or are planned.

- The Alberta Zero Emissions Truck Electrification Collaboration (AZETEC) involves the demonstration of 2 heavy-duty, class 8 fuel cell electric trucks that will operate freight, year round, between Edmonton and Calgary

- The Alberta Motor Transport Association has launched a “Hydrogen Vehicle Road Show” to deploy hydrogen vehicles into member company fleets to build awareness, comfort and interest in hydrogen vehicles

- BC-based Hydra Energy has received orders for over 80 of its hydrogen-diesel dual fuel retrofits, which use up to 40% hydrogen and will also support deployment with the construction of the world’s largest hydrogen fuel station, to be commissioned in 2024

- BC-based HTEC is receiving $16.5 million from British Columbia for the Pilot Hydrogen Truck Program to procure 6 heavy-duty fuel-cell trucks and complete updates to a hydrogen-fuelling station in Tsawwassen and a maintenance facility in Abbotsford

Urban transit

Hydrogen fuel cell buses (FCEBs) are well suited to longer routes, such as bus rapid transit, suburban, or regional commuter routes, and while battery electric buses have a 23% reduced range in winter, FCEBs provide the same operating range year-round. More than 4,000 FCEBs have been deployed worldwide.

- Edmonton Transit and neighbouring Strathcona County are conducting a pilot trial of 2 hydrogen buses (the buses are currently in service)

- Winnipeg Transit, through its “Transition to Zero Emission Program,” is planning to deploy 33 buses by 2027, with a target of 8 fuel cell buses by 2024

- Mississauga is exploring funding for the MiWay Hydrogen FCEB pilot project to trial 10 buses

- Brampton is planning to have 2 demo buses by 2025 as part of its Zero-Emission Bus Study

- Halifax Transit is considering a bus depot retrofit to switch 40 to 60 buses to hydrogen

Trains

Rail’s energy intense duty cycle and long ranges makes it a sector that is particularly challenging to electrify. Pilot projects are underway that will provide information on the performance and potential opportunity of hydrogen trains in Canada.

- In Québec, Alstom piloted a Coradia iLint Hydrogen train from Montmorency Falls to Baie-Saint Paul over the summer of 2023, carrying over 10,000 passengers over 130 trips, saving 8,400 litres of diesel and averting 22 tonnes of CO2 emissions

- In BC and Alberta, Canadian Pacific Kansas City (CPKC) and Southern Railways are retrofitting diesel locomotives, with ATCO constructing 1 MW electrolysers at Calgary and Edmonton railyards

Aviation

Hydrogen can enable decarbonization of airport operations through deployment of FCEVs and may also help decarbonize aviation through the use of fuel cell planes and hydrogen’s use as a low-carbon alternative fuel or in the production of sustainable aviation fuel.

- Edmonton International Airport is planning to convert some of its airport operations vehicles, including trucks and buses, to hydrogen and is in the early stages of exploring infrastructure for hydrogen aircraft (it added 100 Toyota Mirai hydrogen FCEVs to its fleet in June 2023)

- DeHavilland and ZeroAvia signed a memorandum of understanding in 2022 to collaborate on a hydrogen fuel cell powered Dash 8 aircraft

- Avmax AirCraft ordered 20 turboprop regional hydrogen aircraft and fuel from Universal Hydrogen

Port operations

Projects are underway to demonstrate hydrogen in port operations through terminal tractor, yard and Class 8 drayage truck vehicles.

- BC is providing $4 million through its Commercial Vehicle Pilots Program and Advanced Research and Commercialization program to the BC Hydrogen Ports Project to demonstrate hydrogen at the Port of Vancouver, led by a consortium of companies headed by HTEC

- The Port of Montreal took delivery in June 2022 of 2 hydrogen-powered equipment prototypes, including a terminal tractor, to pilot deployment at the Port

Heavy industry

Petroleum refining and petrochemicals

Projects are announced and operational to capture carbon from (carbon intensive) hydrogen production at existing facilities. New developments could achieve capture rates up to 98% when paired with autothermal reforming.

- Shell’s Scotford Upgrader captured 77% of its carbon emissions in 2022 from producing hydrogen used for upgrading bitumen to produce synthetic crude, surpassing 7.7 million tonnes of injected CO2 since project start-up

- Nutrien’s Redwater Sturgeon refinery and fertilizer plants have implemented CCUS utilizing the Alberta Carbon Trunk Line, transporting 1.6 Mt of CO2 annually for storage and use

- DOW announced plans in 2021 to construct the first worldwide net-zero polyethylene facility in Alberta, which would make use of a hydrogen-fuelled ethylene cracker

Steel

The steelmaking sector estimates Can$3 per kg of hydrogen, equivalent to 3 to 4 times what the industry currently pays for natural gas, is required for hydrogen to be economical as a heating fuel or reductant.

- ArcelorMittal Dofasco in Ontario plans to end the use of coal in its plants, by installing a direct reduced iron plant and electric arc furnace

- The direct reduction process will operate with natural gas to begin with but will be hydrogen-compatible to transition to low-carbon hydrogen fuel as soon as cost-competitive supply is available

- At its steel plant in Contrecoeur, Québec, ArcelorMittal has successfully tested replacing 6.8% natural gas with low-carbon hydrogen during a 24-hour period to produce direct reduced iron, contributing to a measurable reduction in CO2 emissions

- This was a step forward as the iron ore reduction process contributes more than 75% of ArcelorMittal’s overall CO2 emissions

Biofuel production

Hydrogen can be a feedstock in the production of synthetic fuels and biofuels, including e-methane, e-gasoline, sustainable aviation fuel and e-methanol, which is gaining traction as a low-carbon marine fuel for shipping.

- Varennes biorefinery and hydrogen electrolysis project will produce biofuels from waste (wood and non-recyclable materials) and will include a 90 MW Cummins electrolyser

- It is receiving $277 million in financing from the Canada Infrastructure Bank

- Imperial Oil Strathcona refinery in Alberta plans to combine natural gas-derived hydrogen, carbon capture and a biofeedstock combined with a proprietary catalyst, to produce low-carbon renewable diesel

- Tidewater Renewables at the Prince George Refinery in British Columbia is Canada’s first stand alone renewable diesel refinery that has recently completed construction and will soon begin production of low-carbon hydrogen

- Braya Renewable Fuels is partnering with ABO Wind to power the Come By Chance Refinery in Newfoundland and Labrador with low-carbon hydrogen by 2027 and begin exporting biofuels to foreign markets by 2028

- The project has been provided $37 million in funding from the Clean Fuels Fund and $49 million in funding from the Strategic Innovation Fund

Blending and energy storage

Natural gas blending

Blending pilots and feasibility studies are underway across Canada. The Canadian Standards Association has acknowledged that blending up to 5% hydrogen by volume is covered under current certifications for appliances.

