Cobalt facts

Cobalt is a hard, lustrous, silver-grey metal that is used mainly as a cathode material in lithium ion and other types of batteries. It is also used in powerful magnets, cutting tools and high-strength alloys in the aerospace, energy and defense sectors. Cobalt compounds have been used since antiquity as a pigment for pottery, glass, paints and other media. Additionally, cobalt plays a crucial role in human nutrition as a component of vitamin B12.

Key facts

- In 2023, Canada produced over 5,000 tonnes of cobalt, with 43% sourced from Newfoundland and Labrador and the remainder from Ontario, Manitoba, and Quebec.

- Canada's exports of cobalt and cobalt products were valued at $568 million in 2023.

- Currently, most of Canada's cobalt production is a by-product of nickel mining.

Learn more about cobalt

Uses

Uses

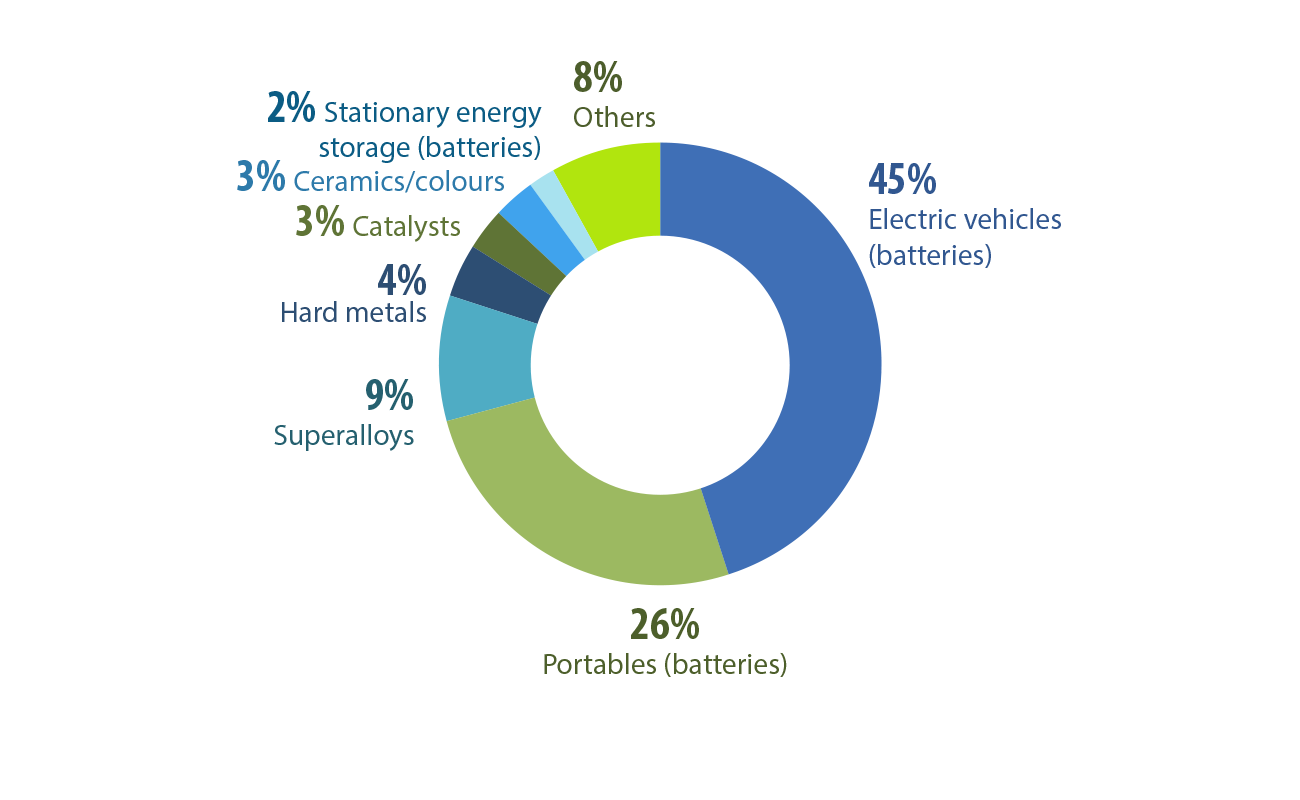

Batteries are the main end use for cobalt as a cathode material. Electric vehicles currently dominate use, but lithium-ion batteries in cell phones and laptops also consume a sizeable quantity of global cobalt. Stationary energy battery storage accounts for a small but growing portion of cobalt use.

