Information Bulletin

(Published in September 2025)

Canada is a trading nation, with its minerals and metals sector (or “minerals sector”) playing a crucial role in its success, supplying ores, concentrates, and semi-fabricated and fabricated productsFootnote 1 to nearly every country worldwide.

Find out how Canada’s mineral trade is performing:

- Overview

- Trade by stage of processing

- Canada’s principal mineral trading partners

- Trade by commodity

- Trade by province and territory

- Tables

Overview

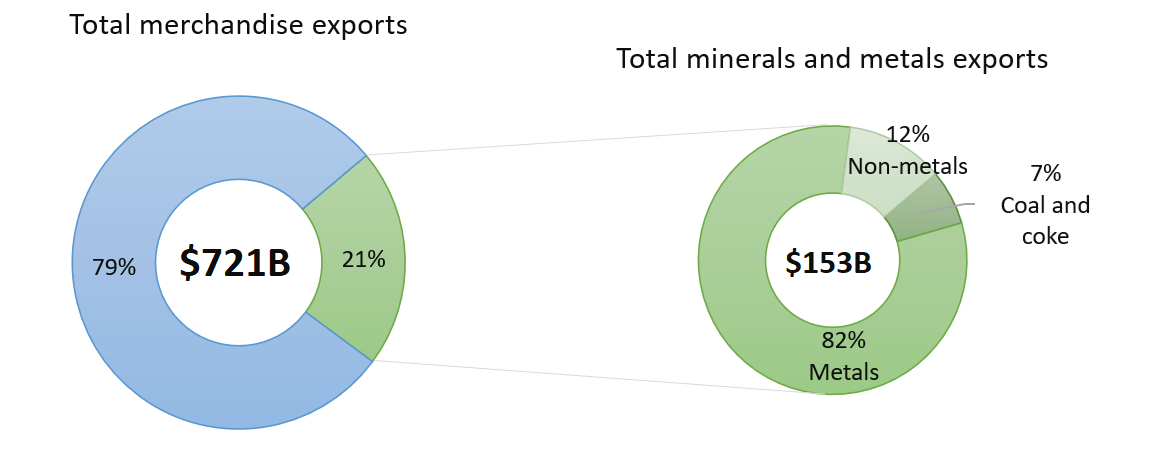

In 2024, Canada’s minerals sector exportsFootnote 2 rose by 2% year-over-year to reach $153.3 billion, accounting for 21% of all Canadian merchandise exports.

This growth was largely driven by a 33% increase in the value of gold exports, spurred by record-high gold prices throughout the year. A modest 2% recovery in commodity prices—reflected in the Bank of Canada’s metals and minerals price index—also supported the overall gain.

Figure 1. Canadian minerals and metals exports as a percentage of total merchandise exports, 2024

Data table – Figure 1

| Sector | Exports ($ billion) |

|---|---|

| Mineral and metal exports | 153.3 |

| Metals | 125.0 |

| Non-metals | 18.0 |

| Coal | 10.2 |

| Other exports | 567.8 |

| Total merchandise exports | 721.1 |

Sources: Natural Resources Canada, Statistics Canada.

B = billion.

Gold maintained its strong performance in 2024, continuing to break price records amid heightened global economic uncertainty, which led investors to increase their holdings of the traditional safe haven asset. Central banks significantly increased their gold purchases as a strategy to diversify reserves, hedge against inflation, and reduce exposure to geopolitical risks. This surge in demand extended gold’s lead as Canada’s top mineral export, accounting for more than a quarter of the sector’s total export value.

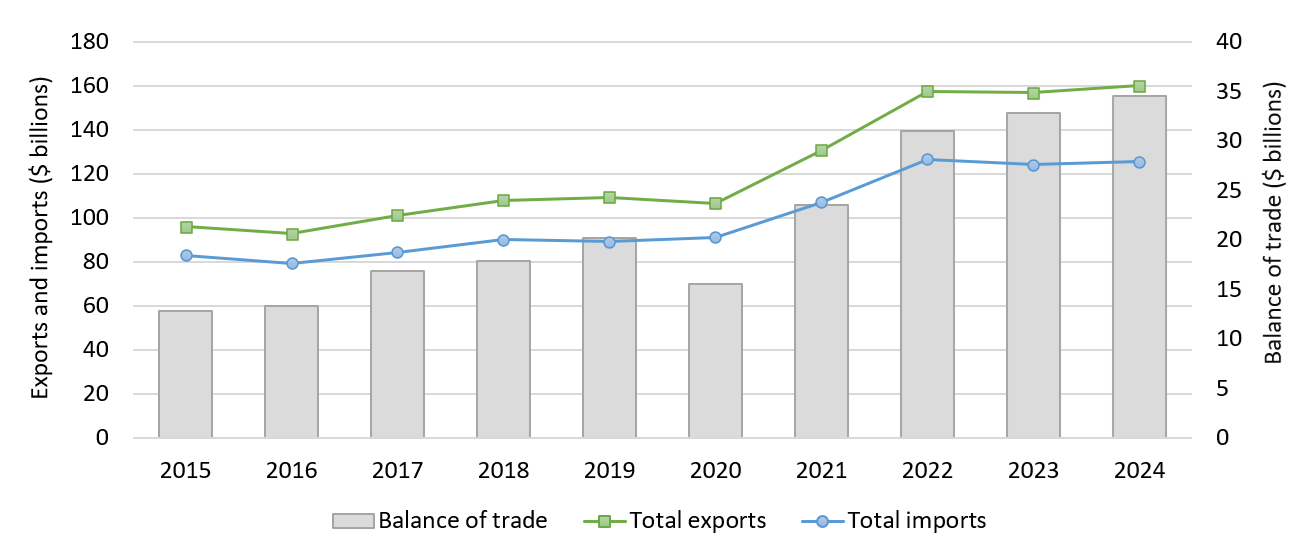

Total mineral imports also increased slightly in 2024, rising 1% to $125.7 billion and making up 16% of Canada’s total merchandise imports.