- Enbridge’s 2.5 MW power-to-gas and natural gas blending project in Markham, Ontario, is currently servicing 3,600 households with up to a 2% blend of hydrogen in its natural gas, reducing GHG emissions by 117 tonnes per year

- The project was provided $882 thousand in funding from Sustainable Development Technology Canada and $1.8 million from Ontario’s Hydrogen Innovation Fund

- In October 2022 in Alberta, ATCO began delivering a blend of natural gas containing 5% hydrogen by volume in Fort Saskatchewan, safely servicing 2,100 customers

- Their Operations Centre will be the first commercial building in North America heated by 100% hydrogen when it becomes operational in 2024 and will demonstrate pure hydrogen appliances and equipment

- ATCO and Qualico are currently studying the logistics, technology requirements and other considerations in safely and affordably developing a 100% pure hydrogen community in the proposed Bremner 100% Hydrogen Community in Strathcona, Alberta

- In 2023, ATCO and Certarus partnered to fuel the Edmonton Convention Centre in Alberta with a 20% hydrogen blend when it hosted the 2023 Canadian Hydrogen Convention

- In Québec, Evolugen and Gazifière’s 20 MW Masson electrolysis project in Gatineau will produce approximately 425,000 GJ of low-carbon hydrogen for injection into Gazifière’s natural gas distribution network, reducing GHG emissions by approximately 15,000 tonnes per year

- FortisBC is exploring opportunities to blend hydrogen into the natural gas system in British Columbia and is advancing a technical blending study in collaboration with Enbridge

Electricity and energy storage

Projects underway or under consideration are demonstrating that hydrogen can decarbonize former coal or natural gas power plants or provide medium-term energy storage, grid stabilization, or to short-term storage to avoid excess renewables curtailment.

- In July 2022, Heartland Generation in Alberta announced it would convert the Battle River Generating Station, a former coal facility, to operate on 100% clean hydrogen produced using autothermal reforming technology with a carbon capture rate of 98%

- Combined with an open access carbon capture hub, if fully utilized, the project could reduce 5 Mt of GHG emissions annually

- Niagara Hydrogen Centre, to be built, owned and operated by Atura Power, will be Ontario’s largest low-carbon hydrogen production facility

- It will deploy a 20 MW electrolyser in the City of Niagara Falls, Ontario, to produce low-carbon hydrogen while supporting the Sir Adam Beck hydroelectric facility’s provision of grid regulation services for the Ontario electricity grid

- Triple Point is considering a major salt dome storage project near Stephenville, Newfoundland and Labrador, with potential to store more than 35 million cubic metres, or the equivalent of 180,000 tonnes of hydrogen, which could be used to store hydrogen destined for export or to store electricity from renewable generation as compressed air

Hydrogen hubs

Hydrogen hubs (regional networks of hydrogen producers, consumers and expertise, linked by connective infrastructure) are developing across the country.

- The Edmonton Region Hydrogen Hub includes more than 25 projects across the value chain

- It has Indigenous co-chairing and has received more than $2 million in government funding

- It has launched the 5,000 Hydrogen Vehicle Challenge as an initiative aimed at getting 5,000 hydrogen powered vehicles, such as buses, trucks or farm equipment, on the road in Western Canada within 5 years

- The Vancouver area is a major hub of Canada’s hydrogen innovation, fuel cell and manufacturing companies, and has the greatest concentration of operational hydrogen refuelling infrastructure

- Simon Fraser University and the University of British Columbia are both leading hydrogen hub initiatives for production, innovation and technology testbeds

- British Columbia considers the Prince George hub as an ideal location for a central hub given its existing infrastructure and is co-developing a study with the city to advance development

- Sarnia-Lambton has outlined a hydrogen hub proposal, forecasting hydrogen demand to increase up to 1 Mt annually by 2050

- The hub would service petroleum refining and ammonia for fertilizers and have the benefit of nearby salt caverns for reservoir storage and connections to US markets

- The Air Liquide hydrogen production plant in Bécancour will be part of Québec’s “Vallée de la transition énergétique” announced in May 2023, providing a supply of clean hydrogen to 7 clean energy, innovation, and industrial decarbonization projects that are receiving over $8 million in funding from Québec

- Early-stage hubs are under consideration in Calgary Alberta, Selkirk Manitoba and Grey-Bruce Ontario

2.2 Implementation framework – Results

The Hydrogen Strategy implementation framework was established in early 2021 to maintain momentum towards building Canada’s hydrogen economy and to follow through on the Strategy’s 32 recommendations. Led by NRCan, the implementation framework consists of 16 thematic working groups covering specific topics and areas that cut across all aspects of the hydrogen value chain.

Working group membership is diverse and consists of over 1,000 individuals from government, industry, academia, and non-governmental organizations. Oversight was provided by a Strategic Steering Committee, supported by an Interdepartmental Working Group and a Federal-Provincial-Territorial working group. Each group was co-chaired by a government and industry representative.

Over 80 working group meetings were held to deepen the knowledge of sector challenges and opportunities and build collaboration networks across industry, governments, utilities, and academia.

The working groups provided analysis that underpins this Progress Report and produced 9 strategic reports, including:

- an export study to deepen understanding of global export markets for Canada’s low-carbon hydrogen exports, which analyzed costs of various export pathways

- a ports techno-economic analysis, which noted a number of existing ports in Atlantic Canada are well positioned to consider infrastructure upgrades necessary to export to European import ports

- technical assessments on hydrogen production from renewable and from nuclear electricity

- a study on the potential for hydrogen to decarbonize steelmaking, which found hydrogen could pave the way for emissions-free steel production if costs of low-carbon hydrogen were lower

- 4 reports analyzing the role of natural gas-derived hydrogen, including to meet future demand, analyze technical feasibility of blending, considerations for an emissions intensity threshold and on certifying natural gas home appliances

Codes and standards development

The work of the Codes and Standards Working Group has also been a key part of delivering on the Hydrogen Strategy Implementation Framework. Harmonizing codes and standards and addressing gaps is essential to enable hydrogen adoption and deployment.

Canada committed $50 million from 2021 to 2026 to support enabling the research and development of new codes and standards.

The Hydrogen Strategy’s Codes and Standards Working Group will complete a Codes and Standards Road Map in 2024. Beyond identifying the gaps that exist, the roadmap will prioritize the various codes and standards gaps based on how critical they are for the hydrogen value chain. It is expected to identify short-term priority elements in the areas of production, delivery and storage, and end-use applications such as bus and truck transportation or steel production.

The working group includes participation from and supports the work of organizations that formally develop codes and standards in Canada. Codes and standards for hydrogen are developed in Canada by accredited standards development organizations (SDOs), such as the Canadian Standards Association (operating as CSA Group), Bureau de normalisation du Québec or the Compressed Gas Association, with support and expertise from governments, industry associations, businesses, regulatory authorities, consumers and end users.

