Statement outlining results, risks and significant changes in operations, personnel and programs

1.0 Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and any Supplementary Estimates approved in a given year by the date of this report. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

Natural Resources Canada (NRCan) works to improve the quality of life of Canadians by ensuring that our natural resources are developed sustainably, providing a source of jobs, prosperity, and opportunity, while preserving our environment and respecting our communities and Indigenous peoples.

Further details on NRCan’s authority, mandate and programs can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates and Supplementary Estimates (A) for the 2021-22 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This Departmental Quarterly Financial Report reflects the results as of June 30, 2021, which include Main Estimates and Supplementary Estimates for which full supply was released. The details presented in this report focus on and compare the first quarter results of 2021-22 with those of 2020-21.

2.1 Authorities

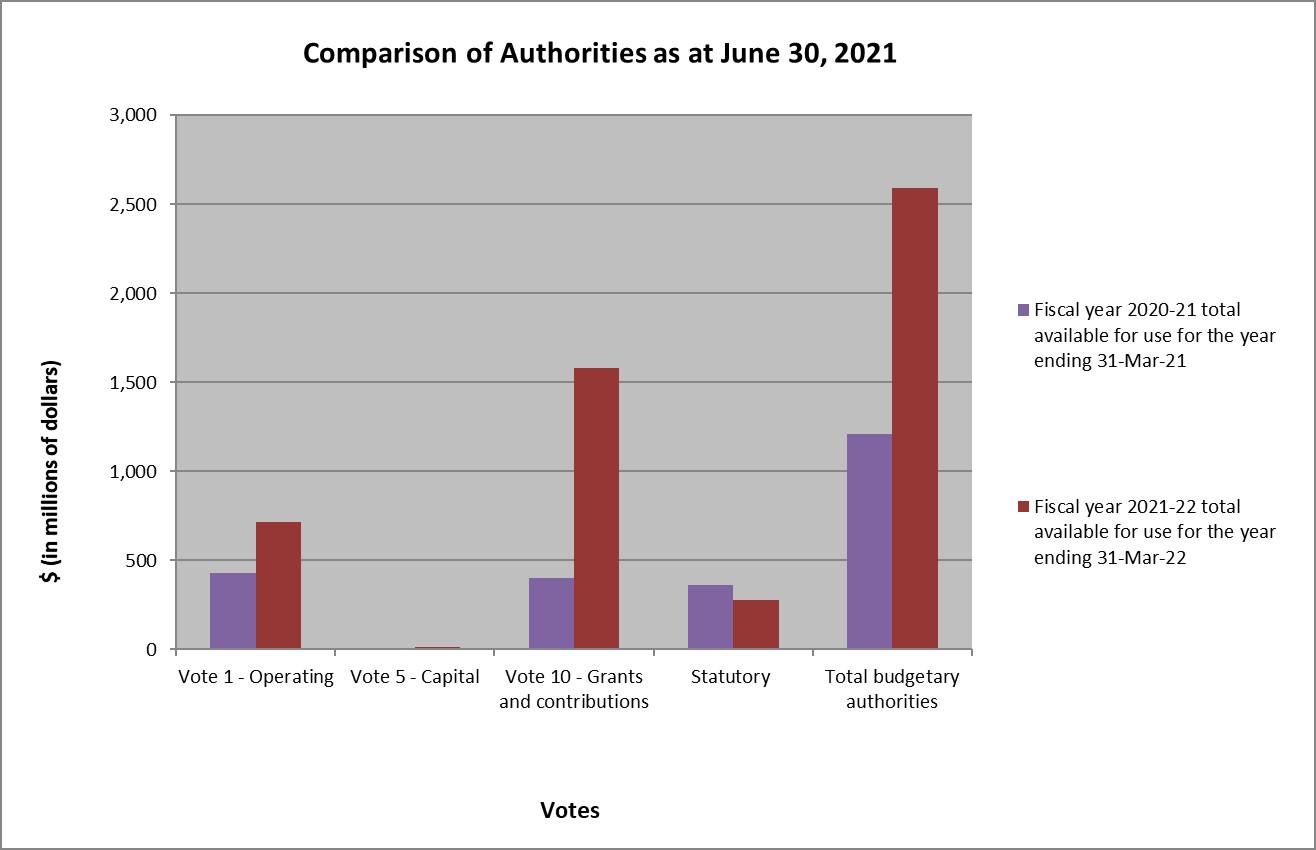

As per Table 1, presented at the end of this document, and on Graph 1 below, as at June 30, 2021, NRCan has authorities available for use of $2,590 million in 2021-22 compared to $1,208 million as of June 30, 2020, for a net increase of $1,382 million or 114 %.