Cobalt is also used in high-strength superalloys, mainly for aerospace applications. In industrial processes, cobalt is used in various metal and chemical products:

- Metal applications: Includes cemented carbides, alloys, magnets and diamond tools.

- Chemical applications: Encompasses a wide range of uses, including pigments, inks, catalysts, tires, and driers.

Cobalt, global uses, 2023

Text version

This circular chart illustrates the primary global uses of cobalt in 2023. The largest segment is for electric vehicles (45%), followed by batteries for portable devices (26%). Other uses include super alloys (9%), hard metals (4%), catalysts (3%), ceramics and colours (3%), stationary batteries (2%), and various other applications (8%).

Production

Production

Canadian production

In 2023, Canada produced 5,099 tonnes of cobalt in concentrate mostly from primary nickel mines in Ontario, Quebec, Manitoba, and Newfoundland and Labrador, marking a 44% increase from the 3,534 tonnes produced in 2022. This production level surpassed the previous record of 5,039 tonnes set in 2019. Mines in Newfoundland and Labrador contributed 43% of Canada's total cobalt output, followed by Ontario at 33%.

In 2023, Canada also produced 4,923 tonnes of refined cobalt at four refineries located in Fort Saskatchewan, Alberta; Port Colborne, Ontario; Thompson, Manitoba; and Long Harbour, Newfoundland and Labrador.

Canadian refineries process nickel and cobalt from domestic and imported materials, primarily sourced from mines in the United States and Cuba.

Looking ahead, cobalt production is expected to continue to come mostly from primary nickel mines in Canada. An exception is the NICO deposit in the Northwest Territories, a cobalt-gold-bismuth-copper deposit currently in advanced exploration stages.