SDOs have been actively working with stakeholders to amend, update or develop new hydrogen codes and standards across the hydrogen value chain:

- CSA Group has supported the development of 22 CSA codes, standards and technical specifications covering the hydrogen value chain

- In addition, over 80 CSA standards were impacted by a recent “Request for Interpretation”, where CSA clarified that natural gas containing up to 5% of hydrogen is already covered by existing requirements in the standards (as such, certifications in accordance with these standards would remain valid for these blending levels)

- In 2022, the Bureau de normalisation du Québec (an accredited national standards development organization) updated the Canadian Hydrogen Installation Code

- This code, which was developed in compliance with Standards Council of Canada requirements, sets the installation requirements for hydrogen-generating equipment for non-process end-use hydrogen utilization equipment, hydrogen-dispensing equipment, hydrogen storage containers, hydrogen piping systems and their related accessoriesFootnote 6

Canada has also helped advance international codes and standards and certification that will enable global trade in low-carbon hydrogen and its derivatives. At COP 28, Canada signed the Declaration of Intent on Mutual Recognition of Certification Schemes for Renewable and Low Carbon Hydrogen and Hydrogen Derivatives. Through its participation in the International Partnership for Hydrogen and Fuel Cells in the Economy, Canada also helped develop ISO/TS 19870, an international methodology for determining hydrogen GHG emissions.

2.3 Recommendations

The Hydrogen Strategy developed 32 recommendations addressed to all levels of government, industry, utilities, academia, non-governmental organizations and standards development organizations, in order to progress on the hydrogen opportunity. The recommendations were organized according to 8 pillars.

This Progress Report is the first progress report on these recommendations. Canada is on target for 13 of the recommendations, progressing on 16, and progress on 3 recommendations has been limited.

Progress was made on recommendations related to strategic partnerships, codes and standards, and the creation of a policy ecosystem of enabling policies and regulations to de-risk investments. This is evidenced by the establishment of measures such as the Clean Hydrogen Investment Tax Credit, funding programs such as the Clean Fuels Fund and the development of 22 codes and standards.

Actions recommended under the regional blueprints and international markets pillar have also progressed well, as can be seen with the establishment of 8 regional hydrogen hubs. On international markets, Canada has done well to develop a strong Canadian brand as can be evidenced through the multiple international agreements, such as the Canada-Germany Energy Partnership or agreements targeting Asian markets. However, export infrastructure has yet to be deployed.

Regarding innovation, progress has been made through research and development reports, federal funding such as through NRCan’s Energy Innovation Program or the founding of research centres such as Alberta’s Hydrogen Centre of Excellence. But there are few streams of dedicated or sustained funding for hydrogen research, development and innovation to date. Progress on awareness recommendations and actions, such as awareness campaigns or development of tools and resources to help quantitatively evaluate hydrogen as an option, was limited.

Details on the status of recommendations and progress can be found in Appendix III.

2.4 Modelling projections of low-carbon hydrogen’s role in net-zero by 2050

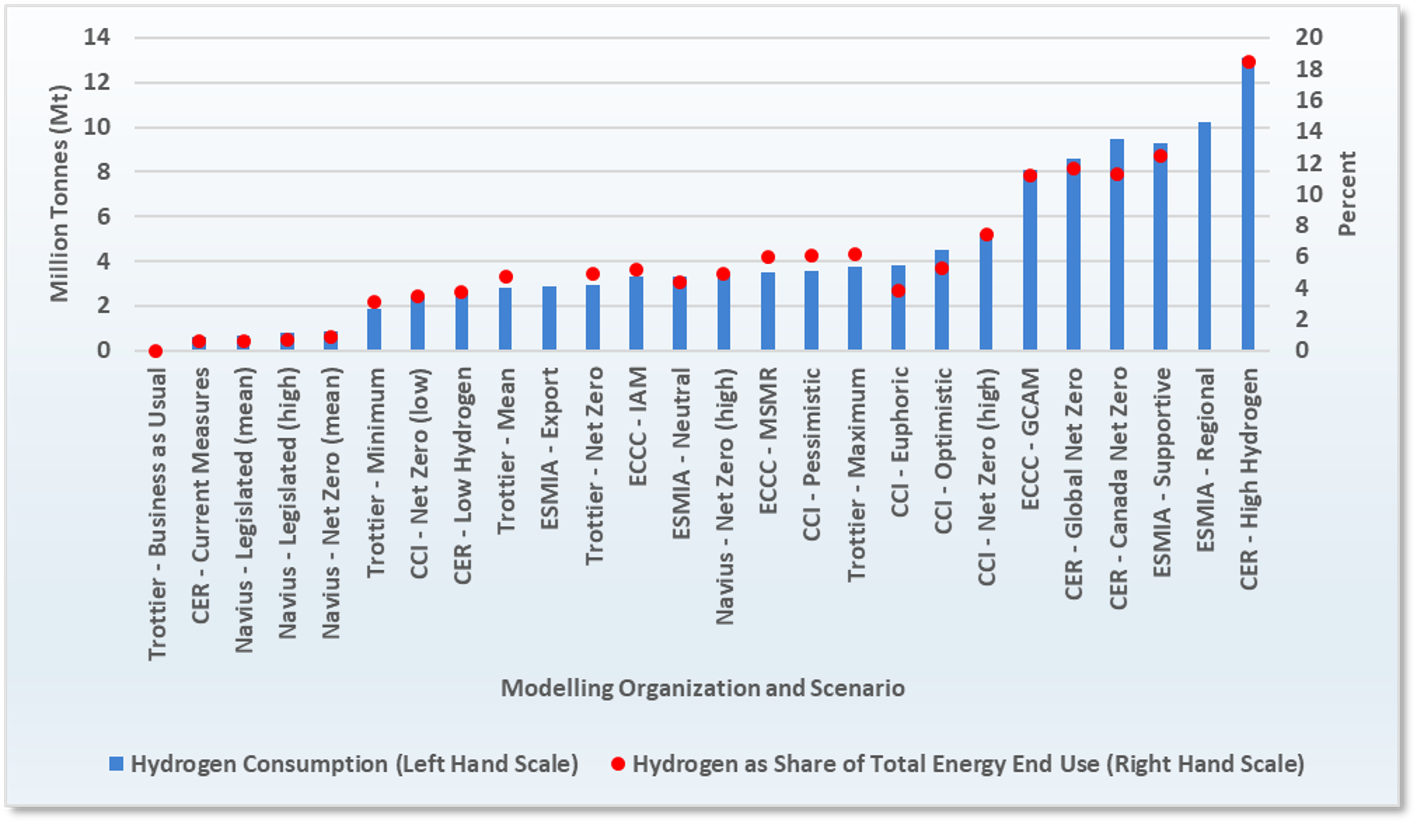

The modelling supporting the Hydrogen Strategy was focused on understanding the full potential role of low-carbon hydrogen in Canada’s energy system. Since then, there have been a number of modelling initiatives that have provided further analysis and projections of the future role of low-carbon hydrogen within Canada’s overall energy system, including scenarios in which Canada reaches net-zero emissions by 2050.

For this Progress Report, Canada looked at 6 recent national modelling initiatives from a variety of organizations and is providing the range of possible outcomes for future hydrogen consumption, production, and exports. The 6 modelling initiatives included:

- Canada Energy Regulator (CER) – Canada Energy Futures 2023

- ESMIA Consultants (ESMIA) – Modelling Hydrogen’s Potential Across Multiple Sectors of the Canadian Economy, prepared on behalf of NRCan

- Environment and Climate Change Canada (ECCC) – Exploring Approaches for Canada’s Transition to Net-Zero Emissions

- Canadian Climate Institute (CCI) – Canada’s Net Zero Future

- Navius Research (Navius) – Canada Energy Dashboard

- Trottier Institute (Trottier) – Canadian Energy Outlook, Pathways Explorer

Projecting the energy system and the role of hydrogen necessarily involves speculative assumptions about the future evolution of policies, technologies and global markets. This results in a wide range of results and uncertainties.

