EXECUTIVE SUMMARY

For the November 2015 through March 2016 winter heating season, consumers can expect low natural gas prices relative to historical averages and to the prices of competing space heating fuels such as propane and furnace oil.

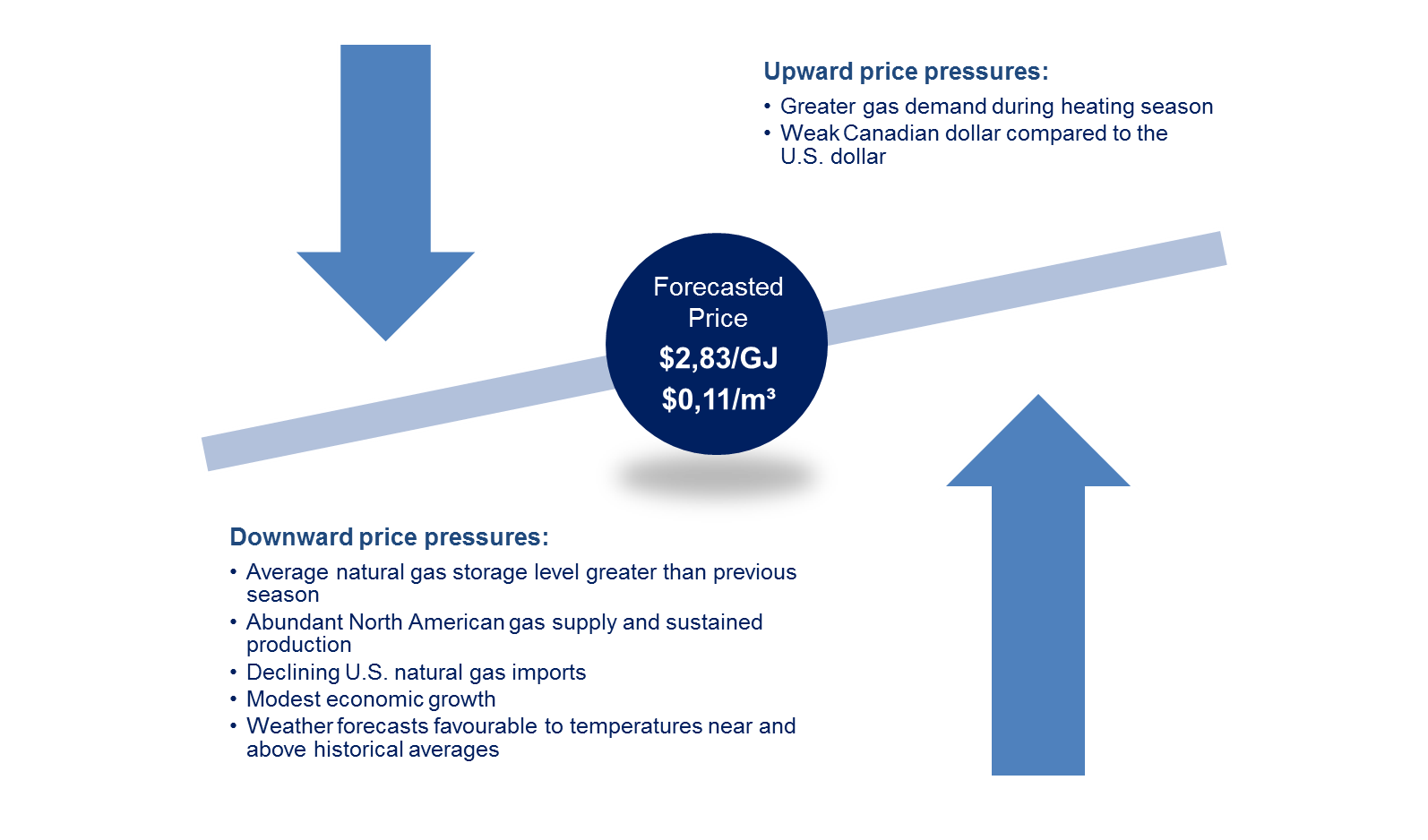

Robust natural gas storage levels, normal and above average winter temperature forecasts, growing North American supply and modest economic growth all point towards low natural gas prices. Based on an average of industry consultants’ forecasts, Alberta wholesale natural gas prices (AECO) are expected to be $2.83 per Gigajoule (GJ) or $0.11 per cubic metre (m3) through March 2016. Anticipated prices are $0.37 per GJ less than average prices last year.