Graph 1

Text Version

| (in millions of dollars) | Fiscal year 2020-21 total available for use for the year ending 31-Mar-21 |

Fiscal year 2021-22 total available for use for the year ending 31-Mar-22 |

|---|---|---|

| Vote 1 - Operating | 432 | 718 |

| Vote 5 - Capital | 9 | 14 |

| Vote 10 - Grants and contributions | 404 | 1,581 |

| Statutory | 363 | 277 |

| Total budgetary authorities | 1,208 | 2,590 |

The increase of $1,382 million in authorities in 2021-22 compared to 2020-21 is explained by the availability of supply in 2021-22. There was reduced supply of the Main Estimates, due to COVID-19 pandemic and limited sessions in the spring 2020 for Parliament to study supply, compared to the full release of supply of the 2021-22 Main Estimates as of June 30th, 2021. The increase in authorities is also explained by the net effect of fluctuations within Vote 1 operating expenditures, Vote 5 capital expenditures, Vote 10 grants and contributions, and statutory authorities, as per the following:

| Total available for use for the year ending March 31, 2021 | 1,208,341 |

| Vote 1 - Operating | |

|---|---|

| New funding for Greener Homes | 98,099 |

| Increased funding for Geo-Mapping for Energy and Minerals Initiative, funding renewed late in 2020-21 | 14,640 |

| New funding for Natural Climate Solutions (2 Billion Trees) | 10,339 |

| New funding for collective bargaining to cover wage increases for 2021-22 | 9,799 |

| New funding for Emissions Reduction Fund | 9,242 |

| New funding for Smart Renewables and Electrification Pathways Program | 8,852 |

| Decreased funding for Advancing Clean Tech - Clean Growth | (6,890) |

| Various minor net increases | 1,831 |

| Sub total Vote 1 - Operating | 145,911 |

| Vote 5 - Capital | |

| Increased funding for Geo-Mapping for Energy and Minerals Initiative, funding renewed late in 2020-21 | 1,095 |

| New funding for Natural Climate Solutions (2 Billion Trees) | 700 |

| Increased funding for Targeted Geoscience Initiative | 700 |

| Various minor net increases | 226 |

| Sub total Vote 5 - Capital | 2,721 |

| Vote 10 - Grants & Contributions | |

| New funding for Emissions Reduction Fund | 681,356 |

| New funding for Greener Homes | 210,500 |

| Increased funding for Smart Renewables and Electrification Pathways Program | 74,848 |

| New funding for Natural Climate Solutions (2 Billion Trees) | 59,500 |

| Increased funding for Youth Employment and Skills Strategy - Green Jobs | 42,102 |

| Decreased funding for the ecoENERGY for Renewable Power as the program has been completed. | (39,851) |

| Decreased funding for the Impact Canada Fund due to reprofiling of funding | (23,803) |

| Various net increases | 60,658 |

| Sub total Vote 10 - Grants & Contributions | 1,065,311 |

| Statutory | |

| Employee Benefit Plan (EBP) adjustments, due to salary adjustments in 2021-22 compared to 2020-21 | 4,243 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board due to increased level of activity | 490 |

| Minister of Natural Resources – Salary and motor car allowance | 1 |

| Newfoundland Offshore Petroleum Resource Revenue Fund adjustment, as it was forecasted at the time of Main Estimates that less revenue would be collected in 2021-22 than in 2020-21, due to fluctuations in oil prices, variances in production and a decrease in planned expenditures* | (90,421) |

| Canada Nova Scotia Offshore Petroleum Board | (373) |

| Sub total Statutory | (86,058) |

| Total increase from previous year due to year-over-year changes | 1,127,884 |

| In fiscal year 2020-21 NRCan received a reduced supply of the Main Estimates due to the COVID-19 pandemic and limited sessions in the spring 2020 for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the supply period into the Fall 2020. Full supply was received in Spring 2021 | 254,140 |

| Total available for use for the year ending March 31, 2022 | 2,590,365 |

| * In order to establish the statutory authority to be presented in the Main Estimates, NRCan executes its economic forecasting model. The model assesses trends in oil and natural gas prices, production levels, anticipated provincial corporate income taxes, and currency rates, among other things | |

2.2. Budgetary Expenditures by Standard Object

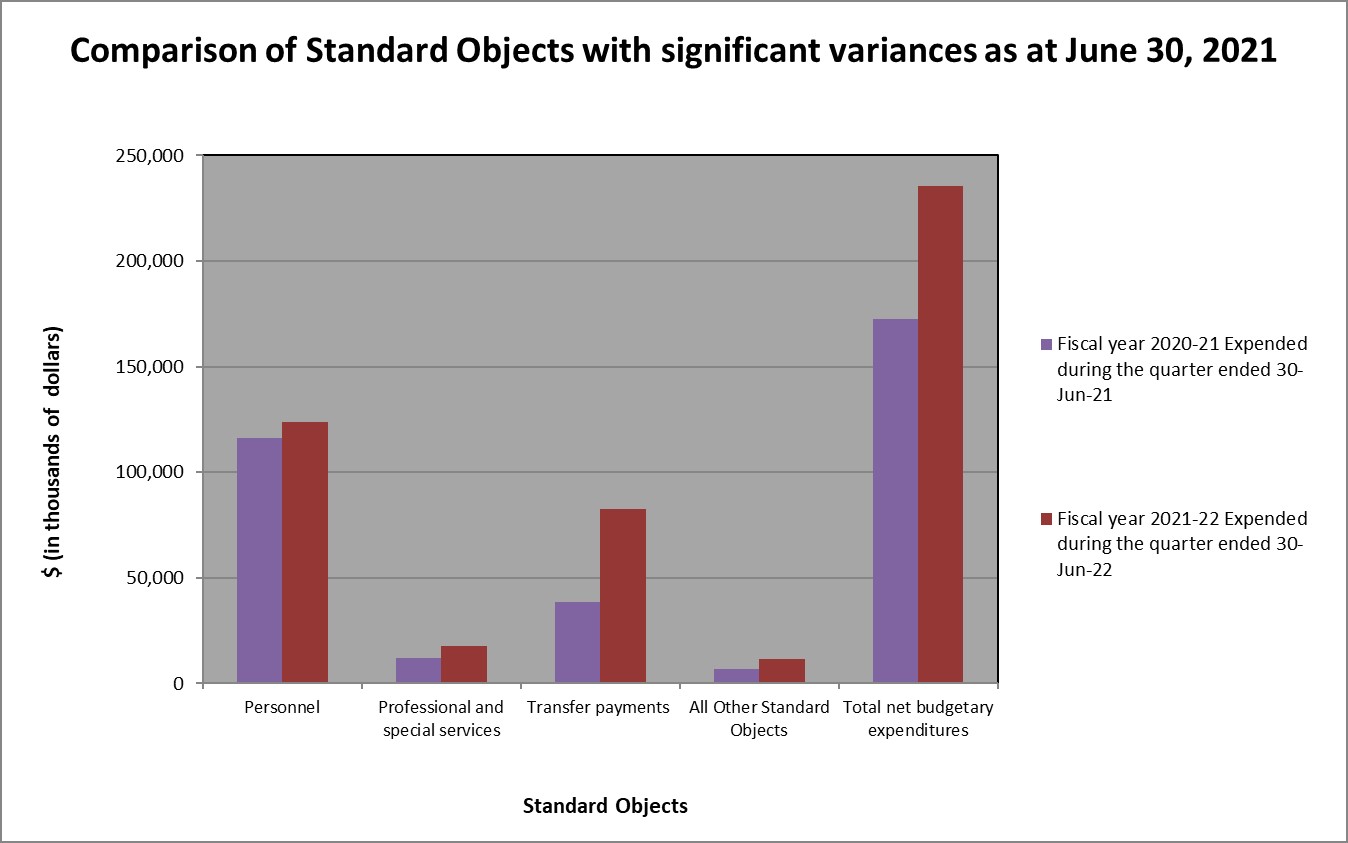

The spending for the quarter ending June 30, 2021 amounts to $235.4 million or 9% of total funding available for the fiscal year, compared to $172.8 million or 14% for the same quarter last year. This increase of $62.6 million in spending is mainly related to an increase in expenditures for personnel, professional and special services and transfer payments in 2021-22 compared to the same type of expenditures in 2020-21. Further analysis has been done on standard objects with significant expenses, as noted in Graph 2 below. Table 2 at the end of this document presents the spending for all standard objects.

Graph 2

Text Version

| (in thousands of dollars) | Fiscal year 2020-21 Expended during the quarter ended 30-Jun-21 |

Fiscal year 2021-22 Expended during the quarter ended 30-Jun-22 |

|---|---|---|

| Personnel | 115,972 | 123,651 |

| Professional and special services | 11,893 | 17,686 |

| Transfer payments | 38,303 | 82,658 |

| All Other Standard Objects | 6,628 | 11,390 |

| Total net budgetary expenditures | 172,796 | 235,385 |

| Standard Object | Explanation | Variance between 2021-22 and 2020-21 Q1 expenditures April 1 to June 30 |

|---|---|---|

| Personnel | The increase is due to higher expenses related to retroactive payments and wage increases from collective bargaining settlements as well as timing of transfers to other departments. | 7,680 |

| Professional and special services | The increase relates to the resumption of regular activities, with the COVID-19 pandemic having less of an impact on the operating environment, as well as the timing of payments from one year to the next. | 5,794 |

| Transfer Payments | The increase is mainly attributed to increased offshore activity which resulted in an increase in transfers’ payment to the province of Newfoundland, and Labrador as well as the timing of payments related Emission Reduction Fund contribution from one year to the next. | 44,355 |

| All Other Standard Objects | Minor increases and decreases within different standard objects. | 4,760 |

| Total Variance | 62,589 | |

3. Risks and Uncertainties

Natural resources are a long-standing source of economic growth across Canada. They accounted for about 17% of Canada’s nominal Gross Domestic Product (GDP), 48% of total Canadian goods exported and over 1.9 million direct and indirect jobs in 2019. As with all sectors of the Canadian economy, COVID-19 significantly disrupted the natural resources sector with an 11% reduction in GDP and 9.4% decline in employment at the height of the lockdown, resulting in risk and uncertainty for the economy.

Despite these impacts, Canada’s economic situation is improving. As of July 19, 2021, Canada had administered 45.4 million vaccine doses, with 49.5% of the population fully vaccinated. The progress in vaccine procurement and rollout is lessening uncertainty, and contributing to economic recovery. In Q1 of 2021, real GDP for the natural resources sector rose 2.8%, exceeding Canada’s 1.4% economy-wide growth. Employment in the sector also rose 1.7% compared to the 1.0% growth across the entire economy.

Economic forecasts confirm that recovery is underway. Finance Canada expects Canadian growth to range between 5.0% and 5.8% and the natural resources sector has recouped 83.2% of the jobs lost and 83.0% of lost GDP at the peak of the pandemic. These forecasts, however, obscure significant regional and sectoral disparities and the risk of an uneven recovery. For example, COVID-19 restrictions limited access to contact-intensive services at the initial stages of recovery and disproportionately shifted consumption towards tangible goods, with a rebalance expected when restrictions are eased. The uneven nature of recovery in the natural resources sector is illustrated by the price of forest products, which increased by 110% from November 2020 to May 2021, followed by a 38% decrease.

Although broader economic recovery is expected, there are still risks that may hinder progress. Another COVID-19 wave is possible due to emerging variants and slowing vaccine uptake in particular regions and export markets. In addition, a potential supply chain and transportation disruption caused by wildfires in Western Canada will prevent the movement of natural resources and goods to and from the Port of Vancouver, which is a key transportation network terminal for Canadian exporters.

In this context, NRCan recognizes that a solid understanding of its risk environment (both internal and external) is fundamental to the delivery of its mandate and fulfilment of its core responsibilities. Risk management has equipped the department to respond proactively to change and uncertainty by defining and understanding its operating environment and the factors that drive risk. At the outset of the pandemic, operational risk management focused on developing an immediate response to risks related to the emerging COVID-19 public health crisis. Emerging risks during this time consisted largely of business continuity planning and addressing IM/IT systems to increase effective remote working capacity for the whole Department while maintaining security.

With the COVID-19 outlook improving, the Department began to focus on addressing strategic uncertainties that posed risks to economic recovery. New initiatives like NRCan’s Canada Greener Homes Grant (CGHG) initiative were launched to assist the natural resources sector during COVID-19, mitigate greenhouse gas emissions, and create employment opportunities in natural resource sectors. Similarly, funding opportunities proposed in Budget 2021, including support for Smart Renewables and Electrification Pathways (SRePs), the renewal of the Clean Growth Hub and Clean Tech Data Strategy, and increased mapping of areas in Northern Canada at risk of wildfires, provide opportunities for NRCan to address strategic risks tied to economic recovery like innovation, competitiveness, and climate change adaptation. NRCan continued to work with central agencies and other government departments to develop targeted mitigation initiatives that addressed these risks while stabilizing and supporting the economy.

As Canada’s COVID-19 situation continues to improve, risk and uncertainties about economic recovery, clean growth, and inclusivity remain. NRCan will continue to monitor and integrate risk information into strategic and operational decision-making to support Canadians and Canada’s natural resources sector through the ongoing impacts of COVID-19 and beyond.

4. Significant Changes in Relation to Operations, Personnel, Programs

During the first quarter of 2021-2022, Prime Minister Trudeau announced that effective May 31, 2021, Mr. Shawn Tupper, NRCan Associate Deputy Minister, would become Deputy Secretary to the Cabinet (Operations) at the Privy Council Office.

No other significant change in relation to operations, personnel or programs occurred during the first quarter of 2021-22. However, there has been an impact on how NRCan delivers its operations and programs, with the majority of employees continuing to work from home and reductions to field and laboratory work due to the COVID-19 pandemic.

Original signed by:

Jean Francois Tremblay

Deputy Minister

Date signed

August 20, 2021

Ottawa, Canada

Original signed by:

Shirley Carruthers, CPA CGA

Chief Financial Officer

Date signed

August 20, 2021

Ottawa, Canada

| (in thousands of dollars) | Fiscal Year 2021-22 | Fiscal Year 2020-21 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2022* | Expended during the quarter ended June 30, 2021 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2021* | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end | |

| Vote 1 - Net Operating Expenditures | 717,524 | 137,228 | 137,228 | 432,403 | 119,950 | 119,950 |

| Vote 5 - Capital Expenditures | 14,329 | 369 | 369 | 8,706 | 242 | 242 |

| Vote 10 - Grants and Contributions | 1,581,070 | 25,935 | 25,935 | 403,728 | 21,927 | 21,927 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance | 91 | 23 | 23 | 89 | 22 | 22 |

| Contributions to employee benefit plans | 62,407 | 15,106 | 15,106 | 58,166 | 14,278 | 14,278 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board | 11,677 | - | - | 11,187 | - | - |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board | 3,933 | 673 | 673 | 4,305 | - | - |

| Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund | 199,335 | 56,050 | 56,050 | 289,756 | 16,376 | 16,376 |

| Total Statutory Payments | 277,443 | 71,852 | 71,852 | 363,503 | 30,676 | 30,676 |

| Total Budgetary Authorities | 2,590,366 | 235,384 | 235,384 | 1,208,340 | 172,795 | 172,795 |

| * Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, for which interim supply was released, and Supplementary Estimates (A), for which full supply was released. | ||||||

| (in thousands of dollars) | Fiscal Year 2021-22 | Fiscal Year 2020-21 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2022 | Expended during the quarter ended June 30, 2021 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2021 | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 479,567 | 123,652 | 123,652 | 355,170 | 115,972 | 115,972 |

| Transportation and communication | 31,090 | 587 | 587 | 17,260 | 274 | 274 |

| Information | 19,826 | 824 | 824 | 7,851 | 483 | 483 |

| Professional and special services | 180,097 | 17,686 | 17,686 | 88,233 | 11,893 | 11,893 |

| Rentals | 28,494 | 4,197 | 4,197 | 14,563 | 3,204 | 3,204 |

| Repair and maintenance | 10,259 | 630 | 630 | 5,825 | 162 | 162 |

| Utilities, materials and supplies | 37,444 | 1,284 | 1,284 | 22,936 | 603 | 603 |

| Acquisition of land, buildings and works | 3,395 | 200 | 200 | 2,449 | - | - |

| Acquisition of machinery and equipment | 32,922 | 1,198 | 1,198 | 18,478 | 963 | 963 |

| Transfer payments | 1,796,015 | 82,658 | 82,658 | 708,974 | 38,303 | 38,303 |

| Other subsidies and payments | 8,118 | 7,074 | 7,074 | 5,184 | 4,312 | 4,312 |

| Total Budgetary Expenditures | 2,627,227 | 239,990 | 239,990 | 1,246,923 | 176,169 | 176,169 |

| Less: Total Revenues Netted Against Expenditures | 36,861 | 4,606 | 4,606 | 38,583 | 3,374 | 3,374 |

| Total Net Budgetary Expenditures | 2,590,366 | 235,384 | 235,384 | 1,208,340 | 172,795 | 172,795 |