The modelling initiatives discussed in this report include the following limitations:

- None are a market forecast – other than certain “current measures” scenarios, they represent what the energy system could look like in scenarios where Canada reaches net zero by 2050

- None of the scenarios include the Clean Hydrogen Investment Tax Credit (CHITC) in their underlying assumptions, as the initial design details were not available at the time the modelling was completed

- Net-zero projections invariably limit hydrogen blending with natural gas, as net-zero scenarios gravitate to pathways with limited unabated fossil fuel use, rather than near-term reduction opportunities such as those offered by blending hydrogen in natural gas distribution systems

- While some scenarios assume a certain level of hydrogen exports from Canada, the export potential is not based on an extensive assessment of future global demand and Canada’s potential role. Net-zero projections also limit proper consideration of the benefits of hydrogen exports. Though it may not contribute as directly to Canada reaching net zero, low-carbon hydrogen produced for export in Canada will contribute to sustainable green job creation, international energy security, and global emissions reductions

By using different modelling approaches and running scenarios with varying technological, economic, and policy assumptions, these modelling initiatives have produced a range of results, which offer insights into how Canada’s hydrogen sector might evolve when subject to different constraints or enablers as Canada works towards a net zero energy system by 2050.

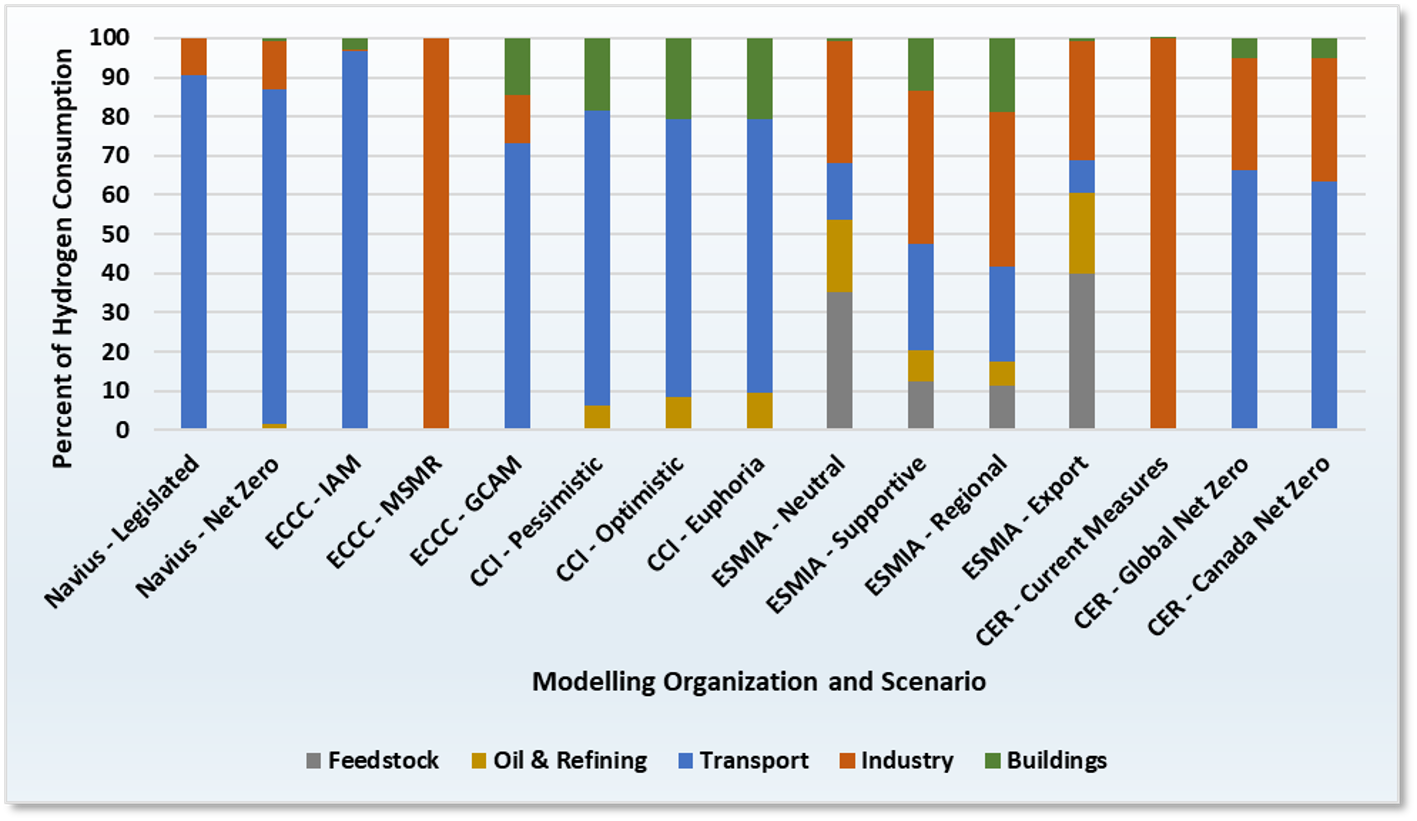

By presenting the results of 6 modelling initiatives, this Progress Report provides a transparent picture of the state of projections of the role of hydrogen in Canada. Ultimately, the results show fair alignment on the role that low-carbon hydrogen could play in Canada’s efforts to reach net zero, including greater certainty in a potential role in transportation and heavy industry.

Key findings

- Overall, up to 18% of Canada’s total energy use could be provided by low-carbon hydrogen by 2050. Most projections fall in the range of 3% to 12%. The scenarios that assume supportive policies or cost reductions could be seen as a proxy for including the CHITC. These scenarios fall in the range of projecting 12% to 18%.

- Most scenarios project low-carbon hydrogen to be a viable and economical decarbonization option in hard-to-abate sectors such as medium and heavy-duty transportation (trucks, buses) or heavy industry (refining, petrochemicals, steel). Hydrogen used in transport could range from 12% to 35% of the sector’s energy use in 2050 and up to 18% of energy consumption in industry.

- The majority of scenarios project total low-carbon hydrogen production to range from 6 to 20 million tonnes per year, but the models vary in projecting whether this production would generally come from electrolysis, natural gas with carbon capture or biomass with carbon capture.

- Exports of hydrogen could play a large role in spurring sector growth, with the scenarios focused on estimating potential exports projecting the highest levels of potential jobs and economic benefits. Not all scenarios considered exports, and for those that did, there is no available projection of the future growth of the global low-carbon hydrogen market to aid in the analysis.

- Few of the modelling initiatives were expressly designed to estimate emissions reductions from low-carbon hydrogen uptake. The overall range of emission reduction results in 2050 was from 17 Mt to 69 Mt in domestic reductions (or up to 109 Mt in global reductions when considering exports). The midpoint of this range would correspond to approximately 6% of Canada’s 2020 emissions, in line with the International Energy Agency’s global Net-Zero Scenario that found that 6% of global cumulative emission reductions from 2021 to 2050 were projected to come from low carbon hydrogen displacing fossil fuels.

