Table of contents

- Introduction

- What is carbon management?

- Role of carbon management in the path to net zero

- Canada’s carbon management advantage

- Federal priorities to promote a robust carbon management sector in Canada

- Consultations with partners, stakeholders, and engaged Canadians

- Conclusion

- ANNEX A: Roadmap to 2050 for carbon management in Canada

- ANNEX B: Enabling federal programs, policies, and regulations in Canada

Introduction

When it endorsed the 2015 Paris Agreement, the global community agreed that the world must hold the increase in the global average temperature to well below 2 °C and pursue efforts to limit warming to 1.5 °C to avoid the most catastrophic impacts of climate change. This is a daunting challenge that requires a rapid transition to a net-zero emissions economy, but it offers enormous potential for a prosperous and cleaner future.

Carbon management—a range of approaches to capture carbon dioxide (CO2) from point sources or the atmosphere to be reused or durably stored—is recognized as a critical piece of global climate action. According to the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), there is no credible path to net-zero emissions without carbon management technologies, and their deployment must be rapid and immense, scaling up by nearly 200 times by 2050.Footnote 1Footnote 2

Vision

Carbon management technologies are deployed to help achieve Canada’s climate objectives, underpinned by the development of a world class, multi-billion-dollar carbon management sector in Canada that supports inclusive, high-value employment and a more sustainable economy.

Carbon management technologies are important tools in the broader climate toolbox that work with a range of other measures that reduce or remove emissions. Innovative countries like Canada must help lead the way by harnessing the ingenuity of its people, communities, and businesses to accelerate climate action. This is why Canada increased its climate ambition, aiming to reduce greenhouse gas (GHG) emissions by 40–45% below 2005 levels by 2030, and enshrined a commitment to reach net-zero emissions by 2050 into law. Meeting these goals requires transforming the way energy and industrial products are produced and used to nearly eliminate CO2 pollution over the next 3 decades.

To that end, in collaboration with provincial, territorial, and municipal governments, the private sector, Indigenous groups, and other strategic partners, the Government of Canada is taking important steps towards achieving its ambitious climate goals. Canada has developed a comprehensive climate plan that includes a price on pollution, regulations, and over $150 billion in federal investments since 2015 to advance climate action. From introducing a world-leading price on pollution, to making major investments in zero-emission vehicles and energy-efficient buildings, as well as helping Canadian industries transition to net zero through solutions like carbon capture, the Government has been working to enable the transition to a prosperous and cleaner future.

Reducing emissions remains the top priority of Canada’s climate plan, recognizing that the best way to tackle climate change is to stop new emissions from entering the atmosphere. Carbon management technologies will be a critical emissions reduction tool for many sectors, including upstream oil and gas, cement, iron and steel, and chemicals. At the same time, Canada needs to scale up solutions that permanently remove emissions from the atmosphere, since some residual emissions are likely to remain despite aggressive mitigation efforts, including in agriculture, aviation, and shipping. The removal of CO2 from the atmosphere is also the only way to directly address historical emissions, which have accumulated in the atmosphere over centuries of industrial activity and continue to contribute to global temperature rise.

The broad suite of carbon management practices, tools, and technologies to reduce, remove, or re-use CO2 from the atmosphere is a not a silver bullet for addressing the climate crisis, but it is an essential element within the suite of measures to address GHGs as detailed in Canada’s 2030 Emissions Reduction Plan. This means scaling carbon management alongside ongoing efforts to meet Canada’s primary goal to aggressively reduce absolute emissions.

Canada can leverage its natural resource advantages, technical and technology leadership, and expertise to advance carbon management to help meet net-zero goals at home and abroad, while creating inclusive and sustainable economic growth across the country. Carbon management offers new economic opportunities to create good, sustainable jobs, it can unlock new export markets, and it can attract foreign direct investment in Canada and in Canadian solutions providers that can serve a rapidly growing, multi-billion-dollar global market for carbon management solutions.

Canada has already established itself as a first mover and leader in the global carbon management sector, with some of the world’s first large-scale projects, favourable geology, cutting-edge innovators and start-ups, early investments in research, development, and demonstration (RD&D), deep technical expertise, a robust policy and regulatory environment at federal and provincial levels, and active international collaboration. Approximately one-seventh of the world’s active large-scale carbon management projects can be found in Canada, with a growing number in the design and development phase across multiple sectors and regionsFootnote 3. In response to the climate imperative, global momentum in the carbon management sector has grown substantially in recent years, with over 570 carbon capture, utilization, and storage (CCUS) projects in development. By 2030, 368 projects are expected to be operational, with an anticipated capacity to capture 743 Mt of CO2 per yearFootnote 4. Even more projects are needed if carbon management is to deliver the reductions projected in scenarios to achieve net zeroFootnote 5Footnote 6. Competition in this sector is also rapidly increasing with major investments made from Canada’s allies like the United States, the United Kingdom, and the European Union.

This Strategy takes a targeted approach to focus on technology-enabled carbon management solutions that support reducing, removing, and reusing CO2—while recognizing the importance of nature-based solutions in supporting a net-zero economy. Already, the Government of Canada is taking important steps to support carbon management with nature-based solutions, including through conservation efforts, a commitment to plant 2 billion trees by 2030, and supporting Indigenous-led nature-based solutions.

Canada’s Carbon Management Strategy is the result of more than a year of concerted engagement with nearly 1,500 stakeholders from across sectors, provincial and territorial governments, Indigenous organizations, and other key partners to gather perspectives and create a vision for a robust Canadian carbon management sector (see Annex A for Roadmap to 2050). This Strategy delivers on Canada’s commitment to develop a comprehensive CCUS Strategy and recognizes that provinces, territories, and other levels of government are already providing important leadership and have a key role to play in supporting the scaling up of carbon management solutions.

This Strategy outlines 5 federal priorities guiding the Government’s approach to promoting a competitive and robust carbon management sector in Canada:

- Accelerating innovation and RD&D

- Advancing policies and regulations

- Attracting investment and trade opportunities

- Scaling up projects and infrastructure

- Building partnerships and growing inclusive workforces

What is carbon management?

Carbon management refers to an ecosystem of technologies and approaches that help to reduce and remove CO2 emissions. It encompasses any activities that capture, utilize, or store CO2, or that connect these activities. It includes, but is not limited to:

- CCUS technologies that mitigate point-source emissions; and,

- Carbon dioxide removal approaches like direct air capture to carbon storage (DACCS), biomass carbon removal and storage (BiCRS), and enhanced carbon mineralization.

