Statement outlining results, risks and significant changes in operations, personnel and programs

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and any Supplementary Estimates approved in a given year by the date of this report. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board (TB). This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

Natural Resources Canada (NRCan) works to improve the quality of life of Canadians by ensuring that our natural resources are developed sustainably, providing a source of jobs, prosperity, and opportunity, while preserving our environment and respecting our communities and Indigenous peoples.

Further details on NRCan’s authority, mandate and programs can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates for the 2025-2026 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements that are part of the departmental results reporting process; however, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This Departmental Quarterly Financial Report reflects the results as of June 30, 2025, which include Main Estimates for which full supply was released. The details presented in this report focus on and compare the first quarter results of 2025-2026 with those of 2024-2025.

2.1 Authorities

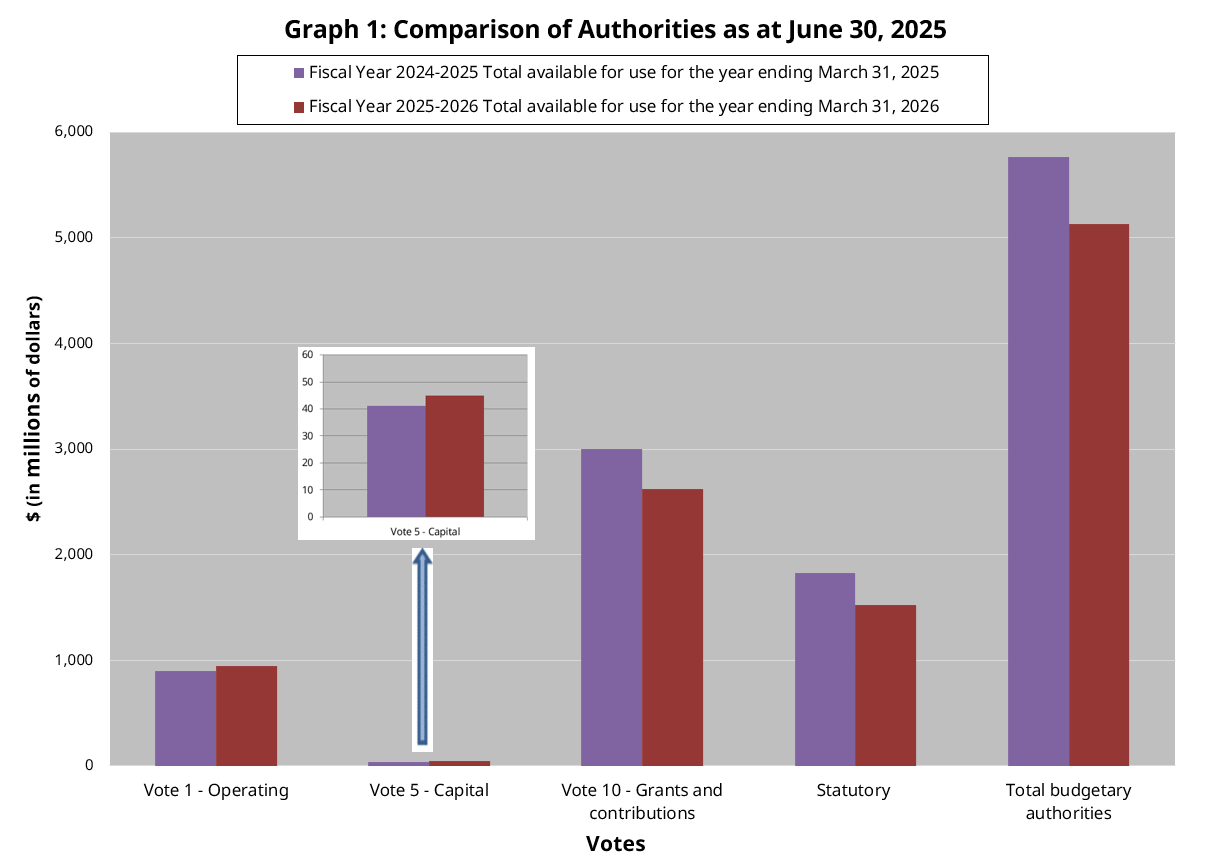

As per Table 1, presented at the end of this document, and on Graph 1 below, as at June 30, 2025, NRCan has authorities available for use of $5,132.6M compared to $5,765.4M in 2024-2025, for a net decrease of $632.8M or 11.0%.

