Evaluation of the Energy Innovation Program

Audit and Evaluation Branch

Natural Resources Canada

July 8, 2019

Table of Contents

- ACRONYMS

- EXECUTIVE SUMMARY

- INTRODUCTION

- FINDINGS

- CONCLUSIONS AND RECOMMENDATIONS

- APPENDIX 1: ECOEII / EIP LOGIC MODEL

ACRONYMS

- ACOA

- Atlantic Canada Opportunities Agency

- ADM

- Assistant Deputy Minister

- APD

- Assistant Program Director

- CAA

- Clean Air Agenda

- CC & CCS

- Clean Coal and Carbon Capture and Storage

- CEF

- Clean Energy Fund

- CEIP

- Clean Energy Innovation Program

- CMSS

- Corporate Management and Services Sector

- CRL

- Commercial Readiness Level

- CTS

- Clean Transportation System

- DEEP

- Centre for Digital Entrepreneurship and Economic Performance

- DG

- Director General

- DOE

- Department of Energy

- ECCC

- Environment and Climate Change Canada

- ecoEII

- ecoENERGY Innovation Initiative

- EEBC

- Energy Efficient Buildings and Communities

- EERE

- Office of Energy Efficiency and Renewable Energy

- EIP

- Energy Innovation Program

- EV

- Electric Vehicle

- EVID

- Electric Vehicle Infrastructure Demonstration

- FAA

- Financial Administration Act

- GHG

- Greenhouse Gas

- IETS

- Innovation and Energy Technology Sector

- IRAP

- Industrial Research Assistance Program

- NG

- New Generation

- NRC

- National Research Council of Canada

- NRCan

- Natural Resources Canada

- NRTEE

- National Round Table on the Environment and Economy

- NZE

- Net Zero Energy

- OEE

- Office of Energy Efficiency

- OERD

- Office of Energy Research and Development

- OGCT

- Oil and Gas Clean Technology

- PCF

- Pan-Canadian Framework

- PERD

- Program of Energy Research and Development

- PRL

- Policy Readiness Levels

- PV

- Photovoltaic

- R & D

- Research and Development

- RD & D

- Research, development and demonstration

- S & T

- Science and Technology

- SDG

- Sustainable Development Goals

- SG

- Smart Grid

- SME

- Small and Medium-sized Enterprise

- TRL

- Technology Readiness Level

- UOG

- Unconventional Oil and Gas

- VOC

- Volatile Organic Compound

- WD

- Western Economic Diversification Canada

EXECUTIVE SUMMARY

About the Evaluation

Program Spending Fact Sheet:

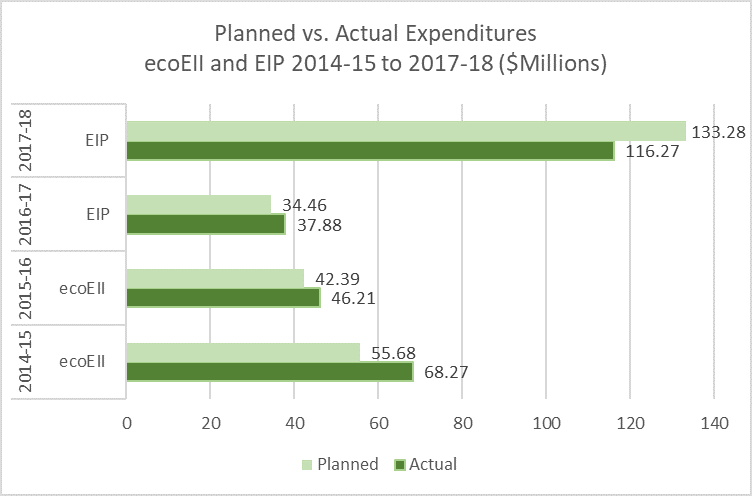

ecoEII and EIP Planned Expenditures: 2014-15 to 2017-18: (O&M, Salaries and EBP, and G&Cs): $265,817,646

Actual expenditures: (O&M, Salaries and EBP, and G&Cs): $268,620,000

The purpose of this evaluation is to assess the relevance and performance of the Energy Innovation Program (EIP), including the last three years of the ecoENERGY Innovation Initiative (ecoEII).The assessment of effectiveness includes consideration of the extent to which the current EIP is designed and delivered in a way that should facilitate or optimize outcome achievement. The evaluation covers the period of 2014-15 to 2017-18 and up to June 2018. These research, development and demonstration programs include funding for contribution agreements and CanmetENERGY laboratories. They cover a broad range of technology areas: electric vehicles, renewables, smart gird, clean oil and gas, and buildings.

The evaluation of the ecoEII and EIP programs is taking place within a broad context of both an evolving Pan-Canadian Framework to address climate change initiatives and Sustainable Development Goals and a major review and potential revision of Government of Canada business innovation program support. There are several other recent programs and initiatives designed to improve horizontal coordination and to develop and implement novel approaches to manage innovation programming. As such, the focus of this study has been to address key past results in terms of the implications for programming going forward.

What the Evaluation Found

The findings of this evaluation indicate that there is a need for federal government support to energy innovation with respect to both energy supply (oil and gas production, power plants, and electric grids) and demand, (buildings, transportation, industry) to address clean energy innovation. The development and adoption of affordable clean energy solutions is considered an important means of addressing climate change issues. Evaluation evidence indicates that government assistance is needed to reduce the risks associated with the high costs and uncertainty of developing and demonstrating new clean technologies. The marketplace on its own is unlikely to invest in sufficient levels to meet Government of Canada commitments to reduce GHG reductions. EIP is consistent with Canada’s commitments to reduce GHG emissions and is an important component of the Pan-Canadian Framework.

Science and technology advancement, on its own, is unlikely to address environmental and competitiveness needs, and should be part of a broader and integrated effort, which includes an appropriate regulatory and policy environment. EIP funding fits directly as part of a Pan Canadian Framework in which the regulatory environment is complemented by directly funded assistance for technology advancement (e.g. EIP). However, even in the absence of a favourable regulatory environment, evaluation evidence indicates that advancing clean energy science and technology is appropriate given the long time-frame required to address technology gaps and the need for science to inform policy, decision-making and regulatory issues.

Optimizing the impact of clean energy innovation also requires cooperation and coordination among federal departments and agencies as well as provincial and territorial governments. At the federal level, efforts are underway for a more coordinated ‘whole of government’ approach to innovation, which includes initiatives such as the Clean Growth Hub. Results of these efforts are expected to be realized over time and are not within the scope of this evaluation. Evaluation evidence suggested good cooperation between provinces/territories and NRCan in several technology areas. Documents also indicate that NRCan’s approach to energy innovation is fairly broad – engaging a variety of producers, adopters, regulators and other stakeholders.

In general, the role of NRCan in conducting and managing energy research, development and demonstration (RD&D) is considered by stakeholders to be appropriate given the Department’s legislated mandate, expertise and long-standing experience in delivering these types of programs. Past funded NRCan energy innovation programs and the Federal CanmetENERGY laboratories have created a tradition of trust which has resulted in NRCan acting as a ‘lead’ or catalyst for others to invest – among both government agencies and private investors. However, the recent creation of several new innovation programs dispersed among several departments and agencies has contributed to confusion among external stakeholders as to NRCan’s role vis-à-vis other federal government players delivering energy innovation programs.

Overall, the evaluation found that the energy innovation programming was reaching key stakeholder and target groups: industry, academia, regulators and provinces/territories. The program has also incorporated several changes to enhance its reach to small and medium sized companies.

Evaluation evidence indicates that outcomes pertinent to collaborations, leveraging, codes and standards, and technical progress have met or exceeded reasonable historical expectations. Indeed, the evidence suggests that NRCan plays an important role not just in its direct support of technology advancement, but also in terms of enabling this advancement through stakeholder engagement, building stakeholder capacity to conduct research, supporting codes and standards development, and generating knowledge to inform policy development and decision-making.

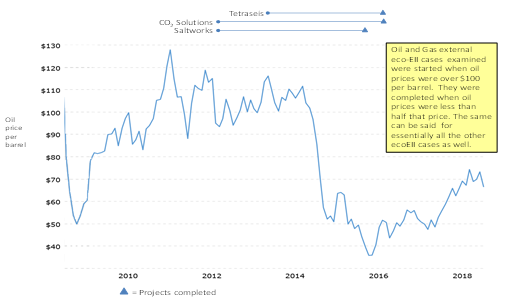

While evidence of longer-term outcomes, including commercial adoption, environmental benefits (e.g. GHG reductions) and economic impacts is limited, several technology areas demonstrate promise such as electric vehicles, renewables, buildings and reducing diesel use in the North. Moreover, as indicated by interviewees and as supported by the literature, the timeline from early stage research to commercialization is typically long and therefore it is too early for the realization of long-term results. Additionally, case study evidence illustrates how consistent and long-term support is a key factor in advancing innovation. For more advanced clean energy technologies, external factors such as low oil prices and unfavourable regulatory environments have hindered more widespread adoption.

The literature on energy innovation indicates that the process is unpredictable and does not progress in a linear fashion from early stage research to commercialization. Indeed, knowledge created during the various stages of innovation can be used to inform thinking and decisions in previous or next stages of the process. Therefore, measures of success for an innovation program have to consider not only how technologies themselves advance, but also how the knowledge that is generated through the RD&D process is used.

The program has a good performance measurement system that tracks a variety of outputs and outcomes related to knowledge, codes and standards development and technology advancement. However, there were some gaps in outcome measurement. For example, there were no systematic measures of knowledge uptake and use, which means program managers did not get consistent or complete feedback on influence of EIP projects. In addition, the follow-on reporting format and structure for contribution recipients has not generated the most relevant data.

The evaluation found good indications that both ecoEII and EIP were well-managed programs. For example, several lessons learned from both ecoEII have been incorporated into EIP going forward. Improvements to proposal solicitation, evaluation and selection over time were noted as well as certain design changes. Some challenges persist - such as the periodic 'call' approach used, funding rules and program timelines (which contributes to lapsing and reprofiling of funds), and repayability clauses. Some of these issues are related to Treasury Board processes pertaining to sunset funding. Moreover, EIP has recently received ongoing funding, which is expected to improve NRCan capacity to respond to these issues.

Interviews and workload records suggested that the workload involved with higher than anticipated letters of interest, applications and projects may have produced a time and effort burden on staff causing less attention to elements that were not urgent but still important – such as performance measurement and monitoring, reflection, information dissemination, and strategy development.

Document and interview evidence show several positive elements of strategic planning such as regular stakeholder consultations and environmental and technology scans. However, there were some reported issues, which were attributed in large part to a lack of ongoing funding for energy innovation, a situation that has recently changed with ongoing funding allocated to energy innovation. Strategic planning was reported to be particularly problematic during the start-up of EIP (2016). The 2016 Budget for EIP, which allocated funding to three program areas, did not according to interviews, fully reflect OERD’s long-term needs. Evaluation evidence also suggests that an enhanced strategic planning approach, one in which more systematically incorporates consideration of policy and systems readiness is required, particularly for more advanced technologies. The evaluation also found that planning documents sometimes contained unrealistic, unclear or inadequate performance targets.

Recommendations

Recommendations have been made to address the findings and lessons learned from the review of ecoEII and EIP over the 2014-15 to 2017-18 time period with a view to improving NRCan energy innovation programming going forward. In general the evaluation found that EIP is a well managed, relevant and effective program requiring some enhancements to its planning, communications, design, and performance measurement system.

| Recommendations | Management Action Plan | Responsible Manager / Target Date |

|---|---|---|

| 1: In light of new core funding for EIP, OERD should strengthen its strategic planning process: | Management agrees Actions: |

|

|

1a. In 2018-19 OERD developed a new strategic planning framework centred around objective-based missions that focus RD&D activities to address specific technology gaps to meet government of Canada priorities using a systems based approach. OERD and IETS labs have already used the framework to develop their integrated 3-year work plan (2019-20 to 2022-23) for internal research and development programs. Currently the framework is informing the planning and design of the relaunch of Energy Innovation Program in 2019-20. | DG, OERD Completed March 31, 2019 |

|

1b. As part of the new strategic planning framework, work plans include a clear delineation of how each project contributes to one or more missions, as well as, targets and milestones that will enable tracking of results. | DG, OERD March 31, 2020 |

| 2: OERD should communicate the role of EIP to external stakeholders to clarify its role | Management agrees. Actions: |

|

| 2. OERD is currently preparing to launch the revamped Energy Innovation Program during FY 2019-20. As part of the relaunch, OERD is working with NRCan’s Communications and Portfolio Sector to develop a new communications plan and suite of products and tools to help clarify the objectives, scope and focus of EIP for external and internal stakeholders. | DG, OERD March 31, 2020 |

|

| OERD will continue to collaborate with its federal government partners, particularly the Clean Growth Hub, to ensure that intended stakeholders and target groups for EIP and other OERD administered programs are able to find, understand, and have the information they need to apply for the appropriate program. | DG, OERD March 31, 2020 |

|

| 3: OERD should further enhance elements of its program design and delivery as follows: | Management agrees Actions: |

|

|

3a. OERD has taken steps to integrate new, flexible funding models and calls for proposals into its program design. The launch of the revamped Energy Innovation Program will incorporate effective practices and lessons from OERD programs, such as Clean Growth Program and Impact Canada Clean Tech Initiative. These could include accelerated approval processes through trusted partnerships; enhanced collaboration through the Science and Technology Assistance for Cleantech (STAC) model, and/or innovation prizes and challenges. | DG, OERD March 31, 2020 |

|

3b. OERD strongly concurs with the recommendation to remove the repayability requirement. OERD will continue to pursue this course of action, working with NRCan’s Corporate Management and Services Sector and the Treasury Board Secretariat regarding the elimination of the contribution repayment clause from OERD programs. Furthermore, OERD will continue to make representation to Finance regarding appropriate funding profiles for innovation programs (i.e. less funding in start up years). |

DG, OERD March 31, 2020 |

| 4: OERD should improve its performance measurement system: | Management agrees. Actions: |

Phase I: DG, OERD June, 2020 |

|

4a. OERD will take a phased approach to enhance its performance measurement processes. Phase I will include a review of performance metrics and the development of new tools and methods for data collection and analysis. By June 2020, OERD will review its performance indicators and metrics as part of a broader NRCan and Innovation and Energy Technology Sector exercise to review performance measurement frameworks (please see 4b). Additionally, in Phase II, which will occur over the next two years, OERD will develop, test and implement methods and tools (2-4) to measure uptake and diffusion of IP, information and influence on codes and standards, as well as, measure the long-term outcomes of OERD investments in energy innovation programs. OERD is also exploring opportunities to automate data collection methods and analysis that will enable more systematic monitoring and reporting of performance information. |

Phase II: DG, OERD March 31, 2021 |

|

4b. OERD is working with other branches in the Innovation and Energy Technology Sector and relevant groups within NRCan to review performance measurement frameworks and reporting requirements (ex. Departmental Results Framework, Performance Information Profiles) in an effort to reduce and streamline reporting requirements. Additionally, OERD is streamlining reporting requirements for proponents as part of the new strategic framework. OERD is also revising its structure for follow-on recipient reporting. Further, the automation of data collection and adoption of new performance measurement methods and tools will improve the quality of performance data, while reducing the reporting burden for proponents. |

DG, OERD March 31, 2020 |

INTRODUCTION

Program Information

This report represents an evaluation of the Energy Innovation Program (EIP) including the last three years of the ecoENERGY Innovation Initiative (ecoEII) based on a review of program documents, project files and supporting literature as well as select interviews with NRCan staff and sector- case studies.

This evaluation covers two research, development and demonstration (RD&D) programs – the ecoENERGY Innovation Initiative (ecoEII) and the subsequent Energy Innovation Program that builds upon the ecoEII. The delivery of ecoEII and EIP involves a combination of non-federal government organizations, such as technology producers, industry, and academia, and internal R&D conducted by federal Canmet laboratories. The majority of the funding is allocated to external organizations via contribution agreements.

The ecoENERGY Innovation Initiative funded under the Clean Air Agenda (CAA), which sunset on March 31, 2016, was designed to improve environmental performance and economic competitiveness and productivity in Canada’s energy sector. In particular, it intended to address the need for reducing the risk and cost of new, clean energy technologies by supporting efforts to bring ‘yet-to-be-proven’ technologies from the conceptual stage to the ‘ready-to-be-tested’ stage of development. Note that ecoEII was extended for one year (until March 2017) to facilitate project completion, although no new funding was allocated to that year.

The ecoEII supports activities related to knowledge and technology development in five technology areas:

- energy efficiency in buildings and communities, industry and transportation;

- clean electricity and renewables;

- bio-energy;

- electrification of transportation; and

- unconventional oil and gas, e.g., shale gas, oil sands.

The Energy Innovation Program was launched in April 2016 as an interim two-year renewal, pending development of the Pan Canadian Framework (PCF). This interim renewal had three components: Clean Energy Technology Innovation (CETI) ($82.4M) (e.g. renewables, smart grid, reducing diesel use in northern and remote communities; reducing GHGs in the building sector, and carbon capture, use and storage; Oil and Gas Clean Technology (OGCT) ($50M); and Electric Vehicle Infrastructure Demonstration (EVID), Phase 1 ($46.1M).

In Budget 2017 EIP was renewed, receiving a total of $211.6M over four years and then ongoing funding of $52.9m per year. The EIP supports research, development and demonstration (RD&D) of clean energy technologies to produce and use energy more cleanly and efficiently. The program aims to deliver a coordinated suite of RD&D activities to address specific innovation needs in PCF sector mitigation strategies for electricity, built environment, transportation and industry in order to meet Canada’s 2030 GHG target, and provide deeper, ongoing GHG reductions post-2030.

Evaluation Objectives, Scope and Methodology

The objective of this evaluation was to assess the relevance (i.e., continued need and appropriateness of federal role) and performance (i.e., effectiveness, efficiency and economy) of the EIP, including the last three years of the ecoEII. The assessment of effectiveness includes consideration of the extent to which the current EIP is designed and delivered in a way that should facilitate or optimize outcome achievement.

The evaluation covers the Department’s direct program spending on the ecoEII and EIP programs over the period of 2014-15 through 2017-18 and up to June 2018 and $265M in expenditures. The emphasis of this report is to draw from (i) past ecoEII performance as established from general document reviews, interviews and case study work; and (ii) information on the recent roll-out of the EIP to address important design and delivery lessons.

While the evaluation covers both contribution funding and internal ecoEII and EIP Federal laboratory R&D, most of the evaluation’s emphasis is on the contribution funding due to its higher materiality.

The evaluation includes a mix of approaches, including an outcome / impact assessment of the ecoEII (2014-15 to 2016-17) and a formative / implementation assessment of the EIP (2016-17 to 2017-18, and up to June 2018). The evaluation utilized the following methods:

- Sixty-seven (67) interviews with internal (28) and external stakeholders (39). These interviews included more general key informant interviews and interviews conducted as part of the case studies.

- Case studies covering the following sectors/themes:

- Buildings (focus on Net Zero Energy)

- Smart Grid (focus on grid integration of Renewable Energy Technologies)

- Oil and Gas

- Transportation (Electric Vehicles)

- Renewables (Alternative Energy – Marine, Wind, Geothermal, Solar)

- Northern and Remote Communities

- ecoEII and EIP program document review (over 300 documents)

- 30 randomly selected ecoEII projects (25 external and 5 internal laboratory projects) in which available completion/project status reports and outcome reports were reviewed. A stratified, random selection process was used in which projects were randomly selected from each of the ecoEII program components.

The case studies are based on a specific theme or technology area (as opposed to one or two specific projects). To assess progress over a longer timeframe and to examine the connections of ecoEII to its predecessor program – Clean Energy Fund (CEF) – previous related CEF projects were also included in the case studies. While each case study assessed several ecoEII and EIP projects (covered a total of 22 ecoEII and EIP projects), they also included broader sector-based document and literature reviews, project documents as well as interviews with a range of stakeholders including those that had broader sector level knowledge. Case study themes were selected in accordance with the key components / technology areas of the ecoEII and EIP programs.

Challenges and Mitigation Strategies

A key challenge in conducting this evaluation was ensuring coverage of the broad range of technology areas and program components contained within both ecoEII and EIP. The theme-based case study approach was utilized to optimize coverage of these components. In addition, the document review covered the key program planning and performance documents for each technology area. Finally, a file review of ecoEII projects (that were not part of the case studies) were conducted to ensure coverage was sufficiently broad.

FINDINGS

Relevance

Summary:

According to evaluation evidence there is a continuing need for NRCan to support research, development and demonstration programs to address clean energy innovation gaps in a broad range of technology areas. The development and adoption of affordable clean energy solutions is considered an important means of addressing climate change issues. Evaluation evidence indicates that government assistance is needed to reduce the risks associated with the high costs and uncertainty of developing and demonstrating new clean technologies. EIP is consistent with Canada’s commitments to reduce GHG emissions and is an important component of the Pan-Canadian Framework.

To what extent is there an ongoing need for the EIP?

Ongoing Need

The EIP has the key objective of reducing GHG emissions in the four key priority areas identified in the Pan-Canadian Framework: electricity, built environment (e.g. buildings), transportation and industry, which are amongst the highest GHG emitters in Canada (National Inventory Report, 1990-2016, ECCC). Various international agencies such as the International Energy Agency (IEA) and The International Renewable Energy Agency (IRENA) note that innovation will continue to play a crucial role in decarbonising the energy sector. The literature on clean energy show technology and innovation gaps exist for energy supply (oil and gas production, power plants, and electric grids) and demand, (buildings, transportation, industry) (International Energy Agency, Tracking Clean Energy Innovation Progress, 2018).

A review of documents (e.g. Expert Panel on the State of Science and Technology and Industrial Research in Canada, 2018; Energy Innovation Roundtables Report, 2014) and interview evidence indicate that the marketplace on its own will not invest at sufficient levels to meet Pan Canadian Framework goals due to the high capital investments and long timelines required to advance technology. Furthermore, end-use demand for clean energy is not sufficient at present. Therefore, government assistance is needed to support high risk, long-term efforts to advance energy innovation.

Energy RD&D as part of overall strategy

Interviews, case studies and documents indicate that RD&D, as part of a coordinated strategy, is needed to optimally address environmental issues. NRCan planning documents, quoting international research reports, note that, given the Government of Canada's recent orientation to address commitments related to reduced GHGs and other goals, a Pan Canadian Framework would advise that carbon pricing should be complemented by directly funded assistance for technology advancement to be able to affect desired change. EIP funding fits directly as part of this Government of Canada strategy.

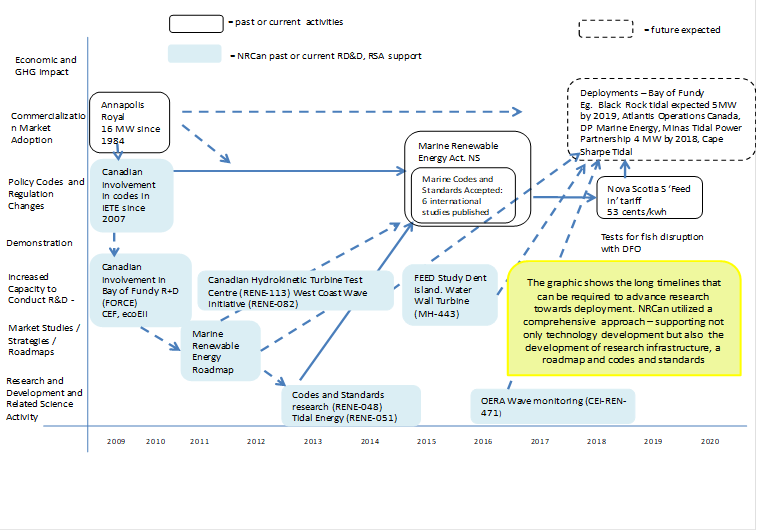

Using a comprehensive approach, NRCan’s energy innovation programming aims to move the system forward. The document review and case studies show that NRCan has engaged a variety of stakeholders – regulators, industry and provincial and territorial governments. It supports various innovation activities – technology advancement, improved information for decision-makers, and codes and standards development. NRCan has also made efforts to better coordinate innovation programming, within the department, through the newer Clean Growth Program, launched in 2017-18, which covers RD&D in three sectors: energy, mining and forestry.

Case study and document evidence suggest good cooperation between provinces/territories and NRCan in several technology areas. At the federal level, efforts are underway for a more coordinated ‘whole of government’ approach to innovation, which includes initiatives such as the recently launched Clean Growth Hub. Results of these efforts are expected to be realized over time and are not within the scope of this evaluation.

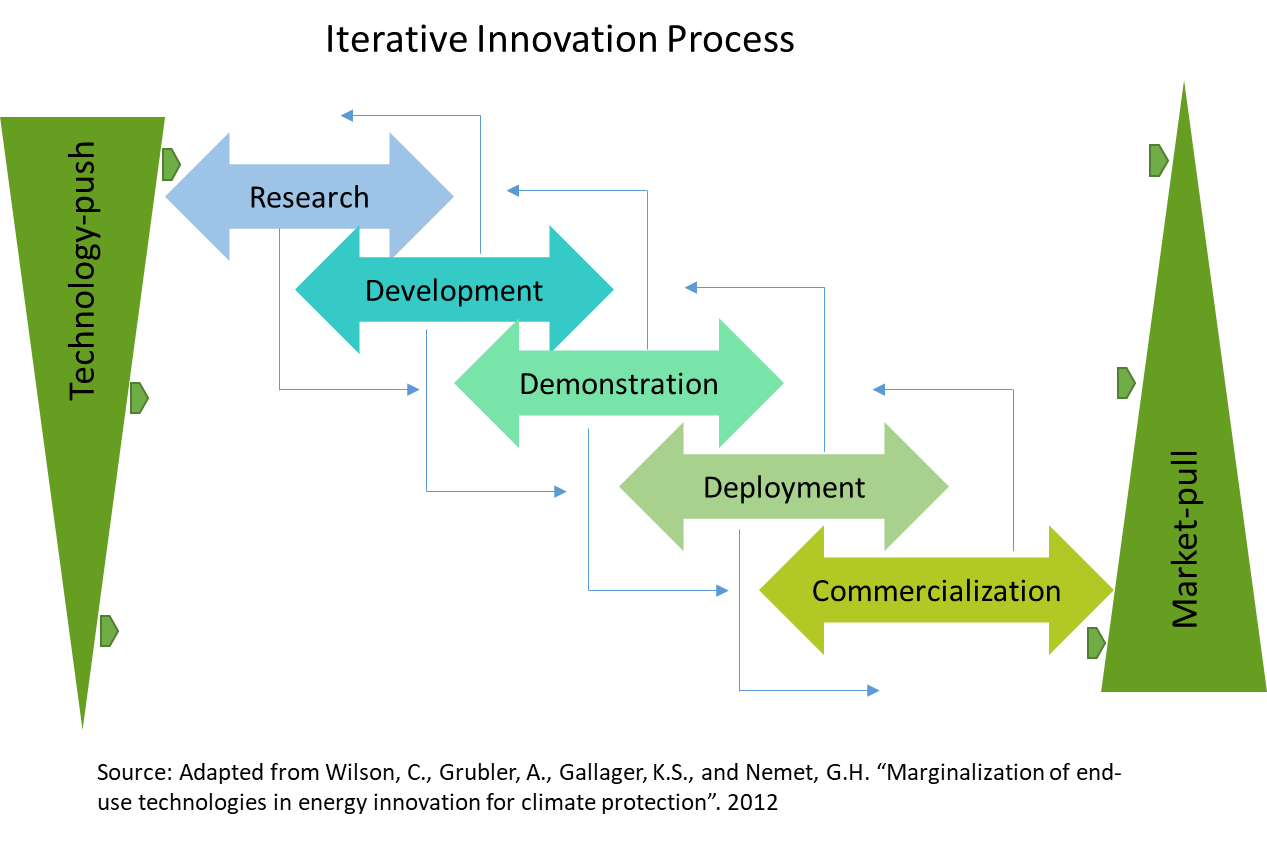

Both internal and external interviewees noted that even without the supporting regulatory environment, clean energy technology RD&D, given that it is a long-term effort, continues to be needed to address technology gaps and to inform regulatory and policy issues. The literature review also shows that the relative importance of technology push (RD&D) and market pull (regulations, policy, codes and standards) varies with a number of factors such as the characteristics of industry, and the nature of interactions and networks. Technology push tends to be more important in early stages and demand pull in later stages. Moreover, incremental innovations may depend on demand pull while far-reaching innovations may require a more concerted technology push approach.

Needs by Technology Area / Sector

Case studies conducted across theme areas (buildings, smart grid, clean oil and gas, electric vehicles, north, and renewables) examined the relevance and performance of ecoEII and EIP in broad areas. The case studies generally conclude that there is an ongoing need for innovation support to these areas. They support federal policy objectives related to reduced GHG emissions, increased economic activity and improved energy security. These technology areas vary in terms of the stages of technology readiness, types of stakeholders, and regulatory environment suggesting the need for a customized approach to program design.

The case studies (e.g. buildings, electric vehicles, smart grid) also highlight the important role that codes and standards play in technology development and adoption. For example, coordinated standards and regulations to advance smart grid development are needed across provinces, territories and internationally to support grid integration and emerging international market opportunities for Canadian smart grid technology companies. As noted in the case of buildings research and past evaluation studies, codes and standards can increase homebuilder, developer and buyer awareness of (and confidence in) new energy efficient products and construction methods.

High subscription rate for ecoEII and EIP

Historically there has been a high subscription rate for energy R&D programs such as those managed by IETS (PERD, CEF, ecoEnergy Technology Initiative, and ecoEII). The high subscription rate for these programs is not necessarily indicative of need. Interview and document evidence indicate that there may be a number of factors influencing the high subscription rate for these programs. However, according to interviews and project documentation there were a substantial number of qualified unfunded EIP (e.g. 2017 EIP) proposals.

OERD launched the ecoEII Demonstration Program and External R&D Program in August 2011. In response, 238 Letters of Interest (LOIs) for demonstration projects and 437 LOIs for R&D were received. Table 1 below illustrates the ecoEII review process for 2011. As noted in the ecoEII 2011-12 Annual Report, the volume of applications received was unprecedented for OERD.

| ecoEII Demonstration | ecoEII External R&D | |

|---|---|---|

| Letters of Interest | 238 | 437 (149 invited to submit proposal) |

| Full Project Proposals ($ Value) | 131 ($878.6M) | 112 ($178 M) |

| Funded Projects ($ Value) | 23 ($59 M) | 44 ($58.5 M) |

| Subscription Rate ($ requested: $ available) | 15:1 | 3:1 |

Source: ecoENERGY Innovation Initiative Contribution Annual Report 2011-12

The Clean Energy Innovation Program (CEIP), a component of EIP, call for proposals in 2016 generated 346 proposals requesting approximately $700 million in funding. A total of 35 projects with a total funding envelope of $25 million were funded. The distribution of proposals by technology area is shown in Table 2 below. It illustrates that the highest number of proposals (and levels of funding requested) came from the renewable, smart grid and storage systems and buildings technology areas. It is also interesting to note that 25% of proposals for methane and volatile organic compounds (VOC) reduction were successful (few proposals but high success rate) vs. about 5% for renewables and smart grid.

| Technology Area | Proposal Count | Funding Requested (million) |

Number Funded | Funding Allocated (million) |

|---|---|---|---|---|

| Renewable, smart grid and storage systems | 117 | $213.2 | 10 | $12.4 |

| Buildings (Net Zero Energy communities, commercial buildings, housing and building design tools) | 84 | $162.0 | 8 | $9.6 |

| Industry emission reductions | 43 | $109.7 | 2 | $3.9 |

| Carbon Capture, use and storage | 36 | $92.2 | 5 | $9.4 |

| Methane and Volatile Organic Compounds (VOC) reduction | 37 | $57.1 | 10 | $8.0 |

| Northern (reducing diesel use in remote communities) | 29 | $77.2 | 2 | $4.2 |

| Total | 346 | $711.4 | 37 | $47.4 |

Note: Total funding envelope was $49.1 million. The ~$1.6M variance reflects a reallocation of funds to other areas (e.g. EVID) to support program needs. Source: EIP Master Tracking Sheet (OERD) May 4, 2018. Energy Innovation Program – Clean Energy Innovation. ADM Committee on Energy S&T. January 18, 2017.

To what extent is EIP consistent with federal priorities?

EIP is consistent with Canada’s commitments to reduce GHG emissions. Canada ratified the Paris Agreement on Climate Change in October 2016, reiterating a commitment to reduce GHG emissions by 30% from 2005 by 2030. To meet the 2030 target, additional mitigation measures are needed including efforts to develop and demonstrate clean technologies that reduce greenhouse gas (GHG) emissions from energy production and use, which account for about 80% of Canada’s emissions (according to NRCan planning documents) and in 2016, following consultations, First Ministers adopted the Pan-Canadian Framework (PCF) on Clean Growth and Climate Change, on December 9, 2016.

EIP represents an important element, in conjunction with other strategies (e.g. regulatory), to reduce GHG emissions. These connect to the broader PFC established in 2016. The PFC has four main pillars: pricing carbon pollution; complementary measures to further reduce emissions across the economy; measures to adapt to the impacts of climate change and build resilience; and actions to accelerate innovation, support clean technology, and create jobs.

To what extent is the role of the federal government/ NRCan appropriate?

In general, the role of NRCan in conducting and managing energy research, development and demonstration (RD&D) is considered by stakeholders to be appropriate given NRCan’s expertise and experience in delivering these types of programs. A history of NRCan clean energy funded programs for energy innovation have created a legacy of trust which select case studies have shown has resulted in NRCan acting as a lead for others to invest – among both government agencies and private investors. In addition, document review, interviews and project case analysis suggest that NRCan has built up the required credibility and expertise to play an ‘honest broker’ role at a vital Pan-Canadian level.

The recent creation of several new innovation programs dispersed among several departments and agencies was noted by some external stakeholders to have contributed to confusion as to NRCan’s role vis-à-vis other federal government players delivering energy innovation programs.

The Natural Resources Act gives the Minister various responsibilities related to the sustainable development of natural resources, including development and promotion of scientific technologies, and the Energy Efficiency Act provides NRCan with authority to conduct research that promotes efficient use of energy and the use of alternative energy sources.

According to case study and interview evidence, government has an important role to play in reducing the risk associated with innovative technologies, including: supporting early-stage R&D and technology demonstrations that enable further de-risking and market uptake. A review of the international literature suggests that the involvement of national governments in the development and evolution of energy-related systems including RD&D, which include a full spectrum from established institutions to start-up technology companies is an important function.

The EIP components provide a mechanism to demonstrate federal leadership in areas pertaining to the Canadian Energy Strategy (CES) (2015). Under the CES, federal, provincial and territorial governments have agreed to collaborate on technology and innovation, including in the areas of small-scale electricity generation, energy storage, electrification of transport, renewable fuels, carbon capture use and storage and reducing reliance on diesel in remote communities.

Although there is no “one best model” for government intervention, analysis indicates that R&D tax credits often do not incent incremental innovation. Indirect R&D incentives are generally non-discriminatory and market-led, direct support may be better suited to targeting specific priorities and addressing market failures, such as combatting climate change and stimulating early-stage innovation (Drummond et al., 2015). Some studies indicate that tax incentives tend to support what would have happened anyway. Therefore, it is more effective for governments to directly support targeted technological advances (e.g., Mazzucato 2013). Furthermore, according to analysts (e.g. Bonvillian and Weiss Technological Innovation in Legacy Sectors, 2015) energy is an area which needs innovation, but has in it traditional sectors which tend to have accumulated unwarranted subsidies and price structures that ignore, for example, environmental externality costs.

Canada as compared to most other OECD countries has in the past spent less on direct support for R&D. Nearly 90% of government investments that support business expenditure on R&D in Canada are indirect, in contrast to 30% for the OECD countries as a whole (OECD 2015). Moreover, Canadian R&D as a share of gross domestic product (GDP) steadily declined in Canada from 2001 to 2015. It is also one of the few OECD countries that had no growth in total national R&D expenditures between 2006 to 2015 (Expert Panel on the State of Science and Technology and Industrial Research and Development in Canada, 2018). While declining business R&D expenditures are a key driver of this trend, government R&D expenditures also declined over the same period. Since 2016, however, Canadian government investments in RD&D investments have increased significantly in support of Mission Innovation commitments.

Performance – Effectiveness

To what extent did the ecoEII achieve its intended outcomes?

Effectiveness Summary

ecoEII has enabled the advancement of science. Progress is evident in the expected immediate/intermediate outcome areas:

- increased investment by stakeholders in energy RD&D,

- effective collaboration between academia, industry and the public sector,

- increased government, industry and academic capacity to conduct RD&D,

- codes and standards informed by research results, and

- technologies / systems moving closer to commercial readiness.

Progress has been made towards the achievement of broader environmental (GHG reductions) and economic impacts. Both ecoEII and EIP are facilitating this progress both directly and indirectly. However, achievement of longer-term outcomes is limited given that it is still early days for many ecoEII and EIP innovations.

ecoEII Performance and Outcomes

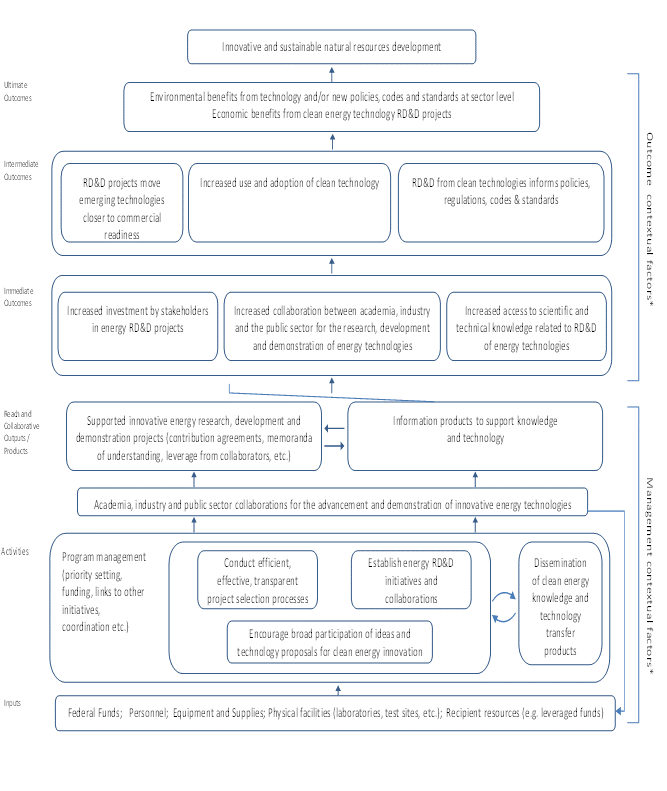

The ecoEII and EIP Results Logic Model is shown in Appendix 1. Measures of program reach and collaborative outputs/products include program support for innovative RD&D projects (e.g., contribution agreements, leverage from collaborators) and information products to support knowledge and technology sharing (e.g., technical reports, presentations, codes and standards, patents).

Expected immediate outcomes are:

- Increased investment by stakeholders in energy RD&D;

- Increased collaboration between academia, industry and the public sector for RD&D of energy technologies; and

- Increased access to scientific and technical knowledge related to energy technologies.

Expected intermediate outcomes are:

- R&D projects move emerging technologies closer to commercial readiness;

- Increased use and adoption of clean energy (limited evidence to date); and

- R&D informs policy, regulations, codes and standards.

Expected Long-term outcomes:

- Environmental benefits from technology and/or new policies, codes and standards; and

- Economic benefits from clean energy technology RD&D projects.

Table 3 shows early impacts for case studies (focused on specific technology or theme areas).

| Outcomes | Buildings (Net Zero Energy) | Smart Grid | Electric Vehicle | Northern Communities | Marine Renewable |

|---|---|---|---|---|---|

| Immediate Outcomes | |||||

| Increased investment | |||||

| Increased collaboration | |||||

| Increased access to scientific and technical knowledge* | P | P | P | P | P |

| Intermediate Outcomes | |||||

| R&D projects move emerging technologies closer to commercial readiness | P | ||||

| Increased use and adoption of clean energy | P | P | P | P | P |

| R&D informs policy, regulations, codes and standards | P | ||||

| Ultimate Outcomes | |||||

| Environmental benefits from technology and / or new policies, codes and standards at sector level | P | P | – | P | – |

| Economic benefits from clean energy technology RD&D | P | P | – | – | – |

Key:

= Cases clearly demonstrated

P = Partially demonstrated (for intermediate and ultimate outcome levels, partial achievement indicates good progress at the project level, but not broader impact)

? = Not clear from evidence

– = Not demonstrated

*All of the increased access to scientific and technical knowledge noted partial due to limited tracking (i.e. Outputs are counted but not influence.)

Effective Innovation

A review of the literature on successful energy innovation indicates that there is a significant time lag from early stage research (e.g. Nemet, G.F., Zipperer, V., and Kraus, M., Energy Policy, 2018). Moreover, the innovation process is unpredictable and does not progress in a linear fashion to commercialization. Indeed, as depicted in Figure 1, knowledge created during the various stages of innovation can be used to inform thinking and decisions with respect to further research. For example, a demonstration project can highlight the need for earlier stage research. Innovation is also cumulative - the more the knowledge base grows, the better the capacity to address barriers to technology adoption (e.g. high costs of technology). Therefore, measures of success for an innovation program have to consider not only how technologies themselves advance, but also how the knowledge generated through the RD&D process is shared and used. In addition, there are a number of enabling factors, (that are part of ecoEII and EIP) such as collaboration networks, capacity building of key stakeholders to conduct and use research and to make informed decisions, and codes and standards development, which are critical to support the advancement of innovation.

Figure 1: Iterative Innovation Process

Text version

Figure 1 shows the iterative innovation process. The steps of this process are as follows: research, development, demonstration, deployment, and commercialization. The graphic shows arrows going forward and backwards from research to commercialization and from commercialization to research. For example a demonstration project may show that more research is needed in a specific area. This is in contrast to the more traditional view of innovation, which has innovation progressing in a linear fashion from research to commercialization. The graphic also shows that technology push is stronger at the research and development stages and that market pull is stronger at the deployment and commercialization stages.

Immediate Outcomes

Increased Collaboration

Effective collaboration is widely viewed as an important condition for successful innovation (International Renewable Energy Agency. Renewable Energy Innovation Policy: Success Criteria and Strategies). Case study and document evidence indicate overall good progress with respect to enhanced collaboration. Note that the evaluation focused on the adequacy of collaboration (e.g. engagement with appropriate groups of stakeholders such as the private sector) rather than on whether collaboration has ‘increased’ – something that is difficult to measure without adequate baselines. In addition, it may not be the most meaningful measure of effective collaboration.

Over 230 collaborations were in place across the 72 ecoEII external RD&D projects, for an average of 3 per project (Source: ecoEII 2017-18 Annual Report). OERD program and project managers noted that this number may be underestimated as it was calculated using the highest number of collaborations in a single year (i.e., it is not sum of unique collaborators per project). Academic institutions led 36% of the ecoEII external R&D projects, followed by the private sector (30%) and industry associations and networks (26%). A review of ecoEII collaborators list (from Project Status Reports) shows a diverse group of stakeholders for external RD&D: industry, industry and standards associations, utilities, provincial and territorial governments, non-government organizations (NGOs) and international organizations.

Table 4 provides a summary of the program reach and indicates that the program is engaging various target groups. The table illustrates that industry and academia are the most frequent type of collaborators with respect to R&D and not surprisingly, the private sector is the most common type with respect to demonstration projects.

| Private Sector | Utility | Academic Institution | Industry Assoc. / Research Networks | Communities | Other | Total | |

|---|---|---|---|---|---|---|---|

| External R&D | 16 | 1 | 19 | 14Footnote 1 | 1 | 2 | 53 |

| Demonstrations | 13 | 2 | 1 | 1 (Province) | 17 | ||

| Total | 29 | 3 | 19 | 15 | 2 | 2 | 70 |

Source: ecoEII Project Summaries, NRCan website.

Industry involvement in EIP appears to be significant as shown in Table 5. For the three EIP components, private sector companies led the majority (70%) of projects. The EIP Master Tracking spreadsheet provides a count of the number of collaborators per project (showing an average of 3.2 collaborators per project) but does not provide information on the type of collaborators.

| Private Sector | Utility | Academic Institution | Industry Assoc / Research / Networks | Communities | Total | |

|---|---|---|---|---|---|---|

| Electric Vehicle Infrastructure Demonstration | 7 | 1 | 1 | 1 | 10 | |

| Oil and Gas | 6 | 2 | 8 | |||

| Clean Energy Investment Program (CEIP) | 24 | 2 | 4 | 2 | 4 | 36 |

| Total | 37 | 3 | 5 | 4 | 5 | 54 |

Source: Innovation and Clean Growth Contribution Programs – Midyear Report 2017-18. OERD.

Case studies and interview findings reveal the extent and importance of collaboration in each clean energy technology area supported. For areas such as marine tidal wave energy development, smart grid technologies and electric vehicles cases revealed strong collaborative networks among different communities which have helped to establish important science in these areas, as well as codes and standards.

External interviewees reported new collaborations among sector players (e.g., private sector technology providers, utilities, end-users) and improved cooperation and consultations with stakeholders, including community groups (Indigenous and others), provincial governments, and codes and standards organizations. Case study and file review evidence also show appropriate and effective collaborations within each of the projects reviewed.

Examples of New Collaborative Arrangements

The demonstration of smart grid and renewable energy technologies in remote geographic regions was made possible through new collaborative arrangements. In the case of northern community renewable and smart grid demonstration projects, local industry and communities developed new partnership arrangements with technology providers and system integrators. For example, the installation of a wind turbine and energy storage system at Glencore’s Raglan mine complex involved a new partnership between Glencore and a new innovation-driven SME (Tugliq Energy Company) with support from established companies for system components and related software (Hatch Associates).

In addition, recent developments in northern and remote communities point to new, sustained efforts to coordinate federal and provincial/territorial activities related to energy use (e.g., off-diesel projects).

There is case study evidence that the EIP has adapted its offerings to reach potential users. For example, small and medium-sized enterprises (SMEs) who may have been under-represented in earlier programs appear to be better represented in current processes. Case studies involving small companies suggested that their efforts had been better received in more recent iterations. For example, funding for Front End Engineering and Design (FEED) studies helped new program proponents (SMEs) access funding for the required up-front project design issues such as permitting, community consultations (especially important in the north) site selection, and consideration of local knowledge. Case studies showed that FEED studies allowed SMEs to be funded during early project development stages, i.e., support for activities required before developing and submitting a proposal for a demonstration project.

The program approach to built environment projects encouraged multi-disciplinary project teams. Owens Corning Canada’s Net Zero Home (NZE) Home demonstration project involved a team of experts in the fields of building technology, building science, solar technology, and energy efficiency, each with experience mentoring production builders to adopt voluntary energy efficiency/renewable energy measures.

Source: NRCan website

NZEH buildABILITY Corporation was the lead consultant managing the project, with participation by five building science and technical consulting companies. Five homebuilders in four provinces (Alberta, Ontario, Quebec and Nova Scotia) built a total of 26 net zero energy and net zero energy ready homes in four communities, the largest NZE community demonstration in Canada to date. In addition, according to interviewees, Owens Corning Canada’s NZE Home demonstration project contributed to the development of the ad-hoc Canadian Home Builder’s Association New Zero Energy Housing Council. The project’s participating builders and partners were founding and sponsor members of the Council whose mission it is to help launch the first private Net Zero Energy certification for housing.

Increased Investment and Leverage

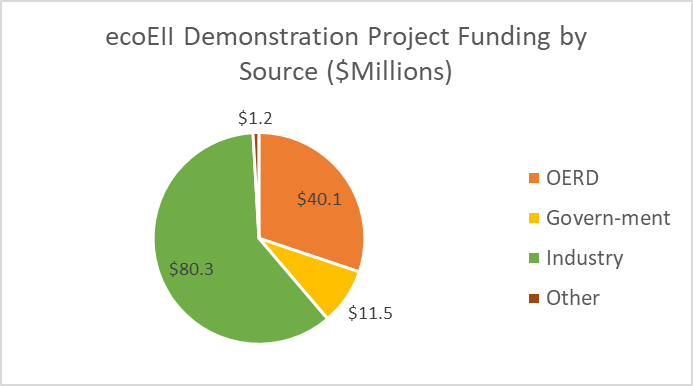

Between 2011-12 and 2016-17 ecoEII leveraged significant investment from external sources. Overall, for every dollar (contribution funding to recipients) provided, $1.50 was provided by others, with industry providing almost half of the overall funding. As shown in Figure 2, OERD contributed 30% of total demonstration project costs, with industry participants providing the majority of funding at 60% (10% provided by universities, other government sources, etc.). For every $1 of ecoEII investment in demonstration projects the program leveraged $2.32 from other sources. This is slightly higher than ecoEII’s predecessor program, the Clean Energy Fund, in which for every $1 of CEF funding for smaller demonstration projects, an additional $2.10 was invested in the projects by others.

Figure 2 – ecoEII Demonstration Project Funding by Source

Text version

Figure 2 is a pie chart that shows the sources of funding for ecoEII demonstration projects. OERD, NRCan provided $40.1 million, other federal departments and provincial / territorial governments provided $11.5 million, and industry provided the largest portion of funding - $80.3 million. For every $1 NRCan spent, others (industry, government) provided $2.32.

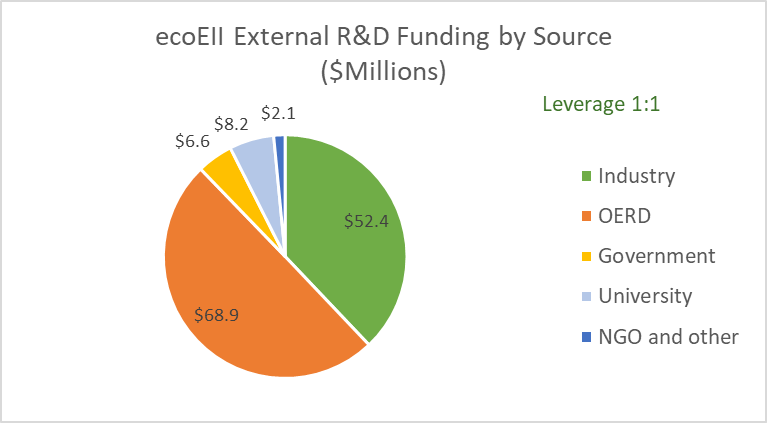

With respect to external R&D projects OERD contributed 50% of total costs and industry 38%. External funders provided $69.2 million for a leverage of 1:1 (Figure 3). Other includes universities and NGOs.

Figure 3 – ecoEII External R&D Project Funding by Source

Text version

Figure 3 is a pie chart that shows the sources of funding for ecoEII external research and development projects. In this case OERD, NRCan provided half of the overall funding which amounted to $68.9 million. Industry provided $52.4 million, other federal government and provincial / territorial governments provided $6.6 million, and universities provided $8.2 million. Non-governmental organizations and others provided $2.1 million. Therefore, for every dollar NRCan provided other stakeholders provided one dollar.

Note the term ‘leverage’ infers that NRCan (Government of Canada) money induces investment from other governments and the private sector. While there has been no independent validation that it was NRCan’s ‘first move’ investment that induced others to invest, case studies suggested that NRCan support has played a particularly important role in leading the way. For example, NRCan has played a leadership role in the following circumstances:

- where there are dominating risk averse actors (e.g. smart grid) as well as special conditions affecting system capacity (e.g. North); and

- in supporting codes and standards development (codes and standards are significant enabler of adoption of innovation).

In addition, the strong technical assessment and credibility of NRCan energy innovation program review and acceptance has enabled other groups with less technical capacity to provide funding in several cases. For example, several regional developments agencies have followed ecoEII or EIP funding with their own support to help create hubs or centres of expertise in certain relevant regions.

A number of external respondents pointed to the fact that the Federal Government initiation and consistent support in some areas has led to support by provincial governments. This pattern was confirmed through case studies conducted in the sector areas. For example, the AddEnergie demonstration project (EV charging stations and IT management system) received additional support by the province of Quebec through the Bureau de l’efficacite et de l’innovation energetique (TechnoClimat). The South Coast British Columbia Transportation Authority (TransLink) project received substantial funding in addition to EIP through the Greater Vancouver Regional Fund. Marine energy centres of excellence have been assisted by regional development agencies on both coasts subsequent to ecoEII funding.

RD&D Government-Industry-Academia Capacity Building

Canadian Hydrokinetic Turbine Test Center – University of Manitoba

This project resulted in the installation of the Canadian Hydrokinetic Turbine Test Center that allows manufacturers to test turbine systems fully integrated on to the grid. Case study results show that turbine developers are able to test at low costs and access the site quickly. By the end of this project, the test center had tested various types of turbines more than 20 times.

ecoEII and EIP have supported the development of new capacity for RD&D. These programs led to the development of critical technology development platforms, new research facilities and equipment. Early and on-going support for these platforms enhances the capacity of industry and others to develop clean energy technologies (e.g. components, systems integration). For example, prior to 2011 there was little funding or capacity for smart grid RD&D in Canada. According to case study evidence, beginning with the Clean Energy Fund (predecessor to ecoEII) and continuing with ecoEII, NRCan investments led to increased awareness, understanding and capacity for smart grid technology development in Canada (both private and public sector). A demand response test bench at NRCan’s Varennes Canmet lab was developed to support future proof of concept and standardization.

In addition, ecoEII projects have also supported high quality personnel (HQP) development. According to ecoEII performance database (2011-12 to 2015-16), 904 academic HQP were supported through internal R&D (275 academic HQP) and external RD&D (629). Moreover, 397 professional HQP were supported during the timeframe (348 through Federal laboratory R&D and 49 professional HQP through external RD&D).

Increased access to scientific and technical knowledge

Uptake of Pan-Canadian Wind Integration Study (PCWIS)

In areas such as energy planning, the Pan Canadian Wind Integration Study (PCWIS) was conducted to inform electricity grid managers, planners, policy makers, operators and other stakeholders about the characteristics of different scenarios for implementing wind energy up from its business as usual level of 5% of the grid to as much as 20% or 35%. The study provided insights and information which documents and consultations show were of value to direct users. In addition, this information generated much needed technology infrastructure in the form of a database and protocols to calculate estimates in ‘Nordic’ conditions which serve further research. The benefits and impacts of this work are hard to quantify, but a targeted survey of end users (utility representatives) showed significant evidence of use and claimed value by users with direct areas of application. The strong contribution to utilities and electric grid management and decision-making regarding the use of wind energy translates into what are likely strong energy cost and emission reduction impacts. The evaluation also showed that focused surveys targeted to key end-users, such as was the case here, can be a good tool for measuringuptake of information in certain circumstances.

Overall, the program has produced numerous scientific and technical products as shown in Table 6. Moreover, a project document review (randomly selected) indicated that information, knowledge and data was a key output for many ecoEII projects (e.g. monitoring data for Net Zero Energy and energy efficient buildings, properties of oil sands tailings, purity guidelines for demonstration carbon capture and storage (CCS) projects, Source books for Net Zero Energy Solar Buildings). However, the uptake, use or impact of these types of knowledge products was not systematically tracked. Therefore, the extent of access and use of many of these products cannot be assessed.

By the end 2016-17, as indicated in Table 6, the ecoEII G&C Program had generated 1,790 scientific knowledge products (or an average of 25 products per project), one web page per project and up to five NRCan news stories per project.

| Knowledge Products Generation | Patents | Licenses | Codes & Standards | Peer-reviewed Publications | Presentations | Technical Reports |

|---|---|---|---|---|---|---|

| Total ecoEII | 21 | 5 | 25 | 59 | 330 | 204 |

| R&D | 17 | 3 | 23 | 54 | 253 | 184 |

| Demonstrations | 4 | 2 | 2 | 5 | 77 | 20 |

| Bioenergy | - | - | - | 8 | 21 | 30 |

| Clean Coal &Carbon Capture and Storage | 6 | 1 | - | 31 | 76 | 49 |

| Energy Efficient Buildings and Communities | 2 | - | - | 3 | 20 | 13 |

| Renewables | 6 | 2 | 13 | 17 | 100 | 54 |

| Smart Grid | 10 | 1 | 3 | 3 | 91 | 33 |

| Unconventional Oil and Gas | - | - | - | 7 | 37 | 34 |

| Transportation | 1 | 1 | 9 | 14 | 16 | 19 |

Source: ecoEII Project Summary Report, OERD. July 2016.

ecoEII introduced a requirement for a public report and a summary fact sheet for each project. These documents are posted online (NRCan website and some companies provide links from their corporate websites) and are a key element of the program’s dissemination activities. Case studies and document review indicate that project results were typically shared through publications and other mechanisms such as conferences. The case studies highlighted some best practice examples of information sharing and dissemination. For example, the knowledge transfer component of the Owens Corning Net Zero Energy (NZE) housing project was an integral and funded part of the project plan (one of the primary project objectives was to act as a platform for other builders to promote the adoption of NZE housing concepts).

Nevertheless, information dissemination is one area where several project proponents and NRCan representatives indicated that greater efforts are needed to promote and share findings with relevant stakeholders. Across all technology areas, there is little to no funding allocated to projects directly, or to OERD, to support results sharing and dissemination.

Advancements in Technology

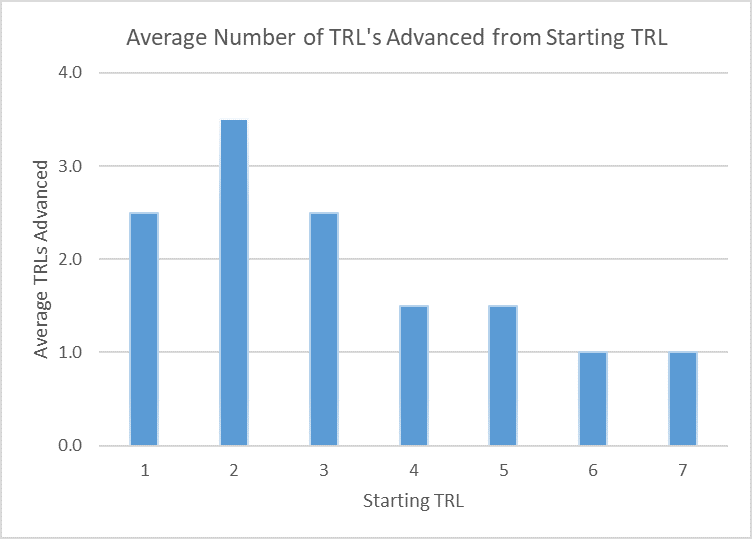

ecoEII began using Technology Readiness Levels (TRLs) as a performance measure in 2013-14. The Technology Readiness Level scale is a standard methodology is a scale from 1 to 9 that helps to categorize a technology’s maturity. TRL stages 1-3 correspond with earlier stage research, TRL stages 4-6 with development and stages 7-9 with scaling-up and demonstration of a proven commercialization-ready technology (TRL 7-9). TRL statistics are available for 46 of the 72 ecoEII projects. Note that the TRL scale is not relevant to all projects. Several ecoEII projects encompass related science activities (RSAs) and such as knowledge generation to support codes and standards or policy development. Moreover, as illustrated by the file review, knowledge generation is a critical part of RD&D projects.

By the end of the program, ecoEII reported a weighted average of 0.82 TRLs advanced per year. According to program documentation, the unweighted average TRL’s advanced for the entire program was 2.34. The majority of projects funded under ecoEII started in TRL 1 – 4 or as Related Science Activity (RSA). By the end of the program, the majority of projects were in TRLs 3, 5 and 6. Data also showed that projects starting between TRL’s 1-3 were on average able to advance by more TRL’s than those started at TRL 4-7, indicating that later stages of RD&D takes more time (as is typical with R&D according to the literature review) than earlier stages as shown in Figure 4.

Figure 4: Average advancement of ecoEII Technology Readiness Levels

Technology Readiness Levels

1-Early-stage scientific research

2-Technology development begins (e.g. concept development)

3- Active R&D initiated to establish proof of concept

4-Basic technological components are integrated (e.g. component prototypes tested)

5 – System prototype improved (e.g. bench-scale integration of components)

6 – Model/prototype tested in relevant environment

7- Prototype near or at planned operational system

8- Technology is proven to work in “real world” setting

9- Commercialisation-ready technology proven through successful operations

Text version

Figure 4 is a bar chart showing the average number of technology readiness levels (TRLs) that advanced from the starting technology readiness level. This chart shows that technology readiness levels that started at early stages such as stages 1, 2, and 3 advanced on average a higher number of levels. The average advancement slowed at the higher starting technology readiness levels from 4 to 7. Research projects starting at TRL 1 advanced an average of 2.5 levels; projects starting at TRL 2 advanced an average of 3.5 levels; projects starting at TRL 3 advanced an average of 2.5 TRL levels; projects starting at TRL level 4 advanced an average of 1.5 levels; projects starting at TRL level 5 advanced an average of 1.5 levels; projects starting at TRL level 6 advanced an average of 1 TRL level; and projects starting at TRL level 7 advanced an average of one level.

On average demonstration projects started at a TRL of 4.4 and advanced approximately 2 TRL levels prior to project completion. External R&D projects began at a lower, average TRL level (3) and also advanced, on average, by 2 TRL levels (to 5.1) by the end of the project.

For ecoEII, proponents provided estimates of their project’s TRL at the beginning of the project, throughout the project and at project completion. This process was continued with EIP, though according to interviews – a closer NRCan review has been maintained on the validity of TRL changes. A review of TRL assessments in selected ecoEII cases versus project descriptions and progress reports shows that there was sometimes a significant disconnect between reported TRLs and actual project progress. Reported level of confidence by NRCan and other delivery partners in these TRL assessments is relatively low.

While TRLs show technology advancement of NRCan projects, it does not capture progress of subsequent projects financed by other sources. Several project proponents noted that ecoEII projects helped to obtain funding from other sources to further scale-up their technologies. For example, CO2 Solutions Inc., a company that received funding from ecoEII to demonstrate a patented process for carbon capture, subsequently obtained financing from SDTC and the province of Quebec for large pre-commercial and demonstration projects.

Increased use and adoption of clean energy

Increased adoption of clean energy requires a convergence of technology supply and demand, which is affected by a number of factors including costs, perceived risk (which can be mitigated by codes and standards), regulations, etc. While there were few examples of widespread adoption of the clean energy technologies supported by ecoEII; case studies and interviews revealed some promising evidence of future use.

The smart grid case study highlights the complex environment in which smart grid advancement occurs. A key aspect of a smart grid is automation intended to achieve one or more of the following benefits - increase grid resilience, environmental performance, and operational efficiencies (Canadian Electricity Association). Provinces and territories have responsibility for electricity grids, and each jurisdiction has different levels of interest in, and support for, smart grid and related systems research (e.g., charging stations, storage). Each province or territory approach differs according to its assets and need, but the more active regions (e.g. Ontario, B.C.) are responding to economic drivers coupled with quality of service and environmental drivers. A number of factors contribute to the differences among provinces including energy mix (hydro, oil, gas, coal) and grid ownership.

Smart meters are used to replace the traditional approach of manual meter reading and their deployment is generally regarded as the first stage of smart grid development. In 2014, approximately 67% of meters were smart meters as compared to 2018 when about 82% of meters in Canada were classified as smart meters (Smart Grid in Canada Reports, 2014 and 2018). This upward trend is directly the result of provincial smart meter programs. However, interview and document evidence suggest that ecoEII internal and external RD&D funding have played both an enabling role and a more direct role in smart grid development as a whole. CanmetENERGY energy through the establishment of networks (for example CanmetENERGY established the Canadian Smart Grid Action Network to connect national stakeholders) and ecoEII smart grid demonstrations which have focused on electric vehicle integration, microgrid installations, and grid monitoring and automation.

Industry interviewees commented on the impact of early, ecoEII microgrid projects on the level of understanding and interest in smart grid applications. All industry interviewees reported an increased interest in smart grid / microgrid technologies over the past 8 to 10 years. In some cases, the interest is international. For example, according to interview findings, Hatch’s (industry contribution recipient) small scale, isolated power systems expertise and equipment are of interest to remote communities in the Caribbean, Indonesia and Africa.

In the building sector, the focus was on advancing the commoditization of net zero energy homes (e.g. buildings that can be constructed using commercially available technologies, which therefore limits the need for additional standards-related activity). Technologies were limited to pre-engineered products and systems (e.g. versus custom mechanical systems), which helped to ensure that the technologies could be more accurately modelled and provided assurance with regard to their long-term performance in the Canadian climate. ecoEII project results demonstrated that an R-2000 home can achieve net zero energy performance using off-the-shelf technologies and methods. The project demonstrated the technical feasibility of building Net Zero Energy Housing Communities (with 26 buildings across Ontario, Quebec, Nova Scotia, and Alberta).

ecoEII Project – Low Grade Heat Driver Produced Water Treatment (Saltworks Technologies)

This project developed and tested a low energy technology for treating wastewaters in the Canadian oil sands industry. The project employed the Thermal SaltMaker to produce freshwater (suitable for reuse) and solid materials from oil sands wastewater. The demonstrations showed that a scaled up process could work to generate the anticipated effect -reduced energy costs and environmental impacts. The company used the learnings from this pilot in the further development of the SaltMaker. This technology has been applied in select landfill, mining and other salt-water reclamation applications. However, with the decreased price of oil, the oil and gas industry has been reluctant to move on to major applications of this technology.

Canada generates its majority share of electricity from renewable sources, mostly hydro generation. Approximately 60% of Canadian electricity came from hydropower in 2015, typically from large facilities with reservoirs.

Grid connected and overall renewable energy capacity has experienced growth over the past 10 years, although the total installed capacity remains low. Wind power capacity in Canada increased twenty-fold between 2005 to 2015, with installations across the country. In 2018, the total installed wind capacity was approximately 12.7 GW. It is estimated that about 1 GW of wind capacity is interconnected to the distribution system (CanWEA and internal NRCan reporting, 2018). Solar is a small component of Canada’s electricity (where it represented 5% of total capacity in 2015) and virtually all capacity is installed in Ontario, due to its past incentive program.

The intermittency of wind and solar generation has been a key technical challenge for widespread adoption. A number of ecoEII projects were directed towards this challenge (e.g. RD&D for grid connected battery storage, smart grid technologies, demonstration of EV grid infrastructure, energy storage systems for tidal generation, ecoEII internal R&D for built environment thermal storage, etc.).

Other renewable technologies, such as offshore wind, tidal power and geothermal energy, have not experienced significant uptake in Canada, but have demonstrated potential. Offshore wind projects are proposed on Canada’s west and east coasts, and a 20 MW tidal power facility already exists in Nova Scotia. The Pan Canadian Wind Integration Study – the largest integrated wind study in North America as of its completion and supported by a contribution of almost $1.8 million by ecoEII - showed that wind energy generation systems are showing increasing potential to play a significant role in future electricity grid management. Geothermal projects are also being considered in isolated northern communities, which according to document and interview evidence would benefit from combined heat and power. An EIP demonstration project, located in Saskatchewan, has been launched (project is underway and completed first geothermal test well in 2019) and is expected to be Canada’s first geothermal power plant.

With respect to electric vehicles, case study evidence suggests that several ecoEII projects have provided a foundation for continuing efforts in the demonstration and deployment of electric vehicle infrastructure. According to external interviewees and documents reviewed, ecoEII projects (e.g. Electric Mobility Adoption and Prediction study, ADDEnergie’s EV infrastructure demonstration) contributed to the following: an increased understanding of needs of charging station owners and drivers; identification of areas where further code development is required; fostering of relationships between utilities and other stakeholders; and improved management and IT systems for electric vehicle charging station networks.

ecoEII demonstration projects resulted in the installation of 1200 Level 2 chargersFootnote 1 (700 in Quebec, 100 in Ontario and 400 in BC) and 60 fast charge stations (Level 3). The ecoEII demonstration project, 2011 to 2016, (AddÉnergie Technologies Inc. proponent) resulted in the installation of 600 Level 2 chargers and 5 fast charge stations serving diverse market segments. Charging stations were installed in a variety of locations including shopping centres and residential areas. The installation of this infrastructure aimed to demonstrate the Charging Station Central Network Management System, a cloud based software system designed to manage the charging stations.

However, interviewees noted that for at the public chargers have been underutilized and they typically have not been recovering their costs as anticipated. However, an increased Return on investment (ROI) is expected by project proponents as the demand for electric vehicles continues to increase.

The underutilization of electric vehicle charging infrastructure is not unique to Canada. Other jurisdictions also grapple with the ‘chicken or egg’ dilemma: To demonstrate and install infrastructure to increase demand or to build infrastructure in response to demand. The International Energy Agency (IEA) EV Global Outlook Report (2018) notes that even though the frequency of use of publicly accessible charging infrastructure is fairly low in comparison with private installations, public chargers are an important component of the EV charging infrastructure. The IEA advocates a variety of policies including the direct investment for increasing the availability of public EV charging infrastructure to facilitate the adoption of electric vehicles.

The Electric Vehicle Infrastructure Demonstration (EVID) Program, Phase 1, funded 10 EIP demonstration projects aimed at addressing barriers to the implementation of charging infrastructure in multi-unit residential buildings, along the Trans-Canada Highway, in urban centers and at workplaces. A few projects consisted of installation of overhead charging stations in several municipalities to allow for displacement of diesel buses with electric buses and to improve interoperability of electric bus charging infrastructure. The TransLink project (Vancouver) is the farthest along and in 2018 a two and a half year integration trial of fast-charging buses and charging stations was launched. Four bus and equipment manufacturers involved in the project have agreed to innovate and re-design their systems to establish an interoperable model for electric bus charging infrastructure. Data will be collected on the different technologies to better plan the transition towards a zero-emission bus fleet.

The EVID program (Phase 1 and 2) was launched as part of the Green Infrastructure stream of the Investing in Canada Plan (IICP), a broader federal initiative focused on rehabilitation and modernization of various types of infrastructure in Canada. The objective of the EVID program is to fund demonstrations of next generation and innovative electric vehicle charging infrastructure projects to accelerate market entry and address hurdles to the deployment of EV charging infrastructure.

Some external key informants expressed concerns that the EVID program signaled a migration away from basic R&D for battery development when there are remaining research gaps in energy storage technology (e.g. advanced chemistry batteries). While the ongoing funding for EIP supports clean energy R&D and small scale demonstrations in transportation/vehicle technologiesFootnote 2, this finding highlights EIP’s important role in supporting early and later stage RD&D that is responsive to challenges, opportunities and innovation gaps in vehicle technologies, as part of its strategic planning exercises.

R&D informs policy, regulations, codes and standards.

The deployment of clean energy technologies often face significant non-technical barriers. Federal support for codes and standards development is important for addressing these barriers and are critical to support the deployment of technologies. In established technology areas existing policies, codes and standards provide a framework for the development or amendments needed to support the deployment of new technologies or further use of existing technologies to meet more stringent performance targets (e.g., GHG emission reductions, increased use of renewable energy, etc.).

Document and case study evidence show that ecoEII R&D is being used to inform codes and standards development across many technology areas. According to the ecoEII database 25 codes and standards have been informed by ecoEII R&D. However, the impact of R&D on policy and regulations is not consistently tracked so the extent of achievement of this outcome with respect to informing policies and decision-making could not be fully assessed.

ecoEII external and internal Canmet lab work is contributing to new Code for existing building alterations by 2022 and more stringent model codes by 2020. Adoption by Provinces and Territories of NZE ready codes is targeted for 2030. NRCan Canmet laboratory was done with respect to IEA SHC task 40 – Towards Net-Zero Energy solar Buildings. The labs also participate in the IEA Large Solar Systems Group and the Heat Pump Program. In addition to EIP funding, the federal government allocated $62 million over 8 years through the Green Infrastructure Program to meet this goal. The Owens Corning project involved the entire building supply chain and the lessons learned and performance data from monitoring energy use in the demonstration buildings will support the development of a NZE ready building code.