Details of the modelling projections can be found in Appendix IV.

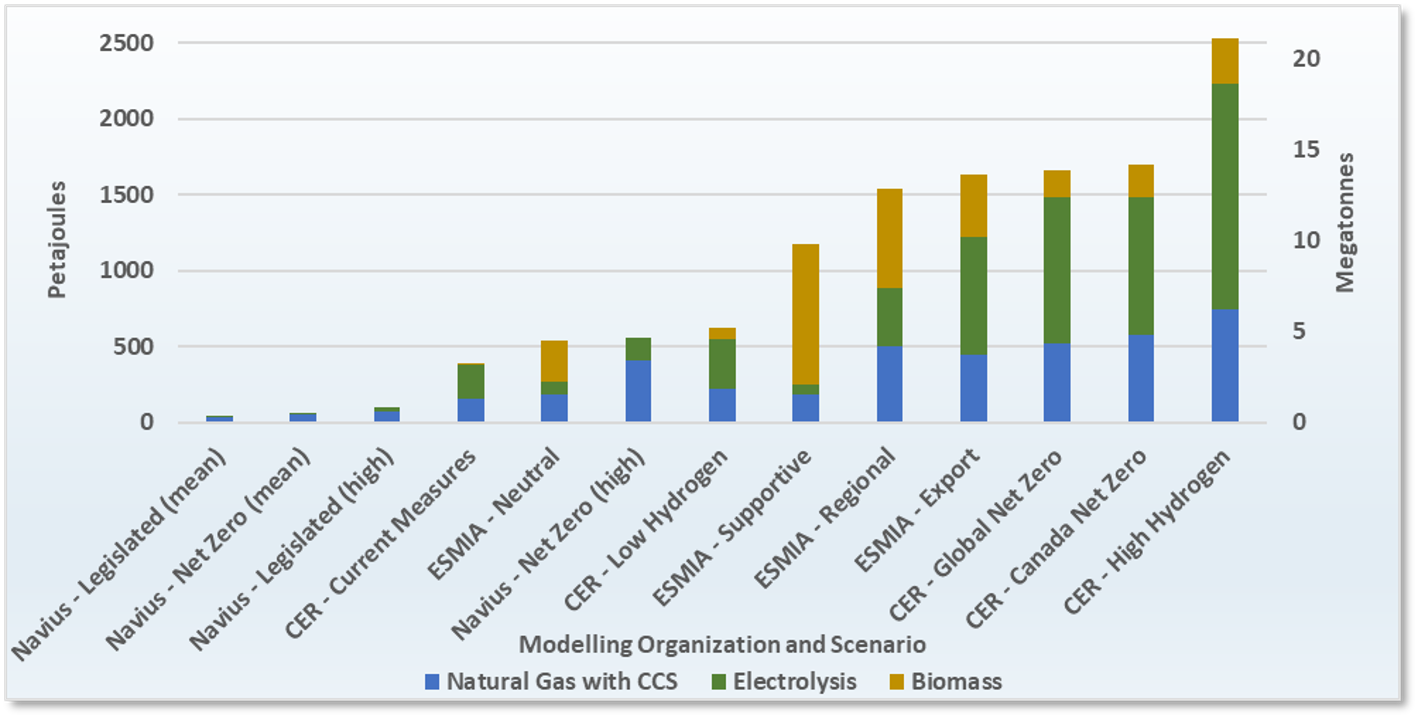

Text version

Bar graph showing projections of hydrogen consumption in million tonnes (Mt) in Canada in 2050 across 26 modelling scenarios, as well as as a percentage share of total energy end use. The bars are organized from left-to-right from lowest to highest projections, ranging from near 0 to up to approximately 13 Mt, and 18%.

Figure 4: Domestic low-carbon hydrogen consumption and share of end use in Canada in 2050.

Note: All scenarios, including those described as ‘current measures’, do not include CHITC.