The value of total mineral exports (domestic exports plus re-exports) increased by 2% in 2024. With exports increasing at a faster rate than imports, Canada’s trade balance (total exports minus imports) for minerals and metals grew by 5% year-over-year, reaching $34.5 billion—its highest value since 2008.

Figure 2. Minerals and metals trade, 2015–2024

Data table – Figure 2

| Year | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| 2015 | 91.9 | 96.1 | 83.2 | 12.9 |

| 2016 | 88.6 | 92.8 | 79.5 | 13.3 |

| 2017 | 97.3 | 101.3 | 84.4 | 16.9 |

| 2018 | 104.3 | 108.1 | 90.2 | 17.9 |

| 2019 | 106.0 | 109.6 | 89.4 | 20.2 |

| 2020 | 102.6 | 106.8 | 91.3 | 15.5 |

| 2021 | 127.0 | 130.8 | 107.3 | 23.5 |

| 2022 | 153.1 | 157.8 | 126.8 | 31.0 |

| 2023 | 150.7 | 157.1 | 124.2 | 32.9 |

| 2024 | 153.3 | 160.2 | 125.7 | 34.5 |

Note: Domestic exports are displayed in Figure 2. However, total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

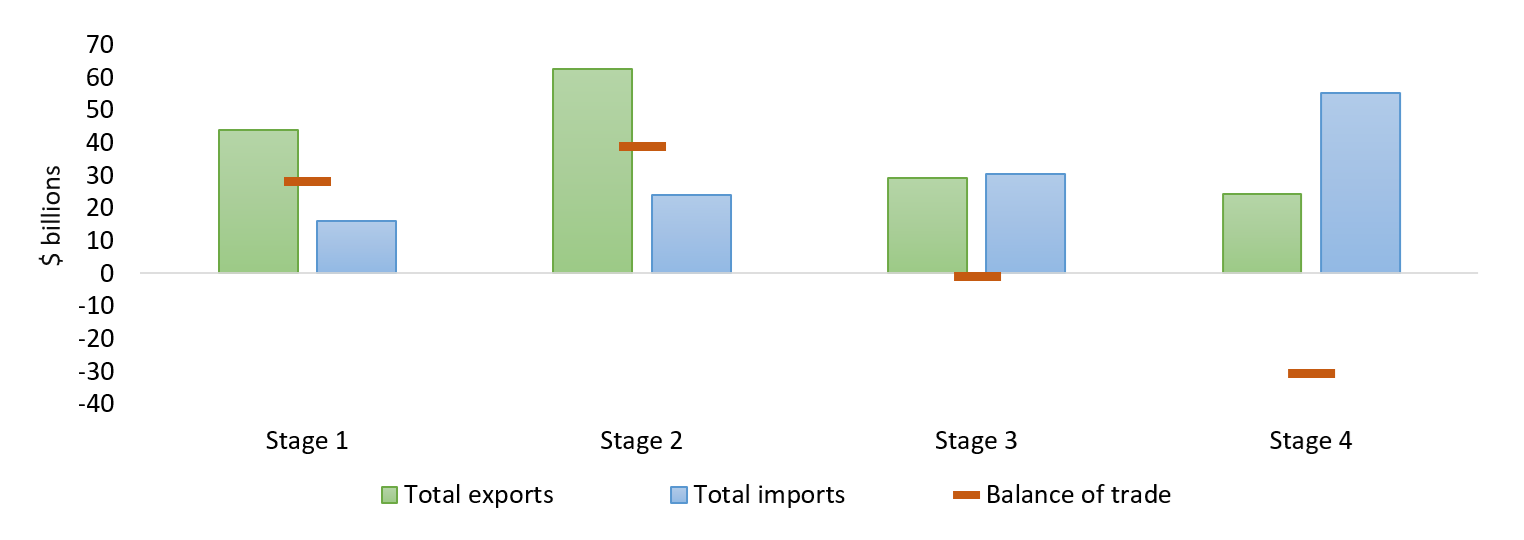

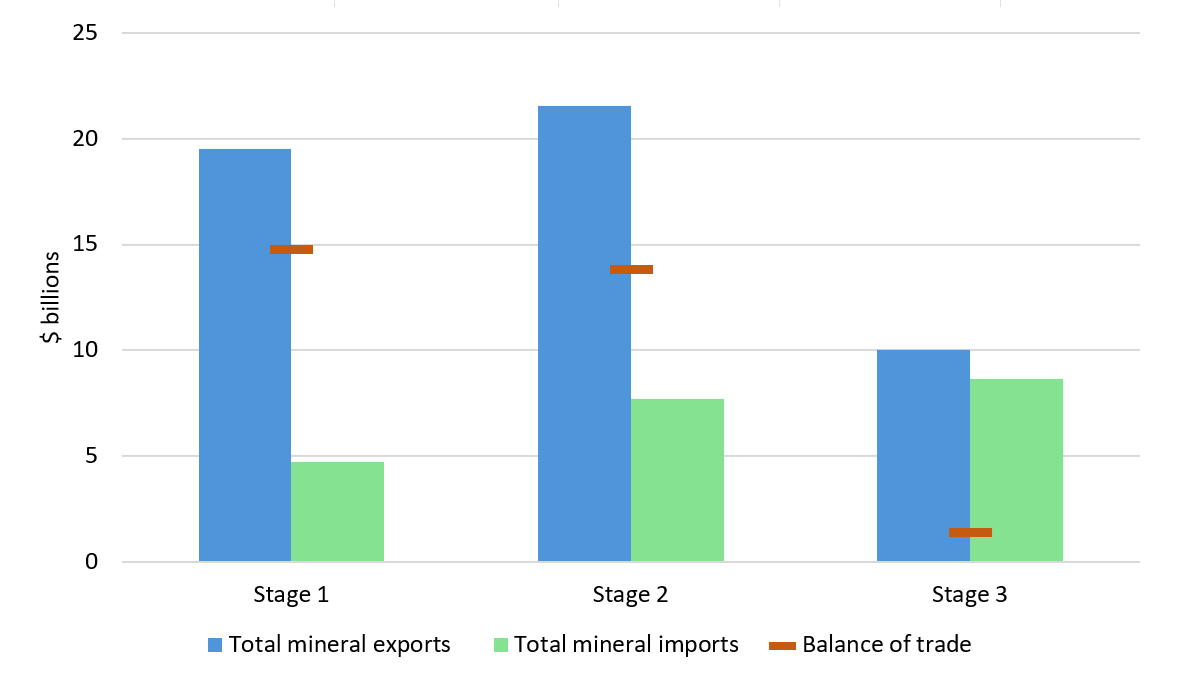

Trade by stage of processing

As illustrated in Figure 3, Canada exports significantly more mineral products in the upstream stages 1 and 2 than it imports. Conversely, it imports a higher value of mineral products in the downstream stages 3 and 4 than it exports. This results in a positive trade balance in the upstream segments of the value chain and a negative balance downstream, reflecting Canada’s rich geological resources and strong mining and mineral processing capabilities compared to its more limited manufacturing capacity.

In 2024, the trade balance for stage 1 products dropped by 21% to $28.1 billion, while for stage 2 products, it increased by 38% to $38.6 billion. Stage 3 products saw an improvement, rising to -$1.2 billion from -$3.1 billion in the previous year, while stage 4 products decreased to -$30.9 billion from -$27.5 billion in the previous year.

Mineral products are classified into four stages of processing:

Stage 1 (primary products) includes metal scrap and products from the mining industry, such as ores and concentrates.

Stage 2 (smelting and refining products) includes products from metallurgical processes, which are relatively pure minerals, metals and alloys.

Stage 3 (semi-fabricated products) includes semi-fabricated products that are input in other industries, such as wire, sheets, strips, tubes and flat rolls.

Stage 4 (fabricated products) includes further processed products and final goods, such as metal structures and framing, hardware items, tools, cutlery and pipefittings.

Figure 3: Mineral and metal trade by stage, 2024

Data table – Figure 3

| Stage | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Stage 1 — Primary products | 44.0 | 44.0 | 15.9 | 28.1 |

| Stage 2 — Smelting and refining products | 61.1 | 62.5 | 23.9 | 38.6 |

| Stage 3 — Semi-fabricated products | 27.3 | 29.3 | 30.5 | -1.2 |

| Stage 4 — Fabricated products | 20.8 | 24.4 | 55.3 | -30.9 |

| Total minerals and metals | 153.3 | 160.2 | 125.7 | 34.6 |

Note: Total exports (including re-exports) are displayed in Figure 3. Total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