For comparison, ten-year (2004-2014) average historical fuel prices were: natural gas $5.13/GJ; auto propane $22.32/GJ (a good indicator of residential propane prices); and, furnace oil $23.98/GJ.

Main Factors Affecting 2015/2016 Heating Season Natural Gas Prices

Text version

Text version

An illustration of a teeter-totter tilting toward the left. An arrow is pointing down on the left side and an arrow is pointing up on the right. The arrow pointing down indicates the factors that decrease (push down) the price of natural gas. These factors are: “Average natural gas storage level greater than previous season”, “Abundant North American gas supply and sustained production”, “Declining U.S. natural gas imports”, “Modest economic growth”, “Weather forecasts favourable to temperatures above historical averages”.The arrow pointing up indicates the factors that increase (pushup) the price of natural gas. These factors are: “Greater gas demand during heating season” and “Weak Canadian dollar compared to the U.S. dollar”. The fulcrum of the teeter-totter contains the 2015-16 heating season forecasted wholesale price of $2.83/GJ or 0,11$/m3.

INTRODUCTION

In Canada, natural gas is used by residential and commercial users as a source of fuel for space and water heating, drying, and cooking. Close to 50% of space heating and 65% of water heating in Canadian homes is fuelled by natural gas. As for Canadian businesses, more than 80% use natural gas for space and water heating.

Wholesale natural gas commodity prices are determined by the market forces of supply and demand. For most Canadian consumers, changing natural gas commodity prices will eventually result in a corresponding change in consumer prices. However, the change will be less in percentage terms, as the cost of the gas commodity is only part of the consumer’s natural gas bill, which also includes charges for transmission and delivery (see Understanding Your Natural Gas Bill).

Understanding Your Natural Gas Bill

A consumer’s natural gas bill includes:

- The commodity charge;

- Long-haul pipeline transmission charges;

- Local distribution and storage charges; and,

- Taxes.

The commodity charge is typically the wholesale price of natural gas in a producing area, and fluctuates with changing supply and demand.

The remaining charges cover the costs of transporting the gas from supply basins to demand centres and then to consumers via local distribution companies.

In most provinces, consumers can either purchase the natural gas commodity from a local distribution company, which buys gas on an on-going basis and bills consumers the same price paid to suppliers; or from a broker or marketer, who instead offers fixed rates to consumers for a set period of time.

For more information, refer to NRCan’s FAQs about natural gas prices.