Text Version

| (in millions of dollars) | Fiscal Year 2024-2025 Total available for use for the year ending March 31, 2025 | Fiscal Year 2025-2026 Total available for use for the year ending March 31, 2026 |

|---|---|---|

| Vote 1 - Operating | 897 | 944 |

| Vote 5 - Capital | 41 | 45 |

| Vote 10 - Grants and contributions | 2,996 | 2,621 |

| Statutory | 1,831 | 1,523 |

| Total budgetary authorities | 5,765 | 5,133 |

The decrease of $632.8M in authorities in 2025-2026 compared to 2024-2025 is mainly explained by the decrease within the Vote 10 grants and contributions and Statutory authorities as well as the net effect of smaller fluctuations within Vote 1 operating expenditures and Vote 5 capital expenditures as per the following:

| Total available for use for the year ending March 31, 2025 | 5,765,391 |

|---|---|

| Vote 1 - Operating | |

| Increase in Collective Bargaining Agreements | 17,643 |

| UNCLOS - Extended Continental Shelf | 16,100 |

| Polar Continental Shelf Program | 11,387 |

| All other net increases less than $10M individually | 2,086 |

| Sub-total Vote 1 - Operating | 47,216 |

| Vote 5 - Capital | |

| Polar Continental Shelf Program | 6,435 |

| Energy Innovation Program | 3,530 |

| Canadian Data Receiving Infrastructure | (4,429) |

| All other net decreases less than $3M individually | (1,851) |

| Sub-total Vote 5 - Capital | 3,685 |

| Vote 10 - Grants & Contributions | |

| Canada Greener Homes Affordability Program (CGHAP) | 44,874 |

| Critical Minerals | 33,110 |

| Decarbonization of On-road Transportation - Zero-Emission Vehicle Infrastructure Program | 25,085 |

| The Sustainable Advancement of Canada's Forest Economy | 20,546 |

| Smart Grids | 20,500 |

| Greener Homes | (183,543) |

| Clean Fuels Fund | (181,115) |

| Smart Renewables & Electrification Pathways | (179,108) |

| Electricity Pre-Development | (26,355) |

| All other net increases less than $20M individually | 50,374 |

| Sub-total Vote 10 - Grants & Contributions | (375,632) |

| Statutory | |

| Newfoundland Offshore Petroleum Resources Revenue Fund (Forecasts are revised annually based on projected oil & natural gas production levels, prices, exchange rates and operator's costs) | (323,328) |