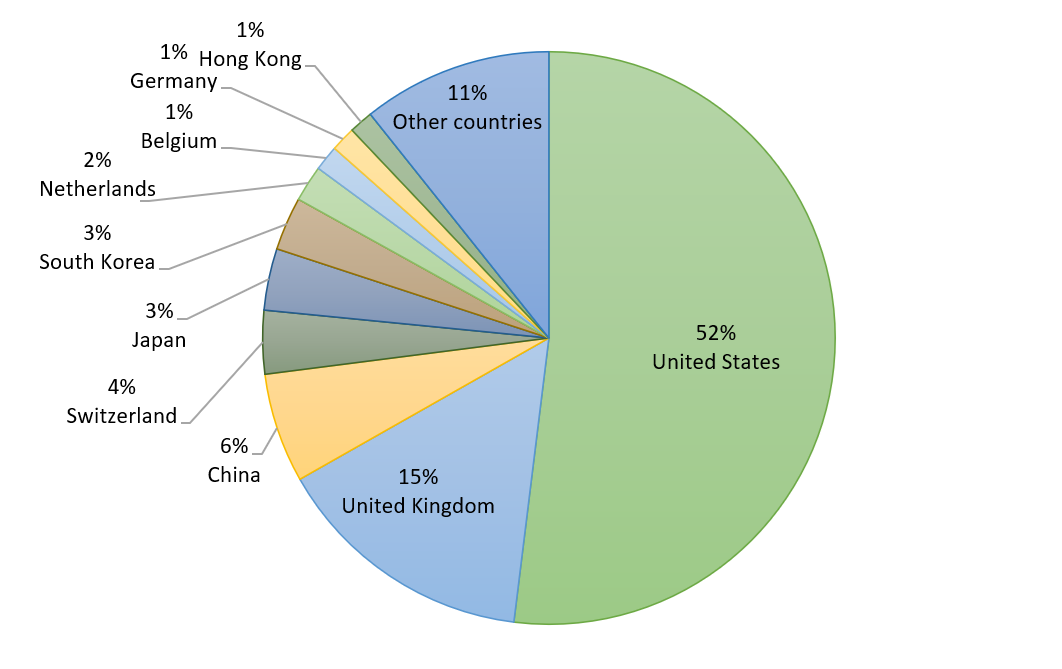

Canada’s principal mineral trading partners

The United States remained Canada’s top destination for mineral exports in 2024, representing 52% of total shipments. Other key markets included the United Kingdom (15%), China (6%), Switzerland (4%), Japan (3%), and South Korea (3%). Together, these six countries accounted for 83% of Canada’s mineral exports.

Figure 4. Canada’s mineral exports by country, 2024

Text version – Figure 4

This pie chart illustrates Canada’s mineral exports by country, with the United States as the leading destination, accounting for 52% of the total. Other notable destinations included the United Kingdom (15%), China (6%), Switzerland (4%), Japan (3%), South Korea (3%), the Netherlands (2%), Belgium (1%), Germany (1%), and Hong Kong (1%). Collectively, other countries account for the remaining 11%.

Sources: Natural Resources Canada, Statistics Canada.

Find out more about Canada’s top three mineral and metal export markets for 2024:

United States

- In 2024, bilateral mineral trade between Canada and the United States was valued at $142.0 billion, marking a 3% decrease from the previous year.

- Canada maintained a significant positive trade balance in minerals and metals with the United States, reaching $26.8 billion in 2024. However, this was a 15% decline from the previous year.

- The value of exports to the United States in 2024 amounted to $79.6 billion, reflecting a 5% decline compared to the previous year.

- Mineral exports were divided between upstream stage 1 and 2 products (47%) and downstream stage 3 and 4 products (53%).

- The leading exports included:

- Iron and steel ($18.7 billion, or 23% of the total)

- Aluminum ($15.8 billion, or 20% of the total)

- Gold ($9.2 billion, or 12% of the total)

- Copper ($5.6 billion, or 8% of the total)

- Potash ($4.2 billion, or 5% of the total)

- Canada also plays a crucial role as a supplier of critical minerals to the United States, including uranium, tellurium, and niobium.

- In 2024, Canada’s mineral imports from the United States increased by 1% to $57.6 billion.

- Stage 1 and 2 products comprised 28% of the imports, while stage 3 and 4 products accounted for the majority at 72%.

- The top imports included:

- Iron and steel ($15.7 billion, or 27% of the total)

- Gold ($6.7 billion, or 12% of the total)

- Aluminum ($4.2 billion, or 7% of the total)

United Kingdom

- In 2024, bilateral mineral trade between Canada and the United Kingdom was valued at $24.1 billion, a 126% increase compared to the previous year, driven primarily by a surge in gold exports.

- Canada maintained a positive trade balance for minerals and metals with the United Kingdom, valued at $22.7 billion in 2024.

- Canada’s mineral and metal exports to the United Kingdom increased by 141% to $22.7 billion in 2024.

- Gold was the leading export, valued at $21.8 billion, which accounted for 96% of the total value of mineral exports. Other notable exports included uranium ($560 million or 2% of the total) and iron ore ($140 million or 1% of the total).

- Gold comprised 81% of Canada’s total merchandise exports value of $27.0 billion to the United Kingdom in 2024. Canada exported 201 tonnes of gold to the United Kingdom in 2024, representing 52% of its total gold exports. This flow of gold is mainly due to the United Kingdom’s role as a financial hub for global gold trade, where international investors actively buy and sell gold on the London Bullion Market Association.

- In 2024, Canada’s mineral imports from the United Kingdom declined by 19% to $687 million. The primary metals imported were iron and steel, which accounted for 34% of total imports, followed by gold and nickel at 7% each.

China

- China is one of the largest global producers and consumers of various minerals and metals.

- In 2024, bilateral mineral trade between Canada and China was valued at $24.4 billion, a 1% increase compared to the previous year.

- Canada had a negative trade balance for minerals and metals with China, amounting to -$5.3 billion in 2024.

- The value of mineral exports to China fell by 9% to $9.5 billion in 2024.

- These exports were predominantly stage 1 products, which accounted for 94% of the total value.