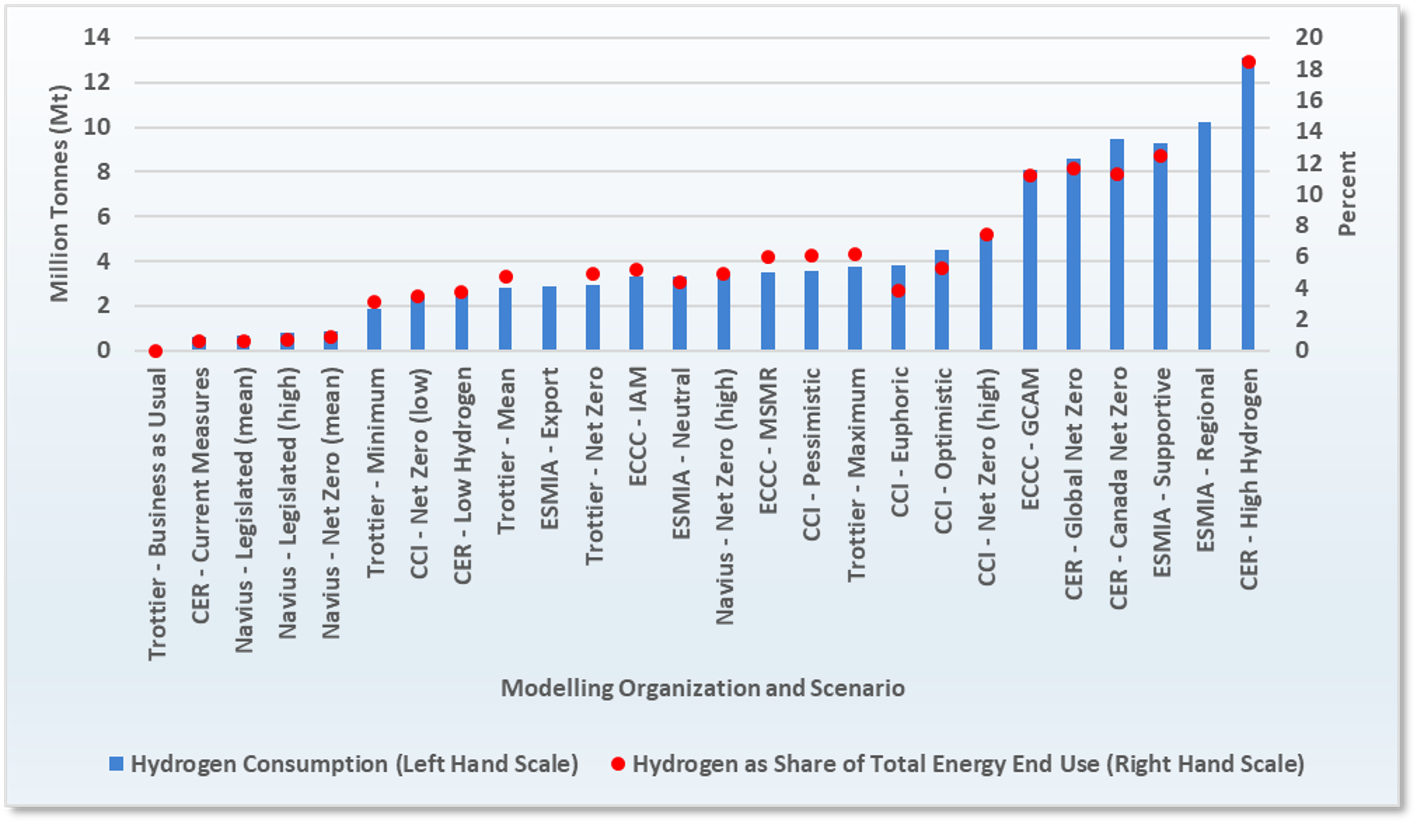

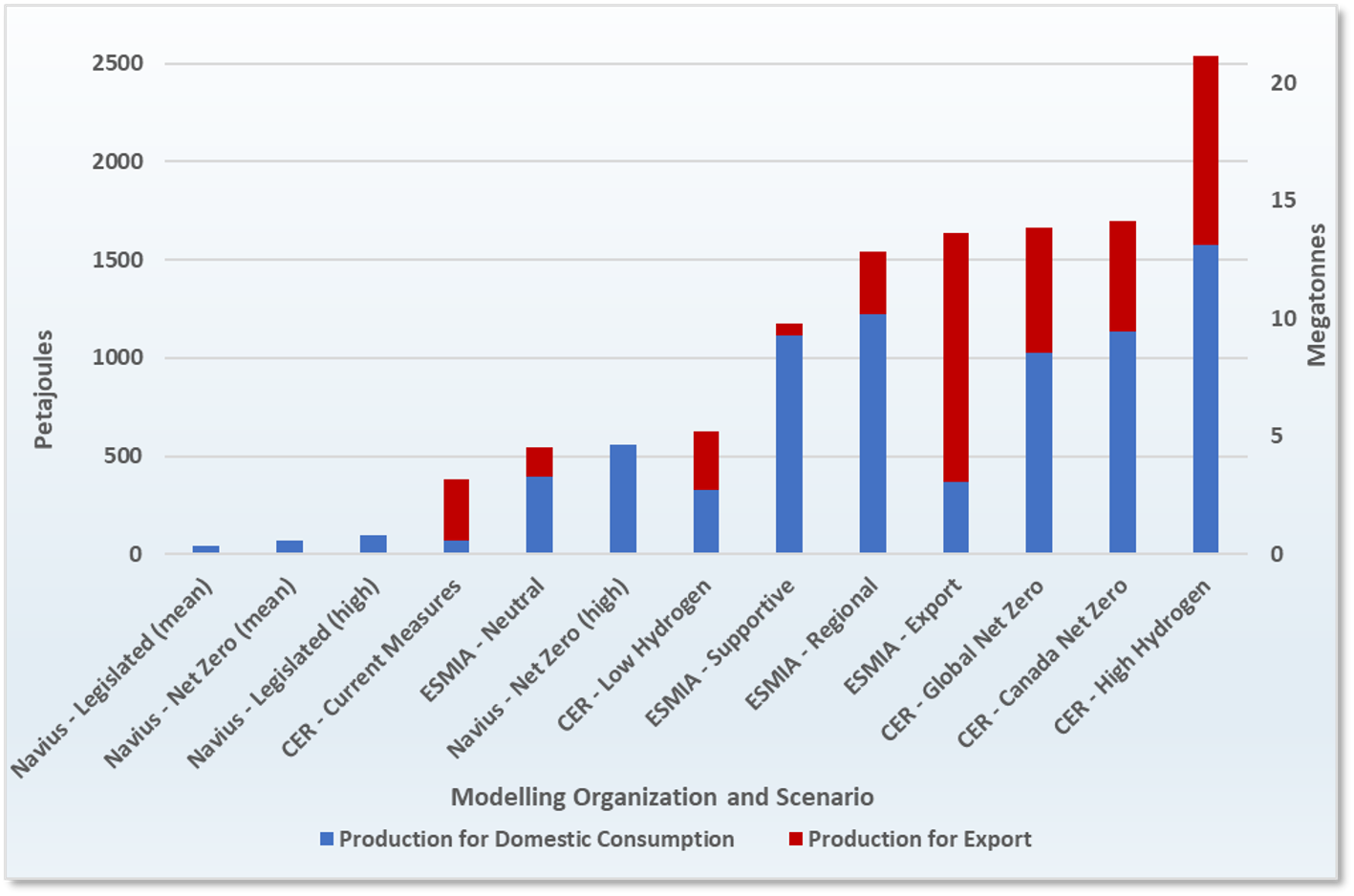

Text version

Bar graph showing projections of hydrogen production totals and by source of production from 13 modelling projections, both in petajoules (left hand scale) and in million tonnes of hydrogen (right hand scale). The projections are organized from lowest on the left to highest on the right. The 3 lowest estimates project under 1 Mt of primarily natural gas with CCS production, while the highest estimate on the right projects over 20 Mt, of which the majority comes from electrolysis, approximately 7 Mt is produced from natural gas with CCS, and the remainder from biomass.

Figure 5: Low-carbon hydrogen production in 2050, by source.

Note: All scenarios, including those described as ‘current measures’, do not include CHITC.

3. What’s next: Priorities and actions

Canada’s strategic priorities for next reporting period (2024 to 2026)

To focus resources in areas to be most effective, and based on engagement with the Hydrogen Strategy Implementation framework membership, the following strategic priorities were identified to guide collective actions during the next reporting period (2024 to 2026).

1. De-risk high-impact production projects of low-carbon hydrogen

First-mover production projects like Air Liquide’s 20 MW or Enbridge’s 2.5 MW Markham electrolysers are operational and other major projects have received environmental approval or are under construction. But other projects are still under development. While these proposed projects are expected to make use of the forthcoming Clean Hydrogen Investment Tax Credit or other supports identified in this Progress Report, there remains a long road ahead for many projects before regulatory approvals, final investment decisions and construction are completed. Ongoing risks include securing offtake agreements or having sufficient confidence in future demand and navigating potential labour or supply chain constraints in the build-out of the project.

A key step to realizing Canada’s potential is to de-risk high impact production projects so that they can move ahead. This is important for projects that provide domestic GHG reductions or significant economic benefits, such as job creation or exports. It is also important for projects with regional benefits or those that have potential to establish new supply chains or drive technological innovation. Maintaining a competitive policy framework will be an important action by Canada to de-risk high impact production projects.

Other actions include regulatory streamlining (where appropriate), carbon contracts for difference, continuing to support innovation to reduce the cost of key technologies, unlocking infrastructure or safety considerations (such as transportation of ammonia by unit trains on rail) and implementing the Clean Hydrogen Investment Tax Credit. In regions without untapped wind or renewable resources, electrolysis projects will need Canada to continue to decarbonize its electricity grid and scale up new clean electricity generation, consistent with Canada’s forthcoming Electricity Strategy and electrification objectives.

As these initial low-carbon hydrogen production projects move forward, they will support Canada’s long-term goal, as specified in the Hydrogen Strategy, of continuing to lower the life cycle carbon intensity of hydrogen production projects to maximize hydrogen’s decarbonization and international energy security potential.