| All other net increases | 15,245 |

| Sub-total Statutory | (308,083) |

| Total decrease from previous year due to year-over-year changes | (632,814) |

| Total available for use for the year ending March 31, 2026 | 5,132,577 |

2.2 Budgetary Expenditures by Standard Object

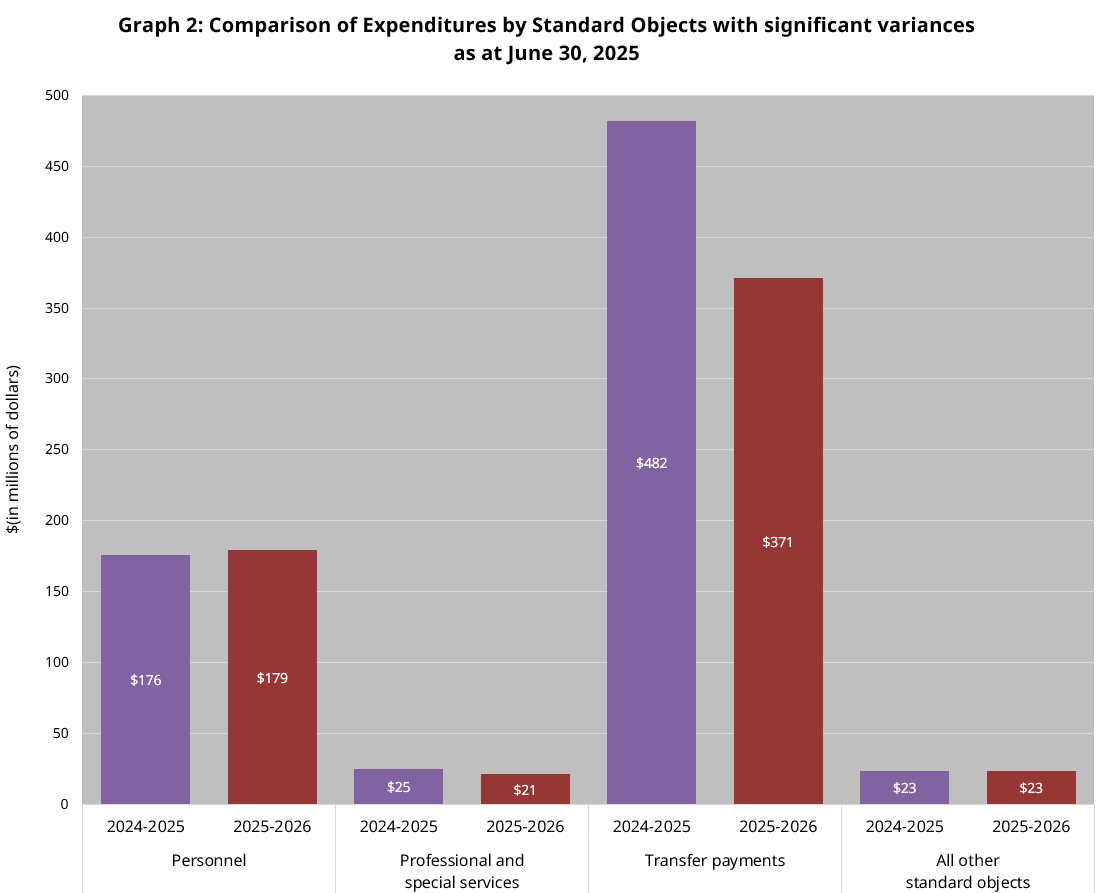

The spending for the quarter ending June 30, 2025 amounts to $594.3M or 11.6% of total funding available for the fiscal year, compared to $705.8M or 12.2% for the same quarter last year. The decrease of $111.5M in spending is mainly related to a decrease in expenditures for transfer payments in 2025-2026 compared to the same type of expenditures in 2024-2025. Further analysis has been done on standard objects with significant expenses, as noted in Graph 2 below. Table 2 at the end of this document presents the spending for all standard objects.

Text Version

| (in millions of dollars) | Quarter ended June 30 | |

|---|---|---|

| 2024-2025 | 2025-2026 | |

| Personnel | 176 | 179 |

| Professional and special services | 25 | 21 |

| Transfer payments | 482 | 371 |

| All other standard objects | 23 | 23 |

| Standard Object | Explanation | Variance between 2025-2026 and 2024-2025 Q1 expenditures |

|---|---|---|

| Personnel | The variance is mainly due to increases from collective bargaining settlements offset by the timing of OGD salary transfers occurring later this year. | 3,559 |

| Professional and special services | The variance is mainly due to the timing of OGD operational transfers and Legal Services bills occurring later this year partially offset by increases driven by higher costs associated with research evaluation activities. | (3,934) |

| Transfer Payments | The variance is mainly attributed to the winding down of the Canada Greener Homes initiative and the Smart Renewables and Electrification Program, as compared to previous. The decrease is partially offset by increased payments in the quarter to the province of Newfoundland and Labrador for offshore activity and payments for the Oil to Heat Pump Affordability program. | (110,769) |

| All Other Standard Objects | Minor increases and decreases within different standard objects. | (399) |

| Total Variance | (111,543) | |

3. Risks and Uncertainties

In a context of heightened risk and uncertainty, NRCan is taking bold steps to proactively identify and mitigate threats and capitalize on opportunities and support the Government of Canada agenda to advance Canadian natural resources as a strategic geopolitical and economic advantage. NRCan maintains its ongoing work to develop policies and programs that enhance the economic contribution and competitiveness of the natural resource sectors, while reducing emissions and other environmental impacts. NRCan continues to collaborate with other government departments, provincial and territorial partners, Indigenous groups, and other stakeholders to build a strong, resilient and sovereign economy for all Canadians. Additionally, NRCan continues to support national and international actions to confront the impacts of climate change and extreme weather events that are becoming more prevalent.

One of the biggest challenges to Canadian natural resource sectors is the uncertainty surrounding commodity demand and prices, in the context of ongoing inflation and a changing international landscape. Elevated levels of uncertainty continue to affect the global economy, producing supply chain disruptions and shifting global market dynamics. Key contributors include U.S. tariff policies disrupting global trade (and specifically impacting Canadian natural resources), a shift from multilateral to bilateral trade agreements, ongoing conflicts in the Middle East and in Ukraine, as well as natural disasters. While Canada is actively negotiating for a renewed trade agreement with the US, NRCan will maintain a focus on proactive risk management and regulatory efficiency. The department will also support major nation-building projects to keep pace at the international level and secure the next generation of Canadian prosperity.

Additionally, NRCan continues to lead cutting-edge research to inform the sustainable management of natural resources, and to position Canada as a clean and conventional energy superpower. Advancing the principles of inclusion, diversity, equity, and accessibility along with Gender-based Analysis Plus, the Department will advance natural resource science and innovative technologies while maintaining a commitment to Canadian values of respect toward each other and the environment.

NRCan maintains its commitment to reconciliation by promoting an integrated and coordinated approach to strengthening Indigenous partnerships and economic reconciliation-focused initiatives in natural resources sectors. This will be achieved by advancing shared governance of Canada’s resources, implementing the United Nations Declaration on the Rights of Indigenous Peoples Act (UNDA) legislation in operations, and building meaningful relationships and collaborative partnerships with Indigenous organizations and communities. Further, NRCan is developing a new National Benefits-Sharing Framework to ensure that Indigenous communities benefit from major resource projects taking place on or near to their traditional territories.

To maintain a competitive edge in the ever-evolving digital world, the department will advance work to implement an integrated plan to respond to Canada’s Digital Ambition. NRCan has developed an AI Strategy to enable responsible AI adoption, aligned with TBS expectations that departments advance the use of AI. By investing in the use of AI and other technologies, and with a focus on cybersecurity, research and innovation, and upskilling staff, NRCan will continue to strengthen and modernize delivery of improved and secure digital services. Given the high priority of enhanced cyber security, in response to increasingly sophisticated attacks, ensuring proper actions are taken to secure digital resources and information will increase NRCan’s ability to protect data assets while delivering key programs and services for Canadians.

NRCan continues to strengthen its risk management capabilities and effectiveness, in support of delivering on its mandate and core responsibilities. The Department is moving forward with the integration of risk management with other departmental processes in support of priority setting and decision-making. This ensures mitigation actions are informed by regular assessment of risk information, serving to strengthen NRCan’s capacity to recognize and understand challenges, and to effectively prioritize actions under fiscal restraint.

As outlined in the 2023-2026 Corporate Risk Profile, the Department is monitoring the following six strategic risks and three operational risks:

Strategic risks

- External Engagement

- Policy, Funding Authority

- Federal Alignment

- Regulatory Regime

- Reconciliation

- Inclusion, Diversity, Equity and Accessibility

Operational risks

- Cyber Security

- Workplace Wellness

- Corporate Service Delivery

Strategic risks threaten the Department as a whole, and its ability to deliver expected outcomes and mandates. Concurrently, operational risks relate to the effectiveness or efficiency of internal-facing activities. NRCan will closely and routinely monitor and update these key corporate risks to inform leadership on risk status, and to identify if further action is required, while continuing to support Canadians and our natural resource sectors in 2025-26.

4. Significant Changes in Relation to Operations, Personnel, Programs

Following the 2025 election in April, Prime Minister Mark Carney appointed the Honourable Tim Hodgson as Minister of Natural Resources Canada.

The Government of Canada has launched a Comprehensive Expenditure Review (CER) to reduce day-to-day government spending by targeting programs and activities that are not core to the federal mandate or not aligned with government priorities. The goal is to lower federal operating costs by 15% over three years, 7.5% in 2026–27, 10% in 2027–28, and 15% in 2028–29. The department is undertaking a review of its programs and operations to ensure alignment with CER objectives.

