Presented to the Departmental Audit Committee (DAC)

October 24, 2023

Table of Contents

Executive Summary

Introduction

Within the Government of Canada, asset managementFootnote 1 activities are governed by a series of legislative, policy, and regulatory instruments, managed by the Treasury Board of Canada Secretariat (TB); Natural Resources Canada (NRCan) is required to comply with these instruments. The primary TB policy that governs these activities is the Policy on the Planning and Management of Investments, which is supported by a series of Directives, all of which came into effect May 13, 2021.

NRCan assets are categorized as capital when their cost is greater than $10,000, whether tangible or intangible. These assets must be used for the delivery of services, have a useful life greater than one year, and are not intended for resale. Attractive assets are considered non-capital assets (valued between $1,500 and $10,000), identified as desirable, typically can be transported by hand, can be easily converted to personal use, and/or represent a higher risk of misappropriation. As at March 31, 2022 NRCan had eight main categories of capital assets with a combined net book value of approximately $323 million.

The Real Property and Environment Branch (RPEB) within the Corporate Management and Services Sector (CMSS) is responsible for creating and implementing the Materiel Management Framework (NRCan Framework) relating to the management of capital and attractive assets across NRCan. RPEB is currently in the process of finalizing the NRCan Framework, which was created to enhance policies, processes, and organizational capacity in alignment with the TB policy suite.

While the RPEB provides guidance to sectors and undertakes inventory counts and reconciliations, sector personnel are considered materiel management practitioners. Sector personnel are required to notify the real property and materiel management teams of asset acquisitions; maintain the condition of assets; complete departmental exercises for reconciliation of assets (attestation and count); and report obsolete or unused assets to the real property and materiel management teams for disposal.

The objective of this audit was to assess the overall effectiveness of the governance and risk management activities, and the adequacy and effectiveness of processes and controls, which form the system used by NRCan to manage capital and attractive assets.

Strengths

Some mechanisms exist to enable communications regarding capital and attractive asset management between the RPEB and sectors, including regional teams.

Areas for Improvement

There is a need for the Department to leverage and implement the governance mechanisms proposed in the draft NRCan Framework to ensure effective management of the materiel management function and compliance with relevant government policy instruments. Collaboration with sector representatives will also be needed to ensure that the NRCan Framework adequately defines roles and responsibilities of those involved in the management of capital and attractive assets, addresses local challenges, and provides a sufficient level of guidance to materiel management practitioners.

Additional work is required to ensure that guidance is regularly updated and effectively communicated to support materiel management practitioners in the planning and procurement of materiel, the maintenance and repair of materiel through its useful life, and the disposal of obsolete or surplus materiel. In addition, there is an opportunity to formalize a mechanism to enable the Senior Designated Official (SDO) to receive timely information regarding asset management so that they can provide meaningful advice to the Deputy Head (DH) regarding NRCan’s asset management activities. There is also a need to ensure that human resource management, such as formal training requirements, professional development, and succession plans, and related monitoring and reporting processes are documented.

Opportunities exist to ensure financial management decisions (i.e., acquisition decisions for attractive and capital assets) are consistently managed in an integrated manner that includes consideration of the full life cycle costs.

Impacts of not addressing these areas for improvement include duplication of effort, materiel not being appropriately planned and managed to maximize its useful life and value to the Crown, and inaccurate or incomplete information to support decision-making related to materiel.

Internal Audit Conclusion and Opinion

In my opinion, although some elements are in place at NRCan to support the Department’s capital and attractive asset management function, several are not functioning effectively and require improvement. Specifically, improvements are required to ensure effective governance and oversight mechanisms are in place, and that key processes and controls related to capital and attractive asset management are updated in a timely manner to achieve TB policy requirements.

Statement Of Conformance

In my professional judgement as Chief Audit and Evaluation Executive, the audit conforms with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and the Government of Canada’s Policy on Internal Audit, as supported by the results of the Quality Assurance and Improvement Program.

Michel Gould, MBA, CPA, CIA

Chief Audit and Evaluation Executive

October 24, 2023

Acknowledgements

The audit team would like to thank those individuals who contributed to this project and particularly employees who provided insights and comments as part of this audit.

Introduction

Within the Government of Canada, asset management activities are governed by a series of legislative, policy, and regulatory instruments, managed by the TB; Natural Resources Canada (NRCan) is required to comply with these instruments. The primary TB policy that governs these activities is the Policy on the Planning and Management of Investments, which is supported by a series of Directives relating to the four functional domains created under the new policy suite: Project and Programme Services; Real Property; Procurement; and Materiel Management (TB policy suite), all of which came into effect May 13, 2021. These instruments serve to provide direction to ensure that organizations implement a set of processes to plan, acquire, operate, maintain, and dispose of assets to support program delivery and organizational services. The Policy’s objective is that organizations manage assets effectively; that decisions are based on full life-cycle costs and demonstrate sound stewardship; and that there is effective asset governance and related collaborative decision-making practices in place within organizations.

NRCan assets are categorized as capital when their cost is greater than $10,000. This includes assets that may be tangible or intangibleFootnote 2, regardless of whether they were purchased, constructed, developed, or otherwise acquired. These assets must be used for the delivery of services, have a useful life greater than one year, and are not intended for resale. As at March 31, 2022 NRCan had eight main categories of capital assets with a combined net book value of approximately $323 million: Land ($7.8 million), Buildings ($138 million), Works and Infrastructure ($19.9 million), Machinery and Equipment ($56.7 million), Vehicles ($3.5 million), Leasehold Improvements ($35 million), Leased Tangible Capital Assets ($53.3 million), and Assets Under Construction ($8.7 million)Footnote 3.

Attractive assets are considered non-capital assets (valued between $1,500-$10,000), and identified as desirable, typically can be transported by hand, can be easily converted to personal use, and/or represent a higher risk of misappropriation and/or require enhanced tracking and management. This may include valuables such as IT equipment, televisions, professional cameras, scientific equipment, firearms, etc.

The Real Property and Environment Branch (RPEB) within the Corporate Management and Services Sector (CMSS) is responsible for the Materiel Management Framework (NRCan Framework) relating to Real Property as well as portions of the management of capital and attractive assets across NRCan. It also supports the roles assigned to the Senior Designated Official (SDO) in the policy suite noted above. RPEB is also currently in the process of finalizing the NRCan Framework to enhance policies, processes, and organizational capacity in alignment with the new policy suite for investments and management of capital and attractive assets.

While the RPEB provides guidance to sectors and undertakes inventory counts and reconciliations, sector personnel are considered materiel management/real property practitioners and cost centre managers, all of whom are responsible for program delivery. For example, sector personnel are required to notify the real property and materiel management teams of asset acquisitions; maintain the condition of assets; complete departmental exercises for reconciliation of assets (attestation and count); and report obsolete or unused assets to the real property and materiel management teams for disposal.

The Chief Information Officer Branch (CIOB) is responsible for Information Technology (IT) asset management. Using a similar structure as RPEB’s management of capital and attractive assets, a central CIOB team oversees IT asset management primarily from an IT security perspective, but sectors hold responsibility for reporting significant events regarding their own IT assets to CIOB.

This audit was included in the 2022-2027 Integrated Audit and Evaluation Plan (IAEP), approved by the Deputy Minister on May 9, 2022.

Audit Purpose and Objectives

The objective of this audit was to assess the overall effectiveness of the governance and risk management activities, and the adequacy and effectiveness of processes and controls, which form the system used by NRCan to manage capital and attractive assets.