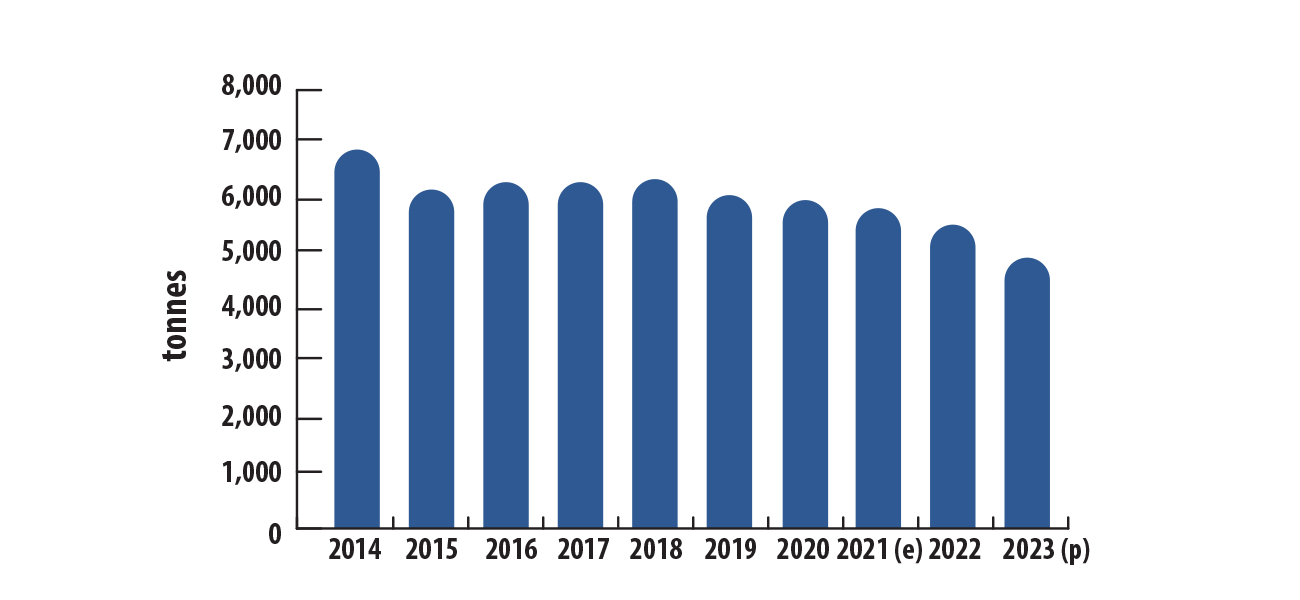

Canadian mine production of cobalt, 2014–2023 (p)

Text version

This bar graph illustrates Canada's annual cobalt mine production from 2014 to 2023. In 2014, production stood at 3,907 tonnes, rising slightly to 4,339 tonnes in 2015 before dipping to 4,216 tonnes in 2016. Production continued to decline gradually, reaching a low of 3,279 tonnes by 2018. A sharp increase in 2019 brought production up to 5,039 tonnes, followed by a decline to 3,953 tonnes in 2021 and a further 11% decrease to 3,534 tonnes in 2022. In 2023, production surged by 44%, reaching 5,099 tonnes.

Canadian refined production of cobalt, 2014–2023 (p)

Text version

This bar graph shows Canada's refined cobalt production from 2014 to 2023. In 2014, Canada produced 6,907 tonnes of refined cobalt, which decreased to 6,126 tonnes in 2015. From 2016 to 2018, production remained relatively stable, ranging from 6,302 tonnes in 2016 to 6,355 tonnes in 2017. However, refined cobalt production declined to 5,965 tonnes in 2020, dropping further to 5,821 tonnes in 2021, 5,501 tonnes in 2022, and 4,923 tonnes in 2023.

The 2021 amount of 5,821 tonnes was an estimate, derived from historical data for January to August, which were suppressed for confidentiality, combined with reported data from September to December.

International context

International context

The Democratic Republic of Congo is the world's largest mined cobalt producer, contributing 73.0% of global output. Because of the rapid expansion of its nickel industry, Indonesia has recently emerged as the second-largest cobalt producer, accounting for 7.3% of global production. Cobalt is primarily mined as a by-product of copper or nickel mining, with notable exceptions being artisanal mining in Congo and production in Morocco.

Canada is the fourth-largest cobalt producer globally, accounting for 2.2% of total production.

China leads the world in refined cobalt production, sourcing most of its concentrate or raw ore from the Democratic Republic of Congo and domestic sources. Additionally, China is the largest consumer of cobalt, primarily for battery manufacturing.

| Ranking | Country | Tonnes | Percentage of total |

| 1 | Democratic Republic of Congo | 170,000 | 73.0% |

| 2 | Indonesia | 17,000 | 7.3% |

| 3 | Russia | 8,800 | 3.8% |

| 4 | Canada | 5,100 | 2.2% |

| 5 | Australia | 4,600 | 2.0% |

| 6 | Madagascar | 4,000 | 1.7% |

| 7 | Philippines | 3,800 | 1.6% |

| 8 | Cuba | 3,200 | 1.4% |

| 9 | New Caledonia | 3,000 | 1.3% |

| 10 | Papua New Guinea | 2,900 | 1.2% |

| Other | 6,600 | 2.8% | |

| Total | 233,000 | 100.0% |

World reserves

In 2023, global cobalt reserves were estimated at approximately 11.4 million tonnes, with the Democratic Republic of Congo holding the largest share, accounting for 52.8% of the total. Canada ranks third globally, with reserves of 600,000 tonnes.

Cobalt terrestrial resources in 2023 were estimated at approximately 25 million tonnes, while global ocean resources were estimated at 120 million tonnes.