2. Achieve scalable hubs and strategic corridors, targeting end-uses with greatest potential

Hydrogen hubs, which are regional networks of hydrogen producers and consumers linked by connective infrastructure, are developing across Canada, but many are still at an early stage. They can also be regional enabling environments, such as ongoing coordination in Atlantic Canada on wind-hydrogen export projects and infrastructure. Hubs will benefit from support to understand the market and GHG reduction opportunities in their regional area and continuing to build connections among supply and demand projects to become self-sustaining and to achieve scale necessary to efficiently lower costs.

Strategic hydrogen corridors, along with hubs, can form the backbone of the future hydrogen sector. Corridors can be land-based, such as between Prince George and Vancouver hubs or the Windsor-Montréal freight corridor or marine-based export and trade corridors from ports to other domestic or international hubs. In 2024, Canada will begin developing a hubs and corridors strategy that will analyze the most promising areas and regions for investment in hydrogen hubs and corridors.

The Hydrogen Strategy for Canada outlines all of the areas and end uses where low-carbon hydrogen could play a potential role in Canada’s decarbonization efforts. Today, Canada’s potential end-use markets are clearer. Hydrogen will play a key role in decarbonizing hard-to-abate sectors, especially where alternatives are unavailable or limited. This evidence currently points to some end-use applications for low-carbon hydrogen being more mature or having more potential than others, including the medium and heavy-duty vehicle transportation sector (for example, long-haul freight trucking and urban transit), heavy industry (for example, steel, chemical and refining) and blending, especially where blending could potentially pave the way for full-hydrogen replacement of natural gas, where appropriate.

Focusing on the near-term deployment of hydrogen in these applications, especially as part of hubs and corridors, will support the establishment of a domestic market, and show how hydrogen can provide GHG reductions, in areas that would otherwise be costly to decarbonize.

3. Codes and standards

Developing codes and standards continues to be important for the deployment of hydrogen technologies, fuel cells and refuelling infrastructure, providing investor certainty across the value chain. It will also be important for furthering the understanding of hydrogen leakage as relating to codes and standards to ensure net GHG benefits of hydrogen use and to drive best practices.

The development of codes and standards across the vast and varied hydrogen value chain is a multi-year process and is led by organizations largely independent of government. It is a patient process that requires persistence and coordination among multiple levels of government, industry and utilities, as well as international coordination, to ensure Canadian standards are effectively harmonized with international requirements for safety, performance and reliability. The Codes and Standards Working Group will publish Canada’s Hydrogen Codes and Standards Roadmap in 2024, setting the stage for next steps in low-carbon hydrogen codes and standards development.

4. Awareness and market data

When the Hydrogen Strategy for Canada was released in December 2020, it was intended as a call to action to all stakeholders in the hydrogen value chain on the opportunity that hydrogen presents. This call was heeded following the launch of the implementation framework and subsequent mobilization across various sub-sectors of the economy. However, average citizens have limited understanding of the potential of hydrogen as a low-carbon energy opportunity to decarbonize and support economic growth in households in Canada. This lack of awareness can result in low confidence in the safety and transformative potential of hydrogen.

Delaying action on hydrogen awareness will inevitably become a bottleneck in gaining social acceptance. While there have been a large number of reports and studies generated over the past years, including by the working groups under the Hydrogen Strategy, more efforts need to be made to ensure their conclusions are broadly disseminated.

Governments, academia and industry need to actively raise awareness to facilitate public acceptance of low-carbon hydrogen, especially in the areas identified as strategic priorities such as de-risking production, end use and hubs projects. Successful examples include information sessions by Transit Authorities displaying Fuel Cell Buses for citizens to learn about hydrogen fuel cells, to support for hydrogen blending projects as a form of passive decarbonization requiring limited public adaptation.

Expectations also continue to grow for improved market data, expertise, projections, analysis and knowledge of low-carbon hydrogen, especially as scrutiny over its potential role for decarbonization increases or as further policy mechanisms are taken into consideration. Modelling projections need to be continually refined and updated to likewise take into account market changes and technological innovations as they arrive.

While a new Statistics Canada survey will report on low-carbon hydrogen production and be available by 2025, it will continue to be a priority for governments and industry to ensure low-carbon hydrogen market data and knowledge is thorough and robust, and for new government modelling to continuously improve, such as to include provincial granularity, economic market forecasting outside of a net-zero scenario and proper incorporation of the impact of recently announced measures like the Clean Hydrogen Investment Tax Credit and others.

Next steps in implementing Canada’s Hydrogen Strategy

The past 3 years of collaboration through the Hydrogen Strategy Implementation Framework’s working groups has generated a wealth of discussions, research, analysis and advice that has allowed Canada to progress on the Hydrogen Strategy’s 32 recommendations, as well as underpin the information provided in this Progress Report.

Going forward, Canada will look to improve the functioning of the implementation framework, focusing on ensuring efficient information sharing, improved communication and public transparency, and that it reflects strategic priorities and market developments of the low-carbon hydrogen sector. One way this could be achieved could be by establishing a regular virtual hydrogen energy forum, bringing together hydrogen stakeholders, where recent strategic priorities established in this Progress Report could be discussed and working groups could report on progress or key findings from studies.

In 2024, the Steering Committee of the Hydrogen Strategy Implementation Framework will update the structure of the strategy’s working groups and task forces, ensuring that the framework in place can build upon the lessons learned since 2020 and advance the strategic priorities identified in this Progress Report.

Conclusion

This Progress Report confirms that hydrogen continues to have a role to play in meeting global energy needs in the context of energy security, energy transition and the broader climate imperative. Canada’s low-carbon hydrogen produced for export will contribute to sustainable green job creation, international energy security, and global emissions reductions. In Canada’s net-zero climate objectives, low-carbon hydrogen will supplement electrification and other carbon mitigation approaches by helping to decarbonize hard-to-abate sectors where electrification alone would be less economical or technically unfeasible.

The work of the past few years has enabled the Canadian low-carbon-hydrogen ecosystem to make progress in many areas and has helped put into focus the areas that require attention in the coming years. Going forward, Canadian governments, industry, non-governmental organizations and academia should continue to work towards the vision set out in the Hydrogen Strategy.

Appendices

I. Hydrogen production project highlights

With up to 80 low-carbon production projects having been announced across Canada since 2020, there is significant interest in the development of this clean energy fuel.

This appendix highlights known low-carbon hydrogen production projects in Canada that are of regional or national significance. Combined, they paint a picture of technological innovation, regional strengths, Indigenous participation and how Canada’s various abundant feedstocks are influencing market development.

Not all announced or known hydrogen production projects are listed; projects where the low-carbon hydrogen would be supplied to a dedicated end use, such as for an industrial facility, biofuels refinery, transportation refuelling or electricity generating station, can be found in the section describing end-use projects.

Atlantic Canada

New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island

EverWind Fuels: Point Tupper Hydrogen and Ammonia Production and Export Project

A planned electrolytic production plant located on an existing industrial site in Point Tupper, Nova Scotia, which offers the deepest ice-free shipping terminal on the North American Atlantic coast. The plant would produce about 1 million tonnes per year of low-carbon ammonia (converted from hydrogen) for export to global markets by 2026, to be powered by new onshore wind and solar resources, with initial production planned in 2025. Further expansion using offshore wind resources could enable production to be increased 10-fold in the future. EverWind Fuels has formed partnerships with the Membertou, Paqtnkek and Potlotek First Nations.

- Current status: Provincial environmental assessment granted, with conditions, in February 2023; Phase 1 FEED complete

- Funding: US$125 million debt facility loan from Export Development Canada

World Energy GH2: Project Nujio’qonik

The planned development of an electrolytic hydrogen production facility in Stephenville and 2 wind farms in Port au Port and Codroy, Newfoundland and Labrador. Through a phased development approach, Project Nujio’qonik (pronounced, “new-geo-ho-neek”) intends to reach initial production by 2026, with potential to expand to over 3 GW of onshore wind energy capacity to power the production of up to 250,000 tonnes per year of hydrogen, to be converted to ammonia for global export.

The project has a MOU partnership with the Qalipu First Nation, which is working with project partner DOB Academy of the Netherlands to develop a training institute offering renewable energy programming with the College of the North Atlantic to provide opportunities for band members. The project has received an investment of $50 million from South Korea’s SK Ecoplant. World Energy GH2 has acquired the deep-water access Port of Stephenville to support the project.

- Current status: Selected for exclusive rights to Crown land; provincial environmental assessment approved

- Funding: US$95 million debt facility loan from Export Development Canada

ABO, Braya Renewables: Toqlukuti’k Wind and Hydrogen Production Plant and Wind Farm

A partnership between ABO, Braya Renewables and the Miawpukek First Nation for the development of an onshore wind farm in the isthmus region of Newfoundland and Labrador to support the production of low-carbon hydrogen, initially for use in Braya’s biofuels refinery in Come by Chance and subsequently for export. The project is targeting the development of 5,000 MW of wind capacity. The first phase, supported by Braya’s hydrogen demand, is expected to be operational in 2027 to 2029, with production scaling through 2028 to 2029 to support export.

- Current status: Selected for exclusive rights to Crown land; pending provincial environmental assessment

- Funding: $49 million from the Strategic Innovation Fund and $37 million from Clean Fuels Fund

Nu:Ionic

A partnership between Liberty Utilities and Nu:Ionic for the development of a 2.4 tonnes per day hydrogen production system utilizing Nu:ionic proprietary Microwave Catalytic Reformers, located in New Brunswick. The project marks the first application of the technology using microwave energy to decarbonize natural gas with electrified reforming. The technology includes a carbon capture system to produce liquid carbon dioxide for reuse or sequestration. Liberty will use the facility to pilot the blending of hydrogen into natural gas. Hydrogen produced will also be used in the heavy-duty and mass transportation sector.

- Current status: Memorandum of understanding signed in August 2023

Port of Belledune: Green Hydrogen and Ammonia Production Hub

Planned development of 200 MW electrolysis production facility, with planned expansion in future to support global export. The project is part of the Port of Belledune’s planned Green Energy Hub, expected to be a driver for the green economy in Northern New Brunswick. The facility could be commissioned as early as 2027.

As part of the plan, the Port and Cross River are exploring the use of ARC Clean Technology advanced small modular reactors to provide a source of energy for expanded hydrogen production and for other industries at the port. The Port has signed MOUs with Niedersachsen Ports in Wilhemshaven, Germany and the Port of Hamburg, to collaborate on shipments of clean fuels and green products. It has also entered a Relationship, Engagement and Consultation Protocol with Pabineau and Eel River Bar (Ugpi’ganjig) First Nations and Mi’gmawe’l Tplu’taqnn Inc. (MTI).

- Current status: Agreement in principle reached between the Port of Belledune and Cross River Infrastructure in August 2022

Central Canada

Manitoba, Ontario, Québec

Air Liquide: Bécancour

Air Liquide’s 20 MW proton exchange membrane electrolyser in Bécancour, Québec, began operating in January 2021, and was the largest electrolyser plant in the world at that time. It produces 3,000 tonnes of low-carbon hydrogen annually, and relative to traditional hydrogen production processes, avoids 27,000 tonnes of annual GHG emissions. The facility uses four 5 MW HyLYZER 1000-30 units developed by the Canadian company Hydrogenics, and benefits from clean electricity from Hydro-Québec and proximity to industrial and transport markets.

- Current status: Operational as of January 2021

Hy2Gen/Yara/EPC: Courant

A 300 MW electrolyser project is under consideration, in collaboration with the Port de Baie Comeau, Québec, and the port’s plans to explore the use of green energy in its industrial zone. Low-carbon hydrogen produced by the project will be used domestically to produce ammonium nitrate for the explosives market.

- Current status: Early planning and feasibility

TES Canada: Project Mauricie

A $4 billion, 1,000 MW electrolyser project using dedicated wind and solar energy located in the Vallèe de la transition énergétique, which will be capable of producing 70,000 tonnes of low carbon hydrogen annually. It will aim to reduce annual GHG emissions by 800,000 tonnes, by dedicating one third of its hydrogen to decarbonizing long-haul transportation, with the remainder producing electric renewable natural gas.

- Current status: Targeting to be in operation by 2028

Bruce Power: Hydrogen Production from Excess Energy

Planned exploration of opportunities to use excess power from the Bruce Nuclear Generating Station in Ontario to produce hydrogen. The project will be conducted in partnership with the Hydrogen Business Council and is part of Ontario’s Low-Carbon Hydrogen strategy.

- Current status: Feasibility study is underway by companies within the Clean Energy Frontier region of Bruce, Grey and Huron counties

Charbone: Selkirk

The City of Selkirk, Manitoba has signed a MOU with Charbone for a proposed electrolysis facility that would be powered by renewable energy and could supply up to 200 kg of low-carbon hydrogen to Manitoba and beyond by as early as 2024. Charbone has leased 4.6 acres of land west of Selkirk’s decommissioned wastewater treatment plan for the facility.

- Current status: Environmental permitting, planning, and feasibility

Western Canada

Alberta, British Columbia, Saskatchewan

Air Products: Net-Zero Hydrogen Energy Complex

Air Products is currently building a $1.6 billion net-zero hydrogen energy complex in Edmonton, Alberta, that uses autothermal reforming technology (ATR) to produce 140,000 tonnes of hydrogen per year from natural gas and a carbon capture process with a greater than 90% carbon capture rate.

The facility is expected to be commissioned in 2024 and serve as an anchor facility for supplying low-carbon hydrogen to end-use projects across the Edmonton Region Hydrogen hub as well as to produce renewable diesel. It includes plans for 35-tonne-per-day hydrogen liquefaction, to be used in the transportation market, a large-scale refuelling station and a 100% hydrogen-fuelled power generation unit, capable of supplying excess power to the Alberta grid.

- Current status: Construction underway

- Funding: $300 million from Strategic Innovation Fund – Net-Zero Accelerator (sunset in 2025), $160 million from Alberta petrochemicals Incentive Program and $15 million from Emissions Reduction Alberta Shovel-Ready Challenge