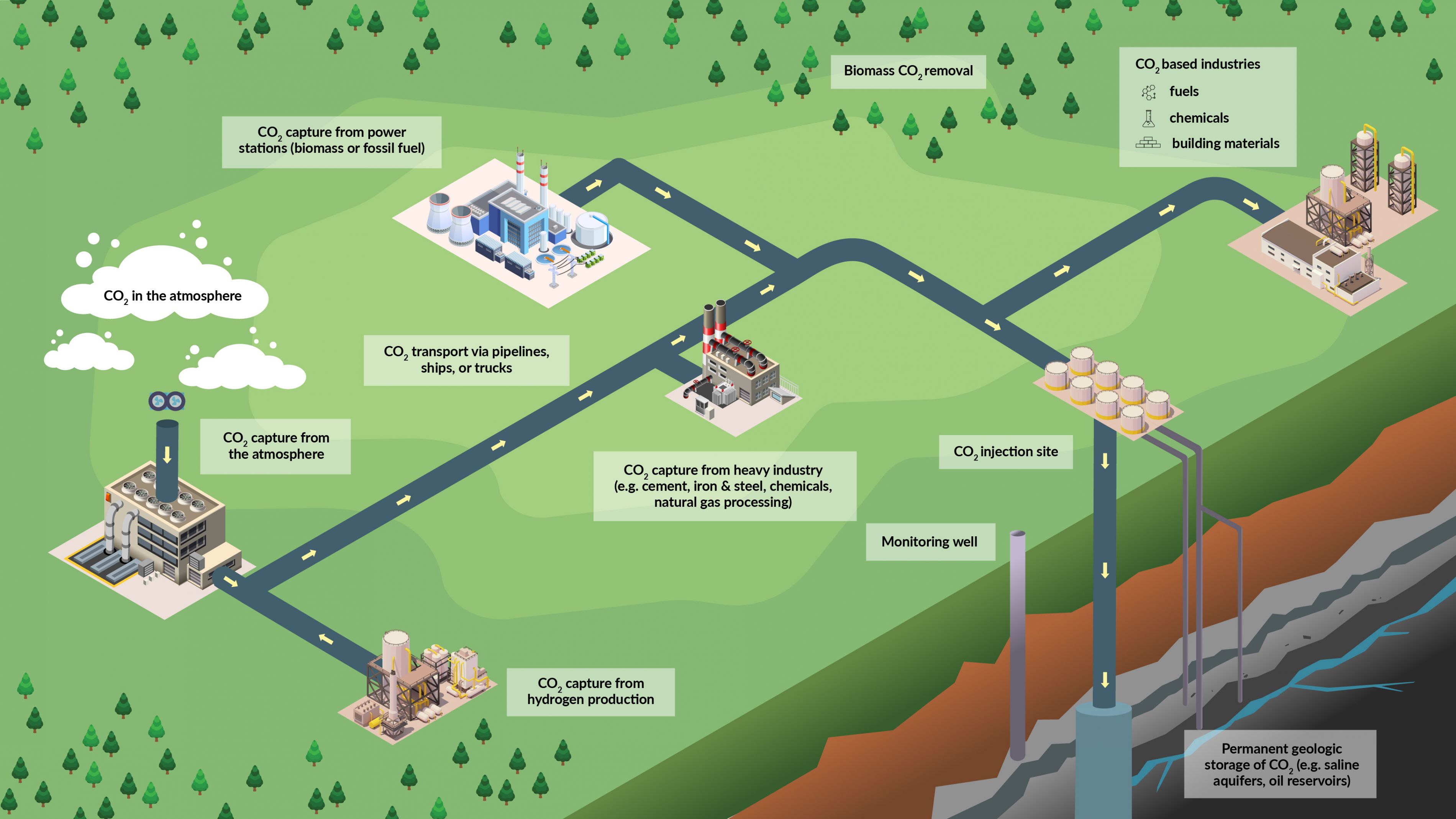

Figure 1. Diagram of carbon management processes

Text description

Diagram showing uses for captured CO2, including direct-uses and conversion into products. Categories of direct-uses of CO2 are shown, including solvents (enhanced oil recovery; decaffenination, dry cleaning), food products (carbonated beverages), yield boosting (greenhouse, algae), working fluids (refrigeration, supercritical power system), and miscellaneous (welding, medical uses). Categories of CO2 conversion are shown, including chemicals (fertilizer, olefins, plastics and polymers, baking soda, chemical intermediates), fuels (biofuels, liquid fuels, methane, and bio-methane, and methanol) and materials (carbon fibre, nanoparticles and carbon nanotubes, cement, concrete curing, filling materials).

Carbon capture, utilization, and storage (CCUS) technologies

CO2 can be captured from emissions streams (point-source capture) or directly from the atmosphere (direct air capture) and transported for utilization or storage in a carbon sink. Each segment of the value chain—capture, transportation, utilization, and storage—is crucial to growing carbon management in Canada, which involves many industries and sectors (see Figures 1 - 3). Globally, 36 such commercial projects are in operation, capturing CO2 from a range of emission sources, such as ethanol, fertilizer, steel, hydrogen production, gas processing, and power generation.

Point-source capture separates CO2 from waste stream emissions, including from industrial processes and the combustion of fossil fuels or biomass. Point-source capture rates of over 90% have been demonstrated at commercial scales in Canada (e.g., Sturgeon Refinery, Glacier CCS Project). CO2 capture is typically the highest cost associated with carbon management projects, ranging from US$15 to US$25 per tonne for highly concentrated CO2 streams, and from US$40 to US$120 per tonne where CO2 is more diluteFootnote 7. Economies of scale and innovation are enabling cost reductions.

Direct air capture (DAC) technologies capture CO2 directly from the atmosphere. While less mature than point-source capture, DAC still holds significant potential, and like point-source capture, the CO2 can be stored or utilized. Since atmospheric CO2 is more dilute than CO2 in industrial emissions, DAC is more expensive than point-source capture.

CO2 can be transported by truck, rail, pipe, or ship. Since CO2 is a valuable feedstock in many sectors, such as food, chemicals, and oil and gas, the technologies and infrastructure to purify and transport it have been used for decades. Significantly more infrastructure is needed to support the scaling up of carbon management to meet Canada’s climate goals. Transportation costs account for a fraction of the cost of abatement and can be as low as US$5 per tonne when the point of capture is close to storage sites.Footnote 8

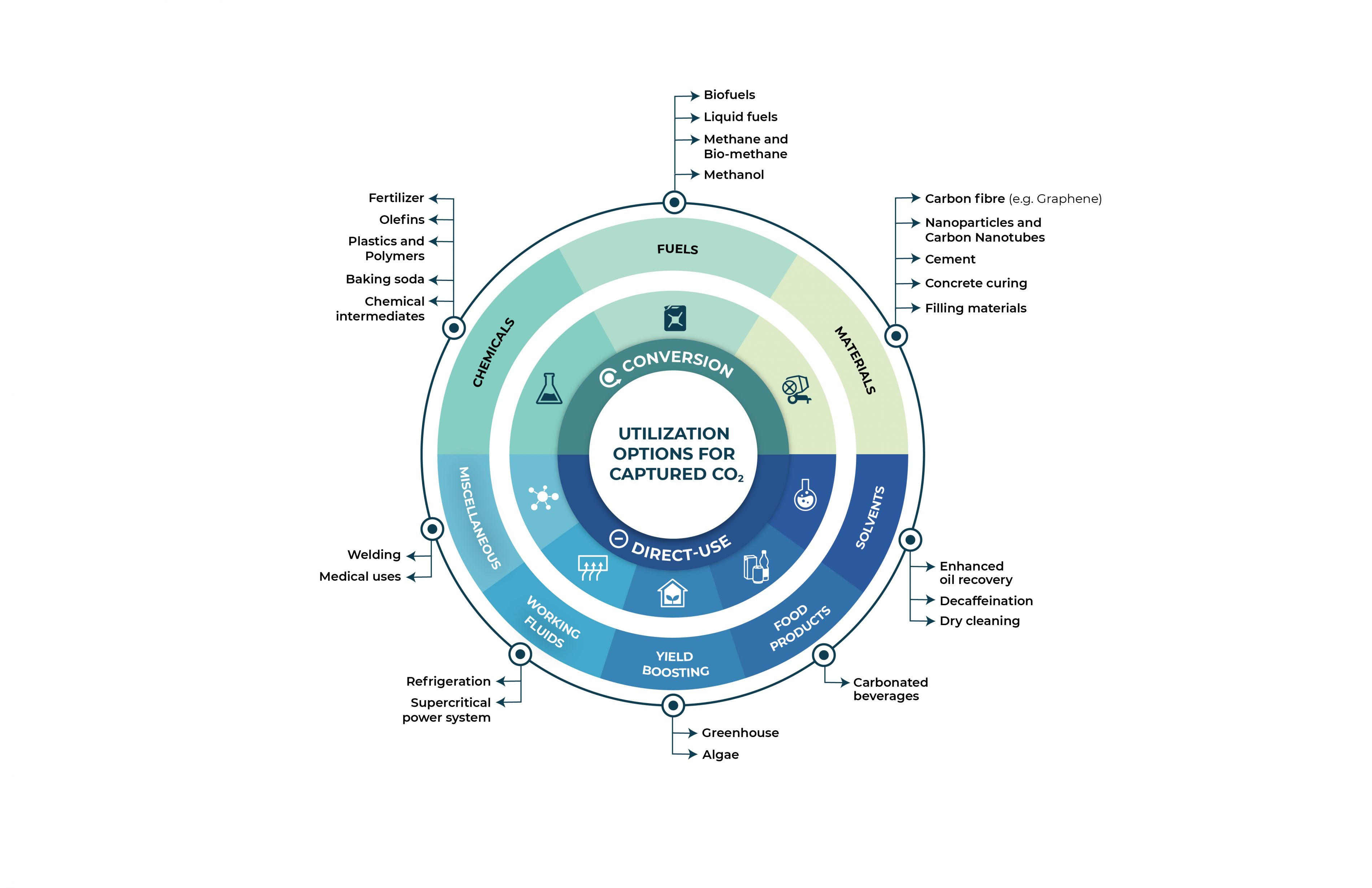

CO2 utilization includes either direct use or chemical conversion into useful products such as synthetic fuels, nanomaterials, and additives for building materials. The diverse suite of CO2 utilization applications has spurred the creation of a “carbontech” industry, providing lower carbon alternatives for products. Converting CO2 “waste” into valuable products can generate revenue to help recoup the costs of carbon capture and supports the shift to a more circular economy. While most captured CO2 will need to be permanently stored to limit global temperature rise, utilization can enable low-carbon alternatives such as synthetic fuels for freight and aviation, and support CO2 use as a feedstock for the chemical industry, such as fertilizer production.Footnote 9

Figure 2. Diagram of CO2 utilization processes

Text description

Diagram showing uses for captured CO2, including direct-uses and conversion into products. Categories of direct-uses of CO2 are shown, including solvents (enhanced oil recovery; decaffenination, dry cleaning), food products (carbonated beverages), yield boosting (greenhouse, algae), working fluids (refrigeration, supercritical power system), and miscellaneous (welding, medical uses). Categories of CO2 conversion are shown, including chemicals (fertilizer, olefins, plastics and polymers, baking soda, chemical intermediates), fuels (biofuels, liquid fuels, methane, and bio-methane, and methanol) and materials (carbon fibre, nanoparticles and carbon nanotubes, cement, concrete curing, filling materials).

The most mature method of CO2 storage dating back almost 30 years, involves CO2 injection into deep geological formations for permanent storage, where it is trapped beneath impermeable cap rocks—in the same way that fossil fuels and other hydrocarbons have remained in place for millions of yearsFootnote 10. Conventional geologic storage costs range between US$2 and US$11 per tonne with potential for further cost reductions through innovation.Footnote 11 Newer mechanisms include CO2 storage in organic-rich shales and basalt rock formations. CO2 injected into basalt can mineralize, meaning the CO2 reacts with the rock to create carbonate minerals that lock away the CO2.Footnote 12 This mineral carbonation process is also being explored as a pathway for CO2 storage within mine tailings.Footnote 13 Other storage options include soil carbon storage (e.g., heat-treated biomass, known as biochar, and pulverized silicate rocks), biomass burial, ocean sequestration pathways, and CO2 use in long-lived products, such as concrete.

Carbon dioxide removal (CDR)

Carbon management also includes CDR approaches that remove CO2 from the atmosphere and store it durably in natural carbon reservoirs, such as rock formations, soils, plants, oceans, or in long-lived products. The removal and durable storage of CO2 can also be understood as “negative emissions.”

While it remains critical to considerably scale up mitigation efforts, significant deployment of CDR will be needed to remove CO2 already in the atmosphere.Footnote 14 CDR is not an alternative to decarbonization—it can decrease historical and residual emissions in support of net zero and even net-negative emissions, meaning that more GHGs are removed from the atmosphere than emitted. Undertaking (LCAs)—a method to assess the full GHG impact of a project—is key to determining the extent to which CDR approaches can contribute negative emissions.

CDR activities can be nature-based, technological, or a hybrid approach of the two. A variety of CDR methods will be needed to meet climate goals, and each has benefits and limitations.Footnote 15 This Strategy focuses on technology-based CDR approaches, with specific consideration of DAC, BiCRS, and enhanced carbon mineralization, all of which have significant long-term CO2 removal and storage potential. This Strategy also recognizes the early potential of ocean-based CDR approaches, such as direct ocean capture and ocean alkalinity enhancement, and will continue to carefully monitor progress and emerging opportunities as science advances. Further RD&D and innovation are critical to advance technology-based CDR approaches required to meet climate goals, as many are at the early stages of commercial readiness.Footnote 16

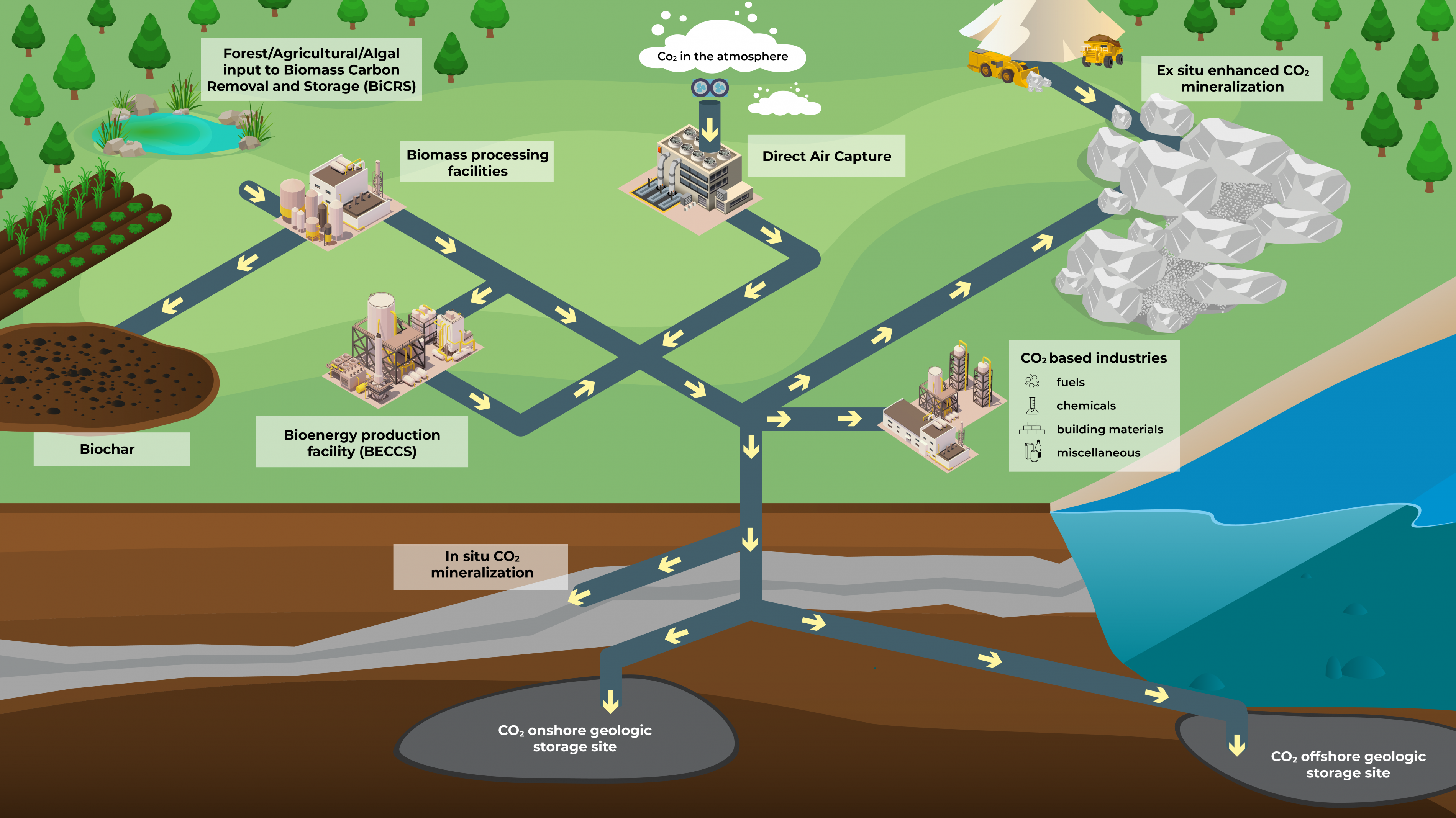

Figure 3. Diagram of carbon dioxide removal processes

Text description

Carbon dioxide removal technology and hybrid processes are shown across a network of interconnected facilities. First, carbon dioxide is removed from the atmosphere, either by a direct air capture facility or through biological processes.

When carbon dioxide is removed through biological processes, the resulting forest, agricultural, and algal biomass input can be processed to be turned into biochar for soil carbon storage or used in bioenergy production and subsequently stored.

Whether carbon dioxide is removed from the atmosphere by direct air capture facilities or biological processes, the carbon dioxide can be transported for use in products, such as fuels, chemicals, and building materials, or permanently stored using various methods, such as conventional onshore or offshore geological storage, or through in situ or ex situ enhanced mineralization.

Direct air carbon capture and storage (DACCS): DACCS refers to the CDR approach when non-emitting energy is used to power DAC technologies and the captured CO2 is permanently stored, removing more CO2 from the atmosphere than was emitted.Footnote 17 The deployment of DAC technologies is currently limited by very high energy needs and costs, given CO2 is more dilute in the atmosphere, and by the availability of CO2 storage resources in some parts of the world. A key benefit of DACCS is the small amount of land required for a DAC facility compared to other CDR methods to achieve the same level of removal. Transportation costs can be negligible if DAC facilities are co-located with CO2 storage sites.

Biomass carbon removal and storage (BiCRS): BiCRS describes a range of technology-based approaches that use plants and algae (which naturally remove CO2 from the atmosphere as they grow) to capture CO2, and then permanently store that CO2 underground or in long-lived products. BiCRS approaches follow a set of “do no harm” principles to value food security, rural livelihoods, and biodiversity conservation.Footnote 18 BiCRS includes various biomass-enabled CDR approaches such as bioenergy with carbon capture and storage, biomass gasification, biomass pyrolysis, biomass burial, and bio-oil burial.

Bioenergy with carbon capture and storage (BECCS): BECCS generates energy from the combustion of biomass, with CO2 capture technology applied to the resulting emissions. If the captured CO2 is permanently stored, the process can result in negative emissions. BECCS can therefore enable CDR, making it a subset of BiCRS in such cases.

Enhanced carbon mineralization: Carbon mineralization is a naturally occurring process where CO2 becomes bound in rocks as a solid mineral, but it can also be enhanced through 2 technology-based approaches to help permanently remove atmospheric CO2:

- In situ mineralization, where CO2 is injected deep underground, reacts with mafic or ultramafic rocks, and becomes part of the rock.Footnote 19

- Ex situ mineralization, where certain types of crushed rock react with CO2, causing it to solidify in a process known as “surface mineralization.” This process occurs naturally but can be sped up with human intervention to deliver permanent CDR (sometimes referred to as “enhanced weathering”). Mining and industrial wastes often contain suitable rocks for ex situ mineralization, while also reducing environmental impact and disposal costs, and in the case of mining waste, can facilitate further extraction of valuable minerals.Footnote 20

Role of carbon management in the path to net zero

Within the broader toolkit of approaches and technologies needed to tackle climate change and reduce emissions, carbon management will be one of many important tools to support the decarbonization of the economy and achieve net-zero emissions in Canada and around the world. As part of Canada’s continued clean economic growth, a competitive carbon management industry in Canada offers opportunities to decarbonize many industrial sectors and develop new ones in support of a prosperous, net-zero economy of the future.

Under the IEA’s 2022 Updated Roadmap to Net-Zero Emissions by 2050, CCUS technologies need to scale up rapidly this decade to capture 1.2 Gt globally by 2030 and 6.2 Gt by 2050, accounting for approximately 15% of total required GHG reductions.Footnote 21 Canada’s international peers have recognized that this is both a challenge and an opportunity, prompting other G7 economies such as the United States, the United Kingdom, and Germany, as well as the European Union, to prioritize carbon management technologies, including through developing national strategies and making significant investments to seize the environmental and economic benefits.

The IPCC found that all pathways that limit global warming to 1.5 °C use CDR to compensate for residual emissions, or in cases where warming peaks beyond 1.5 °C, to achieve net-negative emissions to restore a maximum of 1.5 °C by the end of the century.Footnote 22 The required level of CDR will depend on the amount of emissions that need to be offset.

Adding to the IPCC’s and IEA’s global analysis, the Canada Energy Regulator (CER), in its Canada’s Energy Futures 2023 report, highlights the key role that carbon management will play in domestic emissions reductions. In the CER’s Global Net-Zero Scenario, in which Canada and the rest of the world achieve net-zero emissions by 2050, CCUS sequesters nearly 60 Mt annually in Canada by 2050, 25 Mt of which occurs in heavy industry. In an alternative Canada Net-Zero Scenario, in which Canada reaches net-zero emissions by 2050 but the rest of the world moves more slowly, the CER estimates that CCUS costs are likely to fall more slowly and result in higher captured emissions of 80 Mt due to the greater global demand for fossil fuels.Footnote 23 Similarly, the CER projects that DAC will capture 46 Mt annually in Canada in the Global Net-Zero Scenario, rising to 55 Mt in the Canada Net-Zero Scenario.Footnote 24

How carbon management can support Canada’s path to net zero

Canada’s capture capacity is projected to grow from the current 4.4 Mt of CO2 mitigation per year to 16.3 Mt of CO2 per year by 2030, with significant further scaling required to help reach net zero by 2050.Footnote 25 With a focus on technology-based approaches, this Strategy identifies 5 pathways where carbon management is expected to play a critical role in many sectors to help achieve Canada’s 2030 climate targets and enable a prosperous net-zero economy by 2050:

- Decarbonizing heavy industry, including oil and gas: Fixed-process emissions and high-temperature heat requirements make reducing emissions in many industrial sectors especially challenging. Point-source CO2 capture is a leading option for deep emissions reductions from heavy industrial sectors with long-lived infrastructure, such as cement, iron and steel, and chemicals (e.g., fertilizer), which together account for almost 11% of Canada’s emissions. It is also one of the key technologies supporting decarbonization of the upstream oil and gas sector. Given the long lifespan of many existing heavy industrial facilities and the value of these industries to the Canadian economy, public-private collaboration is critical to advance strategic, economical, and regionally appropriate decarbonization pathways.

- Low-carbon hydrogen production: Producing hydrogen from Canada’s abundant and low-cost natural gas, paired with a high capture rate of CO2 to mitigate emissions, provides one of the lowest-cost production methods of large-scale, low-carbon hydrogen. The competitive life-cycle emissions performance should continue to improve through federal and provincial action to reduce methane emissions across the production and transport of natural gas.

- Low-carbon dispatchable power: CO2 capture can enable power plants to provide low-carbon power on demand as renewables are integrated, grid modernization advances, and long-duration storage capabilities improve. Gas-fired power generation paired with CCUS to abate emissions may be one of the technical solutions pursued by some provinces and regions to significantly reduce emissions from the electricity grid. Carbon management technologies, such as CCUS and BECCS, could enable low- or even negative-carbon dispatchable power, further supporting the Government of Canada’s goal of a net-zero electricity system by 2035.

- CO2-based industries: Although the vast majority of captured CO2 may need to be permanently stored to reach net-zero emissions, CO2 utilization has a role to play in supporting climate goals, including by providing market demand for captured CO2.Footnote 26 As a valuable commodity with many applications, captured CO2 can be converted to make fuels, chemicals, and building materials, or used directly, such as in food and beverage products, and in industrial processes. CO2 utilization helps strengthen the business case of carbon capture projects and the broader carbon management sector.

- Carbon removal: CDR technologies, such as DACCS, BiCRS, and carbon mineralization, have significant potential given Canada’s early technology leadership, abundant sources of biomass, high proportion of non-emitting electricity, and suitable geology for CO2 storage. Accelerated innovation and scale-up of CDR technologies is critical to enabling large-scale deployment to support a net-zero economy by offsetting emissions from the hardest-to-decarbonize industrial sectors, and to address historical emissions already in the atmosphere.

Canada’s carbon management advantage

When it comes to the global race to grow the carbon management sector, Canada has an enviable early advantage. Canada is well positioned to capitalize on its globally recognized expertise, wealth of favourable CO2 storage geology, and leading innovators. Early investment in projects has resulted in a burgeoning carbon management ecosystem and world-class research and testing facilities across many regions. This early leadership, combined with its natural resource advantage, positions Canada to deploy carbon management to mitigate emissions across sectors, advance CDR approaches, and continue to research and develop world-renowned technologies.

CO2 storage capabilities and resource potential

The availability of CO2 storage capacity is essential to carbon management. Globally, it is anticipated that 95% of all CO2 captured will need to be permanently stored.Footnote 27 Canada has vast geological storage resources, which present opportunities to store CO2 sourced domestically and internationally—with potential to generate revenue and investment from abroad. Canada is rich in sedimentary basins that are suitable for CO2 storage, such as the vast Western Canadian Sedimentary Basin (WCSB) that spans from BC to Manitoba, and the Williston Basin, located mostly in southern Saskatchewan. Geological formations in the BC portion of the WCSB could store an estimated 4.2 Gt CO2—more than 66 years of the province’s emissions.Footnote 28 In Southern Ontario and Quebec, there are several sedimentary basins that may also be suitable for CO2 storage. The Canadian capacity of saline aquifers alone (within Canada’s sedimentary basins) is estimated at over 100 billion tonnes, which could provide enough CO2 storage for hundreds of years.Footnote 29Footnote 30

Figure 4. Map of Canada showing saline formations and sedimentary basins

.png)

Data source: North American Carbon Storage Atlas.

Text description

Map of Canada and northern United States, showing large sedimentary basins stretching from the Northwest Territories and British Columbia, across Alberta, and into southern Saskatchewan and Manitoba, with smaller sedimentary basins in the Great Lakes, offshore of North America’s east coast, and in Hudson Bay. Saline formations in Canada are shown in British Columbia, Alberta, southern Saskatchewan, the Great Lakes, and offshore of Nova Scotia, with most indicating a moderate presence of saline aquifers.

Canada’s offshore seabed geology could also hold significant potential for CO2 storage. For example, Nova Scotia and Newfoundland and Labrador have suitable geology for conventional sub-seabed CO2 storage, as well as offshore expertise and infrastructure that could be leveraged to support CO2 storage. Further research, regulatory work, and engagement are needed before offshore activities could occur.

This significant underground CO2 storage potential, including in the Western provinces and the Eastern offshore, could present business opportunities for regional or even cross-boundary CO2 storage hubs. Further source-sink matching analysis, through tools such as NRCan’s CCUS Assessment Framework, alongside provincial systems enabling the evaluation of onshore geological CO2 storage, are being used to advance understanding of these opportunities.

Canada has been an early leader in geological storage. Most notably, the Saskatchewan-based Weyburn-Midale CO2 Monitoring and Storage Project was an international research program, and after over 20 years of operation, its sites are still being used and have successfully stored over 40 million tonnes of CO2.Footnote 31 Nearby, the Aquistore Project CO2 storage initiative includes a field lab for the study of dedicated CO2 storage and monitoring.Footnote 32Footnote 33

Cutting-edge research and deep technical capacity

Canadian researchers and firms have long been major contributors to the development of the global carbon management ecosystem. In addition to full commercial-scale projects in operation, Canada has world-class research and testing facilities in British Columbia, Alberta, Saskatchewan, Ontario, and Quebec to develop and scale up carbon management technologies. This includes 8 publicly funded laboratories and test beds for developing technologies, as well as post-secondary labs and labs run by private organizations. An important aspect of RD&D is the testing of concepts and pilot technologies for scalability and reliability at technology test centres. Canada is a global leader in this space with several test facilities providing access to this specialized infrastructure in Canada.

Canada has a myriad of carbon management technology developers, many of which are emerging from academic labs at universities across the country. These technological advancements have led to successful spinoff companiesFootnote 34 and co-development projects with industry.

Figure 5. Snapshot of Canada’s growing carbon management sector from coast to coast, as of summer 2023

.png)

Text description

Map of Canada showing a snapshot of Canada’s carbon management centres, pilot projects, operational commercial-scale projects, and globally recognized companies:

Ten globally recognized Canadian companies are listed.

- Carbon Engineering in British Columbia

- Carbon Upcycling in Alberta

- CERT Systems in Ontario

- CarbonCure in Nova Scotia

- Svante in British Columbia

- CarbiCrete in Quebec

- Ekona Power in British Columbia

- Ionomr Innovations in British Columbia

- Arca in British Columbia

- Planetary Technologies in Nova Scotia

Centres and pilot projects are listed by province.

In British Columbia:

- Carbon Engineering’s Innovation Centre and AIR TO FUELS™ Pilot

- Project CO2MENT by Svante, Lafarge, and Total

- Carbon Management Canada Carbon Capture and Conversion Institute

- British Columbia Centre for Innovation and Clean Energy

- Trail Operations CCUS Pilot by Teck, which is in development

- Svante Centre of Excellence for Carbon Capture and Removal, which is under construction

In Alberta:

- Natural Resource Canada’s CanmetENERGY – Devon laboratory

- Genesee Carbon Conversion Centre Capital Power, which is in development

- Alberta Carbon Conversion Technology Centre by Capital Power, ENAMX, and InnoTech Alberta

- Carbon Management Canada CaMI Field Research Station

In Saskatchewan:

- VeloxoTherm Carbon Dioxide Capture Demonstration by Cenovus and Svante

- International Carbon Capture and Storage Knowledge Centre

- Petroleum Technology Research Centre Aquistore Project

- Shand Carbon Capture Test Facility

- Cenovus Carbon Capture, Utilization, and Storage facility at Lloydminster Ethanol Plant

- Clean Energy Technologies Research Institute

In Ontario:

- Natural Resource Canada’s CanmetENERGY – Ottawa laboratory

- Natural Resource Canada’s CanmetMATERIALS – Hamilton laboratory

- National Research Council Advanced Materials Research Facility

In Quebec:

- Saipem Canada Carbon Dioxide Capture Unit at pulp mill of Resolute Forest Products – St. Félicien

- Carbon Negative Concrete Pilot Project by Carbicrete and Patio Drummond

- Natural Resource Canada’s CanmetENERGY – Varennes laboratory

- Énergie et Chimie Verte Carbon Capture and Utilization demonstration platform by Valorisation Carbone Québec

There are also 5 operational commercial-scale projects:

- Quest carbon dioxide capture at bitumen upgrader, an Athabasca Oil Sands Project joint venture by Canadian Natural Resources Limited, Chevron Canada, and Shell Canada as the operators, located in Alberta

- Alberta Carbon Trunk Line, a CCUS hub by Wolf, Enhance, North West Redwater Partnership, and Nutrien, located in Alberta

- Weyburn-Midale carbon dioxide injection, monitoring, enhanced oil recovery, and storage by Whitecap and Cardinal, located in Saskatchewan

- Boundary Dam carbon dioxide capture at a coal-fired power station by SaskPower, located in Saskatchewan

- Glacier Gas CCS, a modular carbon capture and storage project by Advantage Energy and Entropy, located in Alberta

Strong enabling policy and regulatory environment

Canada has consistently been ranked as having one of the most enabling policy and regulatory environments for carbon management adoption thanks to both federal and provincial policy and regulatory frameworks.Footnote 35Footnote 36 The federal government’s introduction of an economy-wide price on pollution is a key measure that improves the economics of carbon management projects. Based on the jurisdictional authorities in Canada, provinces own their subsurface resources—including the “pore space” underground where CO2 will be stored—and hold primary responsibility for regulating CCUS activities. Alberta, Saskatchewan, and British Columbia have regulations in place to support safe and permanent geological CO2 storage. These regulations cover pore space tenure acquisition, project permitting, management of long-term liability for CO2 storage, as well as measurement, monitoring, and verification requirements. In Alberta’s CO2 storage hubs funding competition, the initial projects approved reflect a strong emphasis on Indigenous partnerships, which has been lauded as a key step in ensuring that Indigenous rights are reflected as this emerging sector is established. Other provinces, such as Manitoba, Ontario, and Nova Scotia, are taking steps towards developing enabling frameworks for CO2 storage.

Enabling policies, regulations, and investment tools

Canada has a robust policy and regulatory environment, along with strong investment tools that support carbon management deployment, including:

- Canada’s price on pollution, currently $65/t, rising to $170/t in 2030, to incentivize innovation, including the development and deployment of carbon management technologies

- Refundable CCUS Investment Tax Credit (ITC), valued at $3.1 billion over the first 5 years, and around $7.6 billion up to 2030, for projects that enable permanent CO2 storage

- $319 million over 7 years for RD&D to advance the commercial viability of emerging carbon management technologies

- Strategic Innovation Fund Net Zero Accelerator, with $8 billion in funding to help companies reduce emissions and sustainably grow their business

- Canada’s GHG Offset Credit System Regulations, which includes a protocol for direct air carbon dioxide capture and sequestration (DACCS) that is under development to further incentivize permanent storage opportunities

- The Canada Infrastructure Bank (CIB) invests in CCUS infrastructure projects, including through its Project Acceleration funding for front-end engineering and design (FEED) capital expenditures

- The Clean Fuel Regulations, which came into force in June 2022 and include CCUS-related opportunities for credit creation

- Other complementary measures under development, such as the Oil and Gas Emissions Cap and the Clean Electricity Regulations

- The Canada Growth Fund, totalling $15 billion, will offer investment tools designed to address risk and accelerate private sector investment in the carbon management sector, such as contracts for differences

See Annex B for additional details on the federal policy and regulatory framework.

Economic opportunities for carbon management in Canada

Carbon management plays a critical role in advancing progress towards Canada’s 2030 climate targets and enabling a prosperous, net-zero economy by 2050. In addition to enabling emissions reductions, carbon management is also a tremendous economic opportunity. Canada has what is needed to attract international investment in the sector and leverage its expertise to strengthen exports, boost inclusive economic growth, and create high-quality jobs. Given Canada’s vast geological storage resources, this includes potential future opportunities for carbon removal facilities in Canada to advance emissions reduction goals. The emerging sector also presents opportunities to embrace new approaches to partnerships with Indigenous Peoples that are being seen across other natural resource sectors, which boosts the competitiveness of projects and can help advance economic reconciliation.

International investment attraction

Canada can offer project investment opportunities that have a competitive cost per Mt of CO2 reduction, as well as vast CO2 storage potential. Public funding and trade promotion of Canadian carbon management technology companies have already helped pave the way for international investment.

Industry commitment to net zero is also increasing, along with investment and collaboration to advance the technologies needed to achieve it. For example, under the Glasgow Financial Alliance for Net Zero, 550 of the world’s leading financial institutions, managing a combined US$150 trillion, have committed to reduce their financed emissions in line with reaching net zero by 2050.Footnote 37 Leading private standards such as the Science-Based Targets Initiative require value-chain emissions to be reduced by approximately 90%, and only allow residual emissions to be neutralized by permanent carbon removal before a corporation can claim achievement of their net-zero targets.Footnote 38 This strong signal for ESG (environmental, social, and governance) performance improvement can help attract investment in Canada and create opportunities for Canadian SMEs to work with firms looking to adopt carbon management solutions worldwide.

Sustainable jobs and clean growth

The global carbon management sector represents a multi-billion dollar and fast-growing global market opportunity. The IEA projects that US$160 billion of cumulative investment in CCUS technologies is needed globally by 2030—signifying a rapidly expanding market for related technologies and services. New industries associated with carbon management, including hydrogen, negative emissions, and CO2 utilization, can provide an increasingly significant source of export and economic growth.Footnote 39 Commercial development in these adjacent industries is accelerating quickly. Canadian carbon management companies, such as Svante, CarbonCure, and Carbon Upcycling are already expanding their operations outside of Canada and are considered world leaders in their respective technology solutions. Another leading technology provider founded in Canada, Carbon Engineering, has entered into a purchase agreement to be acquired for CAN$1.48 billion (US$1.1 billion) by Oxy Low Carbon Ventures; Carbon Engineering’s research and development activities and Innovation Centre will remain in Squamish, British Columbia.

The near-term clean growth opportunities from advancing carbon management in Canada bring the potential to create and retain jobs in a variety of sectors across the country. For example, the economic benefit of 3 large-scale carbon capture and storage (CCS) projects in Canada could lead to an increase of $2.7 billion in GDP based on a 4-year construction and development timeframe.Footnote 40 The IEA estimates that approximately one to five jobs are created per million dollars of capital spending on CCUS technologies.Footnote 41 Existing large-scale projects in Canada, such as the Alberta Carbon Trunk Line (ACTL) system and the Shell-operated Quest CCS project, have directly employed thousands during their planning and construction, with estimates of thousands more indirect jobs. As the sector rapidly scales up, labour needs will grow immensely, bringing high-value employment opportunities in engineering and RD&D, along with jobs in construction, operation, and maintenance.

Federal priorities to promote a robust carbon management sector in Canada

For Canada to fully seize the opportunity and continue its global leadership in carbon management, accelerated and coordinated action is needed across the public and private sectors. The Government of Canada’s actions are guided by 5 key priority areas: 1) Accelerating innovation and RD&D; 2) Advancing policies and regulations; 3) Attracting investment and trade opportunities; 4) Scaling up projects and infrastructure; and 5) Building partnerships and growing inclusive workforces.

This section outlines the 5 federal priority areas in greater detail, including actions the Government of Canada has already taken, and next steps to capitalize on the progress made to date.

1. Accelerating innovation and RD&D

Objectives

Develop, scale up, and improve the commercial viability of carbon management technologies across sectors, advance the geological science required to further quantify and develop Canada’s CO2 storage potential, and inform future regulatory development.

To develop and deploy carbon management technologies on the scale required to achieve net-zero emissions in Canada by 2050, industry, government, and research institutions must work together to accelerate innovation that supports technology development, scale-up, piloting, demonstration, and de-risking across different sectors, applications, and stages of development.

In the near-term, deployment of higher-readiness technologies will be required to get the projects and supply chain in place to deliver emissions reductions that help Canada meet its 2030 climate target. In parallel, key lower- and medium-readiness carbon management applications in cement, iron and steel, chemicals, and DAC require advancement through piloting and demonstration at large and commercial scales to be ready for large-scale deployment beyond 2030.

Strategic support across the innovation continuum will work to advance the full commercialization of mature technologies while scaling up emerging approaches. Targeted early-stage and foundational support will advance new technologies and applications as support for large-scale deployment and market development expands demand for innovative carbon management technologies and services.

What the Government of Canada is doing

Natural Resources Canada has been a leader in carbon management research, development, and demonstration, working in coordination with domestic and international partners.

Public funding for RD&D is critical to incentivize clean technology development and cost reductions, helping to drive greater private sector investment, particularly in later stages of development and commercialization. This is why, in Budget 2021, the Government of Canada announced an investment of $319 million over 7 years to improve the commercial viability of CCUS technologies through external and federal RD&D activities delivered by Natural Resources Canada (NRCan).

NRCan is funding a range of innovation priorities, including earlier-stage RD&D activities across the CCUS value chain. Funding has also focused on front-end engineering and design (FEED) studies to support demonstrations of novel CCUS technologies and first-of-kind deployment projects in hard-to-decarbonize industries or of DAC facilities. These FEED studies help address uncertainty about technical and financial risks to support a final investment decision.

Other federal support through Sustainable Development Technology Canada, the Strategic Innovation Fund—Net Zero Accelerator, and the National Research Council of Canada’s Industrial Research Assistance Program can help innovative carbon management firms commercialize their technologies through access to capital, as well as access to strategic advisors, incubators, and accelerators. The Canadian CCUS Research and Technology Network, launched in fall 2022, serves to connect technology innovators and industry to organizations providing expertise with the facilities and equipment to help demonstrate, scale, and validate technologies.Footnote 42

Complementary to external RD&D projects, federal scientists across the Government of Canada’s research laboratories are working on R&D activities that contribute to technology advancement and knowledge development, including work on CO2 storage and biomass carbon sequestration. Federal science also supports the development of codes and standards to enable safe and efficient deployment of carbon management solutions. This work is helping to create reliable, publicly available data, with modelling tools also supporting techno-economic analysis and LCA.

Canada is a leader in advancing international collaboration on carbon management, including through the Clean Energy Ministerial (CEM) CCUS Initiative, the Mission Innovation (MI) Carbon Dioxide Removal Mission that Canada co-leads, and more recently, the Carbon Management Challenge—a joint effort and call to action launched by the US at the April 2023 Leaders’ meeting of the Major Economies Forum on Energy and Climate.Footnote 43 Through these partnerships, Canada will continue to advance international discussions across the full innovation spectrum of carbon management solutions.

Advancing foundational science to help with decision-making and regulatory development for emerging carbon management approaches is another key area of importance. For instance, there is growing domestic interest in ocean-based CDR, but foundational scientific research is required to better understand the potential benefits and risks of these approaches.

What’s next

Advance research, development, and demonstration for early-stage CDR technologies; lower CO2 capture costs; advance CO2 utilization opportunities; and develop codes, standards, and geotechnical mapping across Canada.

Canada has an opportunity to build on its early leadership as an innovator of carbon management technologies by continuing to advance RD&D of emerging applications that have the highest potential to contribute to emissions mitigation and removal efforts. The next generation of capture technologies, including non-solvent-based technologies, aims to increase efficiency and reduce energy use to improve capital and operating costs. Further support is required for field demonstrations to scale up and commercialize these solutions, thus ensuring their readiness and availability to supply growing markets.

Further support is also needed to advance mid- and high-readiness technologies to achieve first-of-their-kind commercial scale applications, with priorities such as industrial capture applications, modular technologies, facilities with the potential for net-negative emissions (e.g., DAC, BiCRS, and enhanced mineralization), and permanent sequestration solutions.

The growth of Canada’s carbon management sector can be further supported by expanding the availability of reliable and publicly accessible data to support the innovation system. This includes modelling tools like techno-economic analysis and LCA to inform further RD&D, policy, adopter uptake, and accurate carbon accounting. To enable continued growth of the sector, the Government of Canada will continue to advance geological science to help identify and quantify domestic storage potential and support the safe and permanent storage of CO2.

2. Advancing policies and regulations

Objectives

Ensure evidence-based regulatory frameworks underpin safe and responsible development of carbon management technologies; take a collaborative approach that recognizes federal and provincial/territorial responsibilities; and work with global partners to advance codes and standards that promote international alignment and evolve as the carbon management industry grows.

The Canadian carbon management business environment must be globally competitive to attract the level of investment needed to achieve its emissions reduction potential. Global companies can select where to invest in carbon management, and this decision is often determined by the policy and regulatory environment of a jurisdiction. To strengthen Canada’s attractiveness as an investment destination, policies should aim to provide certainty, transparency, and durability, recognizing that carbon management projects are capital-intensive and require long-term investment decisions.

At all levels of government, it will be critical to enact, maintain, and enhance stable, simple, and predictable policies and regulations to incentivize carbon management development and investment. Provinces hold much of the responsibility for regulating carbon management activities (e.g., requirements for monitoring and oversight of CO2 geological storage). However, there are federal responsibilities for certain aspects. The Canada Energy Regulator, for instance, has responsibilities to regulate cross-border (interprovincial and international) CO2 transport by pipeline. Under the Impact Assessment Act, certain projects could trigger a federal impact assessment. In the marine environment, the Canadian Environmental Protection Act, 1999 will apply for environmental aspects of CO2 storage activities.

Further research and engagement are needed before offshore activities on Canada’s east and west coasts can take place. As Canada does not yet have a comprehensive regulatory framework specific to offshore carbon management, offshore CO2 capture and storage projects would require legislative changes and regulatory development, as well as further foundational science.

Alignment of international standards could improve confidence for industry and investors as the global carbon management industry grows. The International Organization for Standardization and Canada’s CSA Group are advancing standards for CCUS technologies, including standardization of design, construction, operation, risk management, quantification, and monitoring and verification.Footnote 44

Consideration of incentives for CDR can help enable and accelerate the deployment of measures that achieve negative emissions. Supporting the development of an international carbon market and trading system will also be important to enable the supply and demand for CDR projects that deliver carbon removal credits.

What the federal government is doing

Canada has a well-aligned suite of investment tools, incentives, and regulatory frameworks designed to work together to add value to carbon management, support investor certainty, and incentivize early adoption.

The Government of Canada is continuously seeking opportunities to strengthen federal-provincial-territorial collaboration to ensure Canadians across the country can reap the benefits from the transition to a net-zero economy by 2050. Canada’s 2030 Emissions Reduction Plan outlines climate policies to enable Canadian investments in clean energy technologies that are needed to achieve Canada’s climate targets. Late in 2022, NRCan launched the Regional Energy and Resource Tables, a collaborative initiative supported by joint partnerships between the federal government and several provincial and territorial governments, as well as formal collaboration with Indigenous partners and key stakeholders. It aims to align priorities, funding and financing opportunities, as well as policy and regulatory approaches on a regional basis to accelerate economic activity and sustainable job creation towards a net-zero economy.

The Government of Canada has taken crucial steps to support the development of a positive policy environment for carbon management. Canada has an economy-wide carbon pricing system with a benchmark price across the country. This clear price signal, combined with other economic and climate policies and incentives, work together to push in the same direction to support carbon management development and deployment. Alongside rising carbon prices, increasingly stringent emissions standards—such as the Clean Electricity Regulations, Clean Fuel Regulations, and the emissions cap for the oil and gas sector—will further encourage adoption of carbon management technologies. To support access to capital for carbon management projects, the federal government introduced the refundable CCUS ITC, valued at $3.1 billion over the first 5 years. The CCUS ITC will be available for investments from 2022 to 2040, with rates decreasing after 2030 to incentivize early investment.The $15 billion Canada Growth Fund will also catalyze private investment to support the rapid deployment of carbon management projects through tools including carbon contracts for differences and project financing.

To make carbon pricing even more predictable and to support investments to build a competitive clean economy, the Government of Canada will consult on the development of a broad-based approach to carbon contracts for differences that would complement contracts for difference offered by the Canada Growth Fund. A comprehensive list of enabling federal programs, policies, and regulations is detailed in Annex B. In addition to federal measures, actions taken by provincial and territorial governments, including through partnerships and joint investments with the federal government, are essential to strengthening the policy and investment environment for developing Canada’s carbon management sector.

What’s next

Continue an adaptive approach to support the carbon management industry as it grows, contribute to market demand for low-carbon products through government procurement, and continue to support the development of codes, standards, and regulations to enable the safe deployment of carbon management solutions.

Federal action will continue to focus on durable, predictable, and enabling policy measures for carbon management as a key component of Canada’s broader climate change policy. Through collaboration with provinces and territories, including through the Regional Energy and Resource Tables, the Government of Canada will emphasize the importance of complementarity with provincial and territorial carbon management-related policies and regulations, aim to reduce jurisdictional overlap, and address gaps.

As noted, Canada does not have a comprehensive regulatory framework specific to CO2 storage in areas of federal jurisdiction (i.e., federal lands and offshore). Further assessment is required to determine the best path forward to address these gaps.

It is also important to continue federal support for emerging markets through demand-side mechanisms, such as the Government of Canada’s upcoming Buy Clean initiative and the procurement of low-carbon products produced by industries that use GHG mitigation technologies or leverage CO2 utilization. Federal procurement of CO2-utilization products and CDR credits, once available, could help stimulate emerging markets while offsetting residual federal GHG emissions on the Government’s path to net zero.

Carbon Engineering’s pioneering DAC innovation—British Columbia (BC)

Carbon Engineering’s Innovation Centre in Squamish, BC – Carbon Engineering

Founded in Squamish, BC, Carbon Engineering is a world-leading innovator in Direct Air Capture (DAC). Their technology captures CO2 directly from the atmosphere, which can then be permanently stored underground or transformed into low-carbon synthetic fuels.

The Governments of Canada and British Columbia are early supporters of the company’s technology—with funding of over $30 million towards pilot-scale testing of CO2 capture and conversion into synthetic fuels—and an Innovation Centre for technology development (both in Squamish). The British Columbia government is also supporting the preliminary engineering and design of a commercial AIR TO FUELS™ plant in Merritt, BC, being developed by Carbon Engineering’s Canadian plant development partner, Huron Clean Energy.

Continued development and alignment of international standards on carbon management would also improve confidence for industry and investors as the global carbon management industry grows. The Government will continue to support international efforts to address governance gaps and establish global standards for accounting and the measurement, reporting, and verification of emissions. Standards for conducting life-cycle assessments and Environmental Product Declarations will also be important to advance the CO2-based products industry.

3. Attracting investment and trade opportunities

Objectives

Continue expanding Canada’s opportunities to capitalize on foreign investment as international competition grows.

Carbon management represents a multi-billion dollar and fast-growing global market opportunity. The IEA projects that US$160 billion in cumulative investment is needed globally by 2030, a target that looks to be in reach with recent CCUS project announcements pushing annual investment as high as US$40 billion by 2024.Footnote 45 Within the US alone, the National Petroleum Council projects required investments of over US$680 billion in CCUS over the next 25 years. These projections signify a rapidly expanding market for carbon management technologies in North America and around the world. New industries associated with carbon management (low-carbon hydrogen, negative emissions, CO2 utilization) are expected to provide an increasingly significant source of export and economic growth. For instance, market growth for CO2-based products has been forecasted to reach US$1 trillion per year by 2030.Footnote 46

Canada is a leader in carbon management technologies, and given its relatively small domestic market, Canadian clean technology firms are looking to enter highly competitive international markets. Canada has the expertise, regulations, and resources needed to attract significant international investment, particularly as public and private demand for emissions reductions and responsible investment solutions (e.g., ESG performance) are intensifying globally. As the carbon management industry continues to grow globally, Canadian firms need to be positioned and supported to take advantage of these international growth opportunities to maximize the potential of turning Canadian technologies into global solutions, in addition to providing domestic market opportunities.

Heidelberg Materials’ World-Leading Carbon-Neutral Cement Plant—Alberta (AB)

Heidelberg Materials’ cement plant in Edmonton, AB – Heidelberg Materials

The cement sector is responsible for around 7% of global CO2 emissions. Capturing and storing CO2 from cement production is a critical technology to reduce industrial emissions. Heidelberg Materials—one of the world’s largest integrated manufacturers of building materials with an ambitious CO2 reduction strategy—has signed a Memorandum of Understanding with the Government of Canada to support a first-of-its kind carbon management project in North America.

The partnership intends to support the company’s $1.36 billion project to build a full-scale carbon capture utilization and storage CCUS and combined heat and power system at its Edmonton cement facility. This CCUS system will enable the company to produce the world’s first net-zero cement through the capture and transportation of CO2 for subsequent permanent storage, reducing GHG emissions by up to one million tonnes annually.

This project would be a major step forward in establishing Canada as a global leader in the production of low-carbon concrete and supports actions outlined in Canada’s Roadmap to Net-Zero Concrete by 2050—spearheaded by a joint government-industry working group co-led by the Cement Association of Canada and the Government of Canada.

Canada can offer project investment opportunities that have a competitive cost per tonne of CO2 sequestration. Western Canada, in particular, has a vast resource potential for CO2 storage, as well as midstream infrastructure. Canada’s strong forestry, agriculture, and minerals sectors also offer promising opportunities for emerging carbon management solutions. Capital investment from foreign strategic investors can be an important driver for the development of Canadian carbon management projects, as well as technologies and their subsequent integration into global value chains.

As global investors set their sights on the opportunities offered by carbon management, ongoing government engagement and support is critical to maintain Canada’s competitiveness, especially in light of recent movement by the US to grow its own domestic carbon management industry. The Inflation Reduction Act (IRA) passed in August 2022 provided at least US$369 billion in new investments to reduce emissions through tax credits and other financial incentives aimed at making clean energy options more accessible. Alongside the 2021 Infrastructure Investment and Jobs Act (IIJA), the 2 pieces of legislation contain provisions that give rise to several measures to accelerate the development and deployment of carbon management technologies and related infrastructure in the US through tax incentives, loans, grants, and investments in RD&D.

While the new measures introduced by the US and the European Union pose a challenge to Canada’s own carbon management sector, Canada continues to develop a suite of measures to remain competitive, including direct investments in RD&D and deployment projects, investment tax credits, support for workers, demand-side incentives, and federal-provincial/territorial dialogues, all built on the foundation of Canada’s climate plan that puts a rising price on pollution.

What the Government of Canada is doing

Canada’s suite of federal policy and programming supports work alongside other federal measures and provincial/territorial policies, resulting in a competitive investment environment across Canada.

Public funding and trade promotion of Canadian carbon management technology companies help secure Foreign Direct Investment (FDI). Canada’s Trade Commissioner Service (TCS), through its global network, supports Canadian carbon management companies in their export-oriented objectives and efforts to commercialize carbon management technologies in key global markets. This work includes showcasing technologies and solutions to foreign buyers, strategic partners, and foreign investors and facilitating partnerships between Canadian researchers, innovators, and foreign partners.

CarbonCure’s green concrete solution—Nova Scotia (NS)

CarbonCure’s propriety system and CO2 tank installation at a concrete plant – CarbonCure

Founded in Halifax in 2012, CarbonCure uses its technology to inject CO2 into its concrete mix during production to reduce CO2 emissions via carbon mineralization, while improving the strength of the mix. With 650+ systems sold across 16 countries and 5 continents, over 3 million truckloads of CarbonCure CO2-based concrete mixes have supplied a broad range of sustainable construction projects globally.

CarbonCure’s cutting-edge technology has garnered global recognition such as the Cleantech 100 Hall of Fame (as a Global Cleantech 100 company for 7 consecutive years), a 2022 CNBC Disruptor 50 List Company, and the NRG COSIA Carbon XPRIZE Winner (natural gas track). In addition to receiving support from the Government of Canada and BDC Capital, the company is backed by investors such as Amazon, Microsoft, Breakthrough Energy Ventures, Shopify, and Mitsubishi Corporation.

In early 2023, CarbonCure’s demonstration project with Central Concrete and Heirloom achieved what is believed to be the first-ever concrete storage of atmospheric CO2 captured by direct air capture.

An important characteristic of Canada’s carbon management policy environment is the ability to take advantage of benefits from multiple policy measures at once. Federal measures are intended to be “stackable” or combined with other federal measures, including Clean Fuel Regulation credits, incentives from the Canadian Infrastructure Bank, as well as provincial policies, which together are anticipated to help spur carbon management adoption (reaching a total of over 16 Mt/year captured by 2030).Footnote 47

What’s next

Continue to incentivize carbon management investment and use government procurement policies to create supportive lead markets for carbon management-enabled products.

For Canada to remain competitive in the growing global carbon management sector, the Government will continue to advance carbon management-specific policies and incentives that help level the playing field with other countries in terms of capital and operating support, as well as revenue support (e.g., carbon pricing/credits, contracts for differences). This includes dedicated efforts to pull high-readiness technologies into commercial deployment via complementary and stackable government measures at timescales that bring certainty to future revenue streams for the carbon management value chain, and which enable private investment for large-scale deployment projects.

Canada will continue building on its successes and promote Canada’s carbon management opportunities to attract foreign direct investment. With a robust policy framework and competitive incentives, Canada is well positioned to further attract investment, both in support of advancing emerging technologies, and to support the domestic capacity to deliver CO2 sequestration as part of climate action. The Government can also leverage comprehensive free trade agreements and increase bilateral cooperation with key partners, engage in international standards development, and promote the mutual recognition of carbon management norms and standards.

Public procurement of low-carbon products is another policy tool that can help accelerate the adoption of carbon management technologies by supporting the development of a robust market for carbontech products with superior emissions performance that is not yet properly valued. That is why the Government of Canada is also advancing activities under its Buy Clean Initiative, providing a policy signal that can stimulate carbon management technologies that reduce the carbon content in building materials (i.e., embodied carbon). Calculating and comparing the embodied carbon of products will require robust life-cycle assessment methodologies, which has been identified as an area for continued federal action. Other mechanisms, such as advance market commitments for GHG removal credits, may be considered to signal demand for CDR, which may in turn stimulate private investment and encourage other organizations to make similar commitments.

4. Scaling up projects and infrastructure

Objectives

Ensure Canada develops and deploys the carbon management projects and infrastructure needed to achieve targeted emissions reductions.

The related infrastructure expansion to meet the evolving capacity needs of the carbon management sector across the value chain—CO2 capture, transportation, utilization, and storage—is critical and requires continued government support at all levels. Potential for Indigenous partnerships is present across all areas of the value chain and are already being recognized as important opportunities for industry to effectively advance projects while contributing to economic reconciliation. Indigenous communities are already active in advancing carbon management opportunities, such as in Huron Clean Energy’s first-of-its-kind Electro Fuels Project in Merritt, BC, where the Upper Nicola Band has an equity partnership and land-lease arrangement with Huron Energy that will continue to benefit the community and create economic opportunities.Footnote 48

The continued growth of Canada’s carbon management sector must be inclusive to meet its full economic potential, with an emphasis on meaningful consultation with Indigenous communities throughout all stages of major projects. This would ensure equitable access to jobs, training, education, and leadership opportunities for Indigenous Peoples, and guarantee that First Nations, Métis, and Inuit communities gain long-term sustainable benefits, such as equity ownership in carbon management firms and projects. As with the broader transition to a cleaner economy, Canada’s growing carbon management sector presents an opportunity to ensure Indigenous women and 2SLGBTQQIA+ people are included in—and benefit from—the carbon management value chain.

Most CO2 in the carbon management value chain will need to be permanently stored in geologic reservoirs, mineralized into rock, or locked away in long-lived products, signalling a need for significant global expansion of CO2 transport and storage capacity.Footnote 49 Permanent geological storage site development is determined by the suitability of the geology, and is most desirable where emission sources are nearby and concentrated, given that the cost of CO2 transport by rail, pipe, or ship increases with distance.

Carbon management hubs, where shared CO2 transportation infrastructure links clusters of emitting facilities with CO2 storage sites or CO2 utilization opportunities, are a leading model within the carbon management sector. These hubs help spur innovation, enable new business models, reduce barriers to entry for new technology adopters, and encourage the development of cost-effective carbon management technologies at scale. Economies of scale, standardization, and shared facilities can help drive down costs and decrease commercial risk for all stakeholders. Developing infrastructure in a targeted way, such as building transport and storage infrastructure to meet anticipated future capacity needs, can lay a foundation for adding future capture projects to a network that maximizes benefits for all hub participants by reducing future CO2 transportation and storage costs. For example, the 240-kilometre Alberta Carbon Trunk Line (ACTL) pipeline, which has been operational since 2020, is one of the largest-capacity CO2 transportation pipelines in the world and provides the infrastructure to connect CO2 sources with storage. It currently transports 1.6 Mt CO2 annually from 2 industrial emitters and in September 2023, it was announced that a new extension, the Edmonton Connector, will expand the ACTL network to collect captured CO2 from industrial facilities, including the Air Products Net-Zero Hydrogen Energy Complex.Footnote 50

Air Products’ first-of-a-kind net-zero hydrogen energy complex—Alberta

Air Products hydrogen production facility near Edmonton, AB.

Low-carbon hydrogen can be produced from natural gas when combined with Carbon Capture and Storage. Canada’s early leadership in carbon management includes the Shell-operated Quest Project, and the Sturgeon Refinery linked to the Alberta Carbon Trunk Line.

Air Products is building on Canada’s carbon management expertise and infrastructure to produce low-carbon hydrogen. The company is building a first-of-a-kind facility in Edmonton—deploying autothermal reforming (ATR) hydrogen production technology using natural gas, while capturing 95% of the CO2 for storage underground. This innovation is part of Air Products’ Net-Zero Hydrogen Energy Complex, which will also feature a hydrogen-fuelled power plant and a world-class liquefaction facility to access new markets and enable the transition of the transportation sector to zero-emission fuels. The complex is scheduled to start operations in 2024 and is supported by the federal and provincial governments:

- $300 million from the Strategic Innovation Fund’s Net Zero Accelerator (SIF-NZA) initiative

- Over $160 million from the Alberta Petrochemicals Incentive Program (APIP)

- $15 million from Emissions Reduction Alberta’s Shovel-Ready Challenge

Collaboration among players in one region can also make more efficient use of shared operations, and technical, administrative, and commercial resources. Given the cost, size, and intended lifespan of hubs, it is crucial that they be developed in a timely and predictable manner that allows potential users to incorporate their availability into future planning. For example, the Pathways Alliance, representing Canada’s 6 largest oil sands companies and 95% of Canada’s oil sands production, is currently undertaking a regional collaborative approach to develop one of the world’s largest industrial carbon management facilities in northern Alberta. This foundational project proposes a CCS network that would capture CO2 from more than twenty oil sands facilities, transport it to a hub for safe underground storage, and make it available to other industries in the region interested in capturing and storing CO2. Similarly, the Open Access Wabamun Carbon Hub will see Enbridge enter into a 50/50 development and ownership model with Indigenous partners in Alberta to advance an integrated sequestration hub west of Edmonton.

Canada’s carbon management future will likely include a combination of large low-carbon industrial hubs that can include various technology applications, such as low-carbon hydrogen production, carbon capture and use at cement production facilities, smaller distributed hubs, and stand-alone carbon management projects—each driven by location and project specifics, and market forces. Large-scale “anchor” projects, typically capturing over 1 Mt CO2 per year, can help spur hub development. Hubs are often planned in industrial zones, making overall acceptance, planning, and permitting processes easier. In many instances, Indigenous communities have expressed interest in partnerships to continue advancing carbon management projects in their territories.

Hubs also deliver local economic development benefits, as they often provide additional economic opportunities to industrial areas. This may help preserve and create high-quality jobs, while generating new opportunities for industrial clusters. Co-deployment of carbon management with other technologies can stimulate adoption, enable greater emissions reductions, and encourage innovation spillovers.

What the Government of Canada is doing

Working to support planning and decision-making for carbon management projects in Canada.

The Government is working to support carbon management infrastructure development to enable a robust domestic value chain. The Geologic Survey of Canada and NRCan’s CanmetENERGY labs work to enhance knowledge and data on CO2 storage and transport. CanmetENERGY has developed a Canadian CCUS Assessment Framework to provide open-source tools to guide the strategic advancement of carbon management across regions. These tools will help facilitate the planning of large-scale, integrated CO2 transportation and storage infrastructure, supporting coordination among key stakeholders from industry, academia, and government.

The suite of federal supports for carbon management infrastructure has continued to expand in recent years, which is helping to stimulate private sector and provincial funding. This included the now sunset Strategic Innovation Fund’s $8 billion Net-Zero Accelerator that supported the decarbonization of Canada’s largest industrial emitters, scaled up clean technology, and accelerated Canada’s industrial transformation across all sectors, with a target of 23.5 Mt in GHG reductions per year by 2030.

Budget 2022 announced the expansion of the Canadian Infrastructure Bank’s mandate to support the deployment of CCUS technologies and related infrastructure projects. The Canada Growth Fund will also complement these supports with tools designed to address risk and accelerate private sector investment in the sector.

The CCUS ITC, announced in Budget 2022 and enhanced in Budget 2023, will further help to drive near-term scale-up and investment in project and hub development, while ensuring Canada remains competitive in this sector. The CCUS ITC will only be eligible for projects in specific jurisdictions where provincial regulatory frameworks are in place to support the safe and permanent storage of CO2. This currently includes Alberta, Saskatchewan, and British Columbia,Footnote 51 with eligibility for other jurisdictions to be evaluated as regulatory frameworks advance.

As part of the global effort to scale up decarbonization technologies, Canada joined the First Movers Coalition in January 2023 as a government partner. This collaborative public-private initiative leverages the purchasing power of businesses to stimulate market demand for near-zero or zero-carbon solutions and send a clear signal to industry to accelerate the transition to net-zero emissions.

Through the Regional Energy and Resources Tables, NRCan is working with provincial and territorial government counterparts on advancing work plans, some of which focus on carbon management. Indigenous partners and industry stakeholders are also contributing to these work plans, bringing together key actors to collaborate and support the advancement of infrastructure planning and large-scale project development.

What’s next

Work with the private sector to explore blended finance options and alternative financing tools to support strategic investments in key industrial sectors; spur large-scale projects; and advance hub development.

The Government will continue to collaborate with domestic and international financial institutions to support the financing of carbon management projects in a way that recognizes verified climate benefits and encourages clean economic growth opportunities. Dialogue with key financial institutions can explore blended finance options and alternative financing tools to support strategic investments in key industrial sectors and to spur large-scale project and hub development, collaborating with private-sector initiatives aimed at decarbonization.