Most terrestrial resources are found in sediment-hosted stratiform copper deposits in the Democratic Republic of Congo. Significant quantities of cobalt are also present as secondary or tertiary minerals in nickel-bearing laterites in Australia, Indonesia, the Philippines, and Cuba and in magmatic nickel-copper sulphide deposits in Canada, Australia, the United States, and Russia.

Additionally, cobalt resources have been identified in polymetallic nodules on the sea floor.

| Ranking | Country | Tonnes | Percentage of total |

| 1 | Democratic Republic of Congo | 6,000,000 | 52.8% |

| 2 | Australia | 1,700,000 | 15.0% |

| 3 | Canada | 600,000 | 5.3% |

| 4 | Indonesia | 500,000 | 4.4% |

| 5 | Cuba | 500,000 | 4.4% |

| 6 | Philippines | 260,000 | 2.3% |

| 7 | Russia | 250,000 | 2.2% |

| 8 | Madagascar | 100,000 | 0.9% |

| 9 | Türkiye | 91,000 | 0.8% |

| 10 | United States | 69,000 | 0.6% |

| Other | 829,000 | 7.3% | |

| Total | 11,370,000 | 100.0% |

Trade

Trade

Exports

- In 2023, the total value of Canadian exports of cobalt and cobalt-containing products was $567.0 million, a 30% decrease from $813.0 million in 2022. These cobalt-containing products include intermediate products of cobalt metallurgy, waste and scrap.

- The majority of Canadian cobalt exports were destined for Norway (19%), followed by South Korea (15%), China (15%), the Netherlands (15%), and the United States (13%).

Imports

- In 2023, the total value of Canadian imports of cobalt and cobalt-containing products was $60.7 million, down 47% from $114.8 million in 2022. These cobalt-containing products include intermediate products of cobalt metallurgy, waste and scrap.

- Canada's cobalt imports were predominantly from the United States (64%), with smaller shares coming from Morocco (6%), Germany (5%), and Australia (4%).

Prices

Prices

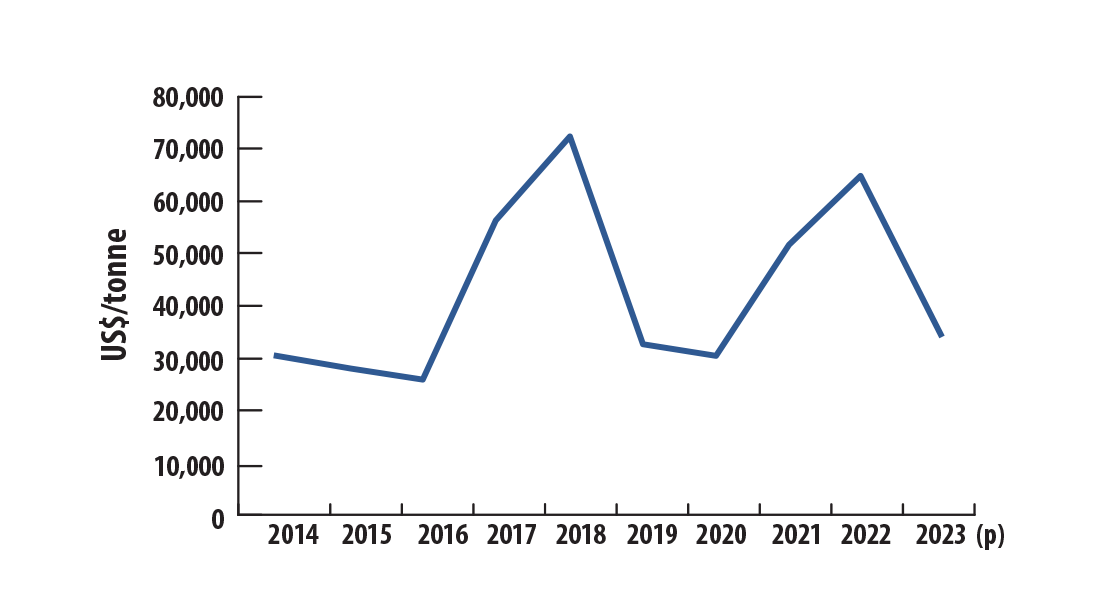

The price of cobalt experienced volatility during the past decade. In 2023, cobalt prices fell sharply to an average of US$35,000 per tonne, driven by concerns about overproduction and a slowdown in downstream demand. Cobalt remains the most expensive of the battery metals, prompting many countries and companies to invest in research and development of cobalt-free lithium-ion battery alternatives.