Specifically, the audit assessed whether:

- Effective governance and management oversight processes have been established to manage the Department’s capital and attractive assets;

- Risk management activities are effectively designed, implemented, and continually updated to support the Department’s capital asset management processes and ability to meet the objectives and requirements established in the TB policy suite; and

- Key processes and controls related to capital and attractive asset management to achieve TB policy requirements have been adequately designed, implemented, and are operating effectively.

Audit Considerations

A risk-based approach was used to establish the objectives, scope, and approach for this audit engagement. A summary of the key underlying potential risks that could impact the effective management of NRCan’s capital and attractive assets include:

- Effective governance structures and business processes to manage the Department’s capital and attractive asset management function and activities in compliance with relevant government policy instruments;

- Clearly defined roles, responsibilities, and accountabilities pertaining to capital and attractive asset management processes and activities;

- Effective mechanisms that enable frequent and timely communication between sectors and the central asset management group;

- Effective resource and financial management, including the planning of new acquisitions, maintenance, and disposal of assets to ensure that the Department’s capital and attractive asset management activities are well supported; and

- Effective information management to ensure that pertinent information is updated and communicated to all key players with capital and attractive asset management responsibilities.

Scope

The scope of the audit focused primarily on the management of capital and attractive asset activities implemented by both RPEB and Sector Management/Cost Centre Managers. This included RPEB’s ability to support departmental priorities and needs, and their ability to support sectors in delivering on their objectives through effective asset management activities. It also included the sectors’ abilities to collaborate within the regions and with the central team to achieve departmental goals and program objectives.

The audit examined capital and attractive asset management activities from May 13, 2021Footnote 4 to December 31, 2022, in order to include the most recent activities and processes. The audit did not assess or provide an opinion on the investment planning aspect of capital asset management, as there was an Audit of Investment Planning and Reporting conducted in 2016-17, and the 2022-2027 IAEP includes an Audit of Investment Planning scheduled to begin in 2024-25. However, the team did examine whether oversight and reporting mechanisms related to capital and attractive assets are integrated with departmental investment plans. The audit did not include real property management, including leasehold improvements, asset retirement obligations, or assets under construction, as these will be covered by an upcoming Audit of NRCan’s Real Property. In addition, the audit did not include procurement activities that fall inside the scope of NRCan’s audit on procurement, which was completed in July 2022. The audit also did not include testing of intangible assets as an Audit of Intellectual Property was conducted by AEB in 2016-17 and will be subject to audit in 2023-24. Lastly, the management of IT assets was included in this audit solely from a physical management of assets perspective, given several recent audits related to IT security services and service management.

In addition, after review of the methodology and results of recent internal control assessments over capital assets conducted by the Financial Policy, Reporting and Internal Controls Division within CMSS, as well as improvements currently being implemented as a result of the government-wide Horizontal Fixed Asset Review, AEB excluded testing of risks pertaining to financial statement misstatement and control testing of accounting assertions (accuracy, completeness, rights and obligations, valuation, cut-off).

The results of previous advisory, audit, and evaluation projects on related topics were considered as deemed relevant in order to inform the audit and reduce duplication of efforts.

Approach and Methodology

The approach and methodology used in this audit followed the Institute of Internal Auditors’ International Standards for the Professional Practice of Internal Auditing (IIA Standards) and the Treasury Board Policy on Internal Audit. These standards require that the audit be planned and performed in such a way as to obtain reasonable assurance that audit objectives are achieved. The audit included tests considered necessary to provide such assurance. Internal auditors performed the audit with independence and objectivity as defined by the IIA Standards.

The audit included the following key tasks:

- Interviews with key CMSS personnel and sector personnel involved in the management of capital and attractive assets;

- Review of selected key documents, business processes, and communication materials;

- File review of asset documentation on a sample basis in support of various controls;

- Walkthroughs of key life-cycle asset management processes, such as planning, budgeting, operations and maintenance and the disposal/divestment process;

- On-site process observation, interviews, and walkthroughs at a sample of sites located within the National Capital Region and regional offices; and,

- Detailed site debriefs of observations.

A total of eight sites were visited during the conduct phase of the audit, including six regional sites located across Canada and two sites within the National Capital Region. The sites were chosen using a risk- based approach that considered input from key stakeholders, the net book value of assets held at each site, and work conducted by the asset management group as part of the triennial physical asset count.

The criteria were developed based on key controls set out in the Treasury Board of Canada’s Audit Criteria related to the Management Accountability Framework – A Tool for Internal Auditors, in conjunction with the Treasury Board’s Directive on the Management of Materiel (TB Directive), and relevant associated policies, procedures and directives. The criteria guided the fieldwork and formed the basis for the overall audit conclusion.

A Subject Matter Expert (SME) was engaged to provide advice on relevant risk areas based on their experience with examining capital asset processes in other government departments, as well as advice and feedback on key targeted audited deliverables.

The conduct phase of this audit was substantially completed in May 2023.

Criteria

Please refer to Appendix A for the detailed audit criteria. The criteria guided the audit fieldwork and formed the basis for the overall audit conclusion.

Findings and Recommendations

Governance and Oversight Activities

Summary Finding

Overall, oversight and reporting mechanisms related to capital and attractive assets are not adequately implemented within NRCan. Several of the Department’s governance structures are integrated with departmental investment plans, however, the audit did not see evidence of investment plans being discussed in the context of capital and attractive assets. Although not yet implemented, the governance mechanisms proposed in the draft NRCan Framework include improved governance mechanisms that appear to be well defined and designed to support effective management of the materiel management function and compliance with relevant government policy instruments.

Roles, responsibilities, and accountabilities pertaining to the Department’s capital and attractive asset management processes and activities outlined in current asset management guidance and the draft NRCan Framework are not fully aligned with the TB Directive or communicated to relevant personnel.

Some mechanisms exist to enable communications regarding capital and attractive asset management between the RPEB and sectors, including regional teams. There is a need to expand the current communication mechanisms and improve awareness of these within the Department, to facilitate integrated and timely decision-making and collaboration of capital and attractive asset management.

No formal mechanisms exist to enable the SDO to receive timely information regarding asset management to ensure that they can provide meaningful advice to the DH.

Supporting Observations

Effective governance and oversight mechanisms should be in place to provide strategic direction to stakeholders and ensure compliance with Government of Canada policies and guidance. The audit examined whether governance structures and mechanisms for capital and attractive asset activities are clearly defined, provide the required strategic and operational direction to key departmental stakeholders, and are integrated with departmental investment plans. The audit examined whether roles, responsibilities, and accountabilities pertaining to the Department’s capital and attractive asset management program are clearly defined and communicated, and adequately align with TB policy requirements. The audit also examined whether the Department has established adequate mechanisms and channels for communication to ensure that decisions related to capital and attractive asset management are made in an integrated manner.

Governance and Oversight

Although NRCan has a documented governance reporting structure and mechanisms, there is a lack of defined accountabilities for overseeing and governing the Department’s capital and attractive asset management activities. The audit noted that the relevant committees and working groups meet regularly, enabling the timely sharing of information. However, the committees’ documented mandates, responsibilities, and meeting minutes, do not address capital and attractive asset management activities. Rather, they largely cover related topics such as Real Property, Procurement, and Investment Planning.