- The leading exports included:

- Coal ($2.8 billion, or 29% of the total)

- Iron ore ($2.4 billion, or 26% of the total)

- Copper ($2.0 billion, or 21% of the total)

- Gold ($504 million, or 5% of the total)

- Potash ($500 million, or 5% of the total)

- In 2024, Canada’s mineral imports from China increased by 8% to $14.9 billion.

- These imports were predominantly stage 4 manufactured goods, which constituted 73% of the value.

- The top imports included:

- Iron and steel ($4.9 billion, or 33% of the total)

- Aluminum ($1.8 billion, or 12% of the total)

- Glass ($798 million, or 5% of the total)

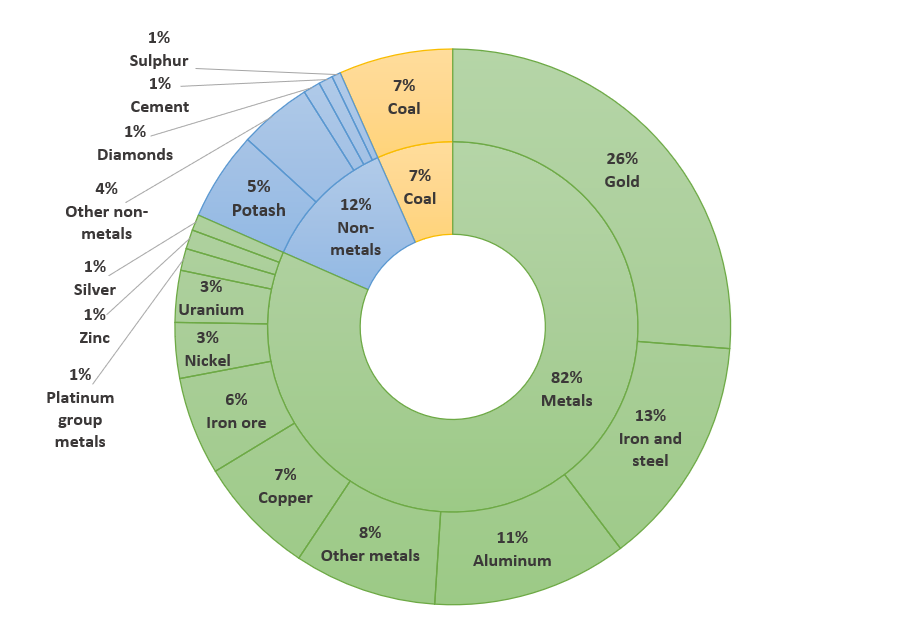

Trade by commodity

In 2024, the export value of metals rose by 8%, while it dropped for non-metals and coal by 19% and 20%, respectively. Metals accounted for the largest share of total export value at 82%, followed by non-metals at 12% and coal at 7%.

Figure 5. Mineral and metal exports by commodity, 2024

Data table – Figure 5

| Commodity | Domestic exports ($ millions) |

|---|---|

| Metals | 125,045 |

| Gold | 40,231 |

| Iron and steel | 20,593 |

| Aluminum | 17,396 |

| Copper | 10,660 |

| Iron ore | 8,767 |

| Nickel | 4,616 |

| Uranium | 4,958 |

| Zinc | 1,956 |

| Silver | 1,718 |

| Platinum group metals | 1,413 |

| Other metals | 12,737 |

| Non-metals | 18,045 |

| Potash | 7,954 |

| Diamonds | 1,519 |

| Sulphur | 1,268 |

| Sulphur and sulphur compounds | 788 |

| Other non-metals | 6,516 |

| Coal | 10,175 |

| Total | 153,272 |

Sources: Natural Resources Canada, Statistics Canada.

Metal products

In 2024, the value of metal product exports rose by 8% compared to the previous year, reaching $125.0 billion. However, Canada’s top exported metals saw mixed results. Export values increased for uranium (53%), gold (33%), copper (15%), silver (14%), and aluminum (3%), while they decreased for platinum group metals (-45%), nickel (-21%), iron and steel (-6%), zinc (-5%), and iron ore (-2%).

Metal imports increased by 2% to $106.2 billion in 2024, with varied results across commodities. Imports increased for aluminum (13%), zinc (13%), copper (12%), and gold (10%). Conversely, declines were observed for uranium (-37%), nickel (-25%), platinum group metals (-24%), and iron and steel (-4%), while iron ore imports did not change from the previous year.

Non-metal products

In 2024, the value of Canada’s non-metal exports declined by 19% to $17.6 billion. This drop was largely driven by potash and diamonds, which are also Canada’s leading non-metal exports in terms of value.

Potash exports fell by 31% to $8.0 billion in 2024. During the COVID-19 pandemic, the global potash supply was disrupted by production challenges, a situation further compounded by economic sanctions on Russia—the world’s second-largest potash producer after Canada—following its invasion of Ukraine. Russia’s restrictions on fertilizer exports contributed to a surge in potash prices in 2021 and 2022. However, prices dropped sharply in 2023 as global supply concerns subsided and continued to decline into 2024.

Diamond exports decreased by 30% to $1.5 billion in 2024, primarily because of a 21% decline in the quantity exported.

Non-metal imports, 90% of which are stage 3 or 4 products, saw a 1% decline in 2024 to $17.6 billion.

Coal and coke products

In 2024, the value of exports of coal and coke products declined by 20% to $10.2 billion. This drop was primarily driven by a significant decrease in the price of metallurgical coal, which is used in steel manufacturing and accounted for 87% of the total export value.

Meanwhile, imports of coal and coke products also declined in 2024, by 15% to $1.9 billion. Metallurgical coal made up 27% of the import value, down from 42% in 2023.

Critical minerals

The Government of Canada unveiled the Canadian Critical Minerals Strategy in December 2022 as a foundational step toward securing a sustainable and resilient supply of minerals vital to the country's economic prosperity, national security, and clean energy transition. Canada released an updated list of critical minerals in 2024 through consultations with provinces, territories, industry stakeholders and Indigenous organizations.

In 2024, the value of critical mineralsFootnote 3exports declined by 4% to $48.1 billion (Table 3). This drop was primarily due to falling prices, particularly for potash, aluminum and nickel. Aluminum led in export value at 33%, followed by copper (22%), potash (17%), uranium (10%), nickel (9%), and zinc (4%). Together, these minerals comprised 94% of critical minerals exports.

The value of critical minerals imports stayed the same at $21.0 billion. Aluminum (including alumina for processing into aluminum) accounted for 39% of the import value, followed by copper (25%), platinum group metals (7%), zinc (6%), nickel (5%), and uranium (5%). Together, these minerals comprised 88% of critical minerals imports.

Canada is the world’s fourth-largest producer and second-largest exporter of aluminum. However, with no domestic bauxite mines (the key ingredient for aluminum production), Canada imports ores and refined alumina for production. Brazil is Canada’s main supplier of alumina and bauxite, accounting for 73% of the $3.0 billion in imports in 2024.

In 2024, Canada’s critical minerals trade balance declined 5% year-over-year to $28.4 billion.

The United States remained Canada’s top trading partner for critical minerals in 2024 (Table 4), with total trade valued at $39.2 billion, reflecting a 2% increase from the previous year. Exports to the United States reached $30.7 billion, accounting for 63% of Canada’s total critical minerals exports. Meanwhile, imports from the United States were $8.2 billion in total, or 39% of Canada’s critical minerals imports. Canada maintained a positive trade balance with the United States at $22.9 billion, reflecting a 5% increase over the previous year.

China was Canada’s second-largest critical minerals trading partner, with trade totaling $5.0 billion, followed by Brazil ($3.7 billion) and the Netherlands ($2.0 billion). Exports to China amounted to $3.0 billion, while imports totaled $2.0 billion. Copper ($2.0 billion) and potash ($500 million) were the top exports, accounting for 83% of the total export value. On the import side, aluminum ($1.3 billion, mostly in stage 3 products) and magnesium ($266 million) were the largest imports, representing 79% of Canada’s critical minerals imports from China.

As illustrated in Figure 6, most critical minerals exports are concentrated in stages 1 and 2 of the value chain, reflecting Canada’ s upstream strength in critical minerals processing.

Figure 6. Critical minerals trade by stage, 2024

Data table – Figure 6

| Stage | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Stage 1 — Primary products | 16.2 | 16.2 | 4.6 | 11.6 |

| Stage 2 — Smelting and refining products | 20.6 | 20.6 | 8.3 | 12.4 |

| Stage 3 — Semi-fabricated products | 11.3 | 12.5 | 8.4 | 4.0 |

| Total minerals and metals | 48.1 | 49.4 | 21.3 | 28.1 |

Note: Total exports (including re-exports) are displayed in Figure 6. Total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

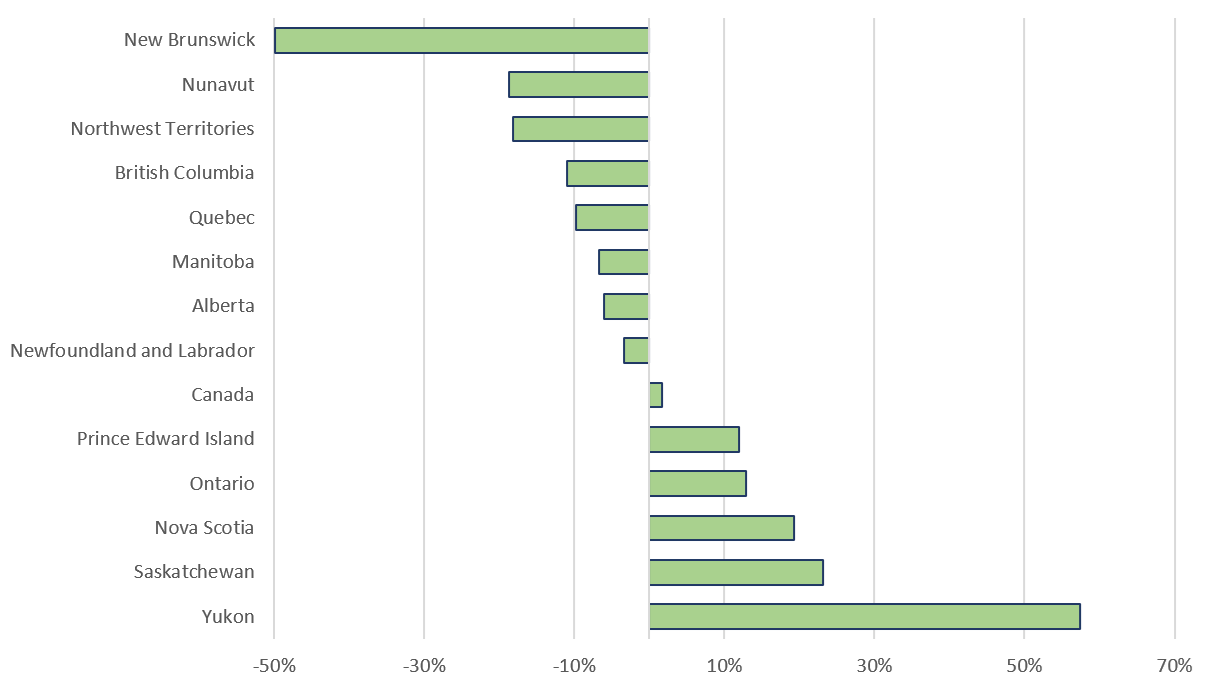

Trade by province and territory

Most of Canada’s mineral trade is concentrated in Ontario and Quebec, with these two provinces accounting for 56% and 20% of exports, respectively. Ontario also led mineral imports, representing 62% of the total, while Quebec followed at 16%. This pattern reflects the significant processing of mine outputs within these provinces before export, along with the high concentration of manufacturing industries. It also highlights the strategic importance of Ontario and Quebec as entry points for Canadian imports because of their proximity to major consumer markets.

From 2023 to 2024, provincial and territorial mineral export values showed mixed results, as illustrated in Figure 7. Most regions experienced a decline in the value of exports, including New Brunswick (-50%), Nunavut (-19%), the Northwest Territories (-18%), British Columbia (-11%), Quebec (-10%), Manitoba (-7%), Alberta (-6%), and Newfoundland and Labrador (-3%). However, some regions saw increases, including Yukon (57%), Saskatchewan (23%), Nova Scotia (19%), Ontario (13%), and Prince Edward Island (12%).

Figure 7. Variation of mineral export values between 2023 and 2024, by province and territory

Text version — Figure 7

This chart illustrates the changes in the value of mineral and metal exports across provinces and territories between 2023 and 2024. New Brunswick saw the largest decline (-50%), followed by Nunavut (-19%), the Northwest Territories (-18%), British Columbia (-11%), Quebec (10%), Manitoba (-7%), Alberta (6%), and Newfoundland and Labrador (-3%). These lower values were offset by increases in other regions, with Yukon recording the highest rise (57%), followed by Saskatchewan (23%), Nova Scotia (19%), Ontario (13%), and Prince Edward Island (12%). Overall, Canada experienced a 2% decline in the total export value.

Sources: Natural Resources Canada, Statistics Canada.

Mineral commodity exports represented a significant share of total merchandise exports for several provinces and territories—making up nearly half of British Columbia’s exports, 37% of Yukon’s, one third of Ontario’s, 31% of Nunavut’s, and one quarter of Quebec’s.

Tables

| Country | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| United States | 79,632 | 84,416 | 57,607 | 26,810 |

| United Kingdom | 22,737 | 23,426 | 686 | 22,740 |

| China | 9,483 | 9,522 | 14,871 | -5,348 |

| Switzerland | 5,485 | 5,491 | 2,570 | 2,921 |

| Japan | 5,342 | 5,356 | 2,573 | 2,782 |

| South Korea | 4,614 | 4,623 | 2,256 | 2,366 |

| Netherlands | 3,127 | 3,567 | 339 | 3,228 |

| Belgium | 2,201 | 2,215 | 361 | 1,854 |

| Germany | 2,149 | 2,449 | 2,691 | -242 |

| Hong Kong | 2,070 | 2,104 | 70 | 2,034 |

| India | 2,067 | 2,082 | 1,742 | 340 |

| Norway | 1,947 | 1,957 | 122 | 1,835 |

| Mexico | 1,380 | 1,513 | 5,077 | -3,564 |

| Brazil | 1.241 | 1,260 | 5.779 | -4,519 |

| France | 1,046 | 1,116 | 903 | 213 |

| Taiwan | 974 | 977 | 1,760 | -783 |

| Australia | 806 | 833 | 1,611 | -778 |

| Spain | 633 | 656 | 913 | -257 |

| Malaysia | 610 | 613 | 306 | 307 |

| Indonesia | 512 | 520 | 453 | 67 |

| Other countries | 5,217 | 5,537 | 22,997 | -17,461 |

| Total | 153,272 | 160,233 | 125,687 | 34,546 |

Sources: Natural Resources Canada, Statistics Canada

| Province and territory | Domestic mineral exports | Total mineral exports | Total mineral imports | Total domestic exports | Domestic mineral exports as a percentage of the total |

|---|---|---|---|---|---|

| Ontario | 85,633,782 | 90,075,532 | 78,283,990 | 252,419,662 | 33.9% |

| Quebec | 30,531,617 | 32,245,472 | 20,349,644 | 121,362,928 | 25.2% |

| British Columbia | 26,653,000 | 27,128,015 | 12,131,737 | 54,650,354 | 48.8% |

| Saskatchewan | 2,835,511 | 2,875,361 | 2,453,315 | 45,316,688 | 6.3% |

| Manitoba | 2,281,398 | 2,340,899 | 5,186,249 | 20,559,219 | 11.1% |

| Nova Scotia | 1,600,568 | 1,644,114 | 710,448 | 6,631,832 | 24.1% |

| Alberta | 1,317,981 | 1,431,663 | 5,662,371 | 182,745,626 | 0.7% |

| New Brunswick | 882,532 | 917,428 | 723,234 | 17,458,678 | 5.1% |

| Nunavut | 698,216 | 698,218 | 3,463 | 2,280,054 | 30.6% |

| Newfoundland and Labrador | 508,521 | 536,388 | 148,519 | 13,634,555 | 3.7% |

| Northwest Territories | 267,003 | 267,003 | 5 | 1,390,040 | 19.2% |

| Yukon | 55,229 | 65,308 | 3,507 | 149,675 | 36.9% |

| Prince Edward Island | 7,140 | 7,150 | 30,478 | 2,517,927 | 0.3% |

| Canada | 153,272,499 | 160,232,551 | 125,686,960 | 721,117,237 | 21.3% |

Sources: Natural Resources Canada, Statistics Canada

| Critical mineral | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Aluminum | 15,653,570 | 15,891,097 | 8,167,540 | 7,723,557 |

| Antimony | 2,092 | 2,178 | 39,759 | -37,581 |

| Bismuth | 572 | 610 | 3,460 | -2,850 |

| Chromium | 3,871 | 5,326 | 116,770 | -111,444 |

| Cobalt | 343,701 | 349,483 | 50,042 | 299,440 |

| Copper | 10,514,155 | 10,590,239 | 5,239,512 | 5,350,727 |

| Fluorspar | 8,699 | 9,852 | 163,135 | -153,283 |

| Germanium | 44,526 | 44,885 | 8,070 | 36,814 |

| Graphite | 71,433 | 80,744 | 213,608 | -132,864 |

| Helium | 28,569 | 28,569 | 314 | 28,255 |

| Lithium | 7 | 7 | 16,970 | -16,963 |

| Magnesium | 88,838 | 91,369 | 335,291 | -243,921 |

| Manganese | 1,056 | 8,695 | 237,066 | -228,370 |

| Molybdenum | 120,532 | 122,627 | 116,935 | 5,693 |

| Nickel | 4,467,723 | 4,509,909 | 1,139,972 | 3,369,937 |

| Niobium | 407,137 | 407,139 | 32,492 | 374,647 |

| Phosphate | 5,573 | 5,611 | 8,542 | -2,931 |

| Platinum group metals | 635,233 | 642,392 | 1,437,043 | -794,652 |

| Potash | 7,953,581 | 7,957,209 | 144,879 | 7,812,330 |

| Rare earth elements (REEs) | 2,728 | 5,757 | 6,772 | -1,015 |

| Tantalum | 14,304 | 14,779 | 14,417 | 363 |

| Tellurium | 39,729 | 61,016 | 54,959 | 6,058 |

| Tin | 31,124 | 31,152 | 119,920 | -88,768 |

| Titanium metal | 167,700 | 182,106 | 406,171 | -224,065 |

| Tungsten | 32,776 | 37,177 | 52,790 | -15,614 |

| Uranium | 4,957,618 | 5,729,953 | 1,151,827 | 4,578,126 |

| Vanadium | 47,014 | 47,124 | 52,298 | -5,174 |

| Zinc | 1,908,635 | 1,910,389 | 1,333,842 | 576,547 |

| Other metals | 450,681 | 459,636 | 320,202 | 139,433 |

| Other nonmetals | 137,599 | 137,657 | 38,830 | 98,827 |

| Total | 48,140,776 | 49,364,686 | 21,023,429 | 28,341,257 |

Sources: Natural Resources Canada, Statistics Canada

| Country | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| United States | 30,734 | 31,081 | 8,160 | 22,920 |

| China | 3,029 | 3,033 | 1,969 | 1,065 |

| Netherlands | 1,519 | 1,938 | 42 | 1,895 |

| Norway | 1,561 | 1,561 | 82 | 1,479 |

| Germany | 1,088 | 1,303 | 313 | 989 |

| Japan | 1,290 | 1,290 | 64 | 1,226 |

| Brazil | 1,155 | 1,158 | 2,511 | -1,353 |

| South Korea | 1,080 | 1,080 | 146 | 934 |

| India | 984 | 984 | 269 | 715 |

| United Kingdom | 638 | 808 | 91 | 717 |

| Belgium | 765 | 766 | 113 | 653 |

| Malaysia | 479 | 480 | 77 | 402 |

| France | 433 | 435 | 114 | 321 |

| Indonesia | 434 | 434 | 28 | 406 |

| Mexico | 339 | 372 | 231 | 141 |

| Finland | 329 | 329 | 250 | 79 |

| Taiwan | 267 | 268 | 46 | 221 |

| Thailand | 219 | 219 | 18 | 202 |

| Switzerland | 199 | 199 | 150 | 49 |

| Italy | 179 | 179 | 127 | 52 |

| Other Countries | 1,421 | 1,449 | 6,222 | -4,773 |

| Total | 48,141 | 49,365 | 21,023 | 28,341 |

Sources: Natural Resources Canada, Statistics Canada.