No other significant change in relation to operations, personnel or programs occurred during the first quarter of 2025-2026.

Original signed by:

Michael Vandergrift

Deputy Minister

Date signed

August 20, 2025

Ottawa, Canada

Original signed by:

Francis Brisson

Chief Financial Officer

Date signed

August 15, 2025

Ottawa, Canada

| (in thousands of dollars) | Fiscal Year 2025-2026 | Fiscal Year 2024-2025 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2026Footnote * | Expended during the quarter ended June 30, 2025 |

Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2025Footnote ** | Expended during the quarter ended June 30, 2024 |

Year-to-date used at quarter-end | |

| Vote 1 - Net Operating Expenditures | 944,230 | 198,160 | 198,160 | 897,014 | 201,682 | 201,682 |

| Vote 5 - Capital Expenditures | 44,926 | 3,275 | 3,275 | 41,241 | 3,917 | 3,917 |

| Vote 10 - Grants and Contributions | 2,620,493 | 177,433 | 177,433 | 2,996,125 | 399,461 | 399,461 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance | 102 | 17 | 17 | 99 | 25 | 25 |

| Contributions to employee benefit plans | 86,261 | 21,565 | 21,565 | 73,038 | 18,168 | 18,168 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board | 14,028 | 7,014 | 7,014 | 12,915 | 2,986 | 2,986 |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board | 4,156 | 2,078 | 2,078 | 2,716 | 1,478 | 1,478 |

| Payments to the Nova Scotia Offshore Revenue Account | - | 1 | 1 | - | 14 | 14 |

| Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund | 1,418,651 | 184,722 | 184,722 | 1,741,979 | 78,078 | 78,078 |

| Geomatics Canada Revolving Fund | (270) | - | - | 264 | - | - |

| Spending of amounts equivalent to proceeds from disposal of surplus moveable crown assets | - | - | - | - | (1) | (1) |

| Total Statutory Payments | 1,522,928 | 215,397 | 215,397 | 1,831,011 | 100,748 | 100,748 |

| Total Budgetary Authorities | 5,132,577 | 594,265 | 594,265 | 5,765,391 | 705,808 | 705,808 |

| (in thousands of dollars) | Fiscal Year 2025-2026 | Fiscal Year 2024-2025 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2026Footnote * | Expended during the quarter ended June 30, 2025 |

Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2025Footnote ** | Expended during the quarter ended June 30, 2024 |

Year-to-date used at quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 651,797 | 179,090 | 179,090 | 603,352 | 175,531 | 175,531 |

| Transportation and communication | 22,318 | 2,733 | 2,733 | 15,001 | 3,163 | 3,163 |

| Information | 30,015 | 2,991 | 2,991 | 29,149 | 4,747 | 4,747 |

| Professional and special services | 238,501 | 20,916 | 20,916 | 224,606 | 24,851 | 24,851 |

| Rentals | 28,710 | 3,745 | 3,745 | 40,196 | 4,517 | 4,517 |

| Repair and maintenance | 9,271 | 864 | 864 | 11,275 | 808 | 808 |

| Utilities, materials and supplies | 42,409 | 2,987 | 2,987 | 43,882 | 3,015 | 3,015 |

| Acquisition of land, buildings and works | 8,948 | 1,407 | 1,407 | 7,149 | 1,557 | 1,557 |

| Acquisition of machinery and equipment | 69,370 | 8,581 | 8,581 | 63,070 | 5,939 | 5,939 |

| Transfer payments | 4,057,328 | 371,248 | 371,248 | 4,753,735 | 482,017 | 482,017 |

| Other subsidies and payments | 10,640 | 3,228 | 3,228 | 10,817 | 3,632 | 3,632 |

| Total Budgetary Expenditures | 5,169,307 | 597,790 | 597,790 | 5,802,232 | 709,777 | 709,777 |

| Less: Total Revenues Netted Against Expenditures | 36,730 | 3,525 | 3,525 | 36,841 | 3,969 | 3,969 |

| Total Net Budgetary Expenditures | 5,132,577 | 594,265 | 594,265 | 5,765,391 | 705,808 | 705,808 |