Earlier in the past decade, cobalt prices remained relatively stable, averaging between US$26,000 and US$31,000 per tonne from 2014 to 2016. However, prices surged dramatically in 2017, reaching an average of US$56,000 per tonne. In 2018, prices continued to climb, peaking at US$95,000 per tonne in March, with an average of US$73,000 per tonne for the year.

This price increase was driven primarily by rising demand for cobalt in lithium-ion batteries and global policy initiatives aimed at achieving net-zero emissions targets. Supply concerns also played a role. However, by 2019, prices had plummeted to an average of US$33,000 per tonne because of increased output from the Democratic Republic of Congo and the stockpiling of cobalt chemicals in China.

The COVID-19 pandemic further depressed demand for cobalt in 2020, leading to a price decrease to an average of US$31,000 per tonne. Prices began to recover toward the end of 2020, reaching approximately US$51,000 per tonne in 2021 and US$64,000 per tonne in 2022, fueled by increased demand in the electric vehicle sector, before dropping to $35,000 per tonne in 2023.

Cobalt, annual average prices, 2014–2023 (p)

Text version

This line graph illustrates the average annual price of cobalt in US dollars per tonne from 2014 to 2023. The values are nominal, based on average spot prices from the London Metal Exchange, and rounded to the nearest thousand. In 2014, the average spot price was around $31,000 per tonne. From 2014 to 2016, the annual average price fluctuated between $26,000 and $31,000 per tonne, but then surged to $56,000 per tonne in 2017 and $73,000 per tonne in 2018. Prices declined in 2019 and 2020, averaging $33,000 per tonne and $31,000 per tonne, respectively, before rising to $52,000 per tonne in 2021. The average annual price reached $64,000 per tonne in 2022 before dropping to $35,000 per tonne in 2023.

Recycling

Recycling

In July 2023, a cobalt sulfate refinery in Timiskaming, Ontario, sent out its first shipment of nickel and cobalt extracted from recycled battery materials. Additionally, another company in the region has begun piloting hydrometallurgical processes for cobalt recycling.

Notes and sources

(p) preliminary

(e) estimated

Totals may be different because of rounding.

All dollars are Canadian unless otherwise indicated.

Uses

- Cobalt, global uses, 2023

- Cobalt Market Report 2023, Cobalt Institute

Production

- Canadian mine production of cobalt, 2014–2023 (p)

- Natural Resources Canada, Statistics Canada

- Canadian refined production of cobalt, 2014–2023 (p)

- Natural Resources Canada, Statistics Canada; U.S. Geological Survey Minerals Yearbook 2015, v. I, Metals and Minerals; U.S. Geological Survey Minerals Yearbook 2022, v. I, Metals and Minerals

- The value for 2021 was estimated based on a combination of historical and reported data.

International context

- World mine production of cobalt, by country, 2023 (p)

- U.S. Geological Survey, Mineral Commodity Summaries, January 2024

- World reserves of cobalt, by country, 2023

- U.S. Geological Survey, Mineral Commodity Summaries, January 2024

Trade

- Natural Resources Canada; Statistics Canada

- Mineral trade includes ores, concentrates, and semi- and final-fabricated mineral products (HS 8105, HS 2822).

Prices

- Cobalt, annual average prices, 2014–2023 (p)

- Cobalt Market Report 2023, Cobalt Institute; U.S. Geological Survey Minerals Yearbook 2022, v. I, Metals and Minerals

Recycling

- Recovery of cobalt in batteries

- Company press releases

Page details

- Date modified: