Statement outlining results, risks and significant changes in operations, personnel and programs

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and any Supplementary Estimates approved in a given year by the date of this report, as well asCanada’s Budget 2019. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

Natural Resources Canada (NRCan) works to improve the quality of life of Canadians by ensuring that our natural resources are developed sustainably, providing a source of jobs, prosperity, and opportunity, while preserving our environment and respecting our communities and Indigenous peoples.

Further details on NRCan’s authority, mandate and programs can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates, allocations through the Budget Implementation Vote, and allocations from Treasury Board central votes for the operating and capital budget carry forward for the 2019-20 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This Departmental Quarterly Financial Report reflects the results as of December 31, 2019, which include Main Estimates and allocations from the Budget Implementation Vote for which full supply was released. The details presented in this report focus on and compare the third quarter results of 2019-20 with those of 2018-19.

Authorities

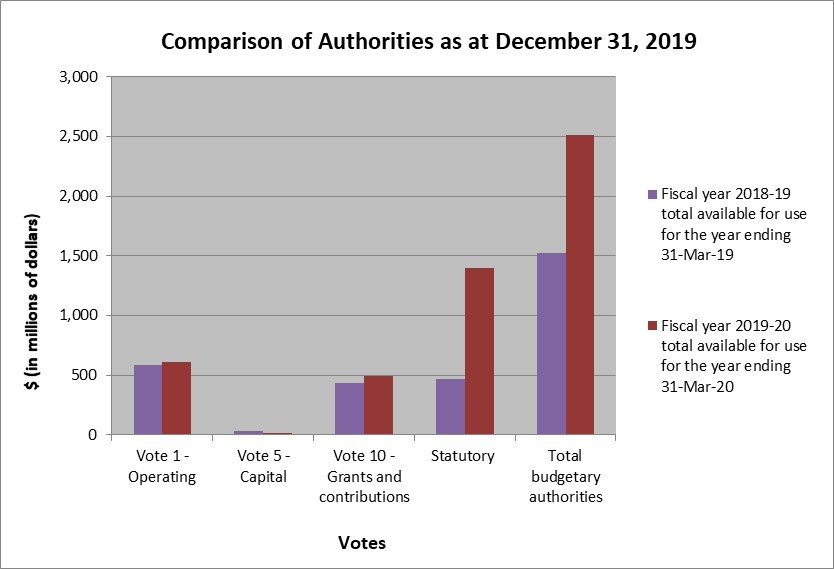

As per Table 1, presented at the end of this document, and on Graph 1 below, as at December 31, 2019, NRCan has authorities available for use of $2,516.9 million in 2019-20 compared to $1,524.0 million as of December 31, 2018, for a net increase of $992.9 million or 65.2%.

Graph 1

Text Version

| (in millions of dollars) | Fiscal year 2018-19 | Fiscal year 2019-20 |

|---|---|---|

| total available for use for the year ending 31-Mar-19 | total available for use for the year ending 31-Mar-20 | |

| Vote 1 - Operating | 585 | 613 |

| Vote 5 - Capital | 32 | 17 |

| Vote 10 - Grants and contributions | 439 | 489 |

| Statutory | 468 | 1,397 |

| Total budgetary authorities | 1,524 | 2,517 |

The increase of $992.9 million in authorities in 2019-20 compared to 2018-19 is primarily due to an increase in statutory authorities (most notably $950 million for the Federation of Canadian Municipalities, who administer the Green Municipal Fund). It also reflects the net effect of fluctuations within Vote 1 operating expenditures, Vote 5 capital expenditures, and Vote 10 grants and contributions, as per the following:

Changes to Voted and Statutory Authorities (2019-20 compared with 2018-19)

| (in $000s | |

|---|---|

| Total available for use for the year ending March 31, 2019 | 1,524,000 |

| Vote 1 - Operating | |

| New funding for Trans Mountain Expansion Project Reconsideration Process | 12,637 |

| New funding for collective bargaining to cover wage increases for 2019-20 and retroactive payments for 2018-19 | 9,675 |

| Increased funding for Impact Assessment and Regulatory Measures Programs | 9,155 |

| New funding for Ensuring Better Disaster Management Preparation Program | 6,346 |

| New funding for Strong Arctic and Northern Communities Program | 6,226 |

| Reduction in Operating Budget Carry Forward due to a lower lapse in 2018-19 | (10,879) |

| Decrease in funding for Geo Mapping for Energy and Minerals Initiative as it nears completion of current phase | (3,201) |

| Various minor net decreases | (1,689) |

| Sub total Vote 1 - Operating | 28,270 |

| Vote 5 - Capital | |

|---|---|

| Reduction in Capital Budget Carry Forward due to a lower lapse in 2018-19 | (8,103) |

| Decrease for the Federal Infrastructure Initiative as the program has ended | (7,200) |

| Various minor net increases | 374 |

| Sub total Vote 5 - Capital | (14,929) |

| Vote 10 - Grants & Contributions | |

|---|---|

| New and increased funding for the Green Infrastructure initiative | 32,879 |

| Increased funding year-over-year for the Softwood Lumber Action Plan due to previously approved reprofile | 14,200 |

| Increased funding for Advancing Clean Technology | 10,512 |

| New funding for Zero Emission Vehicles Program | 9,350 |

| New funding for Engaging Indigenous Communities in Major Resource Projects | 7,740 |

| Increased funding for Protecting Jobs in Eastern Canada’s Forestry Sector (Spruce Budworm Early Intervention Strategy) | 5,300 |

| Increased funding for Green Construction Through Wood | 4,307 |

| New funding for Trans Mountain Expansion Project Reconsideration Process | 3,500 |

| Reduction in funding year-over-year for the ecoENERGY for Renewable Power program as the program nears completion | (30,067) |

| Decrease for the Youth Employment Strategy Green Jobs program, pending renewal of funding later in 2019-20 | (8,400) |

| Various minor net increases | 1,057 |

| Sub total Vote 10 - Grants & Contributions | 50,378 |

| Statutory | |

|---|---|

| New Funding for the Federation of Canadian Municipalities - Green Municipal Fund | 950,000 |

| Employee Benefit Plan (EBP) adjustments, due to salary adjustments in 2019-20 compared to 2018-19 | 2,701 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board due to increased level of activity. | 640 |

| Minister of Natural Resources – Salary and motor car allowance | 2 |

| Newfoundland Offshore Petroleum Resource Revenue Fund adjustment, as it was forecasted at the time of Main Estimates that less revenue would be collected in 2019-20 than in 2018-19, due to fluctuations in oil prices, variances in production and a decrease in planned expenditures.* | (18,342) |

| Nova Scotia Offshore Revenue Account, as revenues are to cease due to the end of production at the Deep Panuke and the Sable Offshore Energy Project in 2018. * | (5,356) |

| Payments of the Crown Share Adjustment for Nova Scotia Offshore Petroleum Resources, as it is expected to cease in 2019-20, due to the end of natural gas production at the Deep Panuke and the Sable Offshore Energy Projects projects. | (438) |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board due to a lower level of activity. | (50) |

| Sub total Statutory | 929,157 |

| Total Increase from Previous Year | 992,876 |

| Total available for use for the year ending March 31, 2020 | 2,516,876 |

* In order to establish the statutory authority to be presented in the Main Estimates, NRCan executes its economic forecasting model. The model assesses trends in oil and natural gas prices, production levels, anticipated provincial corporate income taxes, and currency rates, among other things.

Budgetary Expenditures by Standard Object

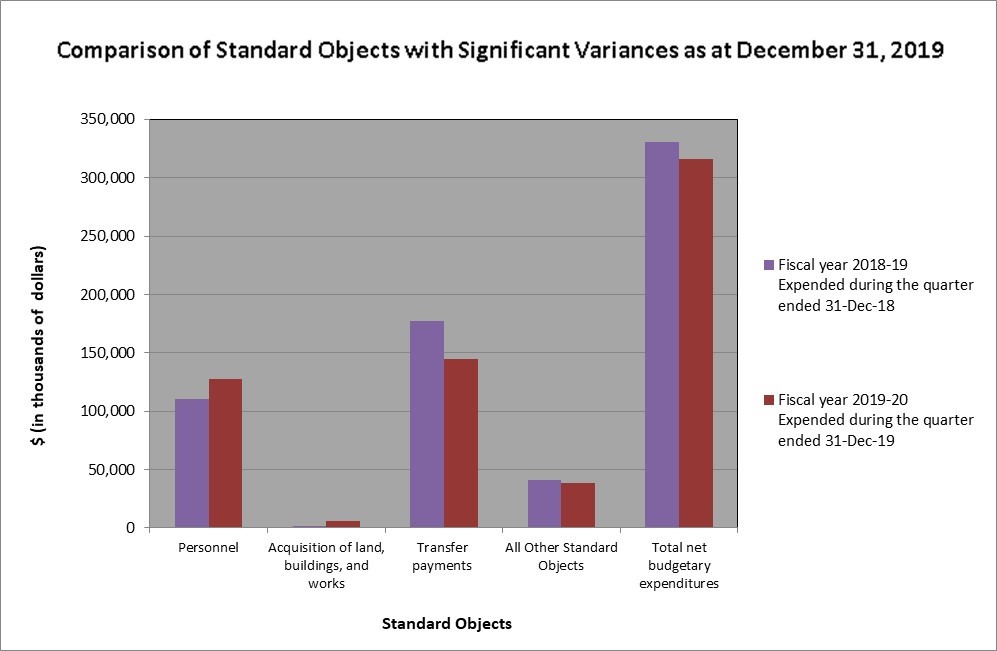

The spending for the quarter ending December 31, 2019 amounts to $316.5 million or 12.6% of total funding available for the fiscal year, compared to $330.9 million or 21.7% for the same quarter last year. This decrease of $14.4 million in spending is mainly related to a decrease in transfer payments in 2019-20 compared to the same type of expenditures in 2018-19 offset by an increase in personnel expenditures. Further analysis has been done on standard objects with significant expenses, as noted in Graph 2 below. Table 2 at the end of this document presents the spending for all standard objects.

Graph 2

Text Version

| (in thousands of dollars) | Fiscal year 2018-19 | Fiscal year 2019-20 |

|---|---|---|

| Expended during the quarter ended 31-Dec-18 | Expended during the quarter ended 31-Dec-19 | |

| Personnel | 110,231 | 127,815 |

| Acquisition of land, buildings, and works | 2,079 | 5,707 |

| Transfer payments | 177,551 | 144,548 |

| All Other Standard Objects | 41,042 | 38,439 |

| Total net budgetary expenditures | 330,903 | 316,509 |

Variance in Budgetary Expenditures by Standard Object (2019-20 compared with 2018-19)

| (in $000s) | |||

|---|---|---|---|

| Standard Object | Explanation | Variance between 2019-20 and 2018-19 Q3 expenditures October 1 to December 31 | Variance between 2019-20 and 2018-19 YTD expenditures April 1 to December 31 |

| Personnel | The increase is mainly due to higher expenses related to retroactive payments and wage increases from collective bargaining settlements as well as new hires to support new programs. | 17,584 | 30,033 |

| Acquisition of land, buildings and works | The increase is mainly due to the Watermain and Sanitary Sewer Replacement Project at the Bells Corner Complex, which was more advanced in the third quarter of 2019-20. | 3,628 | 114 |

| Transfer Payments | The decrease in the third quarter is mainly attributed to Statutory Atlantic Offshore transfers as a result of lower production and oil prices compared to last year. This is partially offset by an increase in contribution payments. The year-to-date increase is mainly attributed to a statutory payment in 2019-20 to the Federation of Canadian Municipalities for the purpose of providing funding to the Green Municipal Fund. |

(33,002) | 972,176 |

| All Other Standard Objects | Minor increases and decreases within different standard objects. | (2,602) | 2,811 |

| Total Variance | (14,392) | 1,005,134 | |

3. Risks and Uncertainties

NRCan recognizes that a solid understanding of its risk environment (both internal and external) is fundamental to the delivery of its mandate and fulfilment of its core responsibilities. Risk management equips the department to respond proactively to change and uncertainty by defining and understanding its operating environment and the factors that drive risk. Risk considerations are integrated into strategic and operational decision- making, priority setting, and resource allocation in order to minimize potential negative impacts and maximize opportunities across the diverse range of services and operations. NRCan’s approach to risk management is codified in the Integrated Risk Management Policy Framework, which is aligned with the Treasury Board Framework for the Management of Risk.

Natural resources are at the nexus of Canada’s economic and environmental agendas. They confer significant economic benefits, accounting for about 17% of Canada’s nominal Gross Domestic Product and the support of 1.7 million jobs in 2018. Furthermore, our natural resources sectors inform Canada’s environmental performance. Our collective challenge is to set and implement a plan that will ensure that the natural resources sectors are competitive while continuing to adopt sustainable development practices as we move towards a low carbon future.

During the third quarter of 2019-20, the department focused on managing its risks to advance priorities in the areas of energy infrastructure and market access, a modernized regulatory environment, Canada-U.S. relations, clean technology, and Indigenous reconciliation. NRCan also engaged in several Budget 2019 initiatives supporting Canada’s transition to a low-carbon economy. For example, NRCan continued to drive Canada’s broad-based energy efficiency work, supporting new energy-efficient housing units across the country, and expanding the charging and refueling station network for zero-emission vehicles. In addition, NRCan supported the Government of Canada’s initiative “Just Transition for Canadian Coal Power Workers and Communities” by investing in skills development and training. The department has continued efforts to transform the forest sector and emergency management measures.

NRCan also managed uncertainties regarding its future funding level and spending. The Department continuously tracks program spending, following best practices that comply with the Financial Administration Act and requesting the reprofiling of funds, as required, to ensure program objectives continue to be met. NRCan has continued to pro-actively engage with central agencies to manage the financial uncertainty associated with the sunsetting of specific time-limited programs. The department also continues to assess ways to realign resources to address pressures and multi-year transformation initiatives.

NRCan will continue to monitor and integrate risk information into strategic and operational decision-making in support of advancing the prosperity of Canada’s natural resource sectors while also achieving environmental results through sustainable practices.

4. Significant Changes in Relation to Operations, Personnel, Programs

The department has welcomed the arrival of the Honourable Seamus O’Regan as the new Minister of Natural Resources, as well as Paul Lefebvre as Parliamentary Secretary to the Minister of Natural Resources.

In addition, a realignment exercise was undertaken to strengthen our policy capacity.

Original signed by:

Christyne Tremblay

Deputy Minister

February 25, 2020

Ottawa, Canada

Original signed by:

Linda Hurdle, CPA, CA

Chief Financial Officer

February 24, 2020

Ottawa, Canada

| (in thousands of dollars) | Fiscal year 2019-20 | Fiscal year 2018-19 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2020* | Expended during the quarter ended December 31, 2019 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2019** | Expended during the quarter ended December 31, 2018 | Year-to-date used at quarter-end | |

| Vote 1 - Net Operating Expenditures | 613,186 | 151,197 | 428,009 | 584,916 | 135,994 | 395,345 |

| Vote 5 - Capital Expenditures | 17,143 | 6,191 | 7,210 | 32,072 | 3,182 | 8,606 |

| Vote 10 - Grants and Contributions | 489,199 | 74,645 | 144,432 | 438,821 | 42,092 | 99,673 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance | 88 | 12 | 56 | 86 | 22 | 65 |

| Contributions to employee benefit plans | 59,315 | 14,544 | 43,633 | 56,614 | 13,904 | 41,710 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board *** | 9,475 | (43) | 3,369 | 8,835 | (5,230) | (2,023) |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board *** | 4,305 | (2,150) | 3 | 4,355 | (977) | (414) |

| Payments to the Nova Scotia Offshore Revenue Account | - | 3,262 | 4,143 | 5,356 | 62,279 | 64,702 |

| Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund | 374,165 | 68,833 | 230,408 | 392,507 | 79,510 | 223,227 |

| Crown Share Adjustment Payments for Nova Scotia Offshore Petroleum Resources | - | - | 24,862 | 438 | 123 | 123 |

| Spending of amounts equivalent to proceeds from disposal of surplus crown assets | - | 18 | 27 | - | 4 | 4 |

| Federation of Canadian Municipalities - Green Municipal Fund | 950,000 | - | 950,000 | - | - | - |

| Total Statutory Payments | 1,397,348 | 84,476 | 1,256,501 | 468,191 | 149,635 | 327,394 |

| Total Budgetary Authorities | 2,516,876 | 316,509 | 1,836,152 | 1,524,000 | 330,903 | 831,018 |

| * Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates and Budget Implementation Vote which reflects some measures announced in Budget 2019. | ||||||

| ** Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, Supplementary Estimates (A) and Budget Implementation Vote which reflects some measures announced in Budget 2018. | ||||||

| *** The negative amounts in the Offshore Boards are due to the timing of Natural Resources Canada's transfers to, and the timing of cost recovery from, the Offshore Boards. | ||||||

| (in thousands of dollars) | Fiscal year 2019-20 | Fiscal year 2018-19 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2020* † | Expended during the quarter ended December 31, 2019 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2019** | Expended during the quarter ended December 31, 2018 | Year-to-date used at quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 462,738 | 127,815 | 358,592 | 433,081 | 110,231 | 328,559 |

| Transportation and communication | 19,801 | 4,340 | 13,206 | 18,695 | 4,255 | 12,045 |

| Information | 9,938 | 2,061 | 4,805 | 7,045 | 1,243 | 2,851 |

| Professional and special services | 130,001 | 27,152 | 66,676 | 141,740 | 27,782 | 67,728 |

| Rentals | 20,881 | 1,185 | 15,294 | 18,550 | 2,001 | 11,618 |

| Repair and maintenance | 9,015 | 894 | 2,731 | 7,819 | 678 | 2,375 |

| Utilities, materials and supplies | 32,274 | 3,839 | 10,164 | 47,562 | 3,827 | 9,526 |

| Acquisition of land, buildings and works | 6,791 | 5,707 | 6,275 | 14,469 | 2,079 | 6,161 |

| Acquisition of machinery and equipment | 28,846 | 2,581 | 6,094 | 18,955 | 2,770 | 6,706 |

| Transfer payments | 1,827,144 | 144,547 | 1,357,217 | 850,312 | 177,551 | 385,041 |

| Other subsidies and payments | 7,088 | 2,733 | 9,006 | 2,897 | 3,123 | 10,992 |

| Total Budgetary Expenditures | 2,554,517 | 322,854 | 1,850,060 | 1,561,125 | 335,540 | 843,602 |

| Less: | ||||||

| Total Revenues Netted Against Expenditures | 37,641 | 6,345 | 13,908 | 37,125 | 4,637 | 12,584 |

| Total Net Budgetary Expenditures | 2,516,876 | 316,509 | 1,836,152 | 1,524,000 | 330,903 | 831,018 |

| * Total available for use represents planned expenditures for the fiscal year. Planned expenditures reflect some measures announced in Budget 2019. | ||||||

| ** Total available for use represents planned expenditures for the fiscal year. Planned expenditures reflect some measures announced in Budget 2018. | ||||||

| †Planned expenditures by standard object have been adjusted to better align with historical spending patterns causing some variances with the planned figures of the previous fiscal year. | ||||||