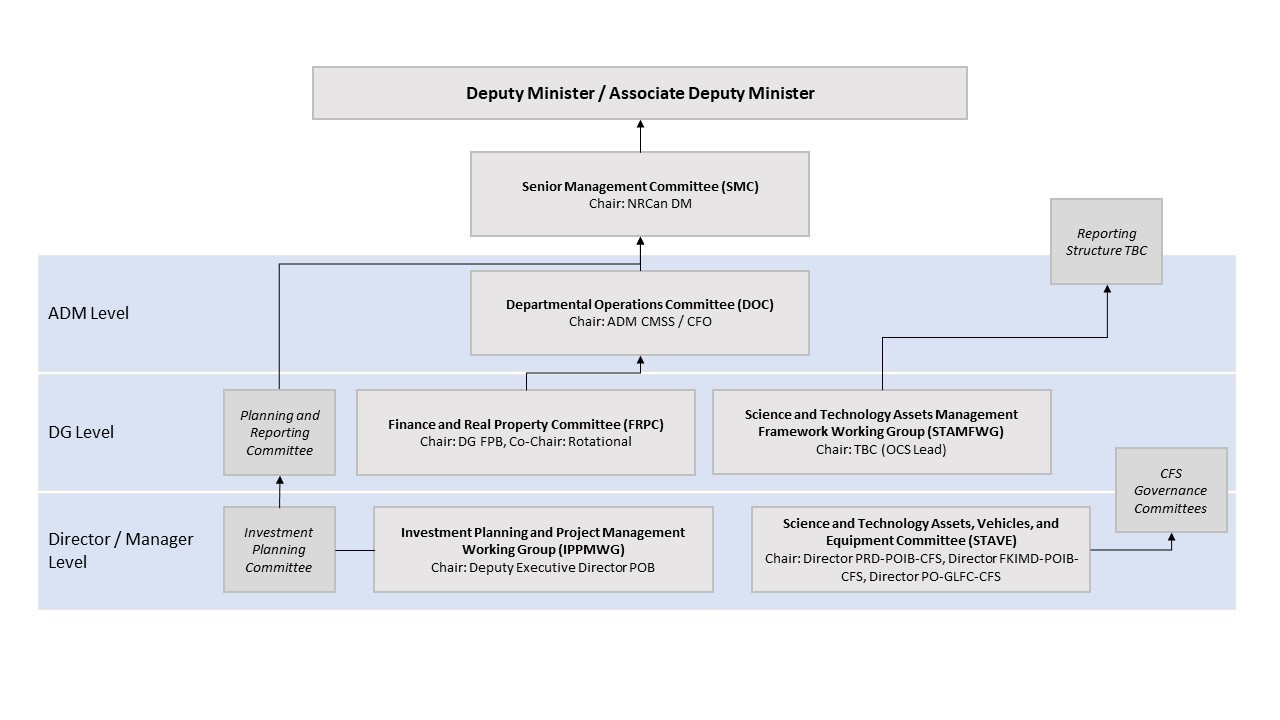

Figure 1 illustrates the current governance reporting structure related the Department’s capital and

attractive management activities.

Figure 1 – Current Governance Reporting Structure Footnote 5

Text Description

NRCan Asset Management Governance Committees

Deputy Minister / associate deputy minister

The most senior level committee is the Senior Management Committee (SMC) which is chaired by NRCan’s Deputy Minister (DM)

The Assistant Deputy Minister (ADM) Level committee is the Departmental Operations Committee (DOC), which is chaired by the ADM Corporate Management Services Sector (CMSS), Chief Financial Officer (CFO) and reports to the SMC

The Director General (DG) Level committees that report upward to the ADM Level committees are:

- Planning and Reporting Committee Reports to SMC

- Finance and Real Property Committee (FRPC) is chaired by DG Finance and Procurement Branch (FPB), and rotational Co-Chair, and reports to DOC

- Science and Technology Assets Management Framework Working Group (STAMFWG) is chaired by the Office of the Chief Science (OCS) Lead with final reporting structure to be confirmed (TBC)

The Director and Manager Level Committees that report upward to the DG Level committees are:

- Investment Planning Committee reports to Planning and Reporting Committee

- Investment Planning and Project Management Working Group (IPPMWG) is chaired by the Deputy Executive Director POB and links to Investment Planning Committee

- Science and Technology Assets, Vehicles, and Equipment Committee (STAVE) is chaired by Director PRD-POIB-CFS, Director FKIMD-POIB-CFS, and Director PO-GLFC-CFS and reports to Canadian Forestry Services Sector (CFS) Governance Committees

The audit team noted the Finance and Real Property Committee (FRPC) and Investment Planning and Project Management Working Group (IPPMWG) both have members with familiarity of asset management; however, the committees’ mandates and responsibilities do not cover asset management explicitly or extensively, which was also observed upon review of the records of discussion, where asset management topics were seldom mentioned. It was noted in the Investment Planning and Project Management Framework (IPPMF) that there is a minimum financial threshold of $2.5 million for stand- alone capital investments to be subject to the requirements within the IPPMF; the majority of the Department’s assets do not meet the criteria for strategic visibility or extensive tracking and control by the IPPMWG, and are instead governed by their respective DG committee. Both the Science and Technology Assets, Vehicles and Equipment Committee (STAVE) and the Science and Technology Asset Management Framework Working Group (STAMFWG) lack formal documentation defining the groups' structure and accountabilities, however, existing documentation suggests they both play an oversight role of specific sectors' science and technology assets.

The Departmental Operations Committee (DOC) has some oversight over the materiel management function. Its mandate includes oversight of the Department's resources, and some Committee members have asset management expertise, including the Chair, who is the SDO for the management of materiel. The audit team observed some discussion of materiel management at DOC meetings; however, the DOC currently does not serve as a decision-making or advisory body for the function.

The audit found that mechanisms for oversight, and strategic and operational direction for capital and attractive asset management are not fully established within the Department. This was also supported by sector interviews which indicated they are not involved and do not have any insight into in any asset management governance mechanisms, or whether appropriate stakeholders are invited or involved. A review of committee membership noted a lack of subject matter experts within existing governance bodies. This may result in a lack of information sharing, advice, and decision-making over capital and attractive asset management activities.

Overall, the governance mechanisms reviewed do not currently provide adequate oversight of capital and attractive asset management activities. The Department may not have adequate direction and accountability over the function to make informed decisions without addressing the following: asset management in governance mechanisms; involving key asset management stakeholders in these discussions; and integrating asset management in departmental investment plans.

With consideration of current membership of these governance bodies and linkages with other committees and working groups, there is an opportunity to broaden mandates, responsibilities, and meeting discussions to include asset management activities. The formal establishment of the STAMFWG will likely involve and improve NRCan’s oversight of capital and attractive asset management activities in the specific context of developing the laboratory asset management framework and related investment planning for scientific equipment.

The audit team observed that the draft NRCan Framework also identifies the need for governance of materiel management. The draft NRCan Framework outlines roles of the new National and Regional Materiel Review Committees as well as their proposed leadership. The draft NRCan Framework also identifies opportunities for integration with existing governance committees, however the linkages to the existing governance structures are not fully defined.

The role of the SDO includes the responsibility of providing advice to the DH on the Department’s materiel management function, performance gaps, issues of non-compliance with the TB Directive, the Department’s materiel management strategy, and investments required to maintain the integrity of NRCan’s materiel. There are currently no formal mechanisms in place to ensure that the SDO receives timely information regarding asset management so that they can provide meaningful advice to the Deputy Head (DH) regarding NRCan’s asset management activities.