NATURAL GAS SUPPLY

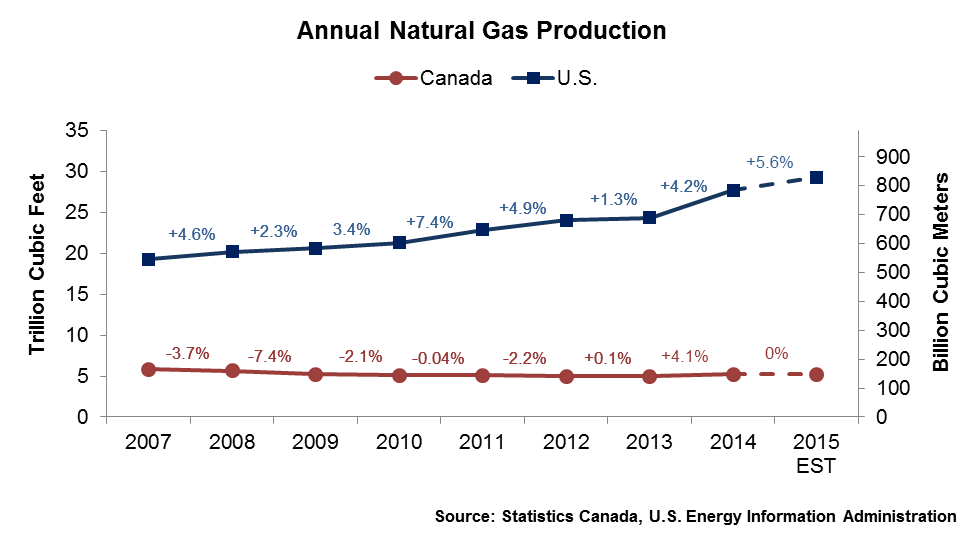

Canada is part of a fully integrated North American natural gas market where natural gas flows seamlessly across borders from supply basins to demand centres. Supported by the ongoing increase in production in the U.S. in 2015, the North American natural gas market continues to be oversupplied. Canada’s National Energy Board’s (NEB) natural gas deliverability mid-range case projects that Canadian natural gas production will rise between 2014 and 2015 by close to 1%, while it will decrease by a little more than 2% in 2016Footnote 1. The U.S. Energy Information Administration (EIA) predicts U.S. natural gas production will increase by 5.6% in 2015, and by 1.9% in 2016Footnote 2.

Text version

Text version

A line graph of the annual natural gas production in Canada and the United States (U.S.) from 2007 to 2015 (estimate). The graph shows that U.S. natural gas production has been continuously climbing since 2007, while Canadian production has been stagnating.

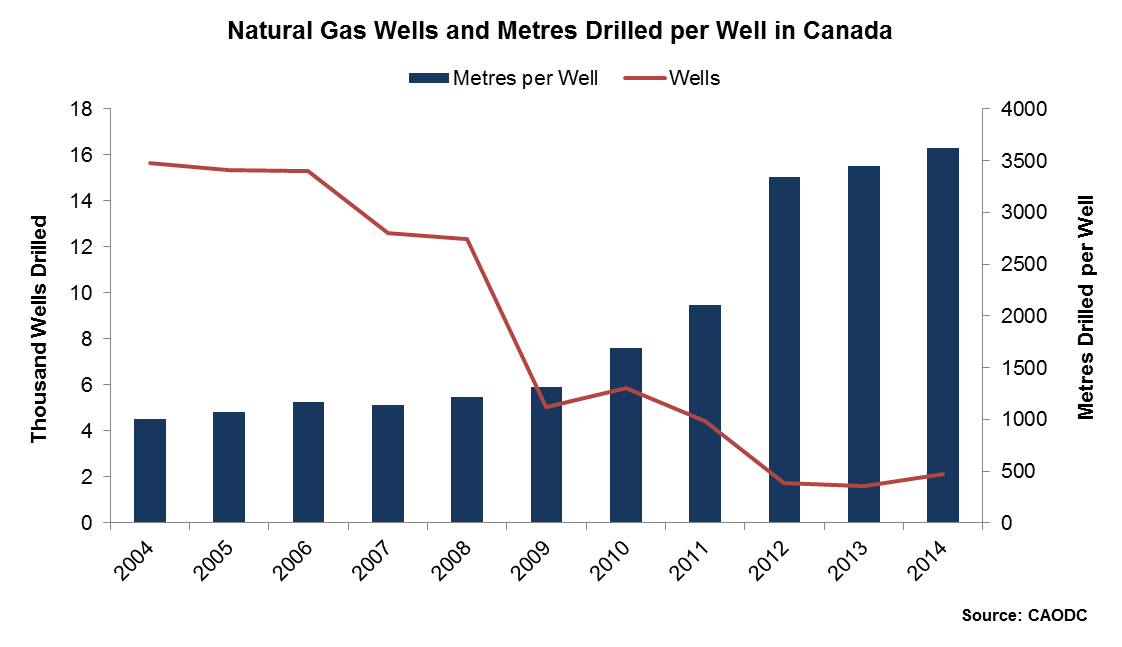

The persistent low price of natural gas continues to put pressure on producers and is leading to decreased capital expenditures and reduced number of wells drilled in Canada, a trend which has already been observed over the last few years. Between January and July 2015, the number of wells drilled decreased by 22% compared to the same period last year.

Natural gas producers generate revenue through the sale of natural gas, and also from the sale of associated natural gas liquids such as ethane, propane, and butane. Natural gas liquids tend to be indexed to crude oil prices since they can serve as substitute fuels. In recent years, producers were able to offset low natural gas prices by targeting and producing from liquids rich formations. However, recent oil price declines are negatively impacting natural gas liquids prices and also producer revenues.

Despite reduced drilling and capital expenditures, ongoing efficiency improvements and cost reduction initiatives are enabling natural gas production to grow. Higher production per well is driven both by the increased length of horizontal wells and improving recoverability rates using hydraulic fracturing. The average length drilled per well in 2014 was a record 3,623 metres.

Text version

Text version

Linear and bar graph of natural gas wells and metres drilled per well in Canada between 2004 and 2014. The graph shows that the number of wells drilled has sharply decreased since 2004, whereas the amount of metres drilled per well has more than tripled during this same period.

NATURAL GAS STORAGE

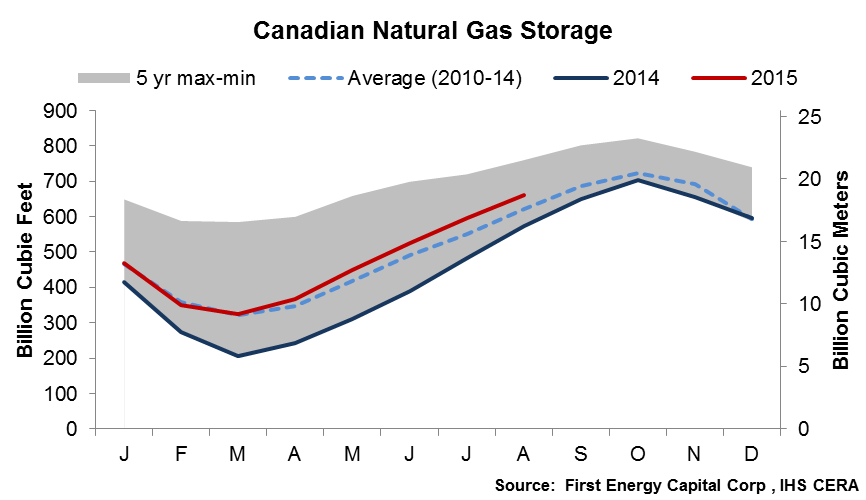

Natural gas storage follows a seasonal trend. In the summer, when natural gas demand is low, gas is injected into underground storage facilities so that it may be available and easily withdrawn during the winter months when demand reaches its annual maximum. Canada’s underground storage facilities can store approximately 30% of Canada’s annual natural gas demand, or close to 45% of the demand during the heating seasonFootnote 3.

The winter of 2013-2014 was unusually cold and long in North America, depleting natural gas storage inventories more than usual and driving prices to records highs. Despite increased and above-average storage injections to rebuild inventories during the summer of 2014, winter 2014-2015 began with higher prices, reflecting concern about storage levels being below their five-year minimum. Prices then dropped over the winter period when it became more certain that there would be no shortage given the sufficient supplies of natural gas.

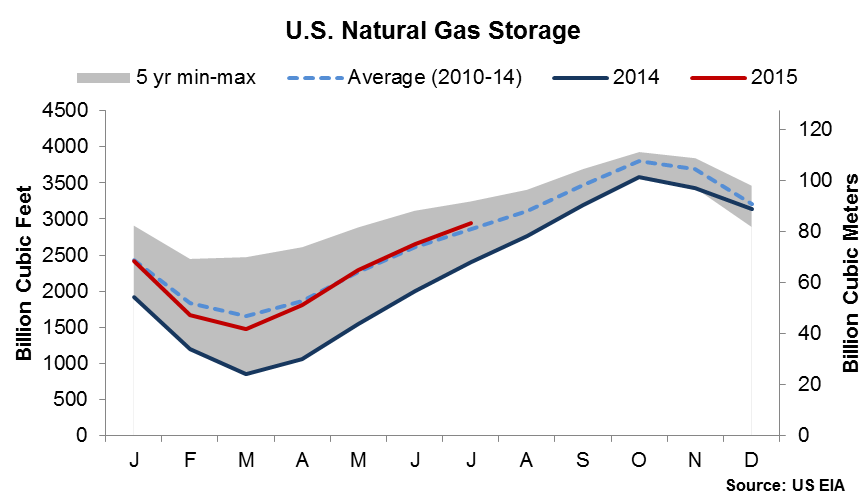

Entering the 2015-2016 heating season, North American storage levels returned near their past five-year average and could even exceed the October 2012 record of 4,700 billion cubic feet of natural gas. This is an indicator that the North American natural gas market is well supplied and that there should be ample natural gas in storage to meet any unexpected changes in demand next winter, which should provide some market stability and help moderate the volatility of prices.

Text version

Text version

Line graph of Canadian natural gas storage levels by month for 2014 and 2015 (year to date), and the five-year average (2010-14). The Canadian storage level in 2015 is above the five-year average.

Text version

Text version

Line graph of United States (U.S.) natural gas storage levels by month for 2014 and 2015 (year to date), and the five-year average (2010-14). The U.S. storage level in 2015 is above the five-year average.

DEMAND FOR NATURAL GAS

Domestic demand for natural gas is split amongst a variety of sectors. Industrial demand is highest, at 49%, followed by residential at 20%, commercial at 15%, and electricity generation at 13%.

Over the coming heating season, industrial demand will be primarily impacted by prevailing economic conditions, while residential, commercial and electricity generation demand will be affected by winter space heating and other requirements. Despite increasing oil sands production (oil sands production projects are major consumers of natural gas in Canada) current consultants' forecasts suggest natural gas consumption levels for the industrial sector will be similar to last year's levels. In the U.S., however, the EIA expects an increase in natural gas consumption for electricity generation due to low gas pricesFootnote 4.

WEATHER

Unusually cold weather can be a strong driver of natural gas demand and prices. As witnessed in 2013-2014, an unusually cold winter tends to put upward pressure on natural gas prices, while a mild winter tends to lead to weaker demand, which can moderate or even reduce prices and their volatility.

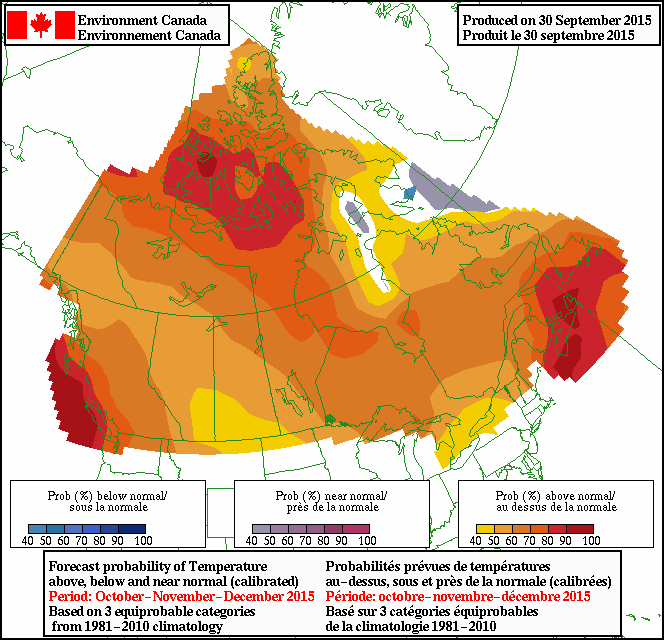

Environment Canada’s temperature outlook for November, December and January, predicts normal and above average temperatures for most of the countryFootnote 5. As a result, Canadian weather conditions are not expected to have a major impact on Canadian natural gas prices.

Text version

Text version

This graphic is Environment Canada’s temperature outlook for November, December and January. The outlook shows forecasts for normal and above average temperatures for most of the country.

For October to December 2015, the U. S. National Oceanic and Atmospheric Administration (NOAA) predicts that the U.S is likely to experience above average temperatures, and even higher temperatures in parts of the Pacific coast, the Northeast and Alaska. Temperatures in New Mexico and Texas, however, are likely to be below seasonal averagesFootnote 6. The U.S. EIA is projecting lower residential and commercial natural gas consumption this winter compared with last winter owing to milder weather forecastsFootnote 7.

ECONOMIC CONDITIONS

With industrial users accounting for 49% of Canada’s natural gas demand, and with industrial activity heavily influenced by economic conditions, the state of the economy can affect natural gas prices.

In its July 2015 Monetary Policy Report, the Bank of Canada noted that global growth had faltered during the first quarter, but that the second quarter saw stronger momentum and growth should average about 3% for the year. In 2015, the Bank of Canada expects the Canadian economy to grow by approximately 1%, while the U.S. economy is expected to grow by approximately 2.3%Footnote 8. With projected modest economic growth this heating season, industrial demand growth is not expected to be a major influence on the price of natural gas.

EXPORTS & IMPORTS

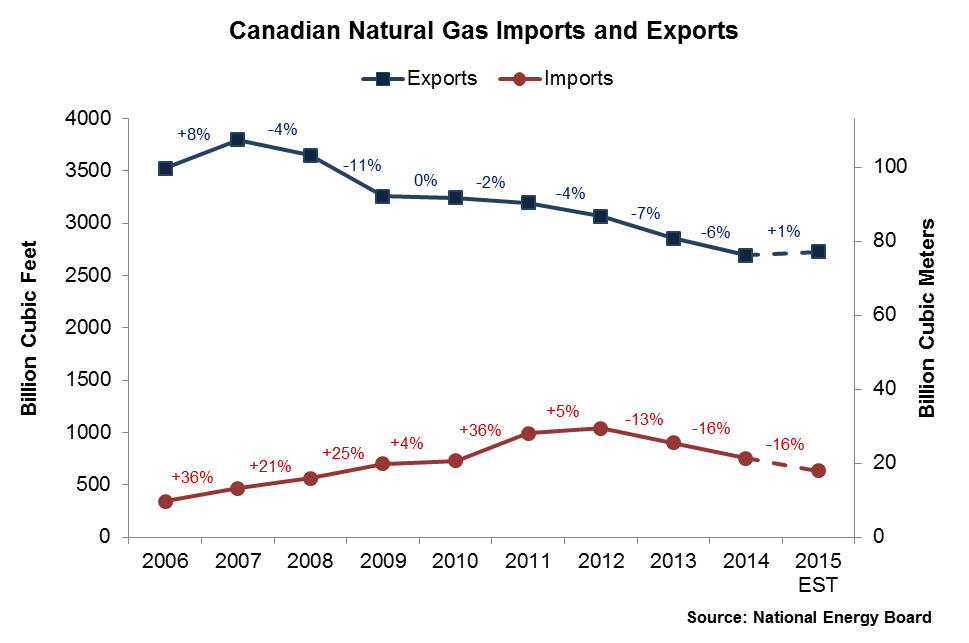

Canadian natural gas exports have continued to decline since 2007. One hundred percent of Canada’s natural gas exports are destined to the U.S. which, owing to its own growing supply, is less reliant on Canadian natural gas to meet its domestic demand. In July 2015, year-to-date Canadian exports to the U.S. were however 1% higher than at the same time last year. Although this data is preliminary and does not provide a view of the entire calendar year, a change in trends, possibly driven by the revival of economic activity in the U.S, could be seen. This increase could also be linked to a particularly hot summer in some U.S. regions.

Text version

Text version

A line graph of annual Canadian natural gas exports and imports between 2006 and 2014 (year to date). A blue line, representing Canada’s natural gas exports to the United States (U.S.), shows a 24% decline between 2006 and 2014 as well as a 1% increase in 2015 when compared to its July cumulative figures from the previous year. A red line, representing Canada’s natural gas imports from the U.S., shows a 120% increase between 2006 and 2014 and a 16% decline in 2015 when compared to its July cumulative figures from the previous year.

Canadian consumers are importing less gas from the U.S. than in 2014. Year-to-date imports are 16% lower than over the same period last year. This continues the trend reversal of significant natural gas import growth seen since 2012.

Overall, from 2010 to 2014, Canadian gas exports to the U.S. have declined by 7% and imports from the U.S. have increased by 21%, yielding a 15% decline in net exports.

SHORT-TERM PRICE OUTLOOK

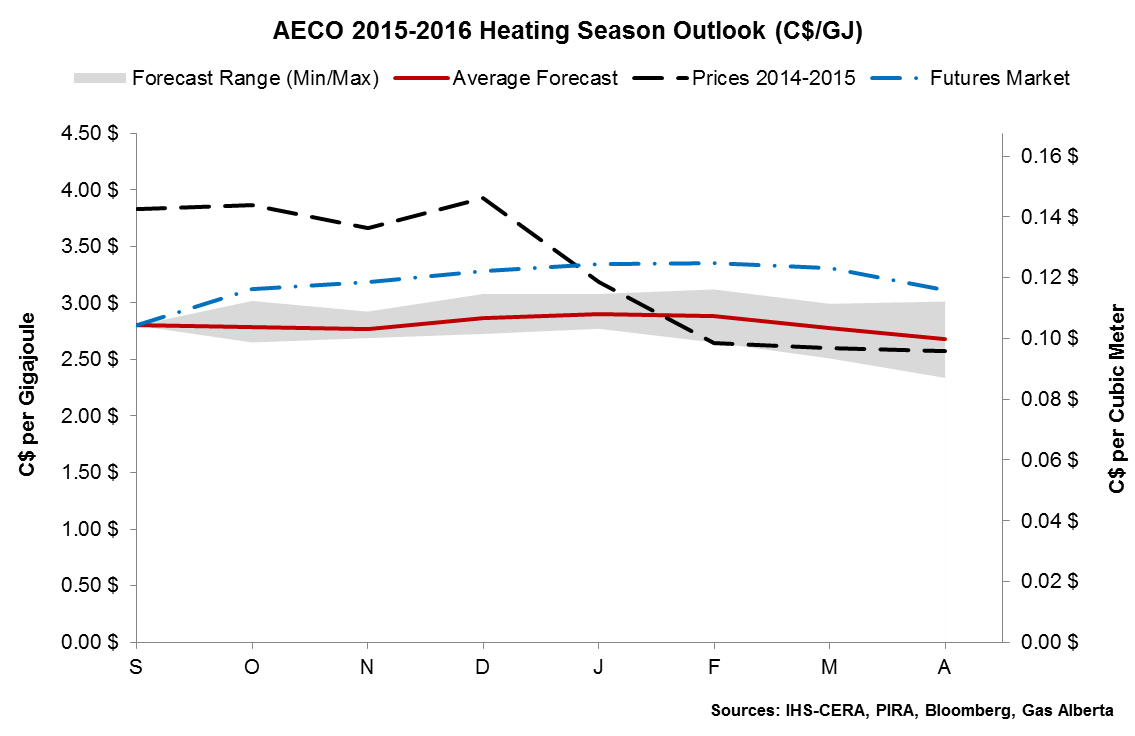

Based on a consolidation of selected expert consultants’ forecasts, benchmark Alberta wholesale natural gas prices (AECO) are expected to remain relatively stable moving into the winter heating season.

The average AECO price of consolidated forecasts is $2.83/GJ or $0.11/m3 over the 2015-2016 heating season, and the range of individual forecasts ranges from $2.51/GJ to $3.12/GJ. If this outlook is realized, natural gas prices will be lower on average than during last year’s heating season, which saw an average price of $3.20/GJ.

Text version

Text version

A line graph forecasting the AECO price for the 2014-15 heating season. The graph features average monthly prices between September and April (which includes heating season prices between November and March). A dashed line indicates prices from last year’s heating season which averaged $3.20/GJ. Another dashed line indicates prices on the natural gas futures market. A red line indicates the forecast prices for the 2015-2016 heating season which are expected to average $2.83/GJ. Contrary to last year’s AECO prices, the forecast for this year indicates stable prices throughout the heating season.

For the 2016 calendar year, the consultants however expect natural gas prices to be slightly higher than 2015, projecting an average price of $2.94/GJ. This represents a 9% increase from the projected average price of $2.71/GJ for the 2015 calendar year.

Overall, for the 2015-2016 winter heating season, Canadian consumers can expect slightly lower prices than last year, with less volatility given the current storage levels, the significant deliverability in North America and favourable weather forecasts. Canadian natural gas consumers should expect the winter 2015-2016 natural gas market to be stable, with no major surprises in natural gas prices and availability.

LINKS TO OTHER USEFUL RESOURCES AND HEATING OUTLOOKS

National Energy Board Outlook on Energy Situations

(http://www.neb-one.gc.ca/nrg/ntgrtd/index-eng.html)

U.S. EIA, Short-Term Energy and Winter Fuels Outlook

(www.eia.gov/forecasts/steo/)

Environment Canada Seasonal Forecasts

(www.weather.gc.ca/saisons/)

U.S. National Weather Service Forecasts

(www.cpc.ncep.noaa.gov/)

Canadian Gas Association Publications

(www.cga.ca/resources/publications/?lang=en)