Roles and Responsibilities

The audit team observed that roles and responsibilities set out in the NRCan “Guide on Assets Management”, do not fully align with the TB Directive on the Management of Materiel. The “Guide on Assets Management” does not include any roles and responsibilities of the SDO and is also missing several of the roles and responsibilities of materiel management practitioners set out in the TB Directive. NRCan’s current guidance outlines roles and responsibilities for the outdated biannual physical asset verification but does not reflect the transition to a triennial exercise.

The audit also observed that the understanding of roles and responsibilities of the various parties involved in the management of capital and attractive assets by sector staff varies greatly. Some staff advised that their roles and responsibilities are sufficiently defined in their work objectives, performance management agreements (PMA), or in their sector’s internal guidance materials; however, many staff indicated roles and responsibilities are undefined and unclear, aligning with the audit team’s documentation review. Sector staff also indicated that there are several asset management activities that require clarity regarding roles and responsibilities, including:

- Entering information into SAP;

- Tagging of assets upon receipt;

- Undertaking the process for the disposal of assets; and

- Completing periodic asset counts and attestations.

There is a lack of internal guidance and materials on roles and responsibilities, hindering the understanding of the RPEB’s, CIOB’s and sectors’ respective roles. There is also a lack of visibility into sectors’ asset management activities given the decentralized model of this function. As such, asset management activities are executed both by the RPEB team as well as sectors, resulting in a duplication of efforts. Both the RPEB and CIOB are leading initiatives to improve the understanding of roles and responsibilities in the Department through the draft NRCan Framework and the NRCan IT Security Policy Suite, respectively.

The audit team reviewed the draft NRCan Framework and observed that the roles and responsibilities defined within do not fully align with the TB Directive. All 16 SDO roles and responsibilities outlined in the TB Directive were addressed in the NRCan Framework, however, more than half of materiel management practitioner roles and responsibilities were either partially addressed or not addressed in the draft NRCan Framework. Discrepancies between the draft NRCan Framework and the TB Directive are identified later in this report.

Although not all roles and responsibilities are addressed in the draft NRCan Framework, key roles, and responsibilities as they relate to asset users and those with relevant authority over capital and attractive asset management are clearly defined and described. These categories include roles and responsibilities of those in the central Materiel Management group, allowing regional teams to better understand the role of RPEB beyond providing guidance. The roles and responsibilities for asset users (Responsibility Centre Managers (RCMs)) and Materiel Asset Custodians are clearly defined and include specific responsibilities such as participation in the physical asset verification, ensuring all assets acquired via acquisition card are recorded, consulting experts when planning acquisitions or divestitures, and divesting of assets that are no longer used or usable. The audit team confirmed with the RPEB that existing roles such as the Stores Person and/or Shipper/Receiver, which are not specifically referenced within the draft NRCan Framework, fall within the role of the Regional Materiel Administrator, subject to change upon consultation with the regional teams.

The detailed breakdown of defined roles and responsibilities in the draft NRCan Framework should help support staff’s understanding of roles and responsibilities of centralized and decentralized groups and improve consistency. These benefits will be dependent on the draft NRCan Framework being fully aligned with the TB Directive and published to the Department’s intranet.

Reporting and Communication

The audit team observed that the Department has established some mechanisms and channels for communication to ensure that decisions related to capital and attractive asset management are made in an integrated manner. There is a need to enhance existing communication processes, as well as to introduce additional communication mechanisms.

Most sector staff interviewed indicated that they use email to communicate with RPEB for asset management guidance. Many staff utilize the generic asset management inbox, while others reach out to contacts in RPEB directly on an as-needed basis. While most of those interviewed noted they are satisfied with the timeliness and quality of RPEB responses, some staff indicated there is a lack of communication and consistent messaging from the RPEB and many opt to seek guidance regarding asset management from one of their local team members.

The RPEB also uses their asset management email to broadly share information related to the management of capital and attractive assets, announcements, or to seek responses and feedback. However, it is unclear if all relevant parties are included on these communications, as the contact list of key sector materiel practitioners is not up to date. Fleet management is an exception, where the key contacts, the Senior Advisor of Fleet, and Regional Fleet Managers, are well known to one another, promoting regular and efficient communication regarding fleet vehicles.

Figure 2 – Identified Best Practices for Roles and Responsibilities

Best Practices Identified

Some interviews and process walkthroughs with sectors identified the importance of having an individual in the Stores Person and/or Shipper/Receiver role(s), as these roles are typically responsible for ensuring that assets are tagged upon receipt and that the process for disposal of assets was completed prior to the asset being removed.

Risk and Impact

Insufficient governance over the Department’s capital and attractive asset management activities, including oversight of capital and attractive asset investment planning, may reduce effectiveness of strategic and operational direction over the planning, acquisition, maintenance, and disposal of assets.

There is a risk that the SDO is not receiving sufficient information to enable them to effectively oversee and make decisions regarding NRCan’s materiel management, to ensure NRCan’s materiel management decisions align with government policies and demonstrating sound stewardship.

Recommendation

Recommendation 1: It is recommended that the ADM of CMSS:

- Implement governance mechanism(s) and leverage existing committees to oversee materiel management activities, including the oversight of departmental capital and attractive asset investment planning.

- Establish communication mechanisms and processes between the national and regional materiel review committees, or a relevant committee(s) charged with governance and oversight for the management of materiel and the SDO, to enable the SDO to fulfill their role and responsibilities as set out in the TB Directive.

Management Response and Action Plan

Management agrees.

In response to Recommendation 1:

A: NRCan is implementing a new Material Management Framework (MMF) as the primary governance body that can leverage existing committees to oversee material management activities, including the oversight of departmental capital and attractive asset investment planning.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

B: NRCan is implementing a new Material Management Framework (MMF) which will establish communication mechanisms and processes between the national and regional materiel review committees, and/or relevant committee(s) charged with governance and oversight for the management of materiel and the SDO, which will enable the SDO to fulfill their role and responsibilities as set out in the TB Directive.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

Design and Implementation of Risk Management Activities

Summary Finding

Overall, departmental guidance and tools exist to support materiel management activities; however, opportunities exist to ensure that guidance is regularly updated and effectively communicated in a timely manner to support materiel management practitioners in executing their duties.

Collaboration and communication related to capital and attractive asset management is not occurring routinely between the RPEB and sectors, or regionally. Specifically, there are opportunities for collaboration between the RPEB and sector representatives to ensure that the NRCan Framework adequately will address local challenges experienced in the regions and provides a sufficient level of guidance to materiel management practitioners.

There is a need to ensure that human resource management, such as formal training requirements, professional development, and succession plans, and related monitoring and reporting processes are documented.

Supporting Observations

Effective guidance should be in place to support the management of capital and attractive assets and to ensure compliance with the Government of Canada policies and guidance. The audit examined whether NRCan had developed and implemented departmental policies and guidance to achieve the objectives of the TB policy suite related to capital and attractive asset management. Further, the audit examined whether NRCan had established, implemented, and monitored a department-wide framework for the management of capital and attractive assets that consisted of processes, systems, and controls to satisfy the requirements of the TB Directive.

Effective HR processes should be in place to support materiel management activities. The audit examined whether the materiel management function had articulated and planned for current and future resourcing needs, including the competencies and knowledge, skills, and capacity required for NRCan to effectively manage its materiel.

Establishment and Implementation of a Department-Wide Framework for the Management of Capital and Attractive Assets

The TB policy suite related to asset management took effect on May 13, 2021, and required departments to implement and conform to the TB Directive within 12 months, by May 13, 2022. The audit team reviewed and assessed NRCan’s development and implementation of ancillary internal guidance to achieve the objectives of the TB Directive. Since the TB policy suite came into effect, a complete update of NRCan’s internal asset management policies and guidance is underway but is still in progress, with implementation scheduled for January 2024. As such, a review and analysis of the current primary source of internal asset management guidance available during the scope period, the “Guide on Assets Management”, was also conducted.

The “Guide on Assets Management”, available on The Source, links to other pertinent internal resources, intranet pages, and key contacts. However, the audit team noted that several webpages on The Source, such as the “Guide on Assets Management” include outdated guidance, broken links, and inaccurate contact information, preventing staff from being informed of best practices and able to seek guidance related to capital and attractive asset management in a timely manner.

The audit team observed that the “Guide on Assets Management” does not fully reflect the requirements outlined in the TB Directive. Particularly, several aspects of the Guide are out of date, including reference to the biannual asset certification process which has become a triennial exercise, as well as references to rescinded TB policy documents. Although existing internal policies and guidance provide some definitions, not all relevant definitions pertaining to capital and attractive assets from the TB Directive are included, such as the distinction between capital and attractive assets.

More than half of sector staff interviewed were either unaware of or do not use existing guidance in the management of capital and attractive assets. Of the staff that do, many leverage guidance available through The Source. Others execute their asset management activities based on prior experience or by seeking guidance from the RPEB or colleagues within their sector. Sector staff indicated that the RPEB had not sent them communications regarding updated policies, tools, and guidance. Rather, they seek out that information through their own research, impeding the ability of materiel management practitioners to execute their capital and attractive asset management activities effectively. As noted previously, management of fleet was an exception to this as RPEB and sector staff indicated that timely communications regarding updates to fleet management guidance are provided by the Senior Advisor of Fleet. Other noted gaps in the current policies and guidance are a lack of guidance specific to regional sites, guidance on estimating full-life cycle costs of assets, and information regarding the triennial count.

To align internal policies and guidance and to comply with requirements of the TB Directive, the RPEB is currently developing the NRCan Framework. The draft NRCan Framework stipulates it will be an evergreen document, suggesting updates should occur as needed. The NRCan Framework will also initiate a transition from guidance on “asset management” to guidance on “materiel management”, thereby increasing the scope covered by encompassing all assets with a life expectancy of over one year. The NRCan Framework has not yet been communicated to the department or completed as of the date of this report. In the interim, the RPEB has completed some updates to internal guidance to reflect requirements in the new TB Directive, which has not yet been released for departmental use. The RPEB informed the audit team that ancillary internal guidance and materials, such as webpages on The Source will be updated to align with the NRCan Framework once it is final.

The audit team reviewed the March 2023 version of the draft NRCan Framework to assess its alignment with the TB Directive. The audit team noted the draft NRCan Framework does not fully reflect the requirements outlined in the TB Directive. Particularly, more than half of the requirements set out in the TB Directive are either partially addressed or not addressed. The draft NRCan Framework does not include requirements for the following aspects:

- ensuring a materiel management information system is in place;

- ensuring that there is a strategy for asset life cycle management;

- ensuring that official Government of Canada and/or departmental symbols are removed prior to divestiture;

- proper use of proceeds of sale;

- asset transfers;

- sale or donation of surplus materiel;

- trade-in of materiel; and

- transfer of materiel between departments.

In terms of relevant terms and definitions, the draft NRCan Framework includes definitions that align well with those in the TB Directive and provides sufficient coverage of the terms used throughout the draft NRCan Framework to adequately support materiel management practitioners in understanding the guidance to carry out their asset management duties. The definitions include the types of authorities involved with materiel management, the main stages of the materiel life cycle, and the main categories and types of assets and goods governed by the draft NRCan Framework. Specifically, the audit team noted the detailed distinction between capital and attractive assets, a distinction that was unclear to many asset management practitioners and asset users in the regions. However, in terms of the life cycle of materiel, divestiture of assets was not sufficiently outlined or referenced in the draft NRCan Framework, despite representing a significant portion of the TB Directive. To achieve the objectives of the TB Directive, the NRCan Framework and ancillary guidance will need to reflect all aspects of the TB Directive.

The audit team also reviewed the scope of the draft NRCan Framework and found that it adequately covers the full range of NRCan’s capital and attractive assets that fall within the scope of the audit, apart from IT assets. The draft NRCan Framework refers to the Chief Information Officer (CIO) as the Technical Authority responsible for establishing the life cycle strategy, disposal strategies, and asset verification for IT assets. The RPEB confirmed that the CIO is the Technical Authority for IT assets and that IT assets are covered by the TB Policy on Service and Digital, separate from the TB Directive.

During the process walkthroughs at regional sites, the audit team noted many gaps and challenges with NRCan’s current life cycle process. Local challenges include assets that were previously disposed still reflected as current assets in SAP, inaccurate location details within SAP, assets not appropriately tagged, and the administrative burden borne by scientists that may detract from their scientific functions. Without meaningful consultation with staff across regions and sectors, these challenges will likely continue to persist, despite the detail provided in the NRCan Framework. In addition, if asset records are not complete and accurate, investment planning and similar decisions can not be made effectively, resulting in potential inefficient use of funding.

Detailed Asset Testing

The total value of attractive assets held by the department is not known. While attractive assets were subject to review as part of the audit, they were not selected for this part of the testing work as they are not tracked in SAP. A total of 276 capital assets with a net book value of $9.5 million across the eight regional sites visited were selected for testing using a risk-based approach. Of these, 200 assets with a net book value of $9.3 million were observed and 76 assets with a net book value of $0.2 million were not observed. Of the 76 assets that were not observed, 25 had been previously disposed and 51 could not be located for observation by the audit team.

As illustrated in Figure 3, the audit team noted numerous discrepancies between the listing of assets provided by Corporate Finance and the actual assets observed during testing, including assets that were previously disposed, assets with either no tag or inaccurate tags, and assets with signs of obsolescence. Discrepancies noted may be a result of many factors, such as assets not being tagged upon receipt, errors or other issues when processing asset disposals, and a lack of inventory count and disposal records being updated in SAP. This may impact investment planning as the information available on which investment planning relies may not be accurate, ultimately resulting in additional expenditures, a lack of asset renewal, and impacting NRCan’s ability to fulfill its scientific mandate.

Figure 3 – Summary of Asset Testing Results

| Total Assets Tested | Assets Not Observed | Assets Physically Observed | |||

|---|---|---|---|---|---|

| Disposed Of | Unable to be Located | Accurate Asset Tags | Inaccurate or Missing Asset Tags | Signs of Obsolescence | |

| 276 | 25 | 51 | 136 | 64 | 27 |

| 9% of assets tested | 18% of assets tested | 68% of assets observed | 32% of assets observed | 14% of assets observed | |

The Polar Continental Shelf Program (PCSP) has an Arctic logistics hub in Resolute Bay, Nunavut which is used to enable scientific and operational endeavours in the Arctic. This facility coordinates logistical operations across the Arctic, including loaning equipment needed for field work. An Independent Assessment of the PCSP was conducted by AEB and was presented to DAC in April 2021. One of the recommendations relating to asset management was evaluated during the conduct phase of this audit. The recommendation was as follows: “to improve or replace the Program’s proprietary logistics and financial systems/tools with commercial solutions that better support integrated and reliable financial reporting, cash management, invoice management and related financial analysis”. The audit team reviewed the PCSP’s new inventory management software and its ability to support financial reporting, cash management, invoice management and related financial analysis. Review of the inventory management software agreement revealed that the software may provide more advanced inventory management capabilities over the existing Field Equipment Inventory Software (FEIS), however the specific reporting capabilities are not specified in the contract. According to PCSP, they are working alongside the software vendor to design the financial reports that will be generated by the new inventory management software. Since the reports are not yet designed or implemented, the audit team cannot conclude on whether the new inventory management software will enable better financial reporting, cash management, invoice management and related financial analysis than FEIS. If the new inventory management system does not enable financial reporting, financial analysis, cash management, or invoice management, this may result in weak asset management and lifecycle planning. The status of this outstanding recommendation will be followed up on through the Independent Assessment of the PCSP to avoid duplication, and no further recommendations related to this observation will be made in this report.

Competencies, Capacity and Professional Development of Materiel Practitioners

Sectors have not established training requirements, succession plans, and mechanisms for tracking competencies and identifying knowledge gaps relating to the management of materiel. Sector representatives expressed uncertainty regarding whose responsibility it is to identify and address the competencies required for effective asset management. This may contribute to a lack of consistency in asset management and significant knowledge gaps across NRCan. Further, there is no widespread monitoring of materiel management competencies, on a sector or departmental level.

The audit team reviewed a manual outlining employees’ required functional and technical competencies and their corresponding performance indicators, as well as a GCpedia page, managed by the TB, that includes mandatory and optional training opportunities for materiel management practitioners. The GCpedia pages have been updated since the new TB policy suite was implemented in May 2021, however, these pages are not internal to NRCan and did not seem to be well-known to the materiel management practitioners interviewed.

Sector representatives expressed an interest in having general training on materiel management available for all employees and more specialized training available for materiel practitioners. General training could create awareness regarding appropriate processes for asset management; and more specialized training may support each site in having a dedicated asset management subject matter expert to support and provide visibility into the management of capital and attractive assets at a regional level. Sector representatives raised concerns about scientists and technicians being tasked with a substantial number of administrative duties, resulting in an administrative burden that may prevent them from fulfilling their core functions.

Figure 4 – Identified Best Practices for Staff Training and Competencies

Best Practices Identified

- The RPEB tracks each employee’s progress towards completing the required Materiel Management trainings. The RPEB also instituted a self-assessment exercise whereby employees reflect on their performance, career goals, areas for improvement, and trainings completed during the review period. These procedures support RPEB in monitoring competencies and identifying knowledge gaps.

- Some sectors leverage cross-training to ensure that employees leaving NRCan or taking leave transfer materiel management knowledge to their successor. One sector representative noted that they created a “Vital Knowledge” document to ensure their successor is well equipped to take on their duties.

Risk and Impact

There is a risk that if communication mechanisms relating to the Department’s capital and attractive asset management function are not broadly known, consistently used, or shared using up-to-date contact information for materiel management practitioners, staff involved in materiel management may not have the information necessary to follow best practices related to capital and attractive asset management. This may result in NRCan’s capital and attractive assets not being appropriately managed to maximize their useful life and value to the Crown, impeding on the Department’s ability to achieve its mission and objectives.

Without sufficient documentation, implementation, and communication of professional development plans, including training requirements for materiel management practitioners, there is a risk that NRCan will not have sufficient capacity of staff with competencies to effectively perform asset management duties. In the absence of monitoring and reporting of competencies, capacity, or skills across NRCan, there is a risk that knowledge gaps may not being identified or corrected. This may result in the inefficient and ineffective use of maintenance and investments in materiel.

Recommendations

Recommendation 2: It is recommended that the ADM of CMSS implement communications processes with materiel management practitioners, provide updated key points of contact, and improve the consistency and frequency of communications for the materiel management function.

Recommendation 3: It is recommended that the ADM of CMSS, in collaboration with the ADMs of all sectors with involvement in the management of materiel:

- Develop, implement, and communicate professional development plans for staff involved in asset management, including training requirements, and processes for monitoring and reporting on materiel management competencies.

- Develop, implement, and communicate formal succession plans for staff involved in asset management to ensure asset management knowledge is transferred between staff members prior to a departure.

Management Response and Action Plan

Management agrees.

In response to Recommendation 2:

NRCan is implementing a new Material Management Framework (MMF) as the primary governance body that will provide materiel management practitioners with key points of contact, and include guidance to improve the consistency and frequency of communications for the materiel management function.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

In response to Recommendation 3:

A: NRCan is implementing a new Material Management Framework (MMF) which will assist in identifying required training for staff involved in asset management. The Material Management staff will be encouraged to participate in consistent training and awareness activities for all of the areas indicated in the audit recommendation on an ongoing basis, including events offered by the Canadian Institute for Procurement and Material Management, the Canada School of Public Service (CSPS) and other fora. The tracking of completed training is currently housed in PeopleSoft and monitored by HR. The Material Management team will also monitor our internal teams PeopleSoft entries to ensure appropriate attendance and training completion.

Complementary awareness sessions will be delivered on an ad hoc basis, such as GCSurplus Masterclass training.

Position responsible: Director General, Real Property and Environment Branch

Timing: July 1, 2023

B: NRCan is implementing a new Material Management Framework (MMF) as the primary governance body that will include directives. These directives will give new employees the knowledge required to complete their duties. Utilizing record keeping such as GCDocs is also vital to ensure information is kept and able to be reused. Material Management information and record keeping will be a subordinate of the directive, thus a part of the MMF.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

Key Capital and Attractive Asset Management Processes and Controls

Summary Finding

The life-cycle approach for the management of capital and attractive assets at NRCan has not been appropriately implemented, monitored, or reported on in a consistent manner. The life-cycle approach is not defined in existing guidance as it pertains to optimizing the longevity of assets’ useful life through adequate maintenance and reinvestment to minimize costs and asset damage/loss.

Scientific equipment with a remaining useful life and positive net book value that are no longer required are typically retained and stored, rather than sold or transferred to other sectors or Government of Canada Departments. It was noted that these assets are retained due to a lack of familiarity with the divestment process, a lack of awareness regarding how to operate the equipment following the departure of the primary user of the equipment, and the belief that the equipment may be used or needed again at some point in the future.

Financial management activities, including ensuring that acquisition decisions for attractive and capital assets are taken in an integrated manner that includes consideration of the full life cycle costs, are not occurring on a consistent basis. While some sectors consider the expected future costs of certain assets at the time of acquisition, such as ongoing maintenance and disposal costs, this practice is not done on a consistent basis across the department.

Opportunities exist to ensure that the NRCan Framework and ancillary guidance, which are currently being drafted, formally document asset management guidance with respect to key materiel management processes and controls in alignment with the TB Directive, and that those processes are adequately communicated to materiel management practitioners.

Supporting Observations

The objective of the TB Directive is that materiel is planned, acquired, operated, maintained, and divested in a manner that supports the delivery of programs and services to Canadians, while ensuring best value for the Crown. The TB Directive sets out requirements for the divestiture of assets to ensure that assets are disposed of in a consistent way that maximizes value for the Crown and minimizes environmental impact. The audit examined whether NRCan has implemented the life-cycle approach for the management of capital and attractive assets, and that financial management activities are taken in an integrated manner.

Life-Cycle Approach to Asset Management

The NRCan “Guide on Asset Management” as the current primary source of asset management guidance does not fully reflect the requirements outlined in the TB Directive. The current internal guidance does not include the following aspects pertaining to the life-cycle approach to asset management:

- The establishment, implementation and maintenance of department-wide oversight, planning and reporting mechanisms;

- A requirement to ensure that a strategy for life-cycle management exists;

- A requirement to ensure that acquisition decisions for materiel are taken in an integrated manner that includes consideration of operational requirements, usage, risks, investments, and divestments; and

- Tracking of performance results and lessons learned to inform materiel decision-making and to identify significant gaps in performance and issues of non-compliance.

Sectors indicated that due to the short-term nature of funding, programs struggle to plan for medium- and long-term asset acquisitions, particularly when there is a change in mandate, such as shifting the focus of research and development from one area to another. Sectors also reported delays in acquiring assets via the procurement process which has resulted in assets not being delivered on time. An Audit of the Management of Procurement Services was completed in July 2022 which made recommendations to address procurement delays, including developing and implementing a prioritization process for procurement requests and a review of the procurement process and service standards. The implementation of the recommendations is currently underway.

Currently, the life-cycle approach to asset management has not been appropriately implemented for all applicable capital and attractive assets. Planning activities, such as calculating the full costs of maintenance and operations for the life cycle of assets, were not occurring on a consistent basis across sites visited. It was also noted by many of those interviewed that at times, assets are purchased without sufficient planning and budgeting, in an ad-hoc, rushed manner without consideration of other costs associated with the asset such as maintenance and disposal costs. Some sectors consider maintenance needs for certain assets at the time of acquisition, opting to purchase service contracts at the same time as the asset. In most cases, however, the estimated cost of maintenance and repairs is not considered at the time of purchase; and maintenance is completed on a reactive basis where needed, as budgets allow. Except for fleet, the department does not have guidelines for the frequency of maintenance on assets or controls in place to ensure that maintenance is completed within recommended timelines. The draft NRCan Framework includes the requirement that investment decisions are based on an assessment of full life-cycle costs, which is consistent with the TB Directive.

The audit observed that attractive assets are not tracked in a consistent manner. When assets are purchased through an acquisition card, it is the responsibility of the card holder to obtain and affix a label as well as to notify asset management to have the asset information inputted into SAP. This process is not consistently followed due to a lack of awareness surrounding attractive assets and their tracking requirements. Tracking of IT assets, including laptops, printers, televisions, projectors, and screens, is done on a more consistent basis as asset tags are generally affixed by IT services prior to being sent to regional sites, and if the asset tag is missing, this is typically remedied by the onsite IT personnel. Due to the fragmented nature of IT asset management at NRCan, and with sectors making some of their own purchases, it is a challenge to keep track of all IT assets. Attractive assets, such as monitors and small printers, are typically barcoded and recorded in SAP but are not subsequently tracked.

Of the 276 assets selected for testing, three of the eight sites visited did not have asset tags on more than 50% of the assets observed. Affixing asset tags, completing the goods receipt documentation and communicating with asset management is most often the responsibility of the Stores Person and/or Shipper/Receiver; the audit team observed that asset tagging happens most consistently at sites that have a well-trained Stores Person and/or Shipper/Receiver. Asset tags are used to track assets; if an asset tag is not affixed to the asset once received there is a risk that the asset will not be adequately tracked and maintained throughout its lifecycle.

Five of the sites visited track all or some of their assets in a database that is independent of SAP. Two of the sites reported tracking fleet, including usage, maintenance requirements, and maintenance records. One site has an engineering services group that proactively manages the required maintenance for certain assets at the site. Two sites manage their entire inventory of assets, excluding real property, through a software that is independent of SAP. Asset tracking is not consistently done by other sites. Metrics such as the physical condition and financial performance of assets are not documented, and inventory counts are generally only done when initiated through the central asset management team.

The audit team reviewed a sample of equipment loan agreements to determine if they complied with TB Directive requirements. For the 2021 season, which ran from February to September 2021, PCSP loaned equipment to 110 groups to support their projects. The average equipment cost per project was $8,850 and the total replacement cost of the equipment loaned during that period was $950,000. The PSPC loan agreements reviewed were fully compliant with all aspects required by the TB Directive. Four other sites visited indicated that they loan assets on occasion. The audit team obtained a sample of loan agreements for 3 of the other sites that loan equipment to third parties and observed that one of the site’s loan agreements was fully aligned with the TB Directive while the other two were missing 3 of the 5 required elements. When asset loaning agreements do not include all required elements from the TB Directive, there is a risk that loaned assets will be damaged or not returned, or that the Department may be exposed to liability should issues arise with the loaned assets. When asset loaning agreements do not include all required elements from the TB Directive, there is a risk that loaned assets will be damaged or not returned, or that the Department may be exposed to liability should issues arise with the loaned assets.

Risks associated with assets, such as equipment containing hazardous materials, equipment requiring the use of personal protective equipment, or equipment requiring use by trained personnel, were observed to be adequately managed through training, standard operating procedures, and restricted access to these assets.

Processes and Controls Related to Asset Divestitures

Documentation reviewed provided guidance on certain elements for disposals that is consistent with the TB Directive. The guidance included the basic steps and requirements for each type of divestiture; a requirement to determine if an asset can be transferred before being divested using other methods; certification that biological and hazardous materials have been removed from assets prior to disposal; and, that all e-waste and scrap materiel must be disposed of in an environmentally friendly manner. Aspects of the TB Directive that are not included current internal guidance are as follows:

- For program leads to first consider the feasibility of the refit, repurpose and reuse of all materiel before divestiture through other options;

- The requirement to removing all official Government of Canada symbols prior to disposal; and,

- Guidance regarding use of proceeds from disposal.

Roles and responsibilities related to the divestment of assets are not defined or set out in a comprehensive manner in the current departmental asset management guidance. A process walkthrough document reviewed by the audit team noted the specific responsibilities of certain asset management roles for certain disposal scenarios. The “Guide on Asset Management” also sets out the requirement to have the Request for Asset Disposal Form authorized by the delegated manager.

The responsibility to identify assets that are surplus to program needs belongs to the users of the equipment. In the case of scientific equipment, it was reported that scientists and researchers prefer to retain and store items rather than to divest of them in case the asset could be used again or because they are not familiar with divestment process. Staff for several sectors reported instances of a researcher retiring or departing, and others not knowing how to use that equipment, resulting in that equipment eventually losing value or becoming obsolete.

It was reported in interviews that the disposal process is not well understood and is unclear which results in assets and the correct disposal process being neglected. Most interviewees reported assets being left to sit idle for years instead of being disposed. This was confirmed during the testing of both current assets and disposals.

The audit team noted discrepancies with the 30 asset disposals that were selected for testing, as illustrated in Figure 5.

Figure 5 - Summary of Asset Disposal Testing Results

| Total Asset Disposals Tested | Disposals Identified by Sectors but Not Reflected in SAP | Disposals Lacking Appropriate Documentation | Disposals Authorized by Staff Without the Appropriate Level of Authority |

|---|---|---|---|

| 30 | 15 | 4 | 2 |

| 50% of disposals tested | 13% of disposals tested | 7% of disposals tested |

Based on the results of key process walkthroughs of the cases examined, the following steps were operating effectively: the removal of Government of Canada symbols and hazardous materials from assets, where applicable, prior to disposal, as well as the divestiture of assets in an environmentally sustainable manner. In addition, unclassified digital assets, such as laptops, consistently have the hard drive cleared prior to being donated to the ISED Computers for Schools program or disposed of. The audit identified gaps in other key steps of the disposal process including that the analysis to support the rationale to dispose of assets is not consistently documented. In addition, materiel practitioners at most sites advised that previously disposed assets reported to the Asset management group continue to appear on the asset listing used in subsequent asset counts which results in current assets being overstated. This was also supported by asset disposal testing as noted in Figure 5.

The current departmental guidance contains limited detail regarding internal controls over the asset divestiture process. Controls include: the requirement to obtain third party documentation to prevent assets from being disposed of prior to the removal of biological and/or hazardous substances; preventing losses to the crown from not obtaining best value for assets being traded in; and, requiring authorizations at specific points during the asset disposal process. The audit team did not observe controls in the guidance to determine whether disposals that occur during the fiscal year are all completed appropriately or to detect assets that are disposed of improperly.

Figure 6 – Identified Best Practices for Key Asset Management Processes

Best Practices Identified

A best practice in place at two of the regional sites is that asset acquisitions are initiated by technologists and reviewed by engineers to ensure an appropriate installation space exists and to consider any power needs or other modifications that may be required to correctly install the asset.

Risk and Impact

There is a risk that materiel management challenges that exist on a regional level will not be resolved and will continue to persist, if sector representatives are not consulted during the creation of the NRCan Framework. This may result in materiel management practitioners lacking support for the planning and procurement of materiel, the maintenance and repair of equipment through its useful life, and the disposal of obsolete or surplus materiel. Ultimately, this may result in additional expenditures, or a lack of asset renewal and impacting the effective use of scientific equipment.

While the draft NRCan Framework includes descriptions of roles and responsibilities for certain materiel management practitioners, it is not complete. There is a risk that if roles and responsibilities are not sufficiently defined and communicated, there may be duplication of effort. This may also prevent the RPEB and materiel management practitioners from completing their duties efficiently. In addition, if materiel management practitioners are unaware of or unable to access up-to-date and comprehensive asset management guidance, processes may not be adequately designed and implemented to optimize the useful life of assets through adequate maintenance and reinvestment to reduce costs and the risk of asset damage or loss.

If the implementation and compliance with the NRCan Framework is not monitored, there is a risk that the asset management activities will not be fully implemented and operating effectively in compliance with the TB Directive. This may result in NRCan’s capital and attractive assets not being appropriately managed to maximize their useful life and value to the Crown.

If disposals are not processed in a consistent manner, as detailed in the TB Directive, materiel practitioners may not process asset disposals in a consistent manner that is safe, environmentally friendly and provides most value to the crown. In addition, management will not have an accurate understanding of the capital and attractive assets held by the department and the Departmental Financial Statements could be impacted if asset disposals are not accurately reflected in SAP.

Recommendation

Recommendation 4: It is recommended that the ADM of CMSS:

- Collaborate with sector representatives on the content of NRCan’s Materiel Management Framework and adapt the NRCan Framework to ensure that sufficient guidance exists to support materiel management practitioners in their duties and that challenges unique to regional sites are adequately addressed.

- Review, update, and communicate the NRCan Framework and ancillary guidance to ensure roles and responsibilities are adequately defined and aligned with the TB Directive, and to equip staff to execute their duties.

- Implement processes to monitor the implementation of and compliance with the NRCan Framework to ensure that materiel management activities are being fully implemented and are operating effectively.

Recommendation 5: It is recommended that the ADM of CMSS, in collaboration with Sector ADMs, improve the accuracy of asset information in SAP by ensuring that results of periodic inventory counts, and asset disposals are reflected in SAP in a timely manner.

Management Response and Action Plan

Management agrees.

In response to Recommendation 4:

A: NRCan is implementing a new Material Management Framework (MMF) the framework will include as the primary governance body that can leverage existing committees to oversee material management activities, including the oversight of departmental capital and attractive asset investment planning. The MMF will be reviewed and shared within the department through working committees to ensure any internal challenges are mitigated. The Material Management group will be consulting sectors and regions before the finalization and promulgation of the MMF.

The MMF will be presented to the RPEB DG Advisory committee on August 17, 2023 to address any initial concerns. The Material Management Group will be going for the MMF approval through governance, FRPC, Ops and SMC. Once approved, it will be publish online (Intranet or Sharepoint), advertised in The Source and a SDO email promulgating the MMF is now active.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

B: Through NRCan’s new Material Management Framework, roles and responsibilities will be clearly defined with updated guidance based off of the TB Directive and internal processes. The document will be shared with Material Management Practitioners who can reference the document whenever required. Further directives branching off from the MMF will be completed to ensure a clear direction for staff to execute their duties. An annual MM report will be presented to FRPC and Ops and will review the programs performance. The report will provide information on the annual program of work progress, verification and certification results, including the state of the inventory, training, etc.

The report content will be clearly defined in 24/25 and will support the audit findings.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

C. NRCan’s new Material Management Framework will identify reports which are to be run in order to provide clear visibility on the compliance of the MMF. As well, during the next capital asset internal control assessment, FPB will confirm that the MMF was approved, implemented, and is functioning as intended from a financial management perspective.

Position responsible: Director General, Real Property and Environment Branch Timing: March 31, 2024

In response to Recommendation 5:

NRCan is implementing a new Material Management Framework (MMF) the framework will include as the primary governance body that can leverage existing committees to oversee material management activities, including the oversight of departmental capital and attractive asset investment planning. NRCan has received presentations from GCSurplus and Masterclass training sessions have been set up to further the knowledge of all staff on the topic of divestment. Within the MMF, reporting requirements and exercises are identified which will help ensure the accuracy of SAP. The Triennial Inventory count, which is currently occurring is an example of risk mitigation strategy in regard to SAP accuracy. SAP content needs to be audited by the MM team and reported annually in the MM report.

Position responsible: Director General, Real Property and Environment Branch

Timing: March 31, 2024

Appendix A – Audit Criteria

The criteria were developed based on key controls set out in the Treasury Board of Canada’s (TB) Audit Criteria related to the Management Accountability Framework – A Tool for Internal Auditors, in conjunction with the TB Policy on the Planning and Management of Investments, and the TB Directive on the Management of Materiel, and relevant associated policies, procedures, and directives. The criteria guided the fieldwork and formed the basis for the overall audit conclusion.

The objective of this audit was to assess the overall effectiveness of the governance and risk management activities, and the adequacy and effectiveness of processes and controls, which form the system used by NRCan to manage capital and attractive assets.

The following audit criteria was used to conduct the audit:

| Audit Sub-Objectives | Audit Criteria |

|---|---|

Sub-Objective 1: To determine whether effective governance and management oversight processes have been established to manage the Department’s capital and attractive assets. |

1.1 It is expected that oversight and reporting mechanisms related to capital and attractive assets are clearly defined, provide the required strategic and operational direction to key departmental stakeholders, and are integrated with departmental investment plans. |

1.2 It is expected that NRCan has developed and implemented ancillary departmental policies and guidance to achieve the objectives of the TB policy suite related to capital and attractive asset management. |

|

1.3 It is expected that the roles, responsibilities, and accountabilities pertaining to the Department’s capital and attractive asset management program are clearly defined and communicated, and adequately align with TB policy requirements. |

|

1.4 It is expected that the Department has established adequate mechanisms and channels for communication to ensure that decisions related to capital and attractive asset management are made in an integrated manner. |

|

Sub-Objective 2: To determine whether risk management activities are effectively designed, implemented and continually updated to support the Department’s capital asset management processes and ability to meet the objectives and requirements established in the TB policy suite. |

2.1 It is expected that there is an established and implemented department-wide framework for the management of capital and attractive assets that is regularly monitored and consists of processes, systems, and controls to satisfy the requirements established in the Directive on the Management of Materiel. |

2.2 It is expected that mechanisms exist to provide advice and information to the Deputy Head as required by the TB Directive on Management of Materiel. |

|